Inflation, U.S. Dollar and Interest Rates Cooling

2022.11.14 16:43

[ad_1]

Last week saw the numbers come out indicating that inflation has begun to cool. On Thursday morning the release of October’s CPI was expected to come out at 0.6%. When released the number was actually 0.4% and the market took off like a rocket ship. Year-over-year inflation went from 8.2% in September to 7.7% and investors celebrated a possible slowing (pivot) of future Fed interest rates.

Our take: folks 7.7% is still a very hot number, and don’t count on Chairman Powell and company slowing down the pace of interest rate hikes anytime soon. They have made their opinion (and hawkish posture) very apparent. They have renumerated numerous times that they will not stop raising rates until inflation is trending towards 2% YoY. We do not believe they have any reason to pivot as yet.

However, the market had a different take and the had it’s biggest two day decline (Thursday-Friday) since 2009. interest rates had a significant retracement and rates eased with the new information. We went from a 4 print on the 10-year to a 3 print by day’s end on Friday.

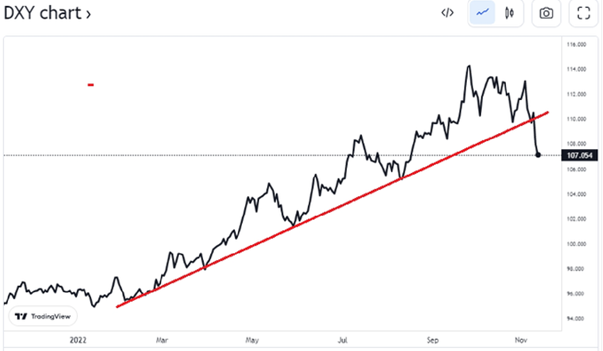

The (chart broke its steep trendline this past week:

DXY Chart

The Invesco DB US Dollar Index Bullish Fund (NYSE:) had quite the fall. See the graph for UUP and (10-year Treasury Rates) having fairly big price drops below:

UUP Daily Chart

The “Cooling Off” of the Dollar and Interest Rates was a welcome sign that the economy is indeed “slowing down”.

The lower October CPI print motivated traders to cover shorts and put new money to work. It was the fifteenth best daily return on the in history.

At week’s end, the was up 8.4% in just two trading days (Thursday & Friday). It was Nasdaq’s biggest gain since December 2008 . However positive that news is, it is important to note that just like in December 2008, we are still in a bear market. See the chart for the past two months below:

Nasdaq Comp. Index

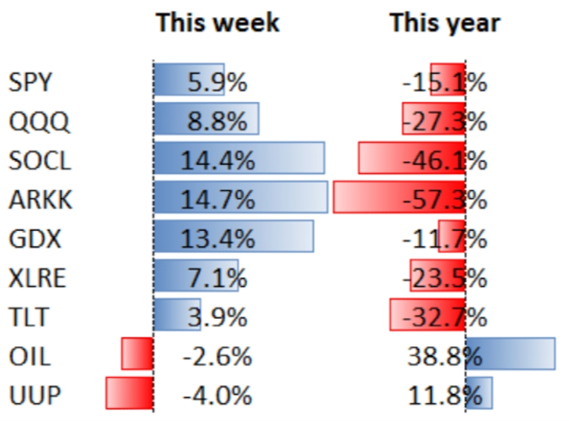

This week saw a real turn of events as 2022’s best areas underperformed and those areas hardest hit this year had huge rallies.

Performance Table

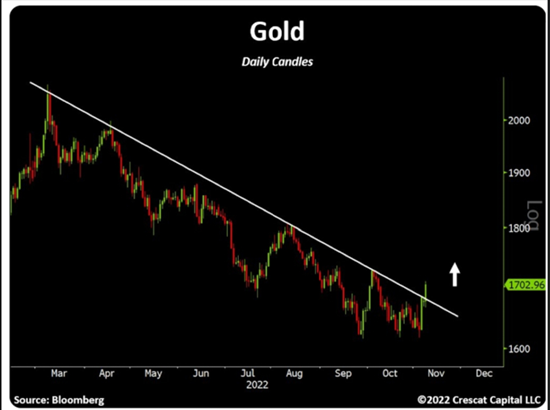

Mish has told many readers to “watch the Dollar”. She has long held the opinion that when the US Dollar breaks its steep incline (see above) that the metals could move dramatically.

was up over $100 an ounce this past week. soared even higher on a % price move. The metals made these moves higher as a result of the US Dollar and interest rates beginning to “cool off” as Mish has been continuing to suggest.

Gold Daily Candles

The following chart shows the relationship of Gold to UUP. One of our favorite technical indicators produced by Decision Point, is the PMO (Price Momentum Oscillator). We are about to get a significant crossover on that indicator, suggesting that has momentum and could rally further. It has been among the best performers currently in Mish’s Premium Trading Portfolio.

GLD:UUP Weekly Chart

Trouble in Crypto Land

We also would like to point out that this past week the Cryptocurrency platform FTX imploded (went bankrupt) and resulted in huge losses of investor capital as well as users of their platform. It may change the blockchain technology business in the short term with positive and negative ramifications.

Many pointed out that this was a “Bear Stearns” type of meltdown and could have long-term effects on the emerging blockchain technology industry. We would like to point out that when events like this occur, they tend to make non-paper assets like gold, copper, and . This may have also fueled the rally in gold this past week.

FTX was a large sponsor of major league sports as well as possessing the naming rights of the Miami Heat arena and a long-term sponsor of MLB Umpires.

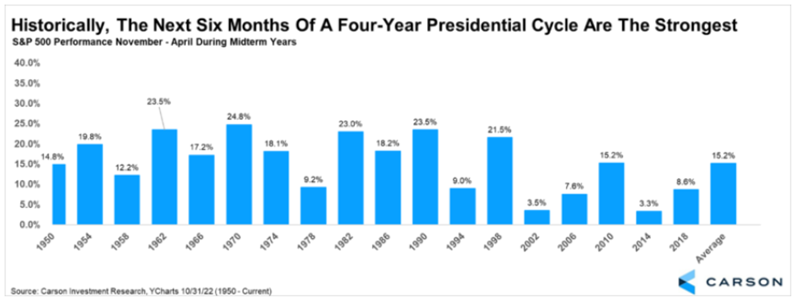

Seasonality and the Election Cycle

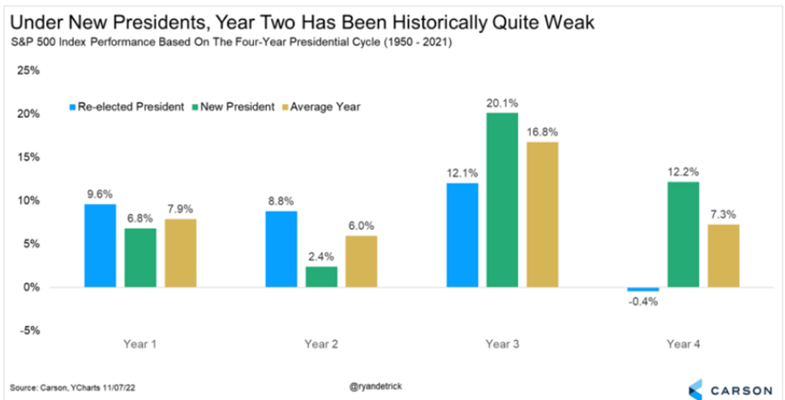

Last week we discussed seasonality and the favorable 4-year cycle that portends some tailwind for investors.

The midterm election has passed and some of the following charts may kick in. Similar to our article last week, we caution you NOT to go “all in” by implementing these historical conclusions. History may not always repeat, but it usually does rhyme in some way.

We likely have a different market environment this year, given the continuing high inflation narrative and the Fed’s persistence on their hawkish path.

Additionally, we really don’t have election conclusions at this time as several of the states have not yet decided who they will be sending to Washington.

S&P 500 Performance Based On 4 Yr Presidential Cycle

S&P 500 Performance Based On 4 Yr Presidential Cycle

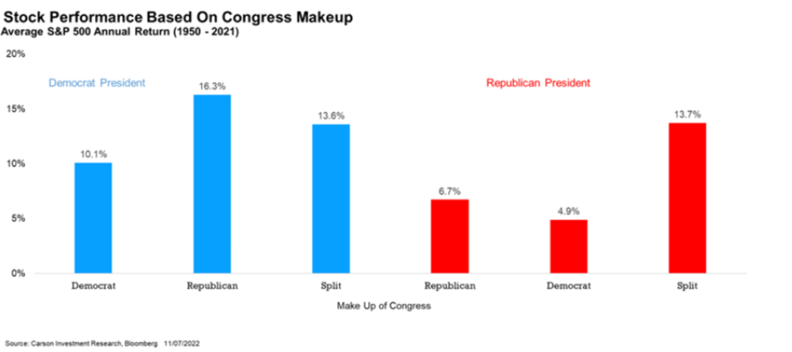

Stock Performance Based on Congress Makeup

Stock Performance Based on Congress Makeup

After reading all this, you may be inclined to want to get aggressive and put more capital to work. Again, we caution you that BEAR MARKET rallies are often mistaken for NEW BULL Markets. They are not.

We may have a long way to go yet. Why? We have not seen the effect of recently announced job layoffs and the expected contraction in revenue, profit margins, and inevitably declining earnings that may be forthcoming.

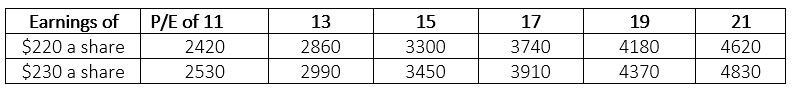

Recently Goldman Sachs and other Wall Street houses began to lower their earnings expectations for 2023. As you are all aware, the market (S&P 500) factors in the earnings expectations 12-24 months out. Given Goldman’s (and other’s) expectations for 2023 earnings of approximately $220 a share, it was a bit surprising to see the huge market rally this past week. That is why it is a bear market rally-shorts running for cover.

Let us give you a rough estimate of what market valuations based on Goldman’s per-share earnings expectations might look like in the near term.

If earnings of $220-$230 (consensus opinion) is the actual earnings per share number in 2023, (numbers listed are for the fair value of the S&P 500), assigning different Price to Earnings ratios can provide an S&P 500 number for valuation. Remember that in the latter part of 2023, the market will begin to factor in 2024’s earnings.

While we have no idea how dramatic the effect of higher interest rates are having on the economy and, therefore, what P/E we should use. Historically, coming out of an economic slowdown (and if we actually see a recession) P/E’s tend to be low to mid-teens. Past recessions have seen these P/E ratios get to 12 or less before beginning to recover and head higher.

This is also why the range for the S&P from Wall Street firms from Morgan Stanley to , Wells Fargo, UBS and others are anywhere from 2800 to 4100 on the S&P 500 index for early next year. Much of it will depend on how high interest rates go and if earnings continue to grow.

Today, earnings are expected to grow by approximately 5% in 2023. Don’t count on it. We believe that there will not be any earnings growth next year and perhaps even a contraction of 5-10%.

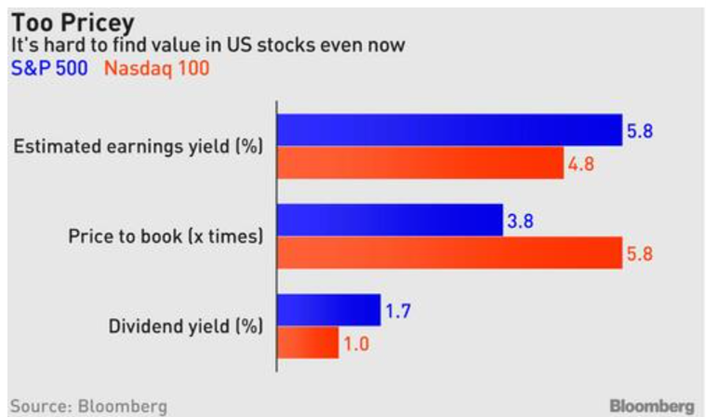

The same reason Warren Buffet is still not buying stocks

The legendary investor is still on the sidelines. He is considered a “value” Investor. According to the metrics that he and his staff of analytical money managers use, stocks are not in the “value zone” and “at this time do not present good valuation prospects.”

The combined market capitalization of the universe of U.S. stocks as constructed by the Wilshire 5000 index totaled $38 trillion as of this week’s close. That amounts to 148% of the 25.7 trillion value of U.S. gross domestic product at the end of the third quarter.

The ratio is now at levels that prevailed in the run-up to the first wave of the pandemic when hardly anyone would have thought stocks offered true value.

From previous comments Buffet has delivered, he said that he likes stocks when the percentage in the above chart is in the 80% area. While his holding company, Berkshire Hathaway (NYSE:) is still making acquisitions, the company’s cash pile at the end of September was $109 billion, compared with $105.4 in June. In other words, he and his staff are NOT currently finding any value in the market of stocks.

Moreover, for all the time we spend writing about the decimation of wealth from 2022’s stock market decline, the price-to-book ratio for the S&P is still VERY high at 3.8x and even more punitive at 5.8x for the Nasdaq 100. With 2-year Treasuries offering a yield of 4.5% and below average dividends on the S&P of 2%, we still have an expensive market no matter what exuberant analysts and prognosticators might tell you.

[ad_2]

Source link