Is Hyper-Inflation That Destroys a Currency a ‘Solution’?

2024.05.30 16:26

When predicting the future, we’re best served by following “what benefits the wealthy and powerful,” as that is the likeliest outcome.

This contrarian sees a strong consensus around the notion that hyper-inflation is the inevitable end-game of nation-states / central banks issuing fiat currencies, i.e. currencies that are not restrained by being pegged to tangible assets such as reserves. The temptation to issue (via “printing” or borrowing new currency into existence by selling sovereign bonds) more currency becomes irresistible to politicians and central bankers alike. as the means to mollify every constituency, from elites to the military to commoners dependent on state-funded bread and circuses.

This unrestrained creation of new money far in excess of the expansion of goods and services (i.e. the real economy) devalues the currency, as “all the new money chases too few goods and services.” Gresham’s law kicks in–bad money drives good money out of circulation–as precious metals, fine art, gemstones, etc. are hoarded and the depreciating currency is spent as fast as possible before its purchasing power declines even further.

The Cantillon Effect also kicks in: those closest to the spigot of new money get first dibs on converting the depreciating currency into tangible goods, leaving the non-elites to sweep up the “trickle-down” shreds left as the currency loses purchasing power daily.

The consensus holds that there is no way to stop this decay of purchasing power to near-zero, i.e. hyper-inflation, once it starts. As in a Greek tragedy, the fatal flaw of the protagonist–in this case, fiat currency–leads inevitably to its destruction.

In the real world, things having to do with money tend to occur because they benefit powerful interests. This leads us to ask of hyper-inflation: cui bono, to whose benefit? Exactly which powerful interests benefit when a currency’s purchasing power plummets to near-zero?

The idea here is that there will be pushback if it doesn’t benefit the wealthy and powerful. So either hyper-inflation somehow benefits the wealthy and powerful, or it escapes their control and wipes them out along with the powerless commoners. That raises the question: didn’t the wealthy and powerful see what was coming and couldn’t they have reversed the policies generating hyper-inflation? If not, why not?

There are a couple of different threads to follow here. One is that capital is what matters to the wealthy and powerful because they own the vast majority of it while credit is what matters to the poor, as credit is their only way to acquire a bit of capital to invest in their own enterprise / household.

The poor owe debt, the wealthy own debt: debt (such as a home mortgage) is an asset to the wealthy, who buy the loan for its income stream, while debt is a liability to the commoners that must be serviced out of their earned income.

If wages rise in parallel with high rates of inflation, those who owe debt find their burdens lightened as their mortgage payment remains fixed while their income rises with inflation. Imagine how cheering it is when one finds a once-onerous $200,000 mortgage can now be paid off with a month’s salary due to hyper-inflation.

On the flip side, the wealthy and powerful who own the debt are less delighted, as the purchasing power of the currency used to pay off the mortgage has diminished, effectively robbing them of most of the value of their original purchase of the mortgage. Where the $200,000 they paid for the mortgage could have bought two nice luxury vehicles, the $200,00 they now receive in full payment can barely buy a used clunker.

This raises an interesting question: why on Earth would the wealthy and powerful let hyper-inflation destroy the value of all their debt-based assets and income streams? Isn’t that completely counter to their interests? If so, why would they let that happen?

At this juncture it’s important to draw a distinction between ancient examples of hyper-inflation and the present-day economy. In the declining era of the Roman Empire, the government drastically reduced the silver content in the coinage to generate the illusion that everyone was still being paid in full with only a fraction of the silver contained in old coinage. This artifice was quickly uncovered, and old coinage disappeared from circulation due to hoarding and inflation caused prices and wages to soar.

The difference is back then, the poor owned virtually nothing. Today, the poor “own” debt service: they owe interest and principal on the vast quantities of debt owned by the wealthy, who will lose out when the value of their debt-based assets crash to near-zero in hyper-inflation. Hyper-inflation is incredibly beneficial to debtors with earned income and incredibly destructive to those who own the debt being wiped out.

This leads to a second thread: the wealthy shift their wealth overseas as inflation picks up, wait for the hyper-inflationary storm to wipe out the value of literally everything in their home economy, at which point they return, foreign cash in hand, to scoop up all the best assets at fire-sale prices.

This certainly works on small developing-world economies, but it doesn’t work in large economies such as the U.S. with $156 trillion in assets to convert into other nation’s currencies and assets. In large economies, the wealth of powerful elites is generated by a functioning economy that produces goods and services and maintains a stable currency. Buying a castle and some gold overseas is not a replacement for productive capital that generates income and capital gains.

Wiping out the value of the nation’s currency also destroys its value as a reserve currency and in global trade, two additional disasters the wealthy and powerful would seek to avoid at all costs. If we tote up the winners and losers of hyper-inflation, the commoners who owe debt win as long as wages rise with inflation, while the wealthy and powerful lose out. Given the vast asymmetry of wealth and power, do you really think this is going to happen?

We must also draw a distinction between borrowing currency into existence via paying interest on a sovereign bond and “printing” currency, as some studies have found borrowing currency into existence precludes hyper-inflation, as the interest payments on the rising debt act as a negative feedback loop on future borrowing: as interest consumes more of the state tax revenues, political and financial pressures to curtail runaway borrowing/spending emerge.

What seems more likely because it serves the interests of the wealthy and powerful is interest rates on sovereign bonds soar, enabling the wealthy who sold off all their risk assets such as stocks and commercial real estate to earn a healthy, low-risk return in Treasuries. The central bank is ordered to stop “printing money” and the government cuts spending across the board, leading to howls of outage but since the interests of the wealthy and powerful are at stake, too bad, suck it up, kids, everyone takes a cut.

Risk assets deflate, the purchasing power of the commoners’ debt service stabilizes, and the ensuing deflation only hurts those who didn’t bail out of speculative risk assets at the top and stash the cash in short-term Treasuries. Then, when rates max out, the smart money shifts capital into long-term sovereign bonds and waits for the deflation to send risk asset prices to the basement. Then the long-term bonds can be liquidated for cash, and the deflated assets scooped up at fire-sale prices.

If we ask cui bono, which scenario is more likely: hyper-inflation or a deflationary crushing of risk assets and soaring interest rates? Yes, a bunch of zombie / marginal borrowers will default, and those holding the debt will be wiped out, but all that is foreseeable and can be remedied by selling when everyone is bullish on real estate and risk assets.

As for the commoners, deflating prices increase the purchasing power of their wages. Those with little or no debt will benefit from deflation, as their wages will go farther and they’ll finally be able to afford risk assets once prices return to pre-bubble levels. As for interest rates, we all paid 12% mortgages in the early 1980s and life went on because the loans were modest in size compared to today’s bloated Everything Bubble.

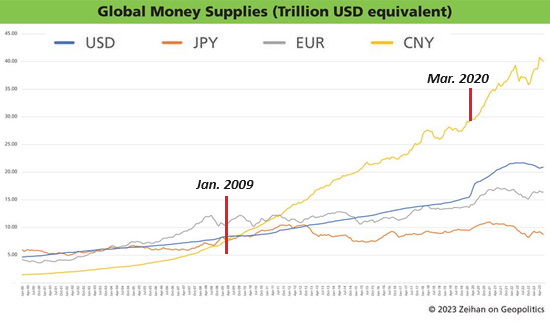

Other than China, it doesn’t appear that global money supply is going parabolic:

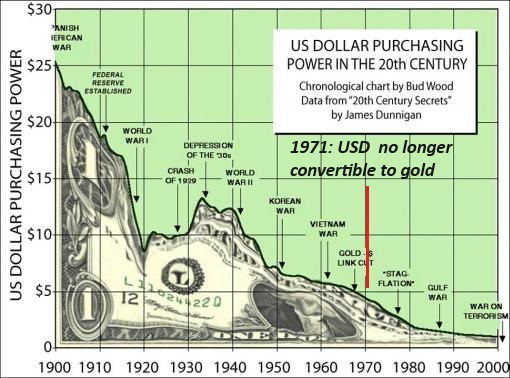

As this chart indicates, inflation is tolerated as long as it’s stretched over a century and wages rise along with prices.

When predicting the future, we’re best served by following what benefits the wealthy and powerful, as that is the likeliest outcome. Is hyper-inflation a “solution”? Not to the wealthy and powerful.