Is Inflation Heating Up Faster Than Markets Realize?

2024.12.12 03:13

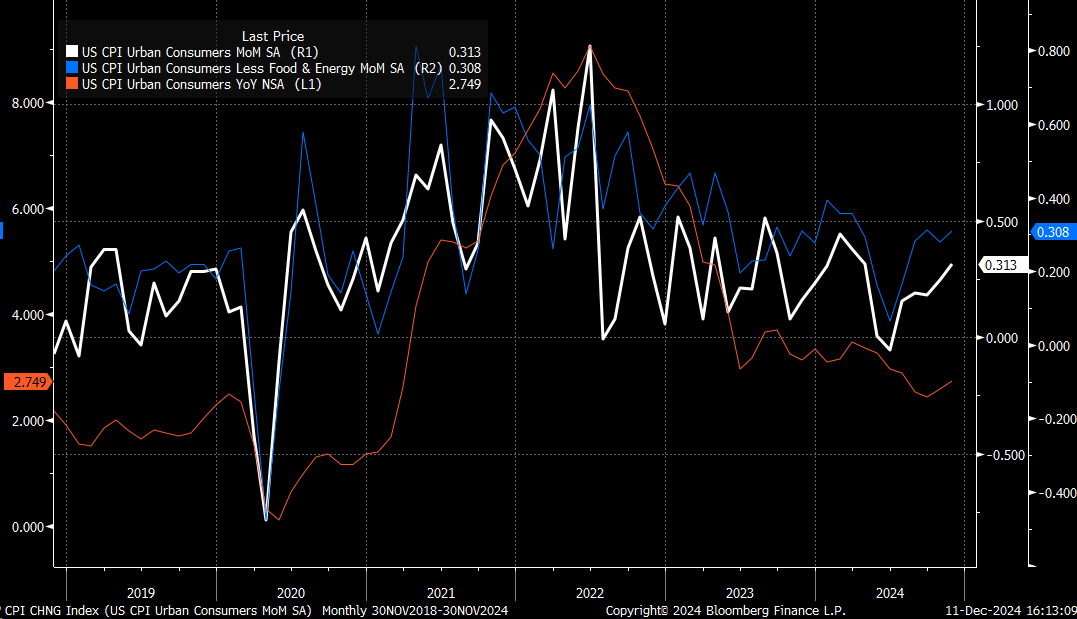

The numbers yesterday largely came in line. But when you took a deeper look at them and rounded them out, you realize they were in line but on the hotter side of inline, meaning the year-over-year number came in at 2.7 but missed a 2.8 print by a hundredth of a percent. The number came in at 2.749%. If it had rounded one more hundredth, it would have rounded up to 2.8%.

Meanwhile, the numbers were in line but above the mean, which was 0.27 for the headline. The headline came in at 0.313, and the core came in at 0.308. They were just on the hotter side of in-line, if you break it down that way.

This matters because one-year inflation swaps traded up five basis points yesterday, back to 2.64. Two-year inflation swaps traded up four basis points, back to 2.61. December swaps are now trading at 2.90, having been closer to 2.84-2.85. These also suggest that December pricing is moving up. Based on swap pricing, the December month-over-month rate is expected to increase by 0.4%, indicating further acceleration in headline numbers by December. yesterday’s month-over-month CPI numbers were some of the highest since the spring.

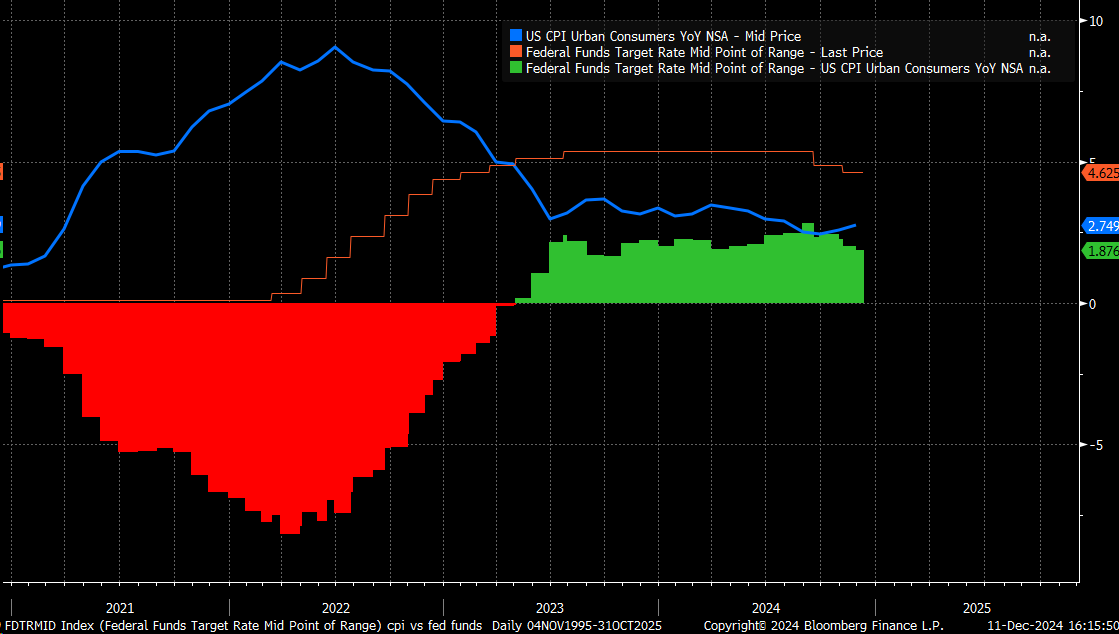

The market doesn’t seem to think this will deter the from cutting rates, as there’s a 98% chance of a Fed rate cut at the December meeting. For the Fed, if they’re concerned about policy being too tight as they cut rates and inflation rises, this dynamic helps ease policy from both sides.

Subtracting the inflation rate from the Fed funds rate gives the real Fed funds rate. With inflation rising and the Fed cutting, the policy rate becomes even easier than if inflation stayed flat. For example, the Fed has only cut by 75 basis points so far, but the real Fed funds rate dropped from 2.85% in September to 1.87% yesterday, more than the Fed’s actual cuts.

If the real neutral rate is around 1% (assuming a nominal neutral rate of 3% and an inflation rate of 2%), the Fed has about 50 basis points of cutting left if headline inflation rises to 2.8% or 2.9%. This implies a higher neutral rate than currently priced in.

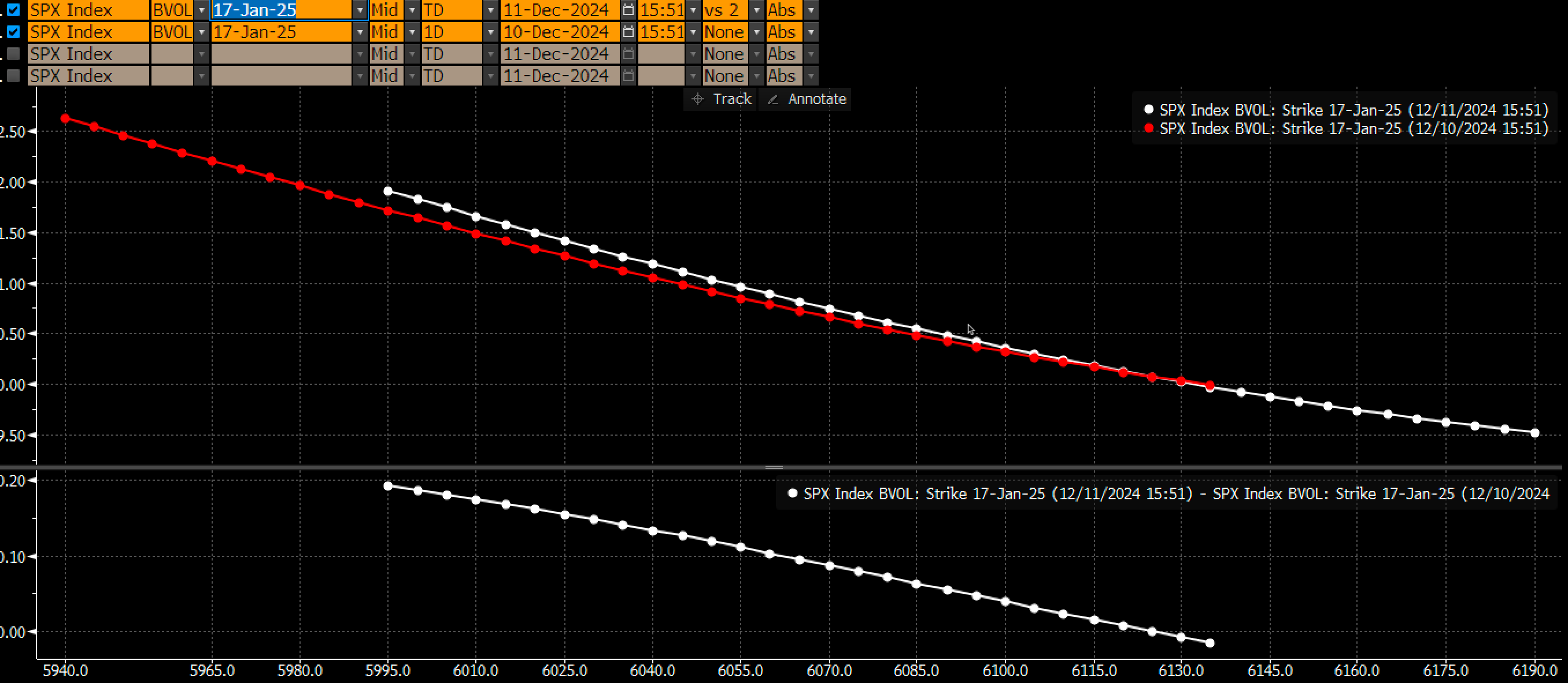

The equity market moved higher yesterday, partly due to implied volatility. The traded lower, but the VVIX, a measure of volatility for the VIX, rose almost four points to 98. Ten-day realized volatility rose to 7.5, and 20-day realized volatility to about 8.7. Fixed strike volatility also increased slightly. Despite the VIX being down, other volatility measures were up, reflecting broader market conditions.

We have a Fed meeting and a meeting next week, which might push up short-dated implied volatility. Inflation rising yesterday initially caused a dip, but the dollar later rebounded. The rose almost five basis points to close at 4.27, up 12 basis points this week—a noticeable move.

In funding markets, spreads indicate rising costs. The numbers were adjusted again after the podcast, so December contracts rose by 28 bps to 142.5, while January contracts rose to 167.5, which allowed the spread to fall to 25 bps. Still, the increases suggest the cost to fund these contracts is still rising.

Have a great rest of your evening.

Original Post