Here’s Why This 10-Year Bear Market Generally Results in a 10-Year Bull Market

2023.05.26 10:52

German engineering used to be world-renowned. Revered, the epitome of manufacturing and perfection. You didn’t want a German girlfriend. She’d beat you up, but you definitely wanted a German car. That’s how well-known it was.

And now look at what Germany does… Germany — or should I say German pointy shoes. In their woke bid to solve a problem that doesn’t exist (climate change) with a plan that won’t work (renewables and 15-minute cities), has finally done it. They’ve shut down their last remaining nuclear power stations.

Hours Before Closing Reactor, German Utility Announces 45% Price Rise

Thousands of consumers in North Rhine-Westphalia have to dig deeper for electricity: market leader Eon increased to 1. June its basic supply prices, as he tells many customers these days. ” In parts of NRW, the new labor price is 49.44 cents gross per kilowatt hour, which means an adjustment of around 45 percent for average consumption “, confirmed a spokesman for Eon Energie. The Verivox comparison portal calculates what that means for a three-person household in NRW that Eon supplies in basic services: From June, he pays 2125 euros for annual consumption of 4000-kilowatt hours of electricity.

As Eon (one of Europe’s largest operators of energy networks and energy infrastructure), and in fact, all of Germany, proceeds to close nuclear, by far its cheapest reliable power, it (Eon) announced a 45% price jump for customers from what are already some of Europe’s highest prices.

Take that, you beer-drinking sausage eaters. Eventually, you’ll own nothing and be happy. You can’t say you weren’t warned.

We have promised before that at a domestic level, these deadly policies (the correlation between energy consumption and mortality well established) would bring about internal bickering and fighting and eventually, if enough pressure is applied, contribute to the fragmentation of and collapse of the European Union itself.

German government rejects Bavaria’s request for nuclear power comeback:

Germany’s Environment Ministry on Sunday rejected a demand from the state of Bavaria to allow it to continue operating nuclear power plants, saying jurisdiction for such facilities lies with the federal government.

Keep in mind that our sauerkraut-eating friends don’t have the same political setup as the yanks do. Each state (Bavaria in this instance) doesn’t have anywhere near as much self determination as do states within the US. So they’re hamstrung by Berlin, which really means they’re hamstrung by the unelected EU official pointy shoes in Brussels, which really means they’re all dictated to by Davos man.

That, however, doesn’t mean that there isn’t anger and bitterness about this down at a more local level. The citizens will increasingly, via whatever means possible (local governments, for example), wake to the asylum they’re now living in.

Enviormentalist

Approaching the Tipping Point

I believe we’re fast approaching tipping points all across the EU, whereby the peasants will say ENOUGH!

It is worth noting that the state of Bavaria is the biggest net contributor to the German Federal budget and also to the EU. Folks will rightly determine that it’s time to leave both. Small independent states serve people.

A breakup of the EU power base is absolutely more likely as the system implodes. This means two things. One, the globalists will face this problem with increased tyranny. Where there are relative freedoms people will move. We’ve already been watching the migration of the wealthy out of the EU. Next comes the newly impoverished middle class and bringing with it the implosion of the EU.

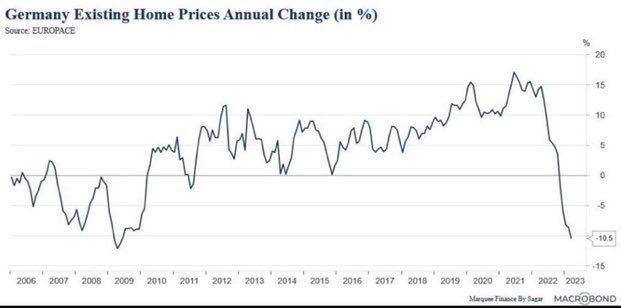

This is already in process. In fact, it is contributing to what is now reflected in house prices.

Germany Existing Home Prices

It really is a race against time.

As complex systems collapse the ability to enforce control changes asymmetrically. This is why they’re rushing as fast as they can to implement CBDC’s. A means of total control.

Sadly the vast majority of people are still wandering through life in a confused daze. They’ll be completely screwed and I don’t say that to be hyperbolic but that’s the lesson of history. The Pareto distribution will excerpt itself with 80% of folks being enslaved. Don’t be one of them.

The pace of change is faster:

Today, at the International Monetary Fund (IMF) Spring Meetings 2023, the Digital Currency Monetary Authority (DCMA) announced their official launch of an international central bank digital currency (CBDC) that strengthens the monetary sovereignty of participating central banks and complies with the recent crypto assets policy recommendations proposed by the IMF.

They’re clearly not ready yet, as this organization didn’t even exist a few months ago. It feels like they’re cobbling together a patchwork of ideas.

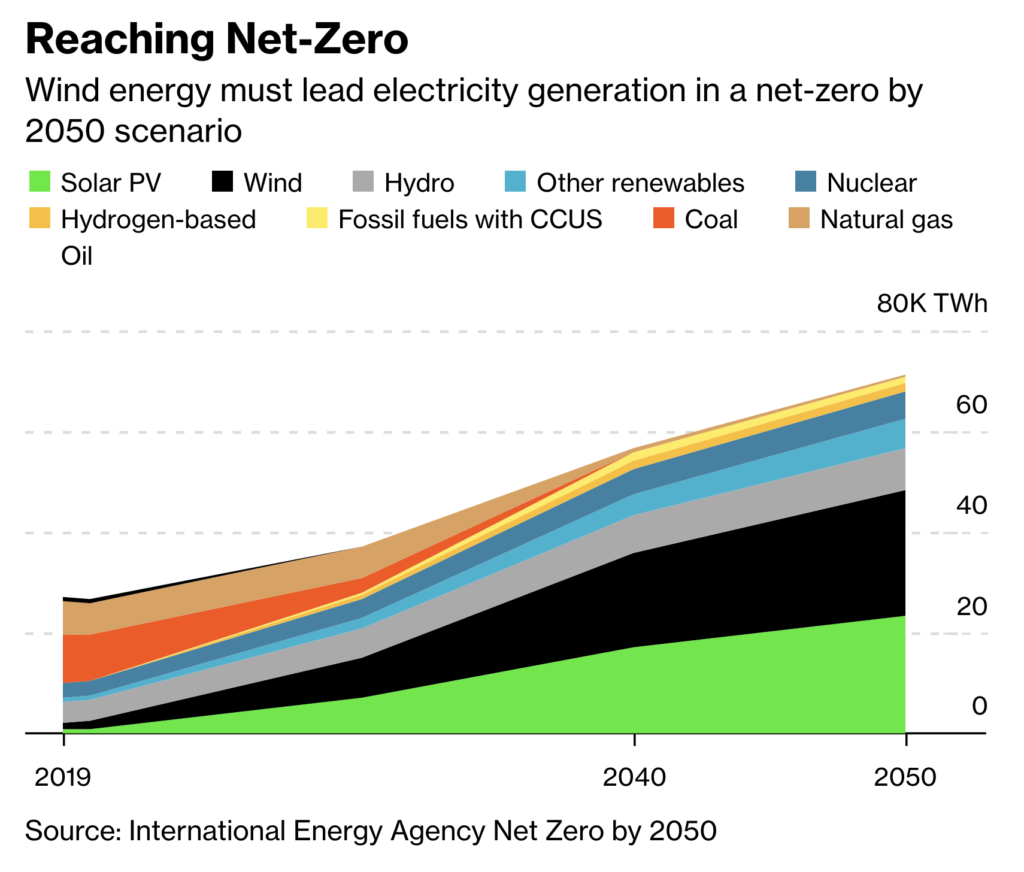

What’s Next? Back to Dirty Old Coal

That’s the answer to the natural question: how or with what this nuclear energy will be replaced?

These coal companies aren’t necessarily going to trade at P/Es of 15x or something like that. They’ll probably trade at 5x but simply keep returning cash to shareholders. You take those dividends and reinvest them for the duration of the decade (plus or minus), and the returns will be very nice indeed.

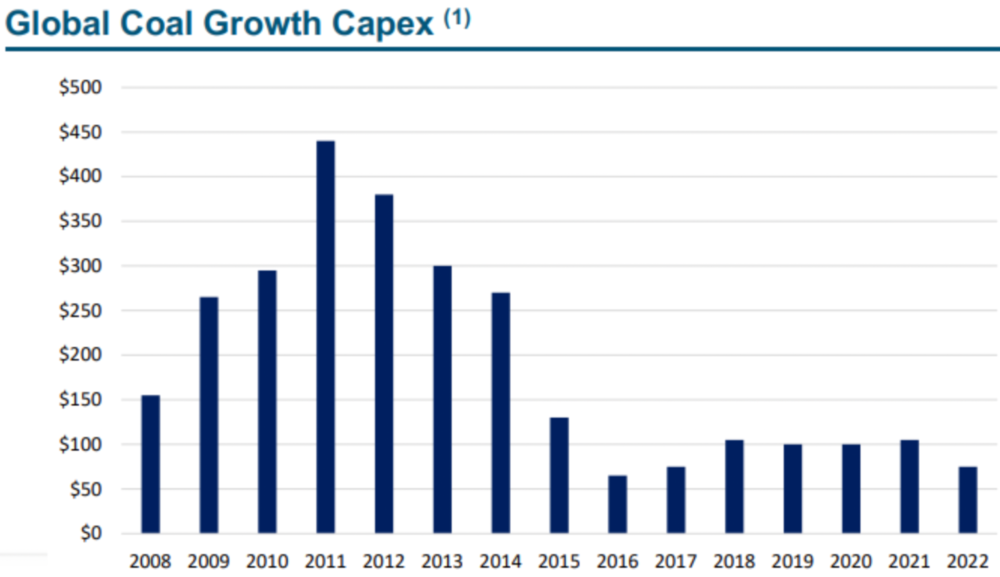

Why? Well, check this out. We came across this graph, and now for the life of me, I can’t recall where from. In any event, we weren’t too surprised.

The bizarre thing is the lack of capex spending, given the dramatic rise in the coal price. Everything has been turned backward.

The thing is, coal miners are reluctant to develop new resources for fears of assets being stranded, political risk, or — and this is significant — they just can’t raise capital to develop new resources, what with Wall Street too busy holding diversity meetings and putting tampons on the boys’ loos.

Don’t underestimate all the rhetoric that goes with the net-zero “goal. This may account for most of the underinvestment.

One thing is for sure. It is highly unlikely we will see any significant increase in coal supply over the next five years or so.

Take a look at coal futures here…

And just for good measure, this is how coal looks on a relative basis.

Coal Miners Index vs S&P 500

Coal Miners Index vs S&P 500

Bloomberg World Coal Miners Index vs

Coal miners are still cheap, very cheap.

The hard part of the coal trade (in fact most of the trades we are on) is sticking with it. In other words, doing nothing and not becoming a hostage to volatility.