Inflation-Indexed Bonds Ex-U.S. Led Global Markets Last Week

2022.11.21 10:00

[ad_1]

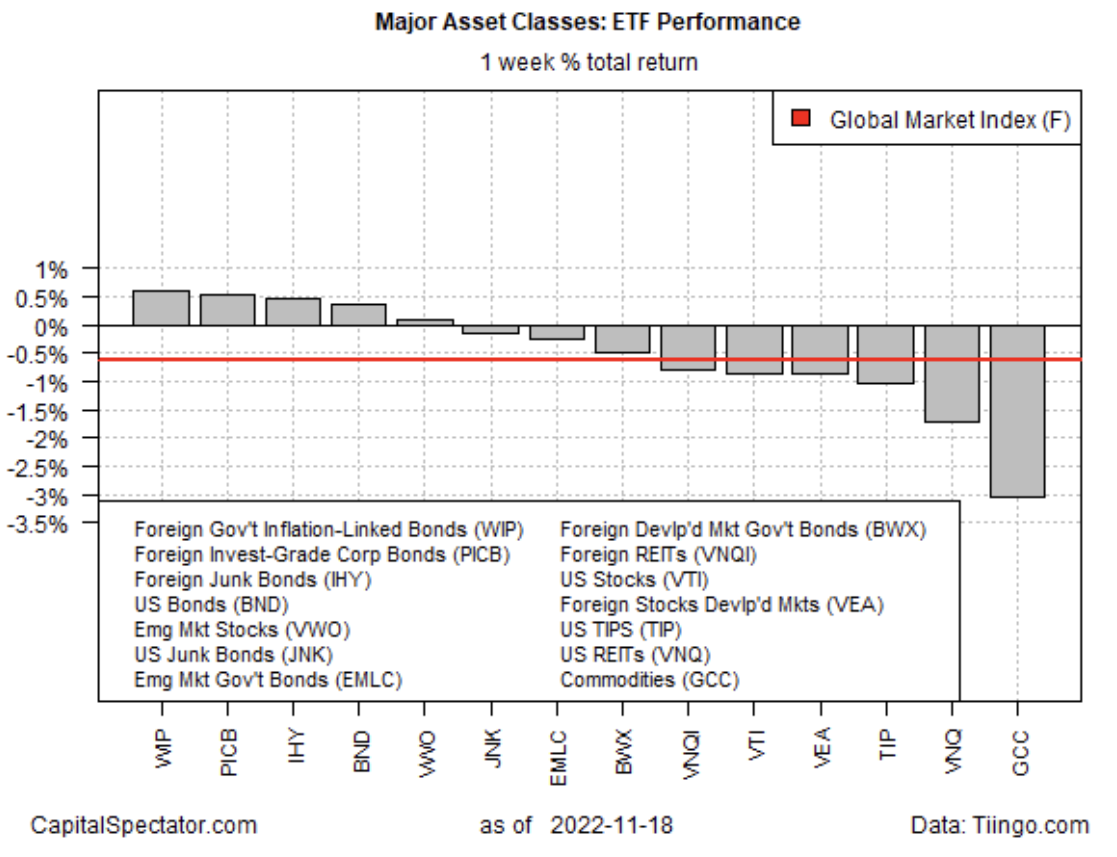

As markets continue to grapple with various macro risks, government bonds indexed to inflation ex-US extended their recent rally and posted the strongest gain last week for the major asset classes, based on a set of ETFs.

SPDR International Government Inflation-Protected Bond ETF (NYSE:) rose 0.6% during the trading week through Friday, Nov. 21. The increase lifted the fund to its highest weekly close in two months. Despite the increase, WIP’s price trend remains bearish, echoing the technical profile for most other bonds sectors at a time of rising interest rates and elevated inflation.

Overall, trading was mixed last week for the major asset classes. Foreign bonds posted the bulk of the gains. Losses, by comparison, were comparatively steep, pulling down prices developed markets via Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:), including the US, via Vanguard Total Stock Market Index Fund ETF Shares (NYSE:).

Equities in emerging markets, via Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:), bucked the trend for stocks with a fractional gain, marking the ETF’s third weekly advance. Nonetheless, the trend for VWO still looks bearish as it trades modestly above two-year lows.

The bias toward selling last week weighed on the Global Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies overall. GMI.F fell 0.6% last week (red line in chart below).

Major Asset Classes 1-Week Performance

Major Asset Classes 1-Week Performance

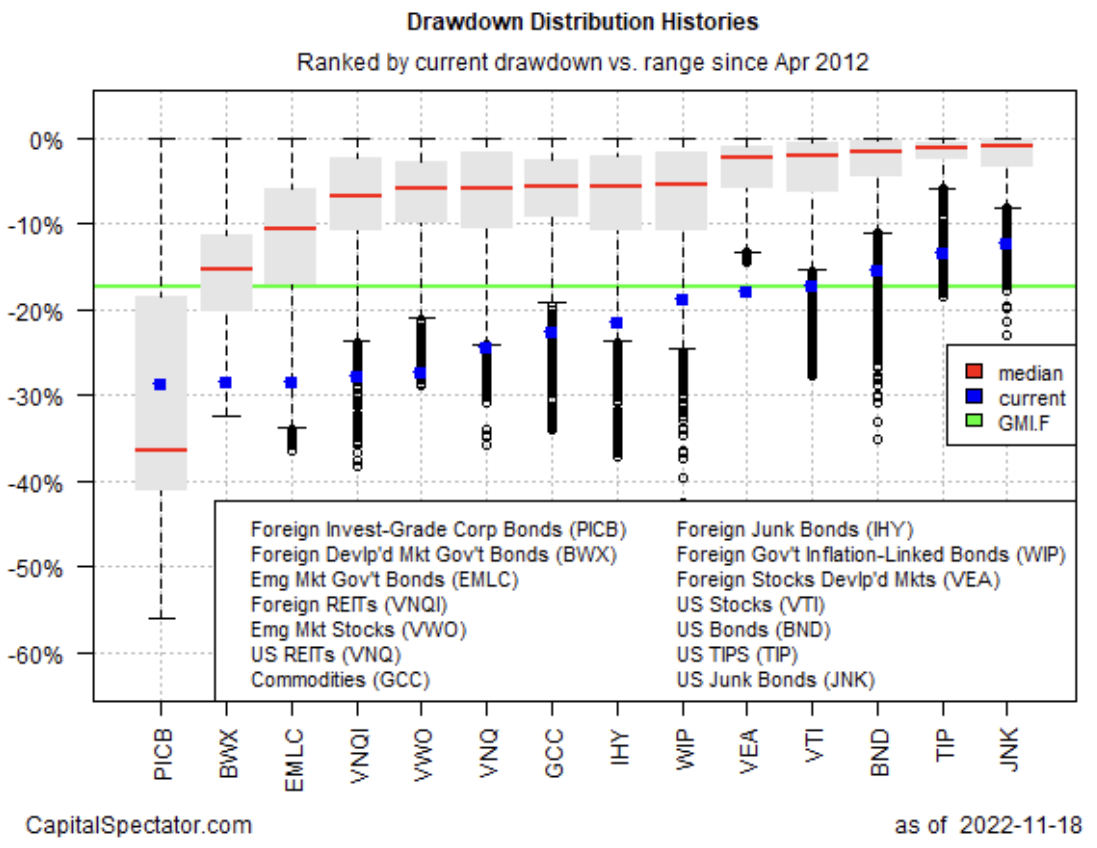

Turning to the one year trend, all the major asset classes remain under water for the trailing one-year window except for commodities via WisdomTree Continuous Commodity Index Fund (NYSE:).

GMI.F is also posting a one-year loss, closing down 16.9% vs. the year-earlier price.

Reviewing the major asset classes through a drawdown lens continues to show steep declines from previous peaks. The softest drawdown at the end of last week: US junk bonds, via SPDR® Bloomberg High Yield Bond ETF (NYSE:), which closed with a 12.5% peak-to-trough decline. The deepest drawdown: foreign corporate bonds (PICB), which ended the week with a 28.8% slide below its previous peak.

GMI.F’s drawdown: -17.4% (green line in chart below).

Drawdown Distribution Histories

Drawdown Distribution Histories

[ad_2]