Is It a Good Time to Be an Energy Bull?

2023.09.28 05:07

- On the back of inventory draws and term structure backwardation, the indicators of real-time supply and demand continue to support oil prices over the short term.

- Although we are probably due for a technical pull-back, expect oil prices to be supported as we close out 2023 as a result of the clear supply deficit.

- However, don’t expect $150+ oil just yet, that is likely a story for 2025 once the US election has come and gone.

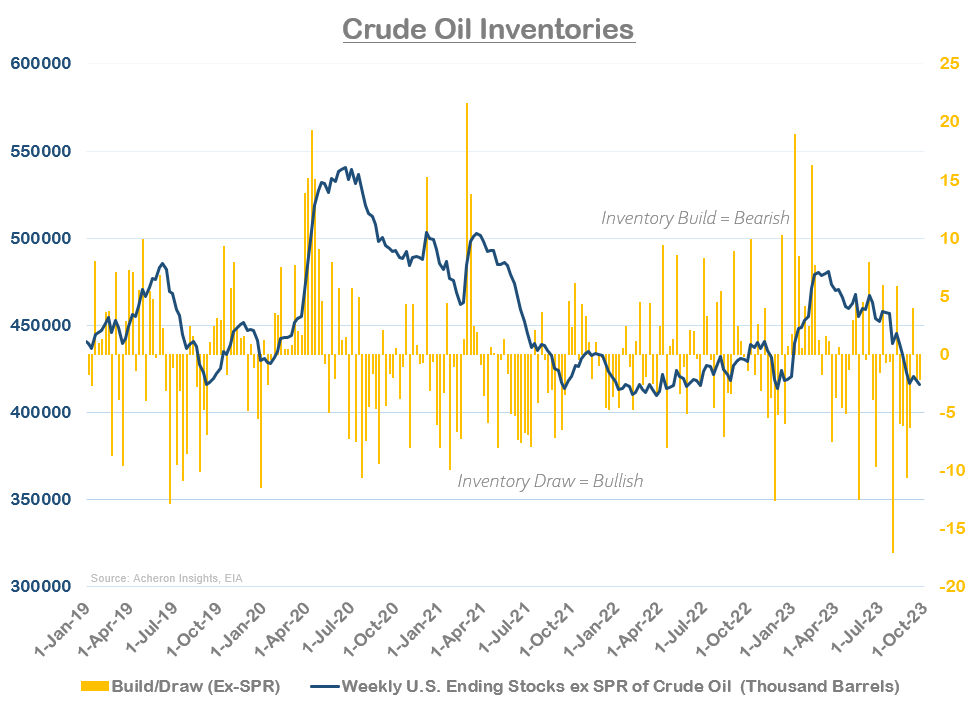

Inventory Draws Continue

In terms of oil market fundamentals, things remain relatively bullish, at least in the short term. Starting with commercial inventories, the EIA reported another 2.2 million barrel draw this past week, following a 2.1 million barrel draw last week.

Following what has been a few months of persistent inventory drawdowns, supplies in the US are becoming increasingly tight. Not only are commercial inventories overall reaching the lows of 2022, prior to the Biden Administration draining the Strategic Petroleum Reserve, but crude oil levels at Cushing, Oklahoma have fallen to only 22 million barrels (down from a two-year high of 43 million barrels in June). Such stockpiles are worryingly close to minimum operating levels, a point which brings into question the quality of remaining stocks.

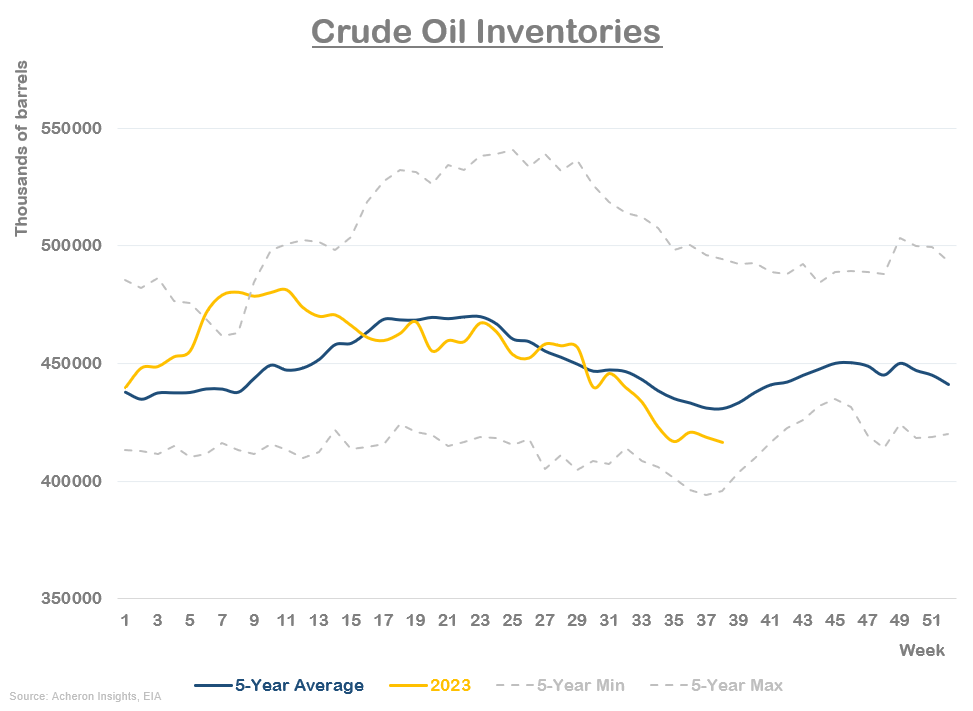

With inventories continuing to track well below their five-year seasonal average, the inventory picture remains bullish and should they continue, oil prices will be well supported.

A Tight Physical Market

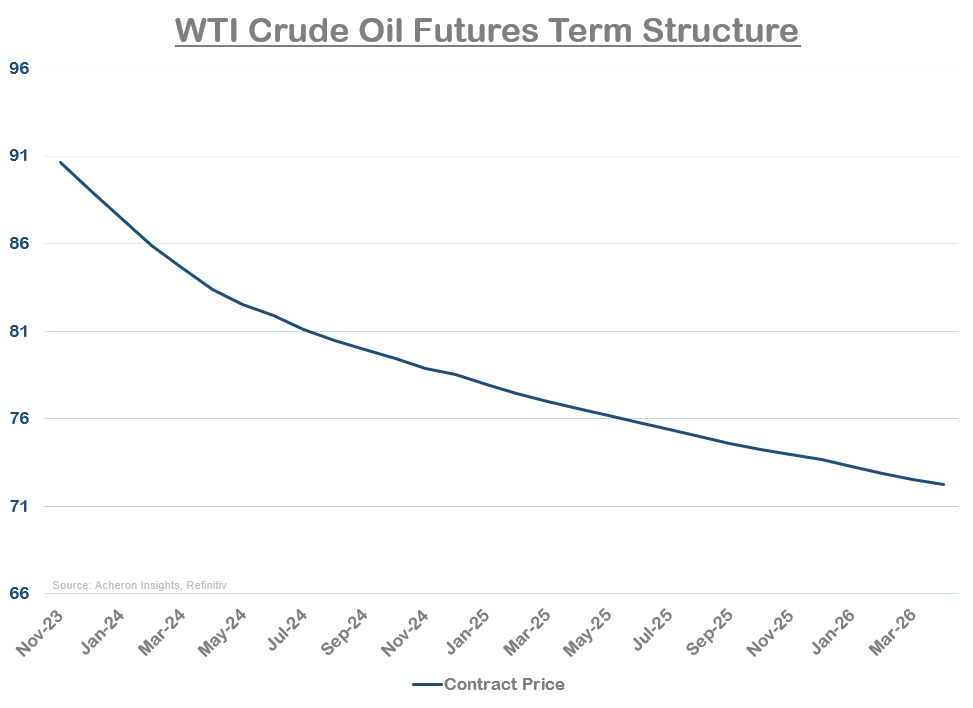

With the inventory picture suggesting excess demand relative to supply, other indicators of the physical market also confirm this notion. Notably, the crude oil futures term structure is currently at its highest level of backwardation in over a year.

Backwardation implies there is a supply deficit as market participants are willing to pay a premium for instant delivery, despite the associated delivery and storage costs. As a result, any deficit will need to be met by drawing down inventories. Clearly, this is exactly what is unfolding at present.

WTI Futures Term Structure

WTI Futures Term Structure

Not only is this true of the term structure as a whole, but front-end prompt spreads are also suggesting the oil market tight.

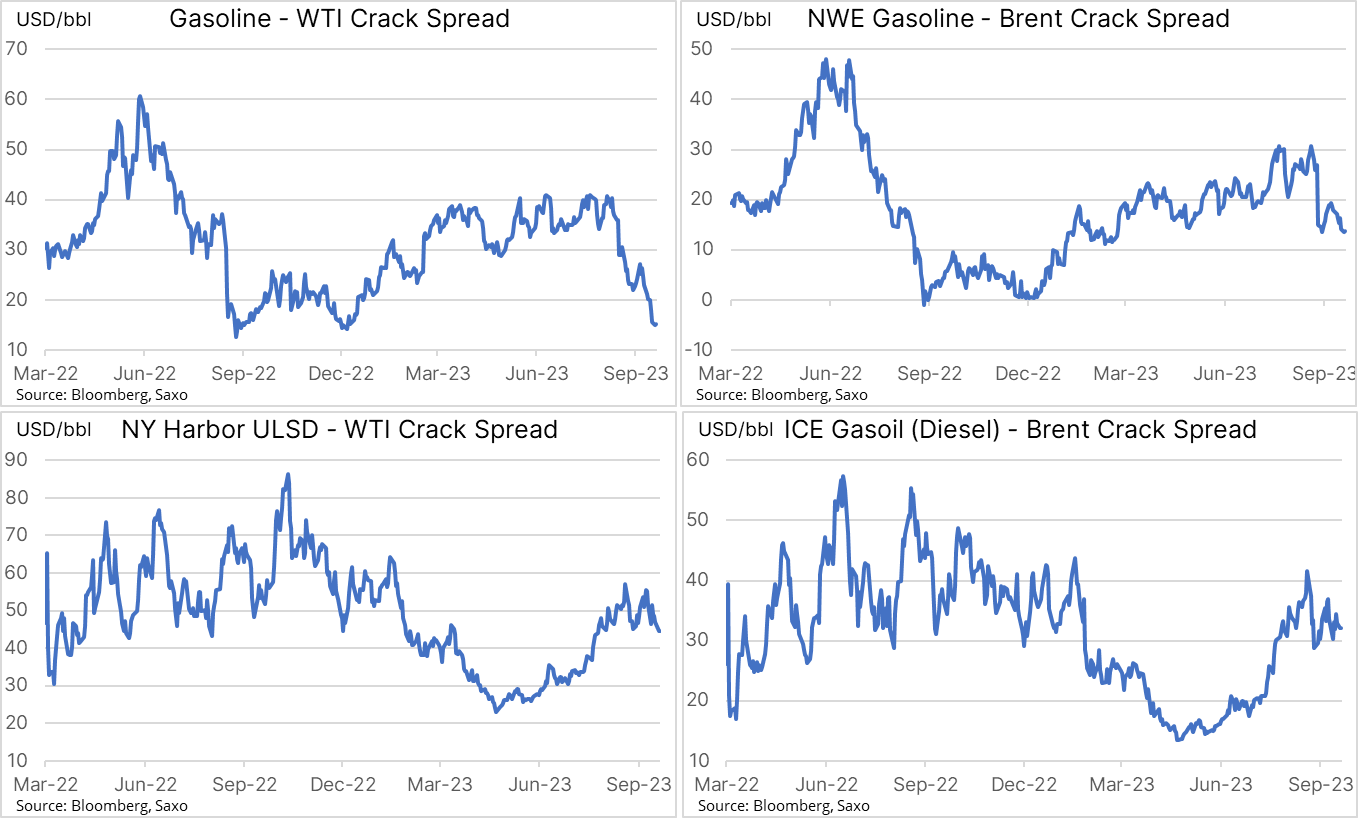

However, while backwardation is bullish for prices, extreme backwardation, and significant spikes in prompt spreads also tend to coincide with short-term peaks in price, something energy bulls should be aware of. The fact that crack spreads have diverged lower throughout September despite higher prices is one physical market indicator suggesting a correction in the oil price could be on the cards, particularly as we are entering refinery maintenance season. Crack spreads measure the difference between the price refiners purchase crude and the price they sell the various refined products.

Gasoline – WTI Crack Spread

Gasoline – WTI Crack Spread

Source: Saxo

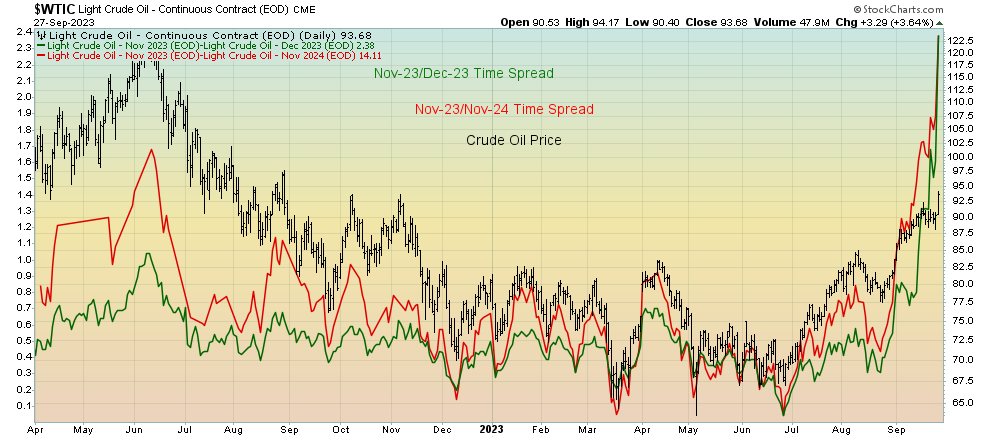

Just Like That, Everyone is Bullish Oil

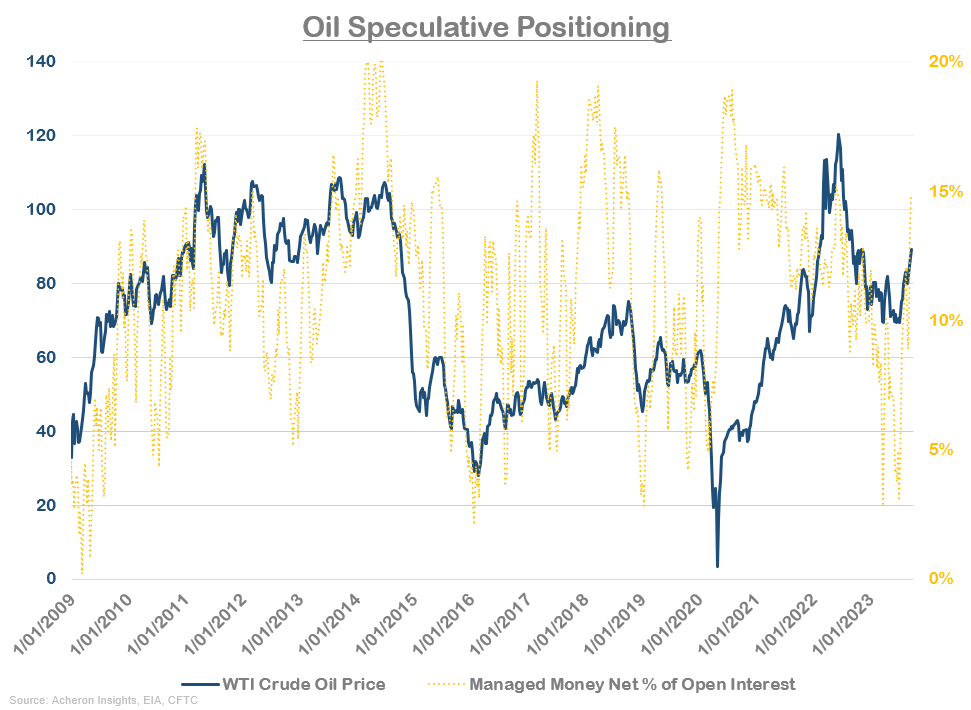

One of the big drivers of this recent rally has been the significant level of speculative buying we have seen from hedge funds and CTA’s. After being caught bearish (to the highest degree in nearly a decade) earlier this year, managed money positioning in the futures market has quickly gone from extreme bearishness to extreme bullishness.

Oil Speculative Positioning

Oil Speculative Positioning

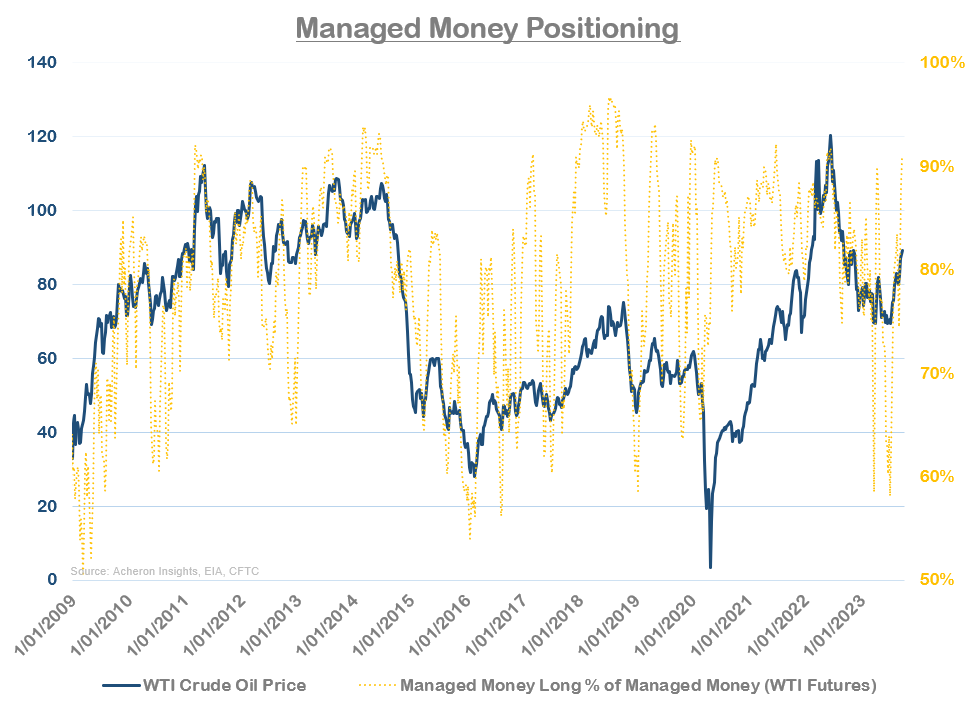

If we measure managed money positioning as a percentage of longs relative to total managed money, we can see hedge funds and CTA’s are now equally as long oil as they have been in years. Similar spikes have at the very least coincided with short-term pullbacks in price. Given how swift this rally in oil prices has been, I suspect we are due for some kind of pullback, if only minor.

Managed Money Positioning

Managed Money Positioning

Oil Deficit Set to Continue

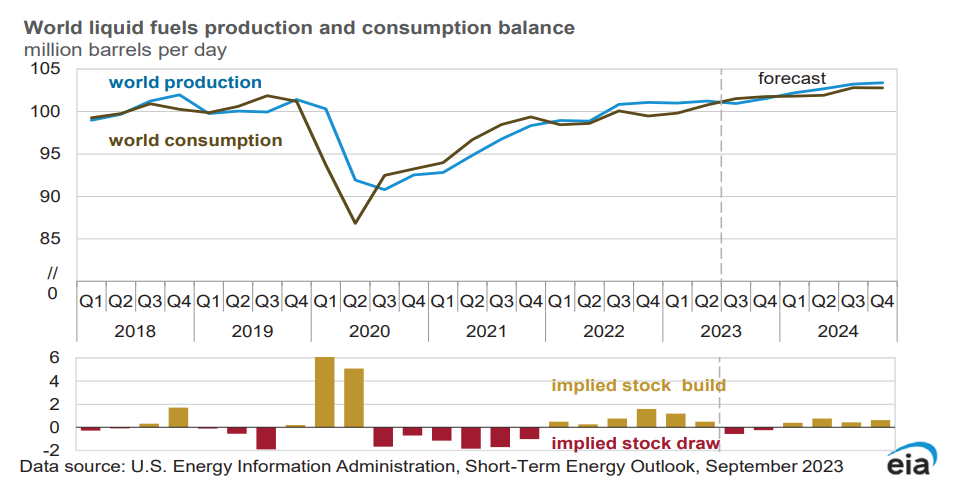

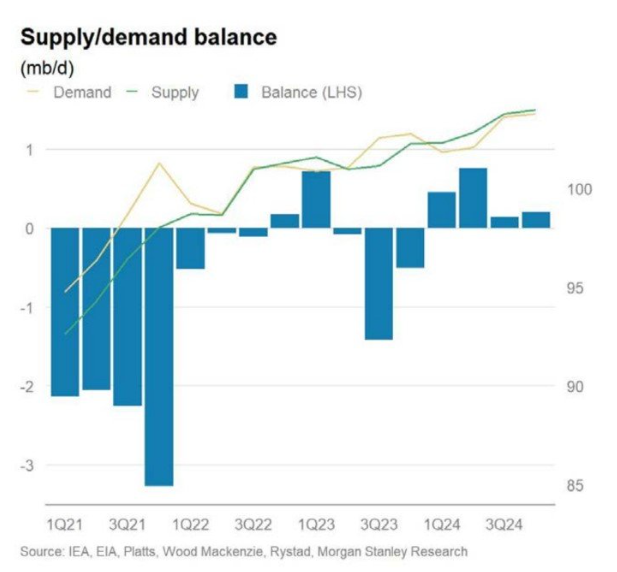

While a short-term correction may be due, the medium-term outlook remains bullish. Indeed, not only do the real-time indicators of supply and demand remain favorable, but forecasts for the remainder of 2023 suggest this deficit is set to continue.

Notably, the EIA – who are notorious for underestimating demand – continue to see a deficit through Q4 of this year

Production and Consumption Balance

Production and Consumption Balance

A view eschewed by Morgan Stanley.

Supply/Demand Balance

Meanwhile, oil analysts at Standard Chartered continue to call for a 1.3 mb/d deficit through Q4 and expect inventory draws to continue into 2024.

Although such forecasts are inherently difficult and error-prone, it seems we are likely to continue to see a supply and demand imbalance toward the bullish side of the spectrum as we close out 2023, an environment that should help put a floor under the oil price.

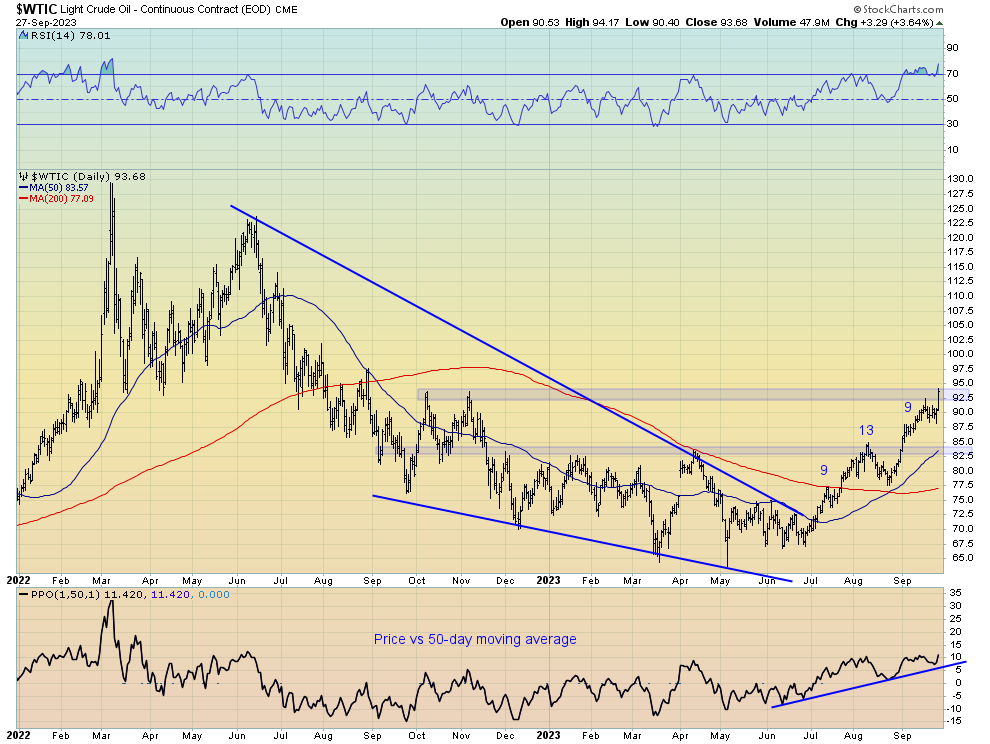

The Technical Picture

From a price action perspective, the daily chart for crude continues to trade bullishly. The downtrend that encompassed the second half of 2022 and the first half of 2023 is clearly behind us, with the major moving averages now turning up and the important $82-$85 resistance level well and truly broken.

However, as I have stated, it seems we are probably due for some sort of technical correction, if only briefly. Indeed, WTI recently triggered a 9-13-9 DeMark sequential sell signal and is now butting heads with the $92 resistance level. Thus, if I were a betting man, I would wager the next $5-$10 is to the downside, with any move back toward the mid to low $80s seemingly an excellent buying opportunity.

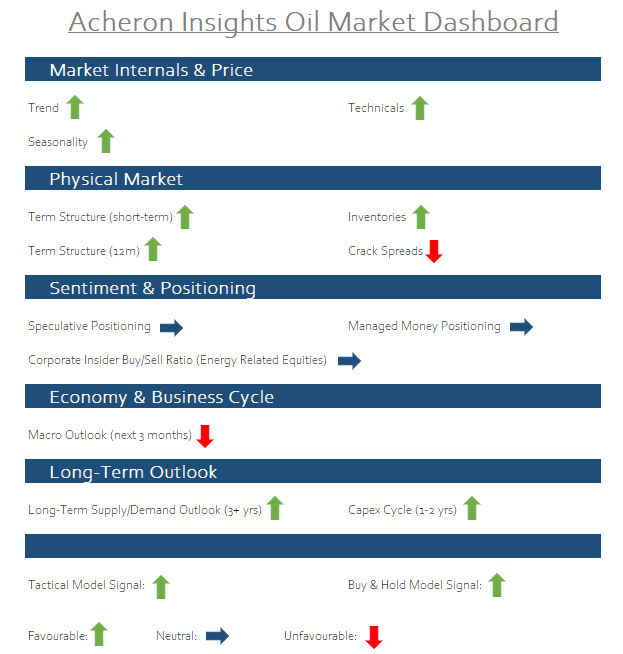

Cautiously Bullish

On the whole, I continue to remain cautiously bullish about oil prices and energy stocks for the remainder of 2023. The real-time fundamental indicators such as inventories and term structure remain supportive, while the technical, momentum, and trend picture is now firmly on the bullish side. The level of speculative buying and falling crack spreads do suggest we are probably in need of some kind of short-term shakeout, an outcome that would go a long way to setting up another leg higher as we close out 2023.

Oil Market Dashboard

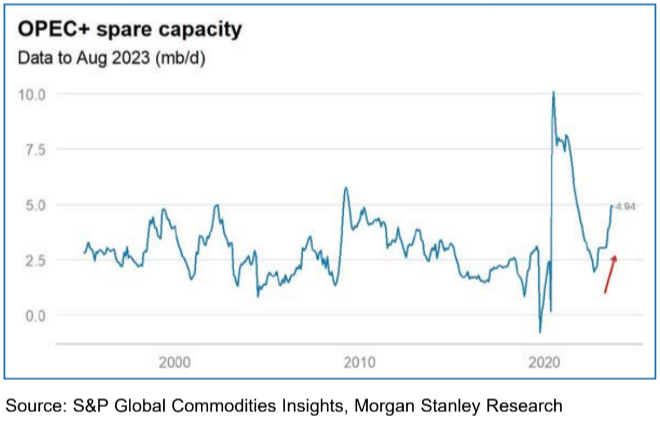

However, having said that, as I opined in my previous oil market update, there remain several factors in play that are likely to put a ceiling on oil prices.

Indeed, much of the current supply deficit is a result of the ongoing Saudi production cuts and Russian export cuts. OPEC+ spare capacity is now the highest it has been since 2010 (ex-COVID lockdowns), and it seems they are once again becoming the primary swing producer of oil.

Meanwhile, Chinese stockpiles have also been filled to the brim, so, should WTI or prices spike into triple digits, I suspect the Saudi’s would be happy to ramp up production, with China also likely to release some of their commercial and strategic stockpiles onto the market. For these reasons, don’t expect a spike to $150 oil just yet. That will happen, but I suspect it will be a story for 2025, once the US election has come and gone.

Though a blow-off top is not impossible, it remains unlikely. For now, enjoy the favorable fundamentals as we close out 2023.