“Hedge or No Hedge?” Stock Market (and Sentiment Results)…

2024.01.04 09:48

Fox Business

On Thursday, after last week’s podcast|videocast, I joined Kelly O’Grady on Fox Business – The Claman Countdown. In this segment we discussed 2024 market outlook, Small (and Mid Caps), why Fed Cuts (this round) are NOT bearish, Cooper Standard updates and more. Thanks to Jake Mack and Kelly for having me on:

Bloomberg HT

Last week I joined Ali Cinar on Bloomberg HT Turkey. We discussed Fed Cuts, Recession, Earnings, Corporate Efficiency, Margins, Energy Prices, Inflation, (!), PYPL, CCI, Stock Market Outlook, Presidential Election year, Large cap v. SMID, CPS, Corporate Credit/High Yield Markets, Refinancing theme, Message for 2024, Breadth, and a lot more. Thanks to Ali for having me on:

As I stated in the media appearances above, while we did/do expect some consolidation/volatility in Q1 after a nice move in Q4, we would not get too cute with shorting or hedging as it’s tough to short new highs. There are still bargains to be found if you look carefully, but certainly an environment to HOLD. We do not sell or hedge stocks on the basis of market timing. We sell stocks when they have reached our estimate of fair value – which we determine BEFORE WE ENTER THE POSITION.

Sun Tzu: “Every battle is won before it’s ever fought.”

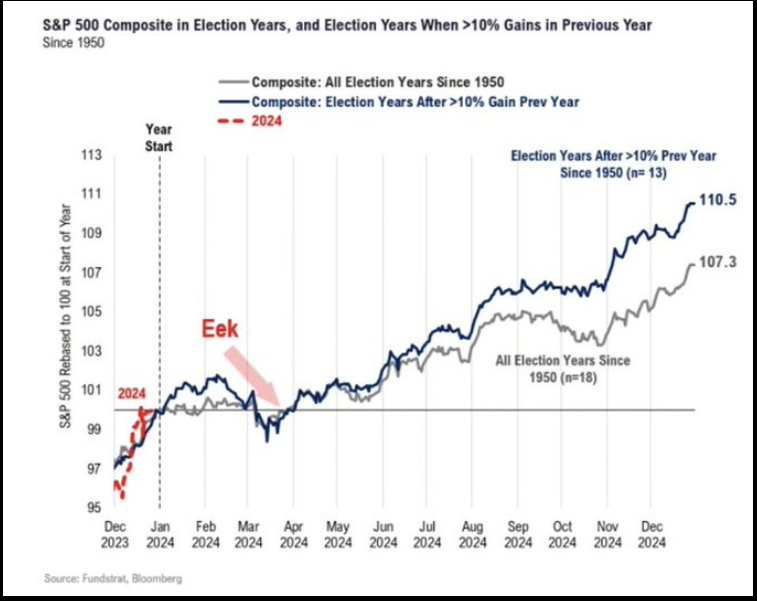

Election Year Historical Performance:

source: Fundstrat

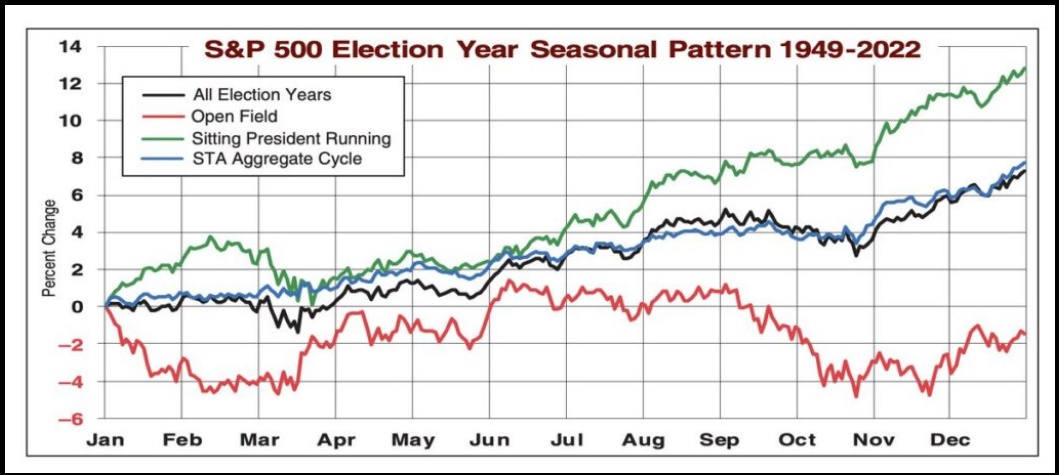

S&P 500 Election Year Seasonal Pattern

S&P 500 Election Year Seasonal Pattern

source: Almanac Trader

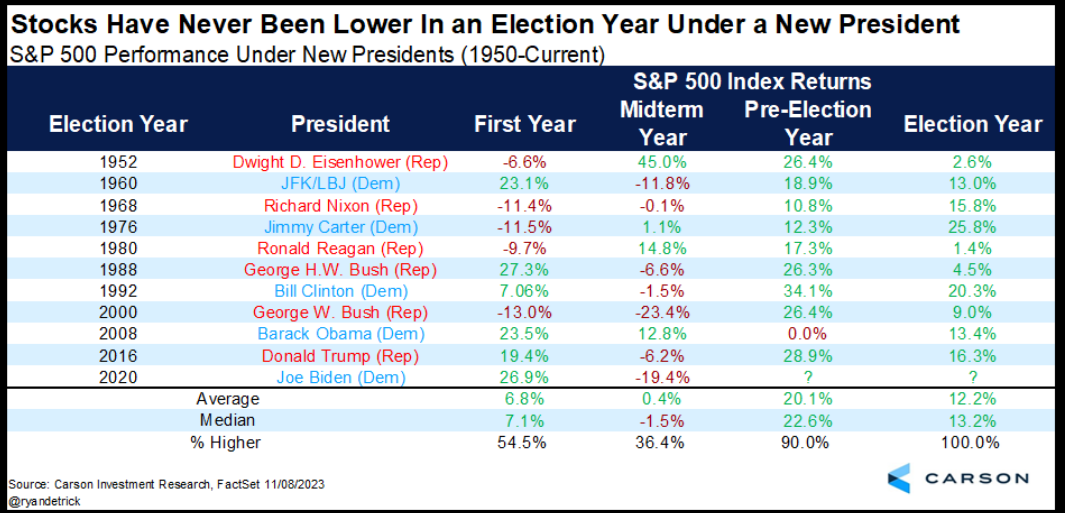

S&P 500 Performance Under New Presidents

S&P 500 Performance Under New Presidents

Last Shall Be First (part II)

Source: Bespoke

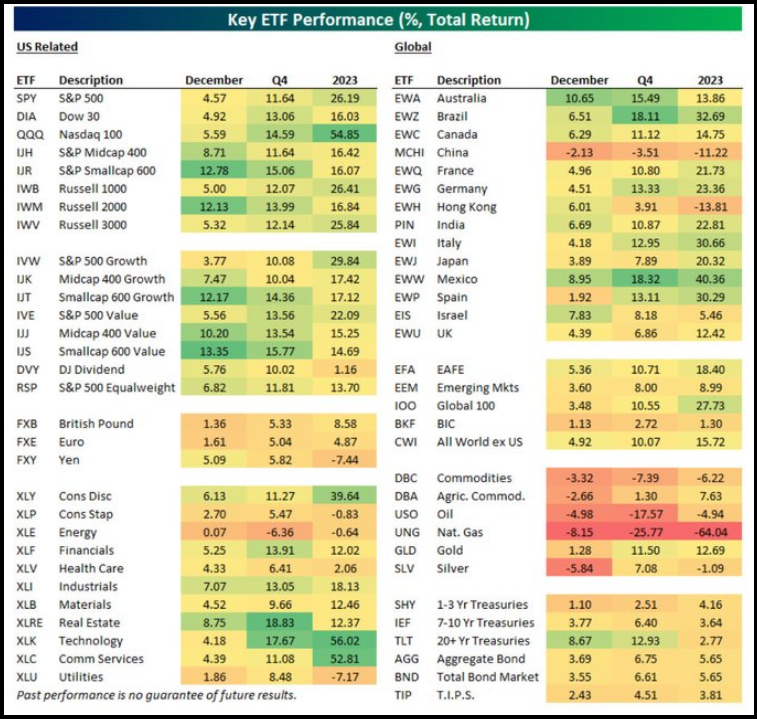

Looking through these asset classes, our eyes are trained for opportunities in last year’s laggards (most of which we have already executed):

Nat Gas, Energy, Commodities, Long Bonds, Emerging Markets, China, Hong Kong, Utilities, REITs, , Staples, Yen, Dividend Stocks, Small Caps, and Mid-Caps.

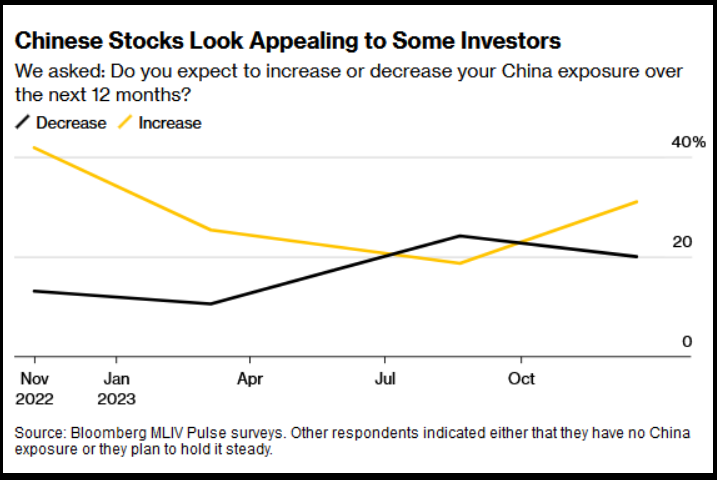

Sentiment changing in China for “Dragon Year” 2024?

Chinese Stocks Look Appealing to Some Investors

Chinese Stocks Look Appealing to Some Investors

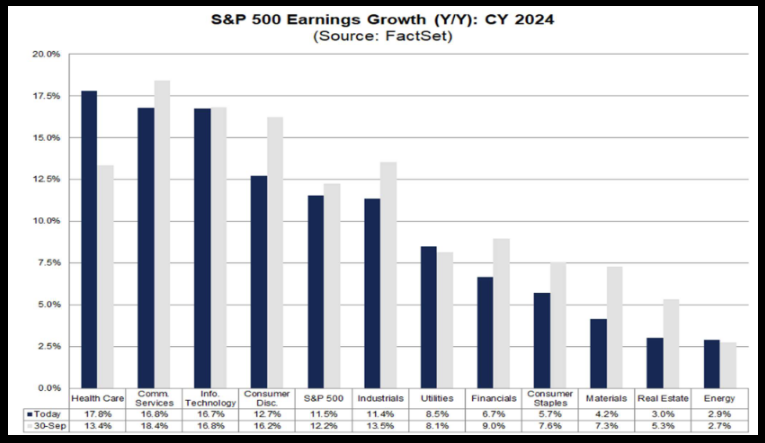

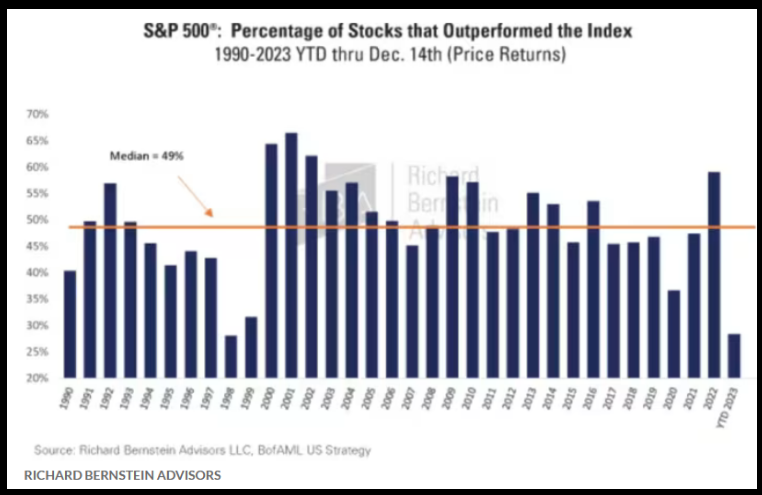

Further room for Breadth Expansion:

S&P 500 : Percentage of Stocks that Outperformed the Index

S&P 500 : Percentage of Stocks that Outperformed the Index

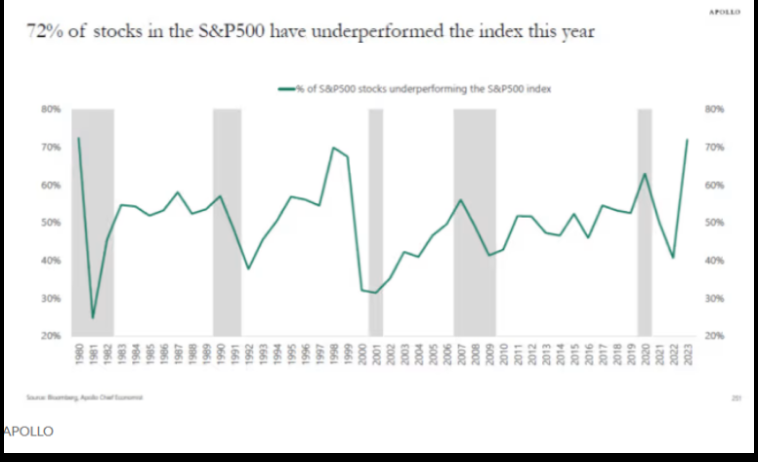

72% of stocks in S&P 500 have underperformed

72% of stocks in S&P 500 have underperformed

Fed Minutes:

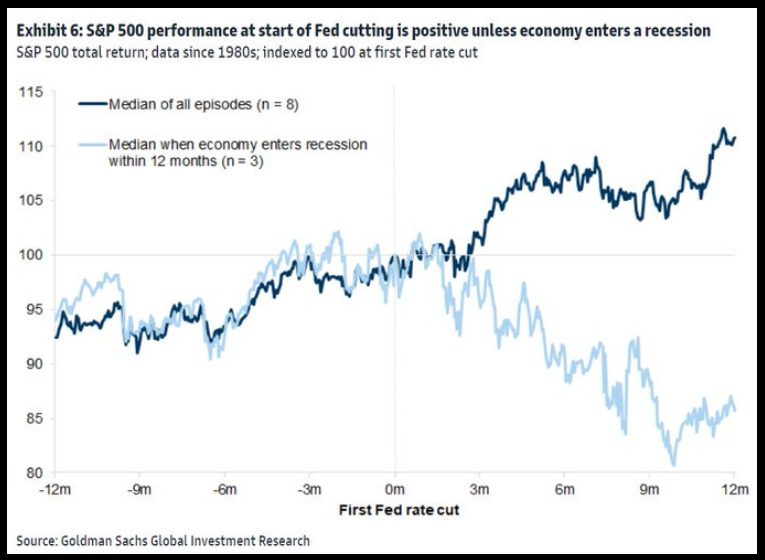

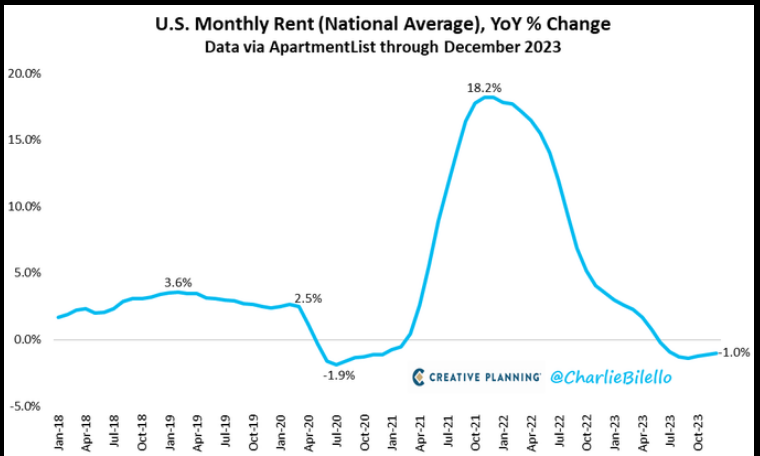

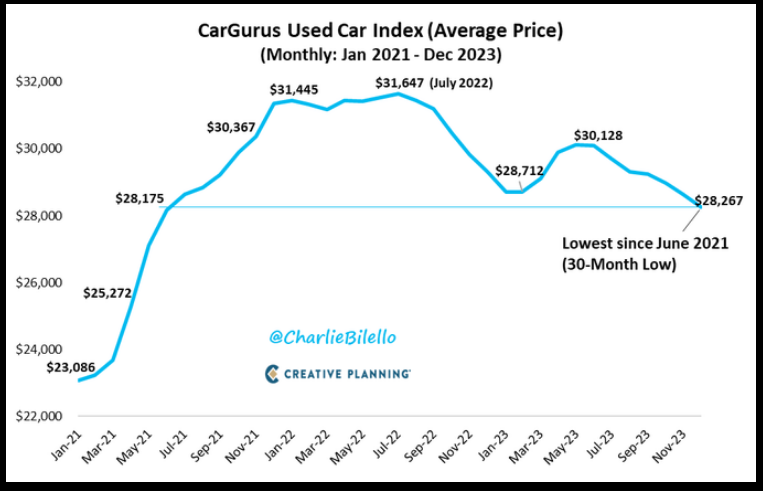

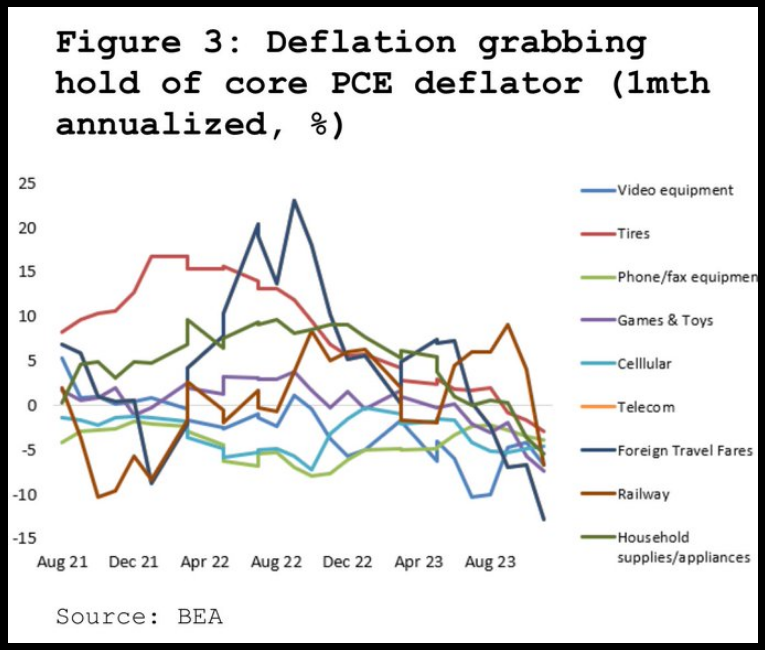

I’m starting to lean on the side of cuts coming in sooner rather than later (1/11 CPI report very important ahead of Jan 31 Fed Meeting). The big drop in the Fed’s preferred inflation gauge (Core PCE) now shows the avg. monthly change of the last half year is BELOW the Fed’s target of 2%.

As we said several times last year in the podcast|videocast if real rates (FFR – inflation) stay too restrictive we could have DEFLATIONARY risks ahead – which are much harder to fix than inflation. A weaker and some commodity stability may hold this risk at bay, but the Fed may have to step in earlier than anticipated – or fall BEHIND THE CURVE once again. An earlier cut will lead to further weakening in the dollar and a potential rebound in commodity prices in the coming year.

U.S.Monthly Rent (National Average)

U.S.Monthly Rent (National Average)

Deflation grabbing hold of core PCE deflator

Deflation grabbing hold of core PCE deflator

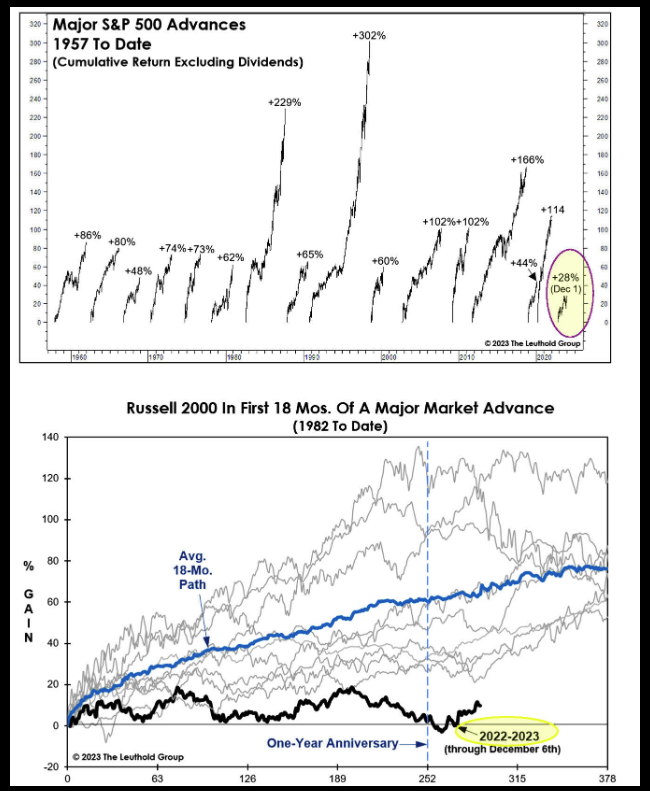

New Bull Market in early stages:

New Bull Market

Source: Leuthold Group

The Goose Is Loose?

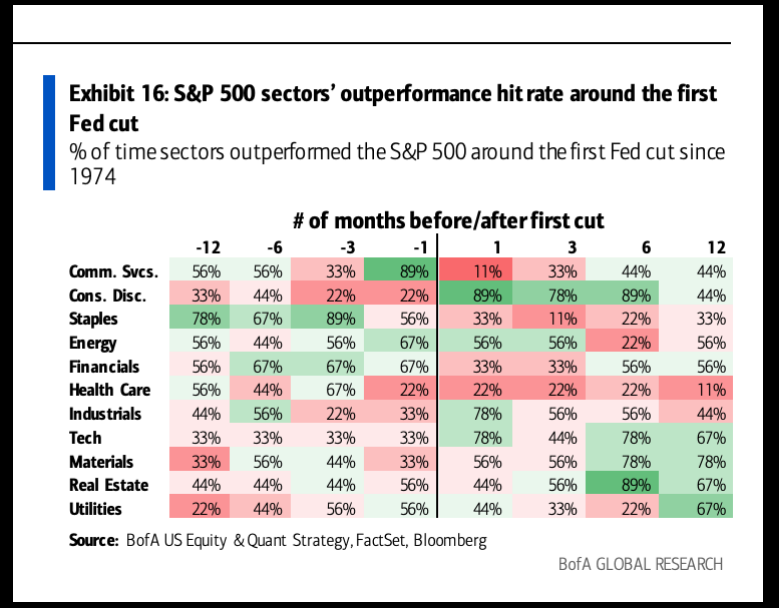

On the Saturday before Christmas, Kaitlyn brought the girls into NYC to join me after one of my hits. We decided to soak in the Holiday Spirit for a couple of days before heading back out to CT to host Christmas. As we walked up 5th avenue, the girls visited their favorite stores and I did channel checks on mine: North Face, Vans (VFC) and a few others. I was interested in surveying the “consumer discretionary” landscape – as that group tends to have the highest probability of sector out-performance following the first Fed cut (see above).

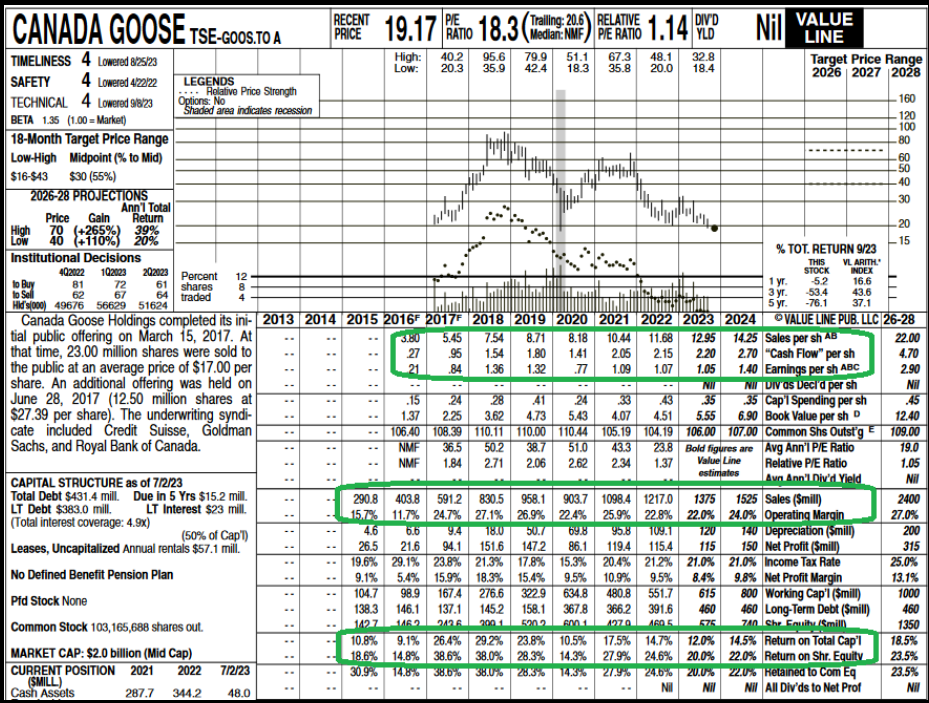

As the girls and Kaitlyn took a turn into Coach, I noticed a store called Canada Goose (TSX:) across the street. I was curious because the stock had popped up several times in the last few months – but I always passed – until I saw the line out the door. You had to wait on the street in the cold because there were too many people in the store and security would only let in a certain number of people at a time. I waited for ~30 minutes until the girls came out of Coach and then I just left because there were too many people in front of me.

It reminded me of Yeti – which also came up a number of times during the Summer. The stock got down to ~$35 from $108 and I took a quick look. I saw a bit of growth deceleration, but it was still a cash generative, high quality business with some level of runway ahead. What I couldn’t understand was who was buying $500-$1000 coolers to store their beer at a tailgate? Isn’t a cooler a cooler?

On the way to attending the Cowboys game in Dallas (against the Jets) – at the beginning of this season (with a good friend and client) – I spoke with another equity manager who had also noticed the stock and not done anything – but had a better grasp of the consumer who purchased these items. It was a luxury spend for people who wanted to show they could afford an expensive cooler. Yes, the quality and durability was probably better at the margins, but this was the Starbucks (NASDAQ:) (of coffee), Apple (NASDAQ:) (of Electronics), Nike/Air Jordans (of sneakers), BMW (ETR:) (of cars), Rolex (of watches) and Coach (of Handbags).

All perceived as “luxury” but any aspirational middle class person could stretch their budgets to show they had “made it.” I couldn’t get there, so I passed. The stock closed the year ~$54. Error of omission. I can deal with that! Maybe I’ll get another look (still not sure if I’d pull the trigger). Maybe not…

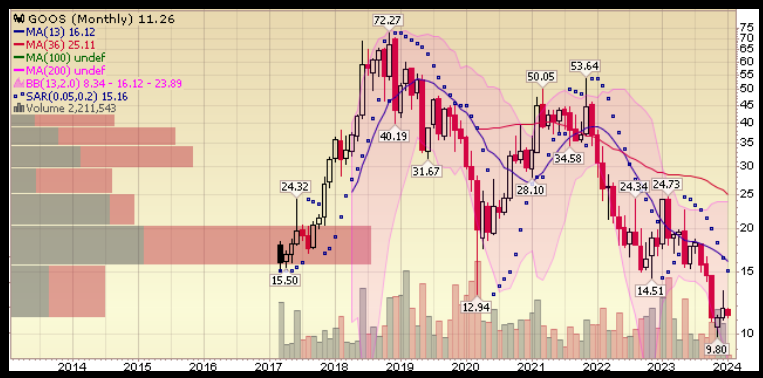

GOOS

We have now established a new starter position in GOOS, across accounts where there is capacity. We are likely a bit early on this one and will have time to add more over time.

The number one thing that stood our for me on GOOS was the fact that gross margins are EXPANDING. You would never guess that by looking at the stock!

They continue to grow revenues and compound shareholder wealth.

Most recent earnings results:

Stock is down due to lowered guidance. Stock down significantly more than guidance!

Now onto the shorter term view for the General Market:

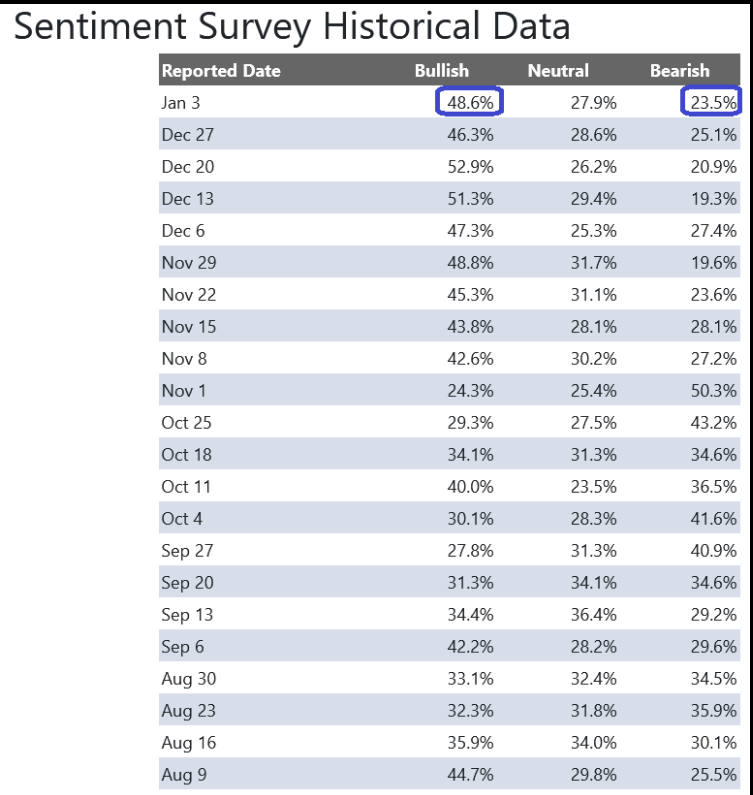

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 48.6% from 46.3% the previous week. Bearish Percent ticked down to 23.5% from 25.1%. Retail investors are ebullient.

Sentiment Survey Historical Data

Sentiment Survey Historical Data

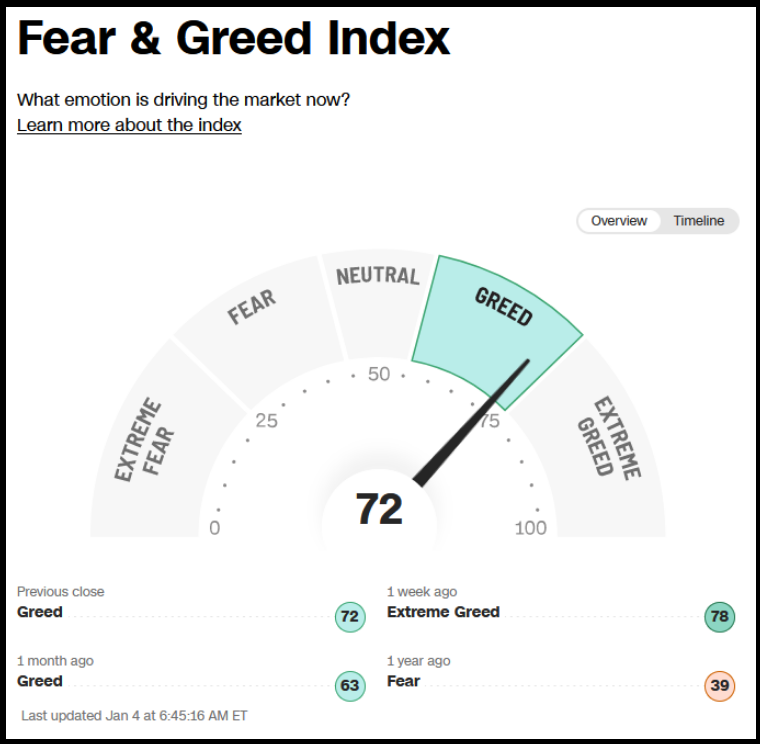

The CNN “Fear and Greed” ticked down from 78 last week to 72 this week. By this metric, investors are giddy, but not yet fully euphoric. You can learn how this indicator is calculated and how it works here: (Video Explanation)

US – CNN Fear and Greed Index

US – CNN Fear and Greed Index

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moved up to 102.71% this week from 97.32% equity exposure last week ago. Managers were “panic chasing” the rally into year end.

This content was originally published on Hedgefundtips.com