Investors Brace for U.S. Inflation Turmoil

2022.12.13 06:37

[ad_1]

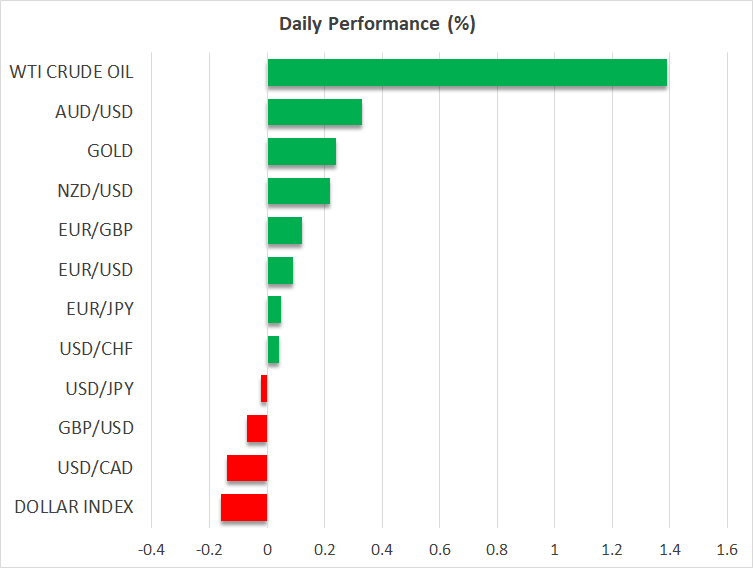

- Dollar drifts lower ahead of pivotal US inflation report

- Delicate balance between optimism and caution in stocks

- Yen suffers some bruises ahead of BoJ’s Tankan survey

Inflation test

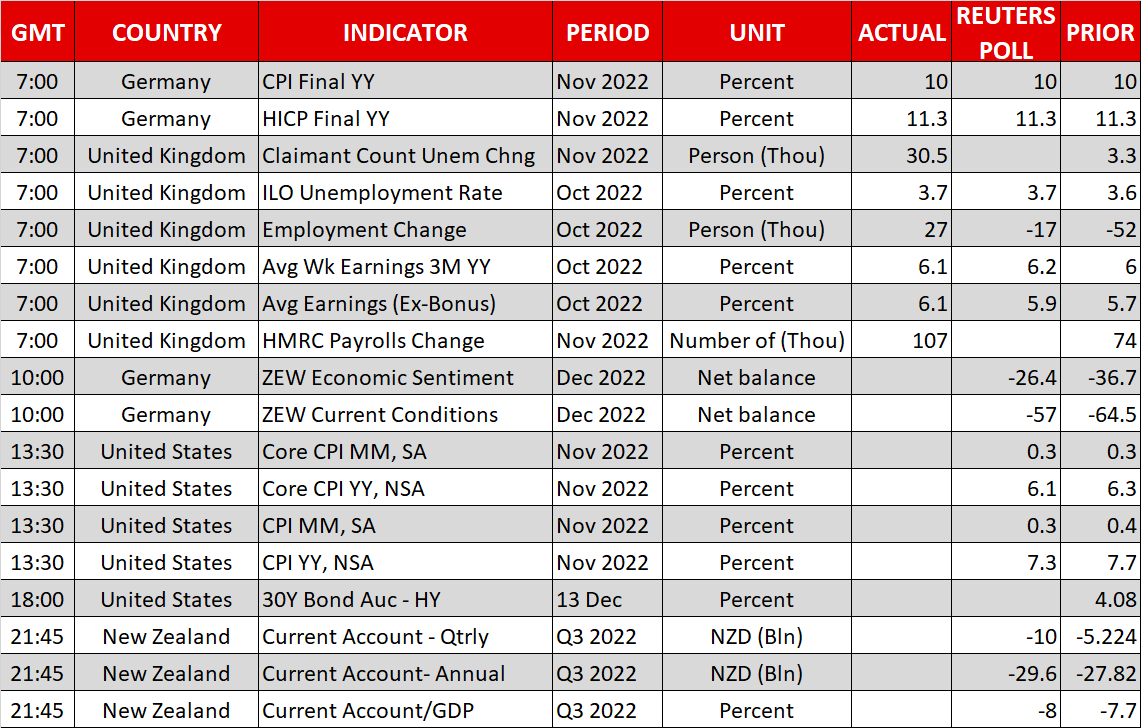

A trial by fire awaits investors today, as the latest US inflation report could single-handedly determine whether global markets end the year with a party or a riot. Forecasts suggest inflation cooled further in November, with the yearly CPI rate projected to decline to 7.3% from 7.7% in the previous month.

Most of the anticipated improvement in inflation is linked to falling energy prices and companies offering steep discounts to stimulate sales in an environment of weakening demand, according to business surveys. The uncertainty revolves around rents, which account for one-third of the CPI basket and are now playing catch-up with the rally in house prices last year, potentially offsetting some of the progress in other categories.

Unless there’s a huge surprise in inflation, this dataset is unlikely to affect tomorrow’s Fed decision, although it could influence the tone of Powell’s press conference. Considering the resilience in incoming data and the loosening in financial conditions since the last policy meeting, which is counterproductive for a Fed still trying to extinguish inflation, there’s a clear risk that Powell sounds hawkish tomorrow – inflation permitting.

Turning to the dollar, the outlook seems neutral here. Inflation is simmering down and the Fed will likely shift into lower gear with its rate increases, but that might not be enough to put the dollar in a bearish spiral because most major economies are in worse shape than America’s. Until the global picture is attractive enough to siphon funds out of the US, the reserve currency is unlikely to break down.

Stocks surge despite stealth hedging

Wall Street kicked off a potentially explosive week in high spirits. The S&P 500 rose by 1.4%, yet a look under the hood reveals that the situation was not as cheerful as it appears at first glance.

The stock market gains were accompanied by a sharp spike in implied volatility and Treasury yields, which is a strange tape. It suggests traders are worried about upcoming events sparking a selloff, but prefer to hedge that risk through options rather than offload their shares, equally concerned about missing out on a massive rally like last month when inflation came in below expectations.

Therefore, there is a delicate balance between caution and optimism in the market, with investors trying to hedge but still capture any upside, covering all bases. This speaks to how uncertain the landscape is.

Admittedly though, downside risks seem to outweigh upside ones. Valuations remain expensive by historical standards and leading indicators suggest the economy is slowing down rapidly, leaving earnings estimates for next year vulnerable to negative revisions as the lagged impact of all the Fed tightening that’s already in the pipeline shows up.

Yen retreats

The recovery in yields yesterday was not enough to boost the dollar, but it did push the Japanese yen lower. A flurry of releases is coming up, including the Bank of Japan’s quarterly Tankan survey, which will be the last major dataset before the December policy decision.

Despite an acceleration in inflation lately, the BoJ is unlikely to tighten policy this month, mostly because wage growth hasn’t fired up in similar fashion and the economy unexpectedly contracted last quarter. Nonetheless, policy could be adjusted next year, especially after Governor Kuroda’s term ends in April.

As such, a reversal in the yen is likely a story for next year. The BoJ looks set to embark on a minor tightening cycle just as foreign central banks conclude their own and global recession risks intensify, a combination that might allow rate differentials to compress in the yen’s favor.

[ad_2]

Source link