How Did Major Assets Perform in 2022?

2022.12.27 10:26

[ad_1]

Dismissing asset allocation as ineffective has become popular in some circles in recent years, but the charge is demonstrably false.

The evidence to the contrary is especially conspicuous in 2022, which is on track to dispense an unusually wide range of returns for the calendar year that nearly run out of road. The implication: opportunity has been unusually high within the realm of asset allocation.

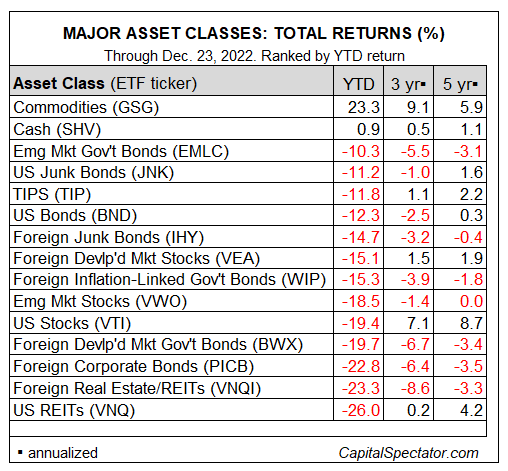

Consider how the major asset classes stack up on a year-to-date basis based on a set of proxy ETFs.

The spread between the best and the worst funds is a hefty 49 percentage points! If variation in results equates with opportunity, the year that’s coming to a close has been ripe with potential.

Major Asset Classes: Total Returns

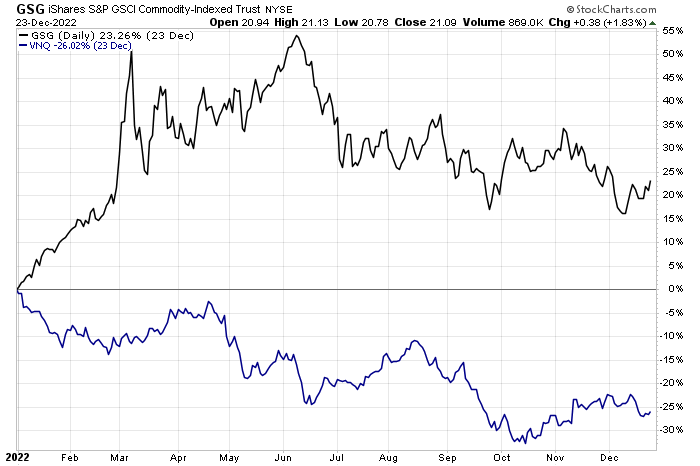

Commodities are set to post the strongest gain in 2022 by far for the major asset classes. The iShares S&P GSCI Commodity-Indexed Trust (NYSE:) surged more than 23% this year through Friday’s close (Dec. 23).

Impressive, but let’s not forget that this year’s hot performance follows an even stronger gain last year for raw materials write large.

The key takeaway: the decision to allocate into commodities or not probably explains a lot about the performance of multi-asset-class portfolios this year.

On the opposite extreme: US real estate investment trusts (REITs), which have taken a beating in 2022 and are set to post the deepest loss for the major asset classes in the fast-fading calendar year.

Vanguard Real Estate Index Fund ETF (NYSE:) is underwater by 26% through the close of last week’s trading.

The table above reminds us that most of the world’s markets are nursing losses this year. Other than commodities, only cash (iShares Short Treasury Bond ETF (NASDAQ:)) cheated the bears in 2022, albeit modestly.

Will these results influence the year ahead? Great question. Unfortunately, the future’s no less opaque at December’s close vs. January’s debut. But that’s no excuse to ignore asset allocation.

History isn’t a crystal ball, but it’s still useful, especially when combined with other metrics, such as valuation, momentum, and various flavors of macro analysis.

In the remaining days of the year, I’ll review 2022 results to date on a more granular level. Tomorrow’s focus: US equity-factor returns.

[ad_2]