Gold’s Resilience: Extreme Shorting Sparks Imminent Bullish Surge

2023.09.01 15:30

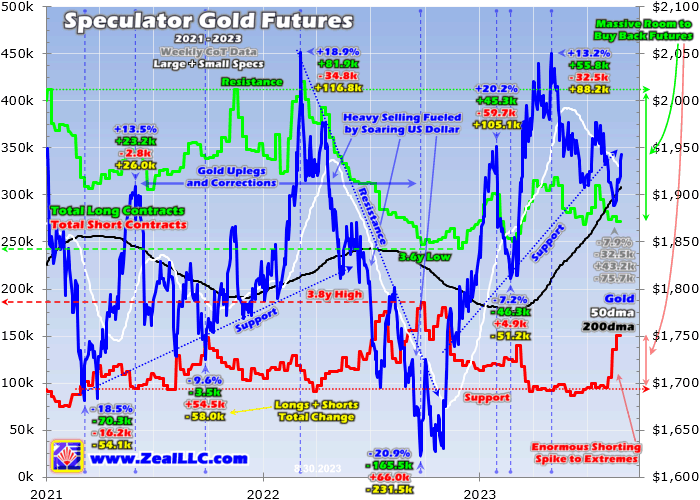

recent pullback sure overstayed its welcome, increasingly vexing as August marched on. That festering weakness really did a number on sentiment, leaving mounting bearishness in its wake. Flaring gold-futures short selling was the dominant reason gold faltered so last month. But such shorting spikes have proven very bullish for gold historically, guaranteed to soon reverse into big proportional buying. With all the apathy and fear reigning in gold land lately, you’d think gold prices must have collapsed. That certainly isn’t true. Gold did suffer a 7.9% pullback over 3.5 months from early May to mid-August, fueling widespread pessimism. But that followed a powerful upleg that catapulted the yellow metal up 26.3% in the preceding 7.2 months. Its $2,050 crest was within spitting distance of a new nominal all-time-record high!

Pullbacks are natural and healthy in bull-market uplegs, serving to rebalance sentiment to prolong their lives. Uplegs take two steps forward before retreating one step back, with the latter necessary to eradicate excessive herd greed near interim highs. This latest gold upleg weathered an earlier 7.2% pullback in February, then quickly surged 13.2% to major new highs. Pullbacks offer mid-upleg buying opportunities.

Although normal-sized, gold’s latest pullback has lingered longer than usual. It looked finished in late June after gold had dropped 6.9% in 1.8 months to bottom near $1,908. I wrote an essay right after analyzing gold’s bullish technicals. Indeed the yellow metal’s strong upleg resumed, surging 3.6% into mid-July to regain $1,977. Gold achieved some confirming technical breakouts and consolidated high. Exiting July at $1,966, gold was well positioned to surge again in August. Last month is normally when gold’s traditional autumn rally seriously gathers steam. During modern gold-bull years, August has enjoyed the third-best calendar-month gains up 1.7% on average! But that sure didn’t happen this time around, August greatly deviated from its seasonal script. Gold was pounded lower by unusual selling pressure.

At worst the yellow metal dropped a steep 3.9% month-to-date in mid-August! That included a super-rare ten-trading-day losing streak where gold broke down below late June’s original pullback low. At worst last month gold closed at $1,889, extending that pullback to 7.9%. That technical relapse certainly wrought a lot of sentimental damage, despite gold only slumping to a marginal new low. Why did all this happen? As usual when gold behaves oddly, the gold-futures speculators are to blame. These guys run extreme leverage that enables them to punch way above their weights in bullying around gold prices. Each gold-futures contract controlling 100 ounces of gold worth $194,000 at $1,940 only requires traders to maintain $8,300 cash margins in their accounts. That enables incredible maximum leverage running up to 23.4x!

Way up near 23x, each dollar traded in has fully 23x the gold-price impact of a dollar invested outright. So gold-futures specs wield greatly outsized influence over short-term gold prices. And that is amplified even further by the US gold-futures price being gold’s world reference one. Investors carefully watch that gold-futures-dominated price action, which can heavily sway their collective psychology on the metal.

Back in mid-July when gold’s resuming upleg regained $1,977, spec gold-futures positioning remained very bullish. Since longs way outnumber shorts, they are proportionally more important for gold’s near-term direction. The total spec longs were just 3/8ths up into their probable gold-upleg trading range! Its lower end was defined in late September 2022 when gold bottomed at stock-panic-level 2.5-year secular lows. Its upper resistance has run around 413k longs in recent years, where spec buying exhausted itself and slayed gold uplegs. This is readily evident in this chart, which superimposes gold prices over total spec longs and shorts since 2021. Speculators’ gold-futures positioning is only published once a week in the famous Commitments of Traders reports. That data is released late Fridays, current to preceding Tuesdays.

With total spec longs remaining on the low side of their range in mid-July, probabilities really favored gold continuing to rally on balance. Total spec shorts were down at lower support, which isn’t unusual later in powerful gold uplegs. Honestly renewed gold-futures short selling wasn’t even on the radar then. Over the last 52 weeks, total spec longs ran 2.4x total spec shorts making them proportionally more important.

At extreme 23.4x leverage, gold-futures speculators can’t afford to be wrong for long. A mere 4.3% gold move against their bets would wipe out 100% of their capital risked! That necessarily compresses their trading time horizons into the ultra-short-term, mere hours or days on the outside. They watch the US dollar’s fortunes for their primary trading cues, which in turn are overwhelmingly driven by Fed rate expectations. Those mostly change in response to major economic data coming in better or worse than economists are expecting, as well as jawboning by top Fed officials. In early July as gold resumed powering higher, key data like monthly US jobs and headline inflation were generally missing which was viewed as Fed-dovish. That slammed the sharply lower, spawning big gold-futures buying and driving gold higher.

But the USDX was getting oversold, so it started bouncing technically in mid-July. That shook loose some gold futures selling, yet the yellow metal still consolidated high. But in late July the Fed-rate-expectations tenor shifted decidedly hawkish, starting with US GDP growth crushing forecasts. That accelerated the US-dollar momentum buying, unleashing more gold futures selling. That’s readily evident in this chart. There have been five reported CoT weeks since gold hit $1,977 in mid-July. The initial futures selling on that USDX bounce came in on the long side, weighing in at a larger 14.0k and 13.3k contracts during the first two CoT weeks into late July. That left spec long-side positioning even more bullish for gold, dragged back down to only 1/5th up into its probable gold-upleg trading range. Gold held strong through that near $1,965.

That spec-long selling started waning into early August, retreating to a sizable 8.4k contracts. After decades of analyzing this CoT data every week, I consider under 5k small, 10k sizable, 15k large, and 20k+ huge. But then with gold weakening, gold-futures short selling suddenly flared as speculators jumped on gold’s downside momentum. That third CoT week of this span saw a shorting surge up to 10.9k contracts.

That was the most by far since early March, pounding gold back down near $1,925. While that ramped bearishness, technically it wasn’t a big deal with gold remaining well above late June’s $1,908 pullback low. But the yellow metal continued grinding lower on balance as the USDX kept rallying, slumping down to $1,903 in the fourth CoT week since mid-July. While minor, that breakdown really fanned the flames of worry. Since that weekly CoT data is delayed a few days, we never have it in real-time. So it was quite shocking to see what transpired in gold-futures-land to push gold marginally under late-June levels. Speculators actually resumed their long buying, adding a small 3.6k contracts. That implied they had run out of near-term capital firepower available for selling, a bullish omen for gold. Yet oddly short selling utterly skyrocketed.

In that fourth CoT week ending August 15th, specs added a jaw-droppingly-extreme 29.2k new shorts! Shorting at that magnitude is exceedingly rare. Out of all 1,285 CoT weeks since early 1999, that ranked as the ninth highest on record for spec shorting! These hyper-leveraged traders apparently expected to see gold’s multi-month pullback really accelerate. Yet gold prices proved remarkably resilient through this. For nearly a quarter-century now, I’ve written weekly and monthly financial newsletters focused on trading gold stocks. Since specs’ gold-futures trading often dominates gold’s short-term price action, I analyze every new CoT in our newsletters. During past CoT weeks seeing extreme shorting, gold often fell hard. 29k+ contracts of shorting should’ve pummeled it 3%+ lower. Yet gold merely slipped 1.2% through that onslaught!

During this latest fifth reported CoT week since late July, gold slipped marginally lower to $1,889. That extended its losing streak to that extraordinary ten trading days in a row. But for all intents and purposes, gold was consolidating low. Its total pullback since early May merely extended to 7.9%. And it was down 4.5% over a month or so where the US Dollar Index soared a massive 3.5% higher! Gold was holding its own. Gold finally started edging higher late in that CoT week. Still, those bearish gold-futures speculators tried to press their advantage, adding another big 15.1k short contracts! That ballooned their total shorts to an extreme and unsustainable 150.6k contracts! Such levels never last long historically, soon giving way to proportional mean-reversion buying. Specs also dumped a small 5.8k longs in that gold-bottoming CoT week.

Gold definitely wouldn’t have broken down to new pullback lows had spec gold futures short selling not flared in early August. Those leveraged traders pressing gold’s downside momentum sucked in investors as well. While global gold investment demand numbers are only published quarterly by the World Gold Council, a great high-resolution daily proxy for them is the combined holdings of the GLD (NYSE:) and IAU gold ETFs.

Exiting Q2, these mighty American behemoths commanded 40.0% of all the gold bullion held by all the world’s physically backed gold ETFs! A UK gold ETF was a distant third at just 7.0%. When GLD+IAU holdings are declining, it reveals that American stock-market investors pulling capital back out of gold. They are selling gold-ETF shares faster than gold itself is selling off, exacerbating the yellow metal’s decline. From mid-July to mid-August when gold fell 4.5%, GLD+IAU holdings dropped a sizable 2.1%. By late August they had swooned to 1,317.1 metric tons which was a deep 3.4-year secular low! American stock investors hadn’t owned less gold since March 2020 just emerging from the pandemic-lockdown stock panic. Gold is seriously out of favor, partially thanks to that huge spec gold-futures shorting driving it lower.

While spec shorts can occasionally shoot higher, that mostly happens after large selloffs approaching or exceeding the 20% new-bear-market threshold. Gold remains far from such carnage, with its powerful upleg since last September very much intact. Massive gold-futures shorting is actually very bullish for gold, guaranteeing imminent big mean-reversion rebounds. This latest one looks to be getting underway. While spec gold-futures long buying is much larger and more important than short selling, the former is totally voluntary. Traders have no obligation to pile in and chase gold upside by adding longs. But once they sell gold futures short, they legally have to close out those bets by buying offsetting longs. So every contract shorted has to be reversed by proportional buying, which quickly catapults gold prices higher.

This spec-gold-futures-positioning chart covering the past few years or so reveals about a half-dozen prior short-selling spikes. All were preceded by sharp gold selloffs on that very shorting, much like this recent one. But all were also immediately followed by symmetrical sharp mean-reversion rebound rallies as specs had to buy to cover and close those short contracts. This time won’t prove any different, gold will surge higher. Major gold uplegs have three distinct stages of buying. The first one is gold-futures short covering, which initially launches gold higher. At major secular gold lows, specs closing out shorts at big profits are often the only meaningful buyers. Even at minor pullback gold lows like this recent one, short covering gets the ball rolling. That propels gold high enough for long enough to start enticing back bigger long-side buying.

Stage-one short covering is the trigger igniting that more important stage-two long buying! And with total spec longs still way down at 271.7k contracts in this latest-reported CoT week, these traders still have a big room to do nearly 6/7ths of their likely gold-upleg buying! That stage-two buying eventually pushes gold even higher for even longer ultimately convincing investors to start returning with their vast stage-three buying.

These sequentially-triggered telescoping gold-buying phases are what fuel big gold uplegs. Already up 26.3% at best so far in early May, today’s is definitely a big one. But with spec gold futures longs still so low, it has good odds of growing into a monster. Back in 2020, a pair of mighty gold uplegs peaked at huge 42.7% and 40.0% gains! Today’s could again best 40% with investment demand coming back online. That portends $2,275 gold in coming months, shattering its nominal all-time-record high of $2,062 from August 2020! Once gold forges into record territory, herd sentiment will shift fast. Bullishness will surge as the financial media increasingly covers gold’s advance, fueling growing greed and fear of missing out momentum-chasing buying. This recent extreme gold-futures shorting being unwound could spark that run.

The battered gold stocks have the most to gain as gold’s powerful upleg resumes with a vengeance. As gold fell 4.5% between mid-July to mid-August, the leading GDX (NYSE:) gold-stock ETF plunged 15.9%. That amplified gold’s downside by a big 3.6x, well beyond the usual 2x to 3x from the major gold miners. It also extended GDX’s total selloff since its own mid-April upleg peak to an also-disproportional 23.4%. So as the gold mean reverts sharply higher initially on gold-futures short covering, the gold stocks should really leverage its gains. GDX’s upleg was up 63.9% at best this spring, but averaged monster 105.4% gains when gold last achieved 40%+ ones in 2020! And the smaller better gold miners now filling our newsletter trading books should way outperform the GDX majors. The opportunities in this sector are awesome.

The bottom line is gold’s recent breakdown to new pullback lows was driven by extreme gold-futures short selling. Speculators piled in to chase gold’s downside momentum as the US dollar bounced sharply on Fed-hawkish economic data. Yet despite some of the largest shorting on record and resulting investment selling, gold proved resilient. Rather than plunging, it merely slumped to marginal new still-pullback-grade lows.

Past shorting spikes have proven very bullish for gold, as those bearish bets must soon be reversed with proportional gold-futures buying. That short covering ignites major gold surges, pushing the metal high enough for long enough to entice back larger gold futures long buying and ultimately investment buying. As usual the battered gold stocks will prove the biggest beneficiaries of gold’s powerful upleg resuming.