Is the U.S. Dollar Index Building Strength to Push Gold Prices Lower?

2023.01.04 11:45

[ad_1]

The is a key driver of prices (apart from real interest rates). How much strength has it shown recently?

In yesterday’s analysis, I compared the current situation in the precious metals to the one in stocks that we saw last year. It appears that the similarity remains up-to-date as gold is up in today’s pre-market trading (at the moment of writing these words).

As you may recall, last year, stocks didn’t decline until the second session of the year. Of course, the history doesn’t have repeat itself to the letter, but I wouldn’t make too much of the upswing in the first few days of the year. Here’s what we wrote about this matter yesterday:

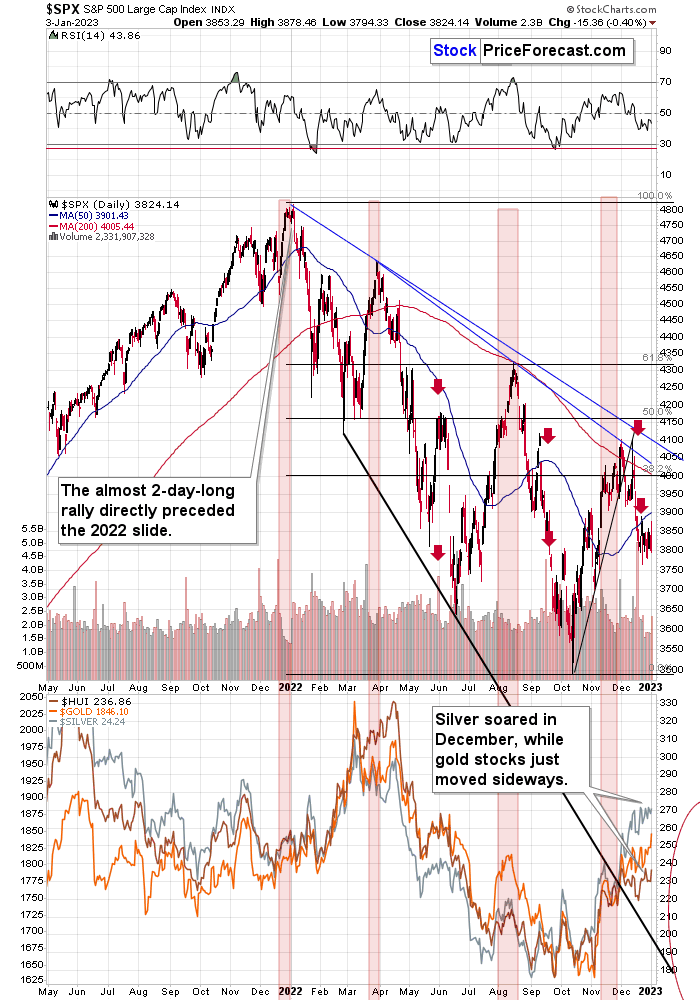

Do you remember the “January rally” that we saw in early 2022? It lasted less than two days. Stocks moved higher in the first session of the year, and they formed an intraday top during the second session of the year.

And then, the moved from about 4,800 to levels below 3,600.

So, looking at the early-January performance might be misleading.

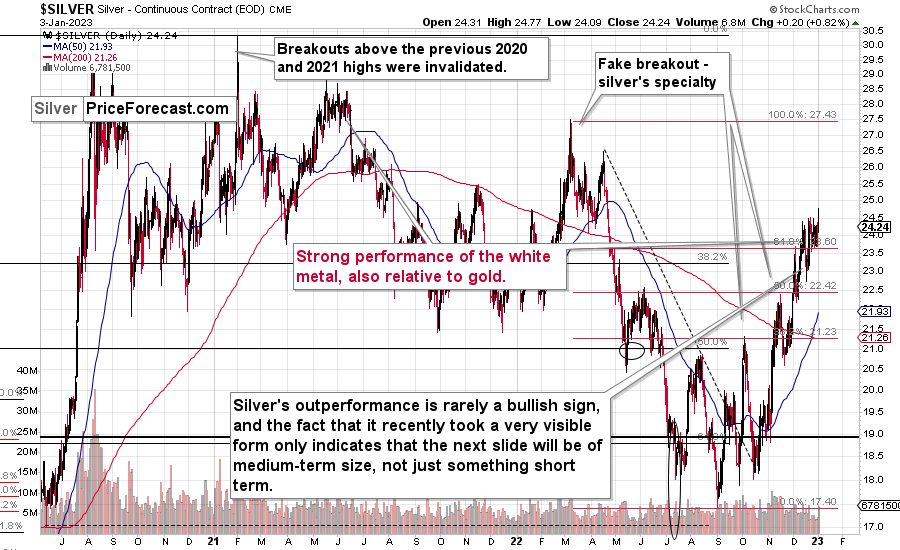

The lower part of the above chart features gold, silver, and the Index (proxy for gold stocks). As you can see, silver outperformed gold strongly in December, while gold stocks did almost nothing, greatly underperforming gold. That’s a very powerful bearish indication for the following weeks. After all, that’s exactly what tends to happen close to market tops – silver outperforms, while gold stocks lag.

Interestingly, stocks started this year with a bearish reversal.

Of course, these are not the reasons for the decline per se – I listed multiple thereof (e.g., rising real interest rates) in my previous analyses.

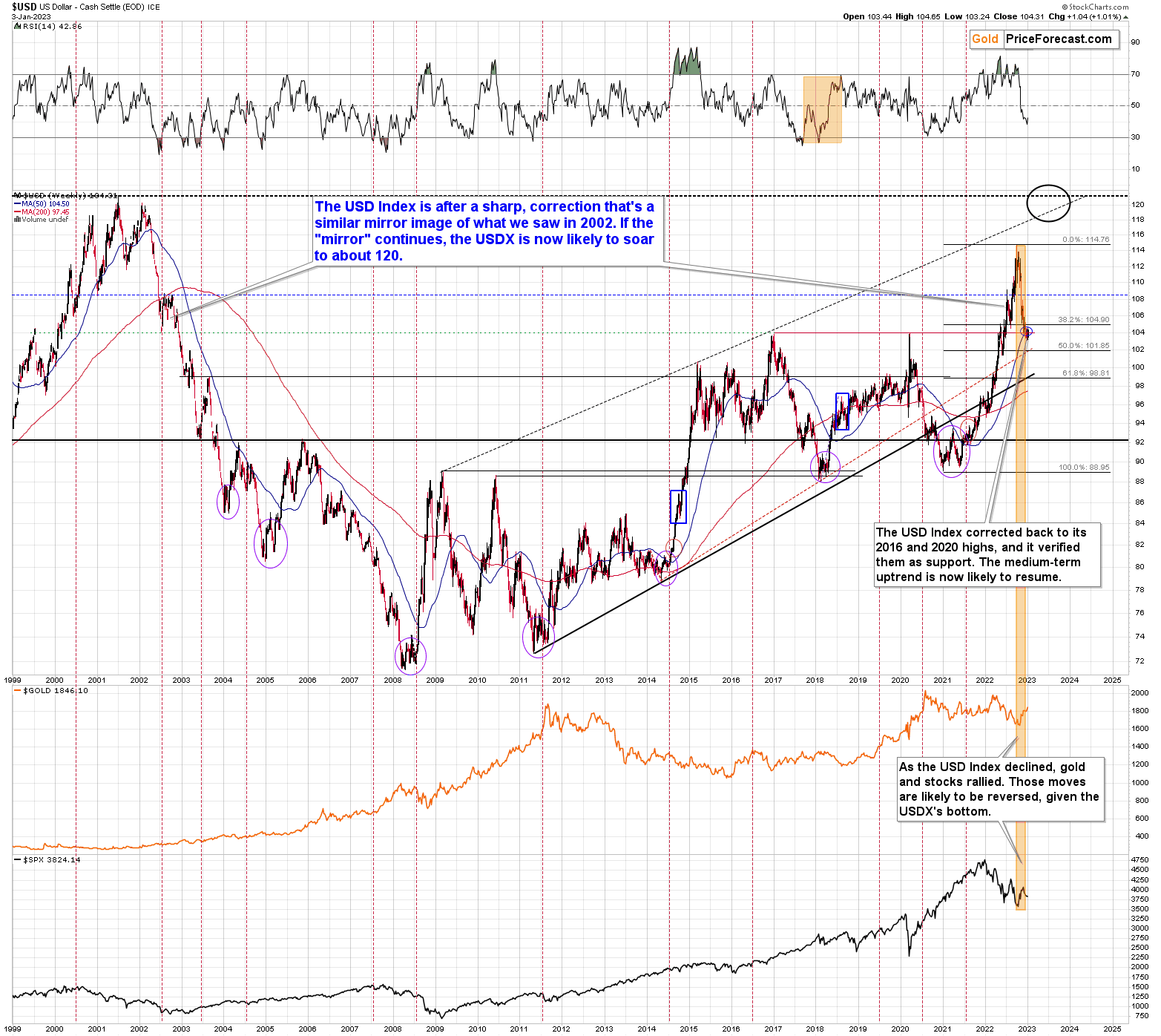

The other key driver of gold prices (besides real interest rates) is the USD Index, and it just showed strength.

The USDX is down in today’s pre-market trading, but it moved substantially higher yesterday. High enough to make it clear that the very strong support provided by the 2016 and 2020 highs held.

This, in turn, means that another medium-term rally in the USDX is likely to begin any day now – and perhaps it’s already underway.

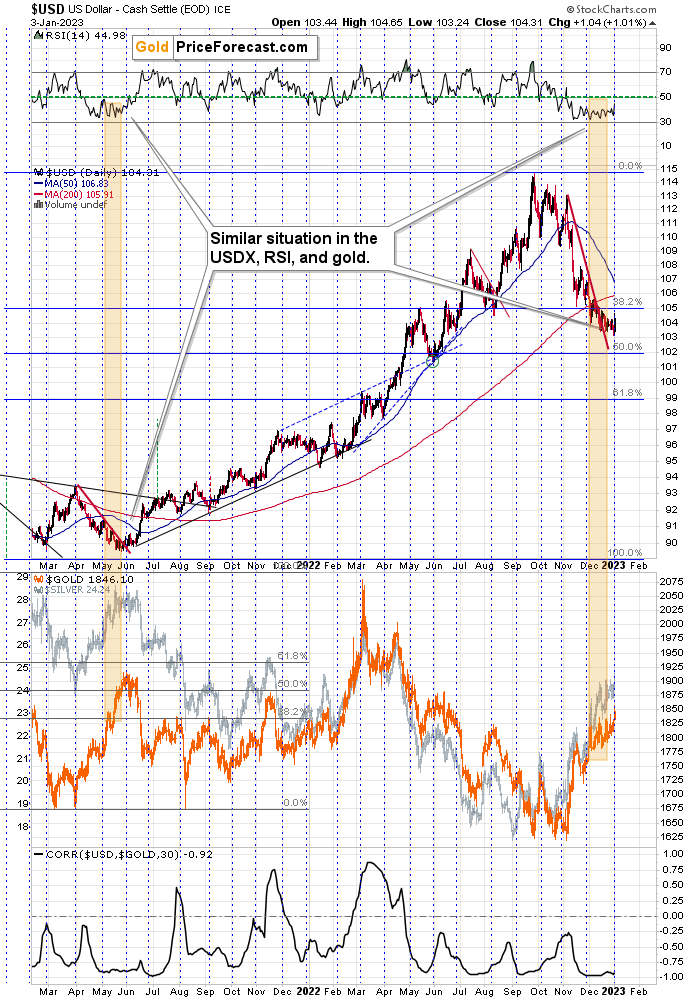

From the short-term point of view, we only saw a daily rally so far, and this rally is being corrected right now, which means that the USDX is still in preparation mode.

Still, the above short-term chart continues to provide us with bullish implications because of the great similarity between the recent action in the USDX itself and the RSI based on it (not to mention the correlation with gold that you can see on the bottom of the above chart) and what happened in mid-2021.

The lengthy bottom was followed by a small breakout at first, and then by a bigger rally. Both gold and silver fell substantially at that time, and it was the start of an even bigger decline in junior mining stocks.

What we saw yesterday was perhaps analogous to that small breakout that started it all previously.

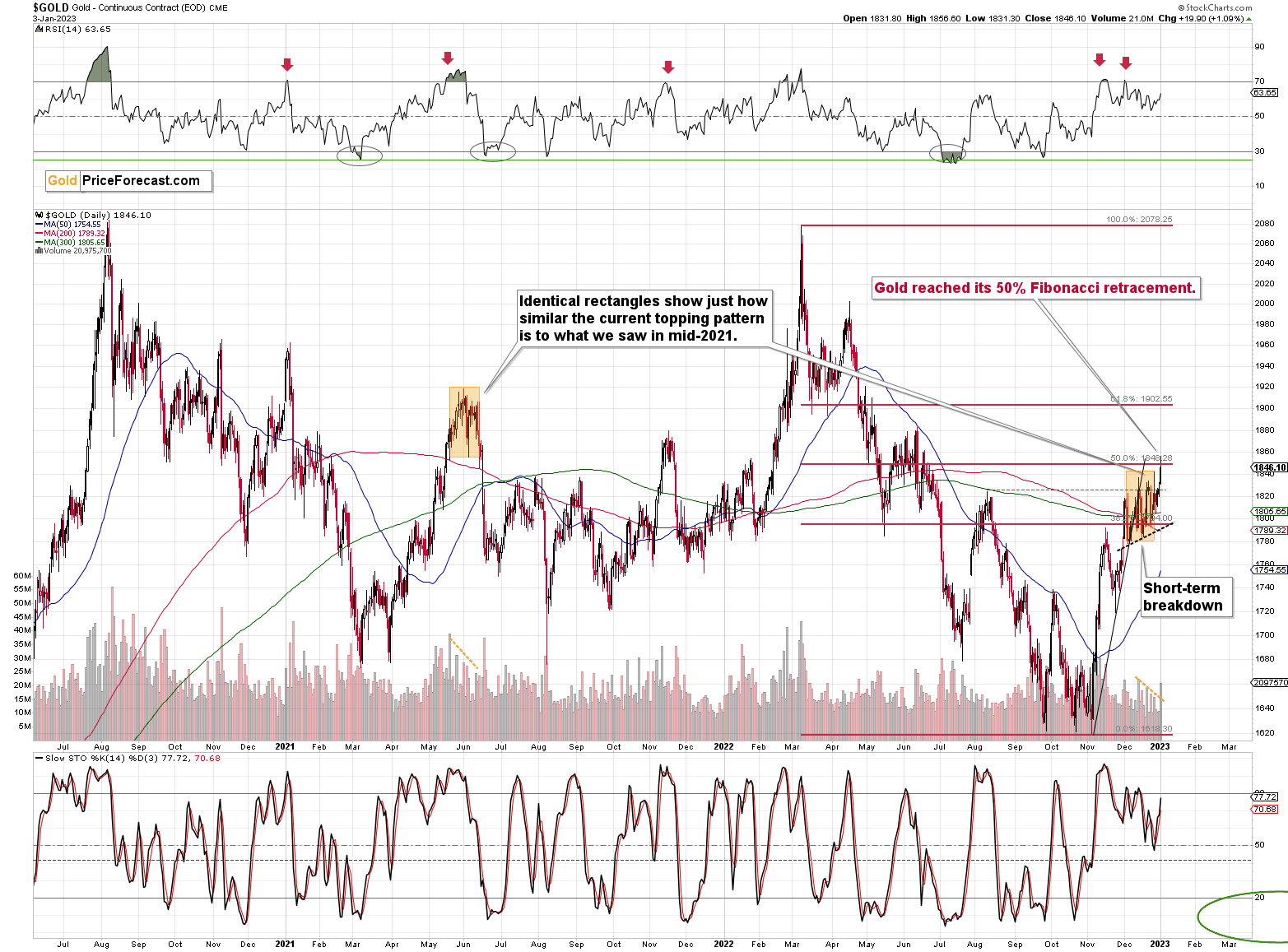

The gold price itself moved to its 50% Fibonacci retracement level, and then moved back down. It reversed on an intraday basis on relatively big volume. It didn’t erase most of the rally, so the bearish indications from the reversal candlestick are not strong. However, the fact that gold moved to one of its key retracements is notable.

In today’s pre-market trading, gold futures moved a bit above that level, but the breakout is not yet confirmed.

Silver reversed in a much more profound and clear manner. In silver’s case, the reversal was clear, and it was confirmed by relatively big volume. This is a bearish indication for the short term.

In today’s pre-market trading silver moved a bit higher, but it didn’t manage to move above yesterday’s intraday highs.

Chart, histogramDescription automatically generated

Chart, histogramDescription automatically generated

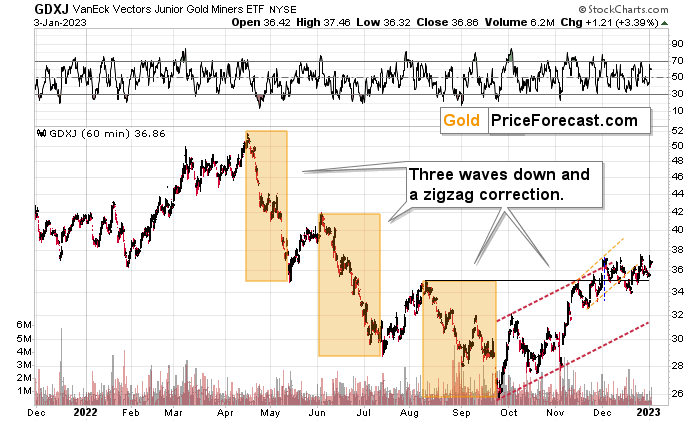

VanEck Junior Gold Miners ETF (NYSE:) moved very close to their previous highs, but then reversed and ended the day visibly below them.

Consequently, nothing really changed, and the overall shape of yesterday’s session was bearish – as it’s the case with daily reversals.

All in all, the short-term outlook for the precious metals didn’t really improve and it remains bearish for the following weeks.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski’s, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

[ad_2]