Investors sell dollars despite strong data

2022.12.05 06:29

[ad_1]

- Budrigannews.com – Investors sell dollars despite strong data

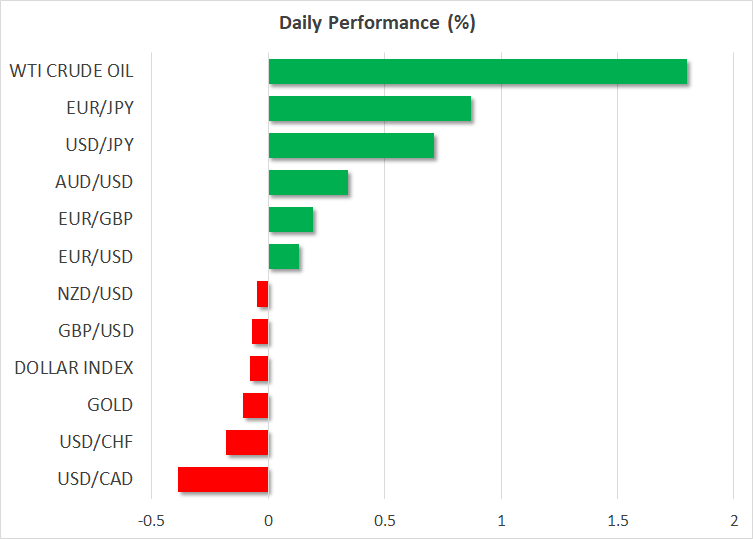

On Friday, there was a lot of volatility in the FX complex.With nonfarm payrolls exceeding expectations and wage growth accelerating, the most recent set of US employment data appeared to be strong, but the dollar could not capitalize for long.

The reserve currency rose initially on indications that the economy is still in good shape, but investors discovered some negative aspects as they read the report.Another difference existed between the payroll and household surveys: while the former indicated a flourishing labor market, the latter revealed job losses, alarming traders.

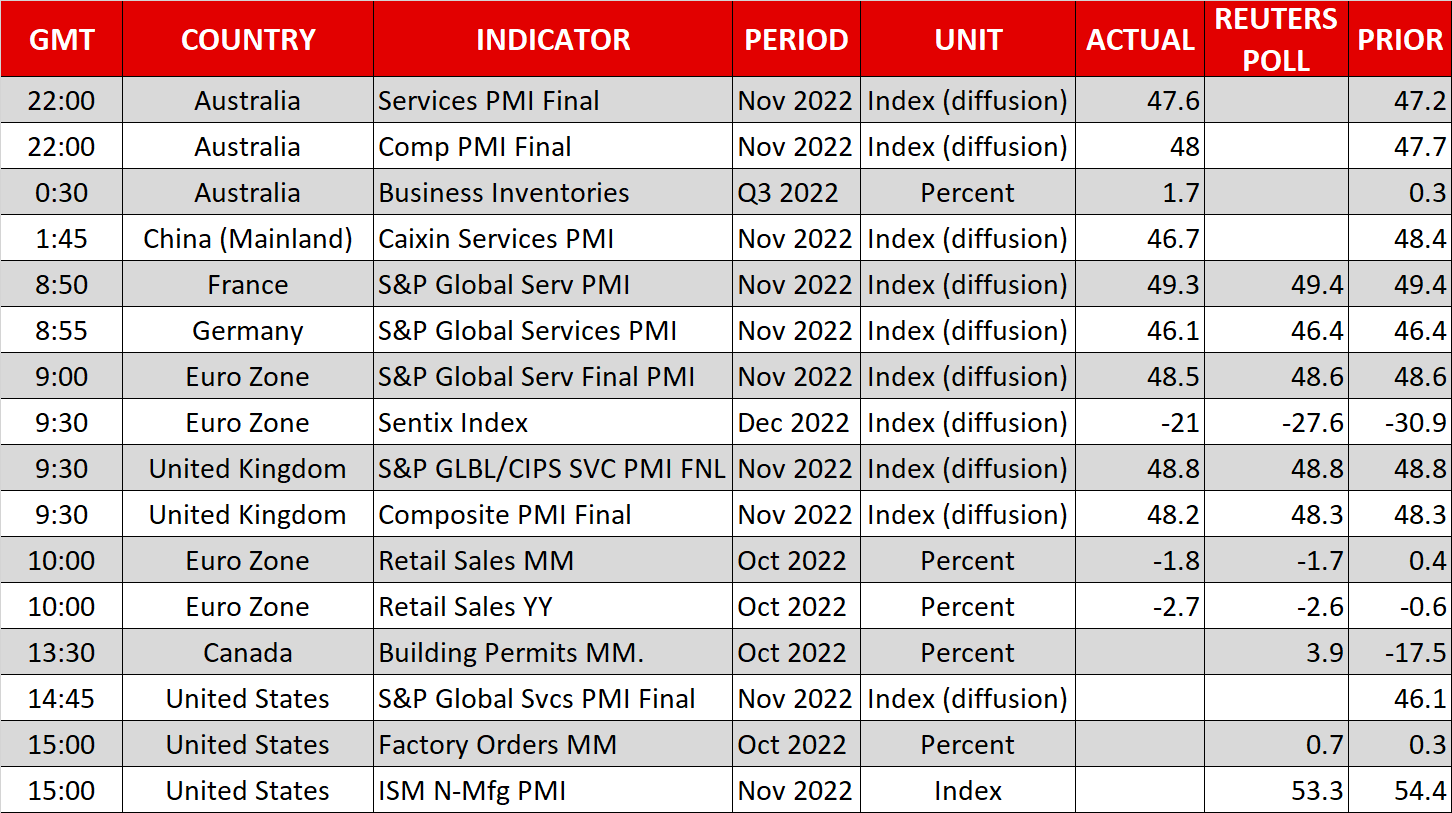

The contradictory messages implied this report was probably not going to make some difference for the Fed, subsequently the following whipsaw in business sectors. A 50bps rate increment is completely heated in for the following week, trailed by a comparative move right on time one year from now that pushes rates to their last objective, just underneath 5%. This path’s expectations will be shaped by the ISM services survey later today.

Despite the most recent decline, it is still too early to anticipate a bearish trend reversal for the dollar.In the past, a softer Fed profile was not enough to turn the dollar around; capital would also have to leave the United States if the rest of the world’s economic outlook improved, which it does not currently.

The vast energy production of the United States protected it from the power shock that has ravaged Europe, but other major economies are in worse shape than the United States.

As a result, any reversal in the dollar appears to be a story for the second half of next year, even though leading indicators indicate that the United States is also on the verge of a recession. However, it may take a few more quarters for the country to reach that point.

Wall Street rebound, OPEC inaction There was a similar turnaround on Wall Street, which recouped some significant losses to finish about the same as the previous day. In the past few months, equity markets have made significant progress.The S&P 500 has risen roughly 16% from its lows, fueled by expectations of a more cautious Fed and weaker US inflation data.

Nevertheless, the fact that the fundamentals have not really changed makes it difficult to trust this recovery. As higher interest rates slow economic activity, valuations remain high and the data pulse continues to weaken. As a result, the optimistic earnings estimates for the coming year appear vulnerable to negative revisions.

Even though OPEC did not intervene by reducing production, oil prices are rising on Monday.Instead, it’s possible that news of China’s relaxation of its COVID restrictions contributed to a brighter demand picture.

In addition, there is a degree of trepidation in the energy markets because a number of significant players have chosen to remain on the sidelines while they wait to see how the EU’s ban on Russian crude and the G7’s $60/barrel price cap will affect prices.

China eases restrictions; RBA makes a decision All of the talk in the markets right now is about how some Chinese cities are easing restrictions on covid. While these are just minor advances, financial backers plainly view them as the plan towards a full returning, in light of the 4% meeting in Hong Kong values.

A

s is always the case, what happens in China will have a significant impact on the Australian dollar and other currencies of nations that rely on Chinese demand to absorb their commodity exports.

The Hold Bank of Australia will meet for the time being and in spite of the fact that market evaluating is inclining towards a quarter-point rate increment, it likewise relegates a 25% opportunity for no progressions by any means.

The RBA is concerned that a global recession next year could reduce commodity demand, despite the fact that house prices are rapidly falling and the employment market and wage growth dynamics remain solid. One strategy for balancing these risks would be to moderately raise interest rates and leave room for a pause next year.

[ad_2]