Interest Rate Bets in Focus Amid Holiday-Shortened Week

2024.12.24 10:22

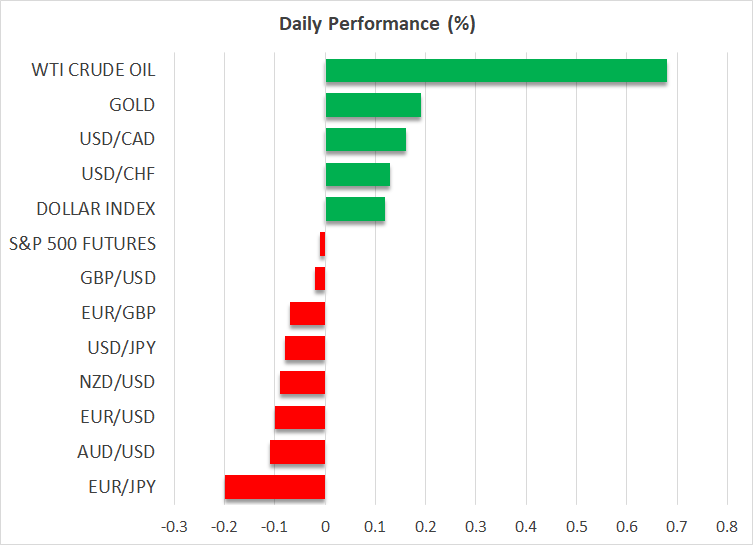

- Dollar rebounds on hawkish Fed outlook.

- Aussie suffers on RBA shift, China concerns.

- Yen hovers near five-month low on BoJ disappointment.

Dollar Flexes its Muscles Against Major Peers

The rebounded against most of its peers on Monday and remained on the front foot on Tuesday, as the lack of major economic releases due to a shortened Christmas week may allow monetary policy expectations to remain the main driver in the FX arena.

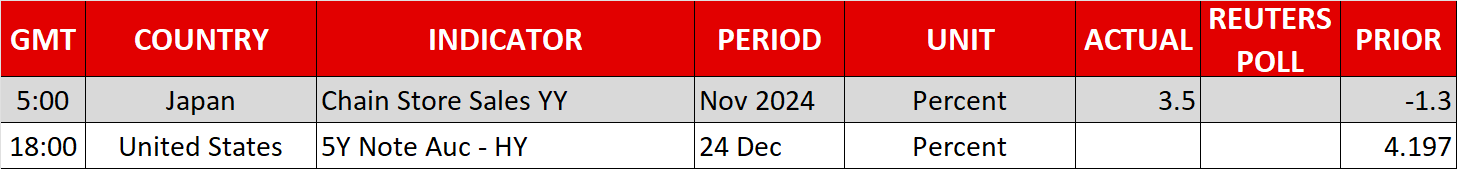

At its latest gathering, the Fed cut by 25bps but revised up its rate-path projections to suggest that only two quarter-point reductions may be needed in 2025. Back in September, the median dot for 2025 was pointing to four rate cuts.

Although Friday’s data came in somewhat softer than expected, allowing some profit-taking on the , the world’s reserve currency staged a comeback this week as the stance on monetary policy is in clear divergence with other major central banks that are turning more dovish.

Currently, investors are penciling in only 36bps worth of rate reductions by the Fed next year, while the ECB is seen lowering its own by another 110bps. This keeps the downtrend in intact and it may be a matter of time before the pair drops below the key support zone of 1.0330.

No End to Aussie’s Bleeding

Another central bank that turned dovish lately, although it was seen as one of the most hawkish ones a few months ago, is the RBA. Today, the minutes of the latest confirmed the Bank’s readiness to lower borrowing costs sooner than previously expected, with money markets now pointing to 75bps worth of reductions in 2025.

The shift hurt the , but monetary policy divergence is not the only headache for Aussie traders. Concerns about a second trade war between the US and China have also been weighing on the currency, which failed to take a breather today after Chinese authorities agreed to issue 3 trillion yuan worth of special government bonds in 2025, in an attempt to revive their struggling economy.

Yen Flirts with Intervention

Only the BoJ is in a rate-hike cycle and yet, the is among the big losers against the US dollar, tumbling to a five-month low last week and triggering fresh intervention warnings.

At its latest gathering, the BoJ managed to disappoint market expectations of another rate increase soon, erasing appetite for its currency. Although officials remained willing to increase borrowing costs further at some point, they appeared in no rush to do so.

Governor Ueda said that they prefer to wait for more information before taking action, emphasizing the uncertainty surrounding the new US administration, as well as the importance of the spring wage negotiations. Today, the minutes of the October meeting revealed that those concerns were on policymaker’s minds even then, before the US election.

With all that in mind, investors are not anticipating a full quarter-point rate increase before May, and more dovish commentary by BoJ policymakers could translate into more yen weakness. Having said that though, a higher dollar/yen may not be the safest trade in town as further advances may at some point trigger actual intervention and thereby a violent pullback.