Is Silver About to Break Out? US Dollar Index Says Yes

2024.07.18 02:54

continues to frustrate investors. Every time it approaches a breakout point, its price retreats. Despite the recurring promise that “this time it’s different,” the metal repeatedly fails to deliver the anticipated gains.

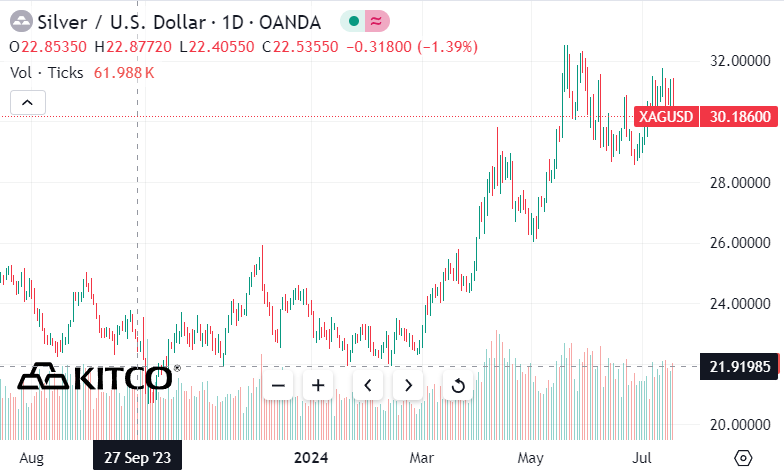

Well, this time I do think it is different and I have been harping on silver since I started writing my blog again in August 2023 and on September 27, 2023, wrote when silver was $21.91 an ounce and today is 30.11, a 37.42% increase.

“That’s great Doug, but I didn’t buy silver back then and have been afraid to buy since.”

That’s the typical response I get from those who have not bought silver or have been afraid to add to a position they bought higher years ago. So what would propel them to buy now when silver hasn’t broken out yet? What if silver goes back down from here right after they buy?

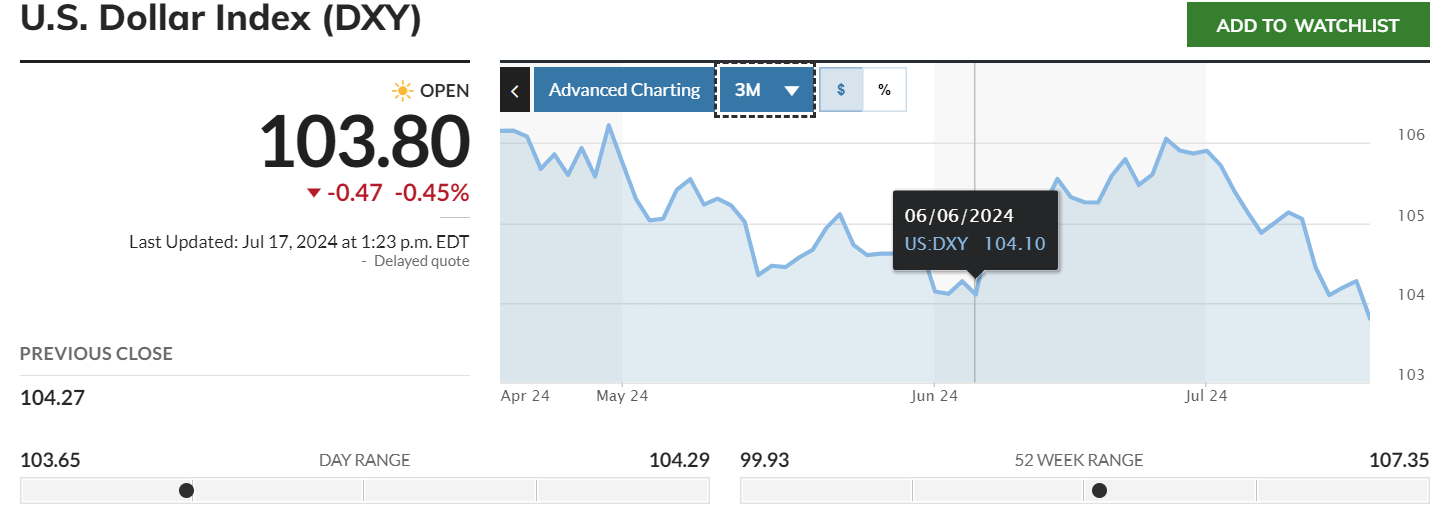

One thing has changed from the time of September 27th to today. The has fallen from a high of 106.67 to 103.80 today, a fresh 3-month low breaking the 104.10 6/6/24 low. In other words, the purchasing power of the dollar has lost 2.69% during that time.

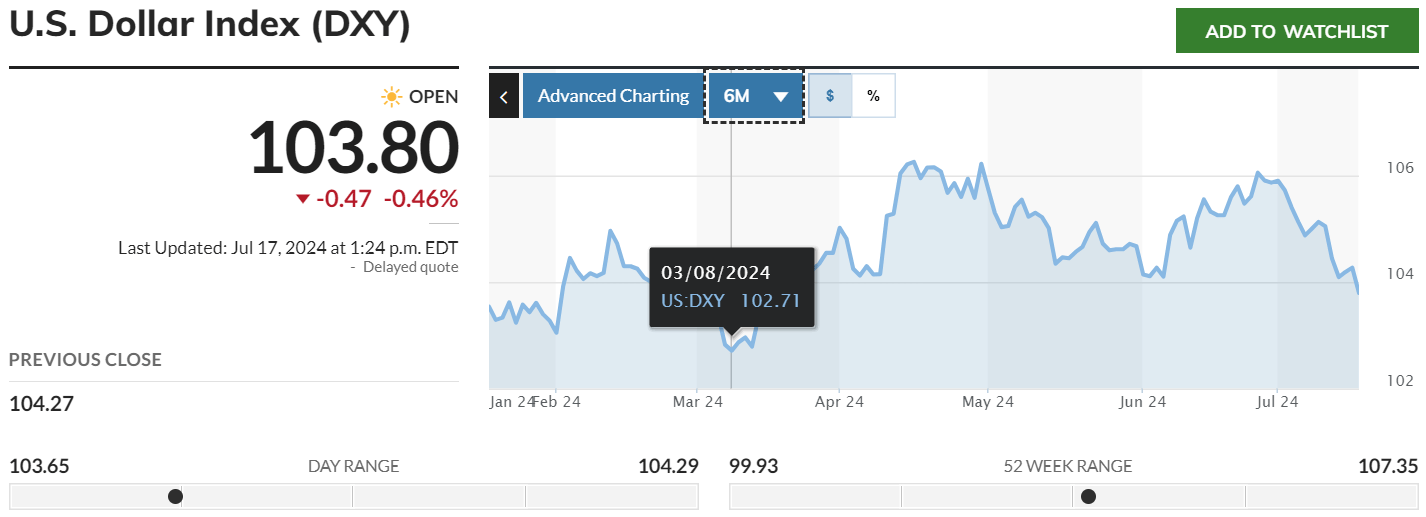

What’s next for the dollar? Next up for the dollar is the 6-month low of 102.71 and below that the 52-week low of 99.93. What happens when the dollar breaks 99.93? And where do you think silver will be then?

I mentioned in one of my last articles what would be a better buy, silver or the stock market moving forward. The stock market is beginning to show cracks and silver is bouncing off of resistance a few times already. With the pullback in the dollar at a 3-month low, and very close to a 6-month low, the silver pullback today is a good time to add to or begin a position in silver.

But what will it take for you to make a purchase? Will it be the dollar below 102.71 or 99.93? Or silver over $35 an ounce which is the next stop before $50?

I have tried my hardest to write timely articles and I think even though the timing of the silver article on October 23 was good, this article is more important for you because the dollar is ready for a big drop.

And notice two other things? I asked what would be a better return, a CD at a bank or silver back when I wrote my first article since my hiatus in writing my next book. The answer is clear. The dollar has lost 2.69% and silver has gone up over 30%. When the dollar has lost 10% silver will be up over 50%.

The one issue that will become more and more prevalent in the future is banks are scrounging for money as is and the next failure will catapult silver in just a few days. Last year 2 bank failing caused silver to move higher. My advice is to get some insurance on your based assets including money at the bank and yes, in the stock market, with silver and gold and sit back and enjoy life.