IMF Says Liquidity Lowest In Recent Years In The Markets

2022.10.31 16:16

[ad_1]

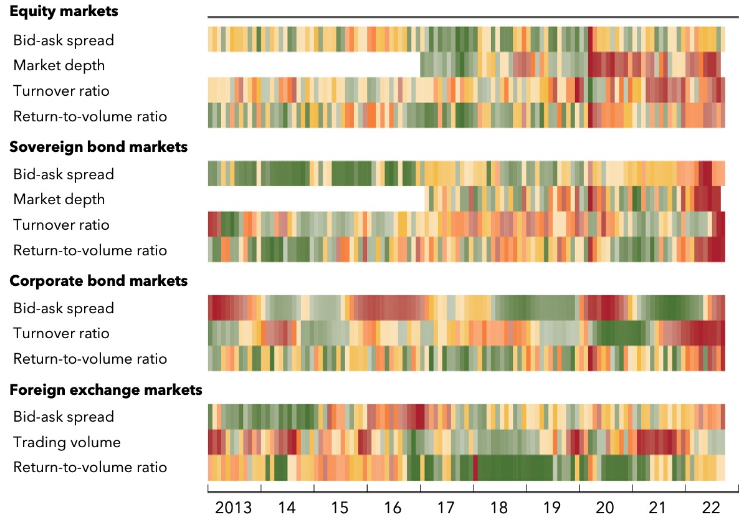

Liquidity is at the lowest levels in recent years in quite a few market sectors, according to an analysis by the International Monetary Fund (IMF), as cheap money (ss: low or even negative interest rates) has ended amid unprecedented monetary tightening.

In the “Chart of the Week” by Fabio Cortes, Glenn Gottselig, Shoko Ikarashi, and Aki Yokoyama, the liquidity chart appear to be… “red.” Liquidity is a key measure of how well financial markets are working. It refers to how easily assets can be bought or sold—when it goes down, it can be disruptive. After more than a decade of abundant liquidity and relative calm in markets, the central bank’s rate hikes to curb inflation has been accompanied by increased market .

As the Weekly Chart shows, measures of market liquidity have worsened across asset classes, especially in recent weeks, as increased uncertainty about the economic outlook and monetary policy has left investors with much less appetite for risk.

Liquidity in various markets.

Liquidity in various markets.

This may pose risks to financial stability. This was recently highlighted by the pressure on the UK government bond market, which required the Bank of England to intervene. This episode showed how sudden price movements combined with forced selling and deleveraging can lead to disorderly conditions in asset markets, threatening broader market functioning and stability. Spillovers from disorderly asset markets could also raise borrowing costs for governments and companies, worsening economic conditions.

Despite the ECB’s for another hike of 75 bp on interest rate last Thursday, on a weekly basis, the rally continued with gaining +3,95%, +5,83%, +2,09, and +4,03%.

[ad_2]

Source link