Inflation Bugs Nervous for the Wrong Reasons After April PPI Report

2023.05.12 03:50

The April report came in on the disinflationary side, and as a side note, unemployment jumped to the highest level since 2021. This has inflation-centric bugs scattering out of the stuff, a label the majority of them wrongly assign to gold and, worse, gold stocks. I wish I could set my watch by these herds because then I’d sell everything and await the inevitable opportunity they produce.

However, on this cycle, I have been much lighter on gold stocks than I will be when the next buying opportunity comes as the inflation bugs scatter amid accelerating real fundamentals and probably amid a deflation scare if our existing theme, to which I strongly considered an alternative last weekend, manifests. But as yet, no as holds support after the weak inflation data this week.

US Dollar Index Daily Chart

US Dollar Index Daily Chart

Weakening inflation data implies a weakening Fed. But our thesis is that the Fed will have brought about a new leg of the broad stock market bear before it begins to reverse policy. A weak Fed implies a weak dollar, but impulsively declining asset prices could imply a liquidity crisis. Where do the herds run during a liquidity crisis? Well, I think you know.

They tend to favor gold over . Here is the state of the Gold/Silver ratio (GSR) taking a hard bounce:

And they tend to stampede into the currency they’ve spent the last extended period of time railing against. The US dollar may be subject to all of the negative inputs noted in my De-dollarisation article, but a liquidity-seeking herd trumps all during a crisis.

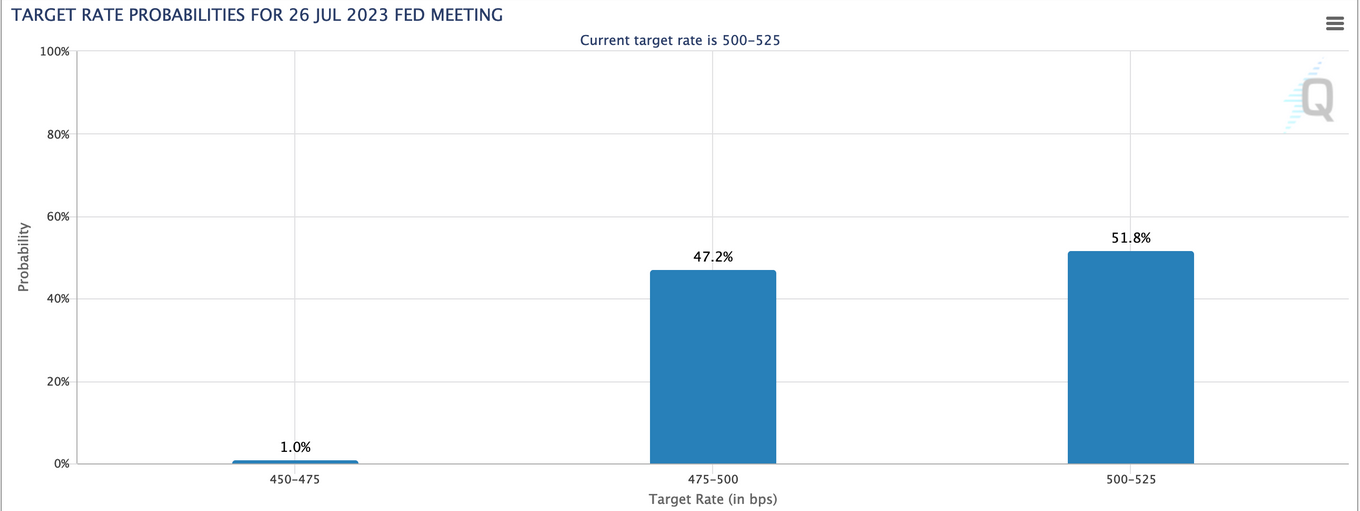

Of course, USD is only just hanging around at support as the economic data continue to erode the Fed’s resolve to fight inflation and, by extension, support the dollar. CME sees no hike in June, a near-even bet on a rate cut in July, and an overwhelming majority in the .25 to .50% rate CUT camp by September. The Fed’s rate hike regime is over, as I’ve been stating lately.

Fed Target Rate Probabilities

Fed Target Rate Probabilities

While USD is floundering, it is still above support. Is the GSR leading it upward? You’ll want to get a handle on that question because if they both turn and burn, the implication is draining macro liquidity, the exact fundamental backdrop for the gold mining sector, because in that event, gold may not go much of anywhere, but its ratios to most cyclical markets sure will. Those cyclical markets include mining cost inputs like Energy and Materials.

As for cyclical vs. counter-cyclical, you can see that within the metals complex, the premier counter-cyclical metal is furthering its upward break vs. the cyclical, inflation-sensitive one. This is bad news for inflationists, commodity bulls, and cyclical players the world over unless somehow the Dedollarisation play manifests per the links above.

Meanwhile, the damage done by and to inflationist gold bugs remains untold. It’s a periodic ritual. You buy from them when they are regurgitating positions because “OMG… NO INFLATION!!!”

As inflation continues to decelerate, opportunities shape up. Opportunity to get trampled if you’re all in with the inflationist herd and an opportunity to capitalize if you’ve kept perspective on the best macro for the gold mining sector. Today we are still in the disinflationary Goldilocks phase, with Tech still a leader, as it has been all year.

The next phase will likely either be a deflation scare per our original and ongoing plans or if USD loses support and breaks down within its longer-term bull market, an inflation trade similar to the 2003-2008 cycle, only on a more compact time frame.

Ironically, this second option is not a positive fundamental backdrop for gold mining, but that did not stop from rallying 300%+ on the ’03-’08 cycle (before the well-deserved crash in Q4). Just as ironically, selling events often come about in the gold mining sector even as its fundamentals scream higher amid deflationary pressures (witness Q4, 2008).

If the US dollar is not sacrificed in a global asset party – as speculated upon in the De-dollarisation article linked above – we are talking post-bubble stuff here and what could be a long phase of positive performance by quality gold mining operations after the bubble pops.