Is Stagflation on the Horizon? Key Ratios Suggest So

2023.03.28 04:16

Friday:

Monday:

Over the weekend, our covered three key ratios to help decipher the market action and the prevailing macro theme for the economy.

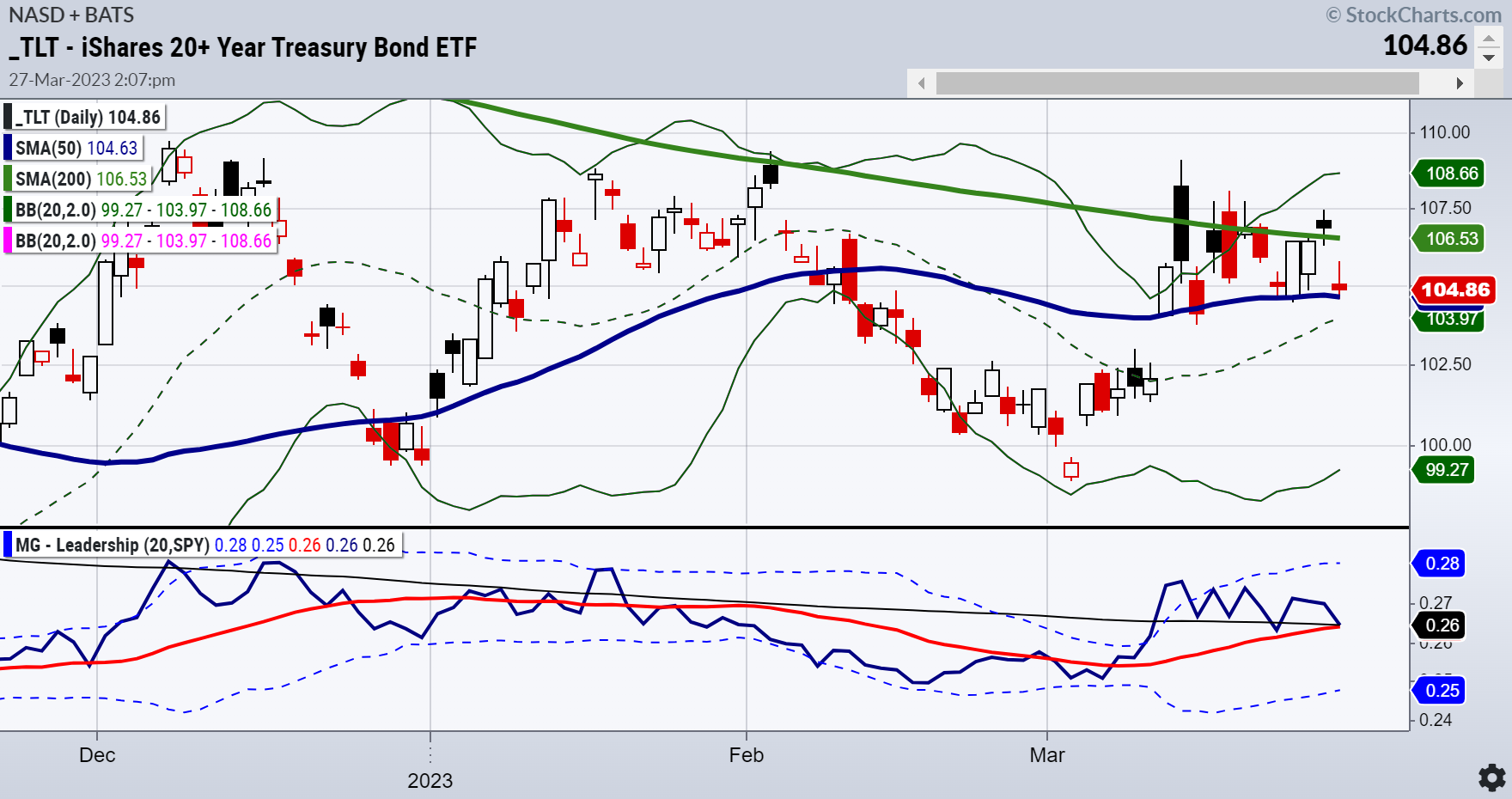

We started with the one between long bonds () and the (). All last week, long bonds outperformed the SPY with calls for recession.

This week so far, bond yields have risen to 3.5%. While declined a bit along with semiconductors, was up $70 a barrel, and grains and sugar prices rose.

Looking at the TLT: SPY Monday, TLTs are performing on par with SPY. Recession fears over, hello stagflation?

Then, as if to support the stagflation theory with yields rising and the indices in a trading range, continues to outperform .

Although silver prices also fell, the ratio between silver and gold entered the “inflation worry” zone.

For the 3rd ratio, we continue to look at the for clues. The dollar typically goes up when interest rates do.

Yet the dollar declined against the euro, now at 1.07. So we have yields rising, silver outperforming, and the dollar declining.

Our Small Cap All-Stars Model had the best daily returns Monday after the bank issues began with good news.

The () could see a further bounce from here. Yet remains stuck in a trading range.

At least we are not seeing IWM head into recession territory. The good news is that the market is optimistic about avoiding recession.

The bad news is that the market has not yet dealt with the possibility of stagflation. And then there is .

A note on Bitcoin from Holden:

The most likely scenario from here is that we’ll see Bitcoin go sideways for a short while in this new range until a new piece of major news comes out to force a break one way or the other. In the event of a breakdown from here, we would expect BTC to find support around the $25,000 level, while the clear target from here is to take out the psychological $30,000 level on a daily closing basis.

ETF Summary

- S&P 500 (SPY) Needs to clear 400 and hold 390

- Russell 2000 (IWM) 170 held-so maybe the ratios are implying no recession after all-180 resistance

- Dow (DIA) 325 cleared now needs to hold

- Nasdaq (QQQ) 305 support 320 resistance

- Regional banks (KRE) Daily up reversal. Weekly more inside the range of the last 2 weeks

- Semiconductors (SMH) Follow through on that key reversal w/ 250 support

- Transportation (IYT) 219 is a level that has been like a yo-yo price

- Biotechnology (IBB) Held key support at 125 area-127.50 resistance

- Retail (XRT) Granny held 60-still in the game-especially since that is the January calendar range low