Inflation, Growth Worries Weighed on Markets Last Week

2022.12.12 10:25

[ad_1]

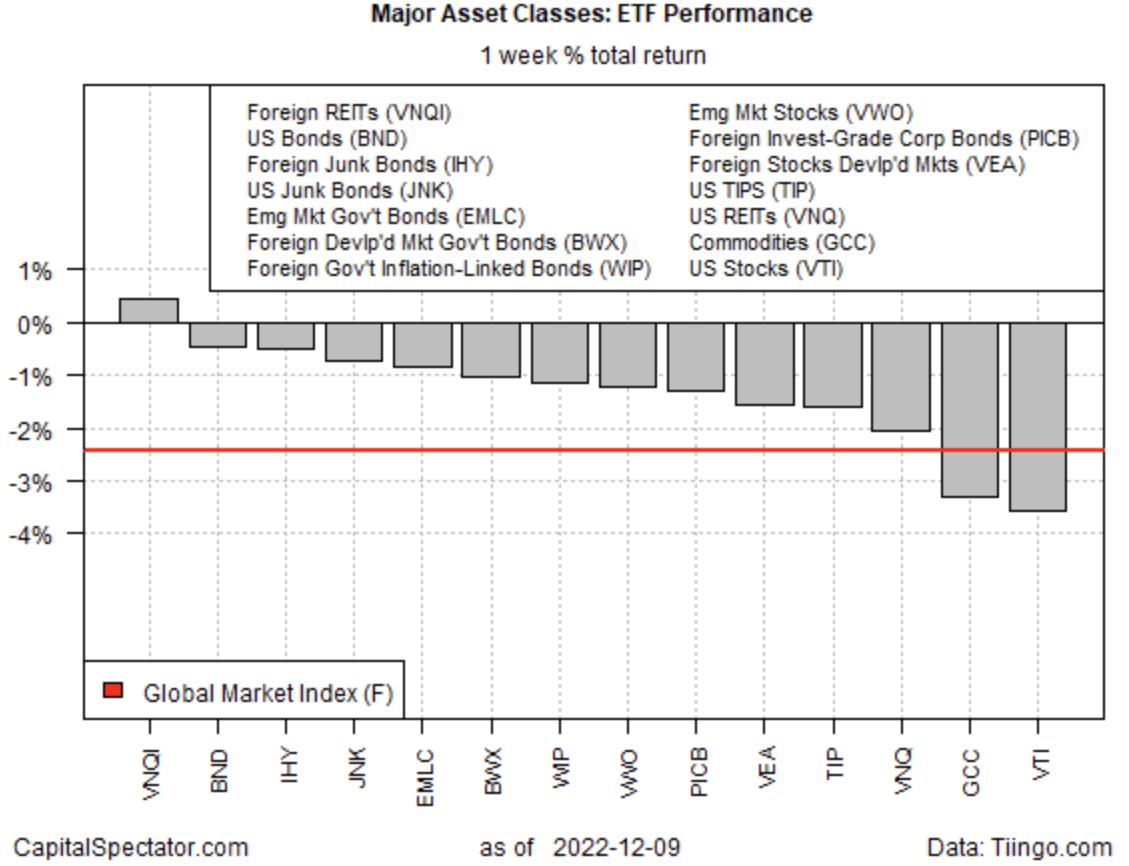

Nearly all components of the major asset classes fell last week, based on a set of proxy ETFs. Real estate shares ex-US were the exception.

The Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:) rallied for a third consecutive week, rising to its highest weekly close since September. But the longer-term trend still looks bearish.

Expectations that the Federal Reserve will announce another hike at Wednesday’s FOMC meeting (Dec. 14) are a headwind for yield-sensitive risk assets such as VNQI. The counterpoint is that VNQI’s trailing 12-month 6.85% yield is now attractive vs. a 3.57% yield on a 10-year Treasury (as of Dec. 9). But VNQI’s bearish price trend is intact and so capital losses in the fund look set to reduce any advantage in yield payout. As a result, deciding if VNQI will continue to provide a better total return than a 10-year Treasury is open for debate. Perhaps this week’s Fed press conference, when Chairman Jerome Powell will update markets on the central bank’s thinking, will offer new perspective.

The critical question: Has inflation peaked and, if so, is the Fed confident that it can soon pause rate hikes? Fed funds futures are pricing in a 70%-plus probability of a 50-basis-points increase on Wednesday and another, perhaps smaller, rate hike is still expected for the February meeting.

“Inflation has probably peaked but it may not come down as quickly as people want it to,” says Kathy Jones, chief fixed income strategist for the Schwab Center for Financial Research.

The crucial factors: how quickly and persistently inflation falls, which in turn will inform the central bank on the timing and degree of future policy adjustments.

“Inflation has seen its peak this year, but it will still be above what we had been used to pre-pandemic next year,” says David Mann, chief economist for Asia-Pacific, Middle East and Africa at the Mastercard Economics Institute.

Another factor to monitor is the market’s evolving view on recession risk, which may be replacing inflation as the main concern. “In both the stock and the bond market, you’re coming around to the idea that you have a much higher risk of a recession next year,” says Cindy Beaulieu, a managing director at asset manager Conning.

Michael Antonelli, a managing director at Baird, agrees. “The better part of this year was all about inflation worries, but that seems to have shifted.”

Perhaps that sentiment shift accounts for widespread losses across the major asset classes last week. The deepest decline: US stocks (VTI), which fell 3.6%, the first weekly setback since mid-November.

The Global Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com, fell 2.4% last week. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies.

Major Asset Classes 1-Year ETF Performance

Major Asset Classes 1-Year ETF Performance

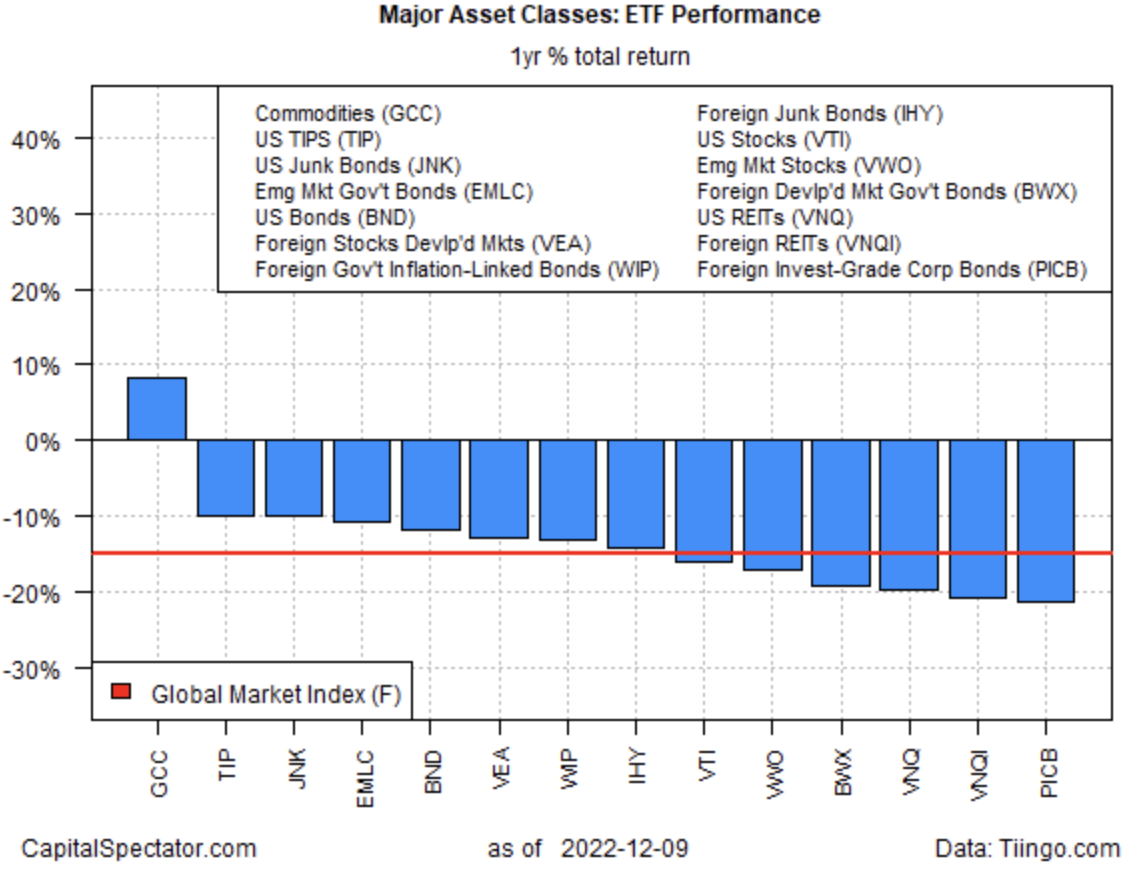

For the one-year trend, commodities (GCC) are still the lone upside outlier, posting an 8.2% gain for the trailing 12-month window through Friday’s close.

Otherwise, all the major asset classes remain under water for the past year.

GMI.F’s one-year performance is also negative via a 15.1% decline.

Major Asset Classes 1-Year ETF Performance

Major Asset Classes 1-Year ETF Performance

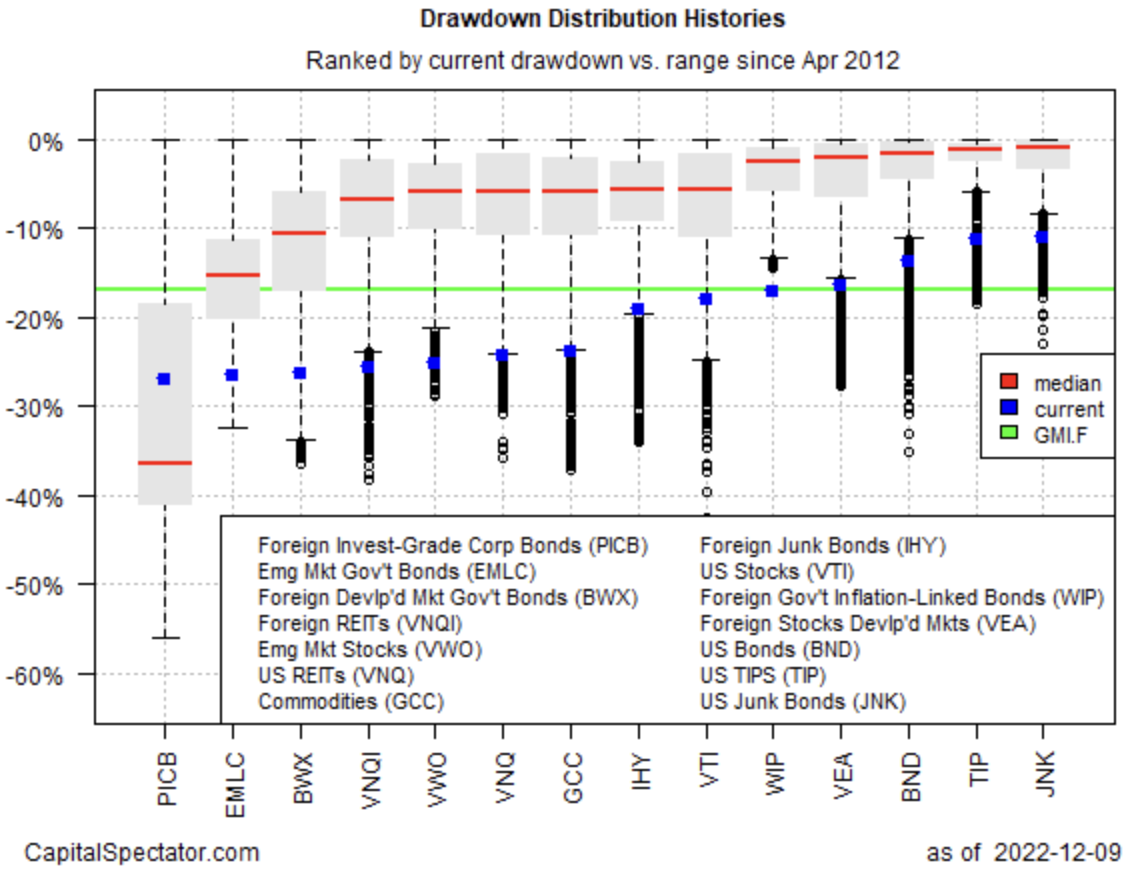

Comparing the major asset classes through a drawdown lens still indicates sharp declines from previous peaks for most markets. The softest drawdown at the end of last week: junk bonds (), which closed more than 11% below its previous peak.

GMI.F’s drawdown: -16.9% (green line in chart below).

Drawdown Distribution Histories

Drawdown Distribution Histories

[ad_2]