Insolvent Banks and Stock Volatility: Ingredients for a Bull Run in Bitcoin?

2023.03.20 12:10

- The complex details of SVB’s failure are still unknown, and the current state of affairs is driven by emotions

- Bond market volatility has risen to levels not seen since the Great Financial Crisis and could lead to a sell-off in stocks

- Meanwhile, Bitcoin has seen a recent inflow of $200 billion, up 38% in the last 7 days

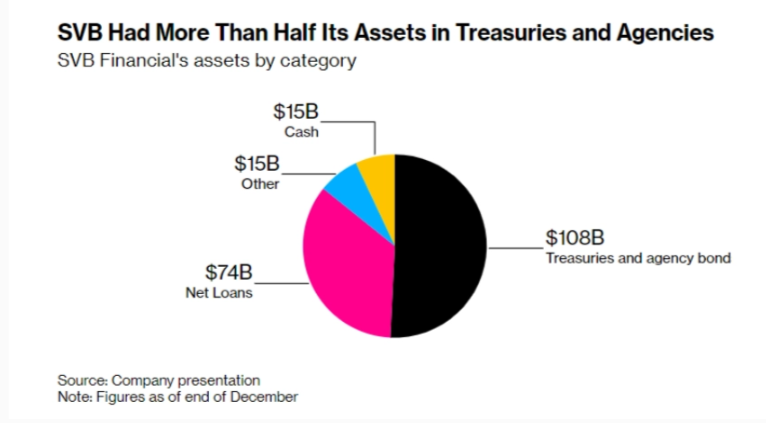

SVB was a publicly traded bank. It was focused on new technologies, meaning it did most of its business with U.S. startups. In recent weeks, SVB Financial Group announced that it had sold $21 billion in securities and $2.25 billion in new shares to shore up its finances.

This upset its investors, who eventually wanted to withdraw their money from the bank. Efforts to find new buyers were abandoned, and the Federal Deposit Insurance Corp forced the bank to close.

The same technology companies that caused SVB to grow so fast caused SVB to fail. With the run on branches, SVB had to sell bonds (which had lost some of their value), resulting in losses of $1.8 billion that would not have hit the balance sheets if they had been held to maturity.

SVB’s problems coincided with the closing of Silvergate Capital (NYSE:) and Credit Suisse (NYSE:).

I’ve encountered many comments from analysts and speculators discussing certain consequences that I disagree with. Moreover, these comments often seem to be based on unwarranted assumptions.

We still have very little idea of the minute details of what has happened, and the only common thread linking all the major (unexpected) events is how little we know, both about how they unfold and what might happen in the months and years to come.

The current state of affairs is driven by emotions, which generally leads to inaccurate assessments.

Many are not focusing on the unknowns surrounding this event:

- Why did the bank invest so much capital in long-dated Treasury bonds?

- Why was Peter Thiel (and others) advising startups/businesses to prepare to protect deposits?

- Were there any other conflicts of interest?

- What other banks might have similar problems with their “safe” investments?

At the moment, even on the EU side, the solution is to address the liquidity problem but not the solvency problem. The latter is downplayed or even treated as non-existent, and the main solution is based on reassuring speeches.

The went ahead and raised interest rates by 50 basis points, emphasizing the regional nature of the problem. Is the regional banking crisis just a contained event, or is the perfect storm coming?

Whenever we have such questions, the first place to look is the bond market. Any signal of stress will tend to manifest itself here.

Let’s overlay the volatility index with the stock index.

MOVE, the index that measures the implied volatility of the U.S. bond market, determines the “emotional state” through two values, 80 points representing market calm and 100 points representing extreme instability.

When the index fell below 80 and reached 38, representing an all-time low, it signaled that stocks were going to collapse. However, it has since rallied back above 100.

This is because investors have returned to bonds. In the last few months, it has fallen back to the 100 level. It is now back at 180. This is extremely high volatility, indicating risk aversion on investors’ part.

This kind of bond volatility has not been seen since the Great Financial Crisis. Its relationship with the VIX means that volatility in one asset class generally leads to volatility in the other.

Just look at how closely these lines follow each other, so if one is trending higher, the other will also be pulled higher. Does that mean broader selling pressure for stocks?

That said, we have all been thinking about déjà vu – even if it is not the subprime/securitized mortgage debacle of 2008-09, I cannot (and no one can) guarantee that nothing unpleasant will happen.

But if there is one theme that unites all these (past) events, as mentioned above, it is how little we are aware of how they are unfolding in real time. The fear is still of a systemic contagion.

Can this panic go viral and lead to a collapse of the banking system?

The has made its biggest move since the early 1980s. Isn’t that a good thing, you might say? Inverted yield curves are leading indicators of recessions.

So does this mean that a strong move higher can bring calm? In theory.

Overlaying the spread with the , whenever the latter rallied out of the negative territory (2001-2007-2020), the bear market, shown in the chart above, began.

I am not saying it will happen 100% of the time, but it is certain that bond market volatility is never a good thing for the market in general.

The banks continue to buy through all this. In 2022 alone, central banks bought a record 1,136 tons of gold, worth about $70 billion.

Gold is reaching March 2022 highs (+9% to date from March 8th levels) as the banking crisis looms.

Could it make new 52-week highs?

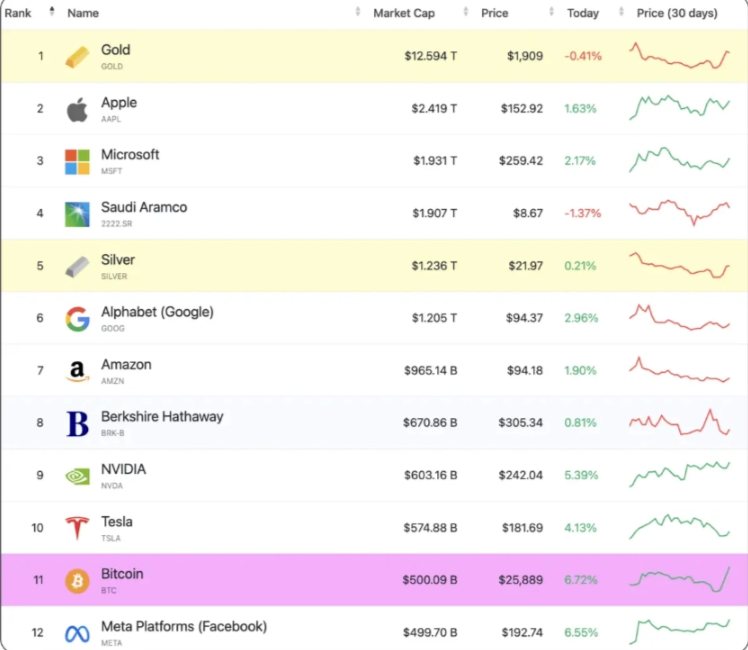

Meanwhile, as it remains at the top of the world’s most valuable assets by market capitalization, is climbing the rankings (worth more than and ).

Asset Ranking by Market Cap

Asset Ranking by Market Cap

Bitcoin is the number of people who have faith in it, the intensity of that faith, and the future value it represents.

So we could say it’s still quite undervalued, and the longer it survives, the lower the risk and greater the functionality of becoming a permanent store of value like gold.

In the last week, the cryptocurrency market has seen an inflow of $200 billion. Bitcoin is up 38% in the last seven days, while is up 26% (as of this writing).

And the total crypto market cap has increased from $918 billion to $1.17 trillion. Are people putting money into BTC faster than the Fed can print $300 billion out of thin air to bail out the banks?

Cathie Wood continues to buy Coinbase Global Inc (NASDAQ:) shares with the ARK Next Generation Internet ETF (NYSE:) and the ARK Innovation ETF (NYSE:), accounting for about 30 percent of all shares purchased in 2023.

Even Buffett, who has been critical of cryptocurrencies, has bet on (Brazilian fintech giant), which offers crypto trading services.

Maybe CZ (Binance) is right?

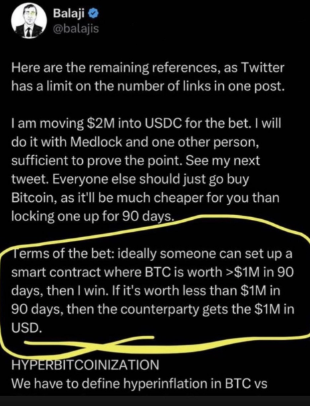

Or Balaji (the former Chief Technology Officer of Coinbase)?

Tweet by Balaji

Entrepreneur, co-founder of Counsyl, 21 Inc/Earn, former CTO of Coinbase, and General Partner of Andreessen Horowitz, Balaji is betting $2 million that 1 BTC will be worth $1 million in 90 days.

This is because the banks are insolvent.

Meanwhile, Bitcoin hit $28,000 when the Fed released its budget, revealing that $300 billion will be injected into the economy in response to the crisis.

The event, which should not be underestimated, practically nullified Quantitative Tightening by adopting the opposite strategy, i.e., Quantitative Easing.

Bitcoin is volatile right now, and it will probably go sideways later. But at the same time, it will have to hold the $26K level that could allow momentum to carry it toward $30K.

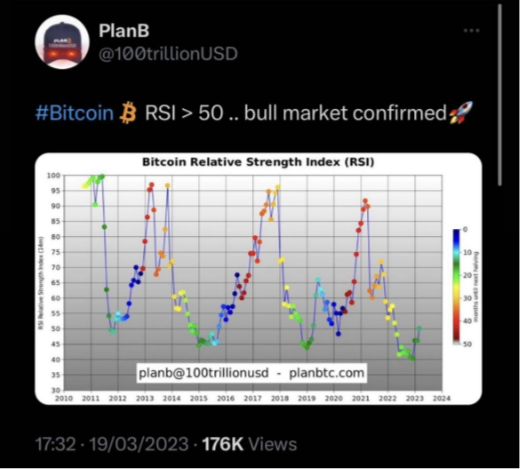

Also, according to PlanB, the bull market is about to start again.

Tweet by PlanB

We can see that the digirìtal currency is back above the 4-year moving average (1,458 days) in addition to the bullish RSI.

BTC 4-Year Moving Average

BTC 4-Year Moving Average

Historically, the SMA 1458 indicator has proven to be a reliable support for bitcoin.

In conclusion, the market is simply doing what it has always done because investor behavior has not changed much over the past 100 years.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remain with the investor.