Hot Gold Drops and Shaky Semis Pop

2023.05.08 07:26

Sector Performance Summary

Sector Performance Summary

Today I’ve got a handful of bullish stock charts for your watchlist next week.

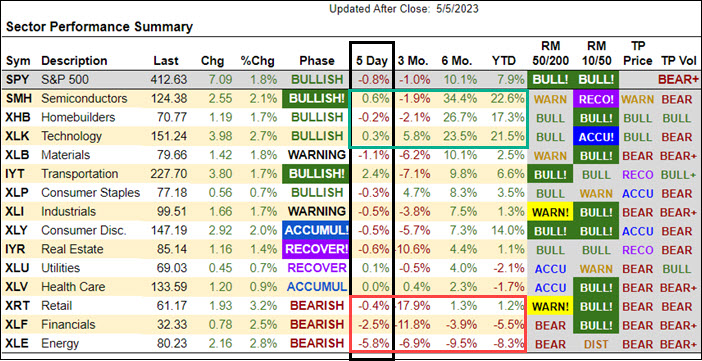

The importance of these stock charts begins with the table shown above.

If you were watching the market last week, it probably didn’t feel calm or uneventful. However, as you can see from the “5 day” column highlighted in the Sector Summary table above, the end result was relatively unchanged in most sectors.

One notable pattern, also highlighted, is that the top 3 sectors based on 6-month percent change were also the better performers for the week and on Friday.

Likewise, the worst-performing sectors for the week are also the worst performers over the last 6 months and year-to-date.

This pattern of the relatively strongest groups or stocks continuing to outperform while the laggards continue to lag is a well-known tendency of the market that we exploit in several of our trading systems.

In recent Mish’s Daily articles I’ve suggested that gold was poised to move higher, and the VanEck Semiconductor ETF (NASDAQ:) was weak and likely to break below its 50-day moving average and decline.

Leading up to the employment report on Friday, was rallying and SMH was rolling over.

However, the report suggested that the economy was stronger than expected, which pushed the stock indexes and the semiconductor sector (SMH) higher. If it trades back over $125 its pattern will turn bullish.

At the same time, gold gapped down on Friday, and then it rallied though out the day.

Is the gap down in gold a dip to buy or a significant top? Will SMH break higher?

In both cases, a move over Friday’s high would be a good reason to look at long trades in the ETFs or in leading stocks in their respective groups.

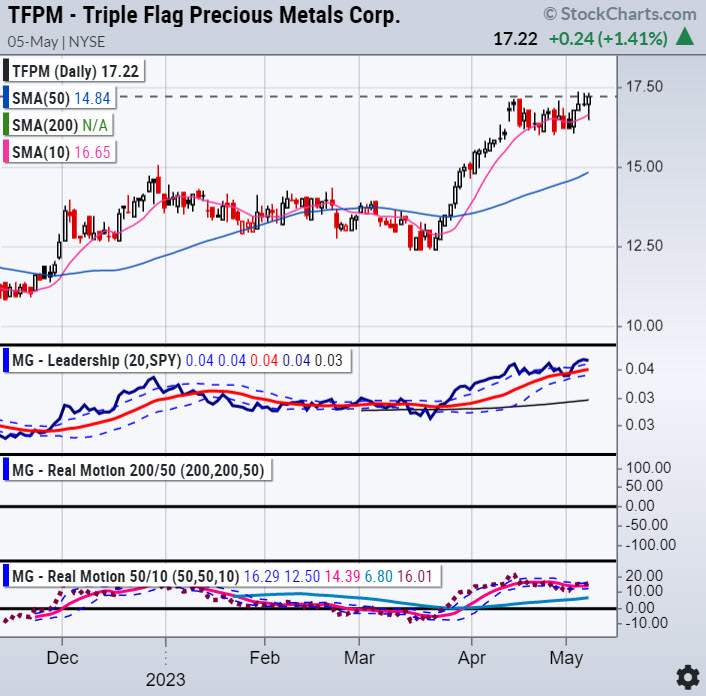

Here are a few gold stocks that have bullish patterns:

These stocks are in bullish patterns as long as they stay over their 10-day moving average (red line).

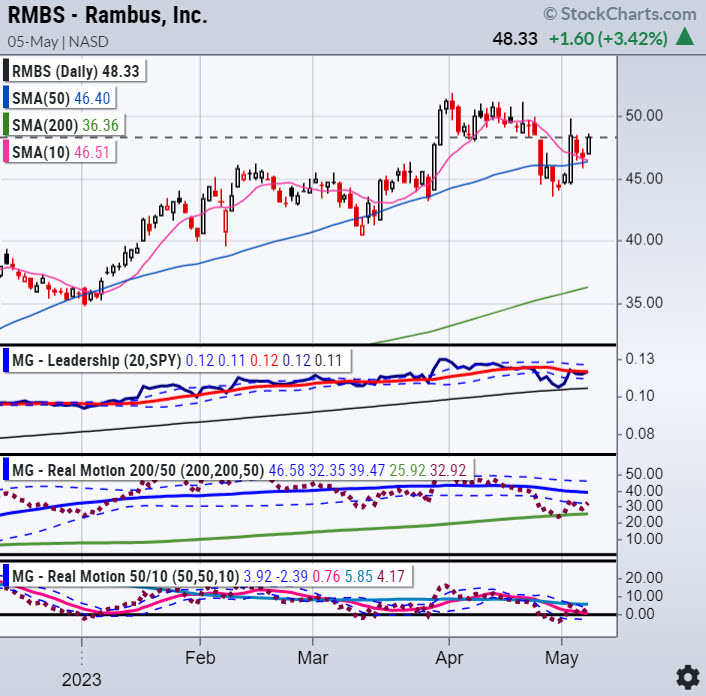

Here are some bullish semiconductor stocks

Warning: The semiconductor group is risky. It still needs to trade higher to confirm the resumption of its bullish trend. If any of these stocks or the SMH trade below last week’s low, it would be very bearish.

However, if Invesco QQQ Trust (NASDAQ:) breaks out and SMH breaks over $125, these stocks could be market leaders.