Gold’s Next Move Is Coming

2024.11.05 16:46

By Brien Lundin

was smashed last Thursday, dropping over $50 an ounce at one point during the trading session.

Since then, the price has traded sideways as investors contemplate the potential outcome of the U.S. presidential election, with results expected tomorrow evening…or at some point over the weeks to come.

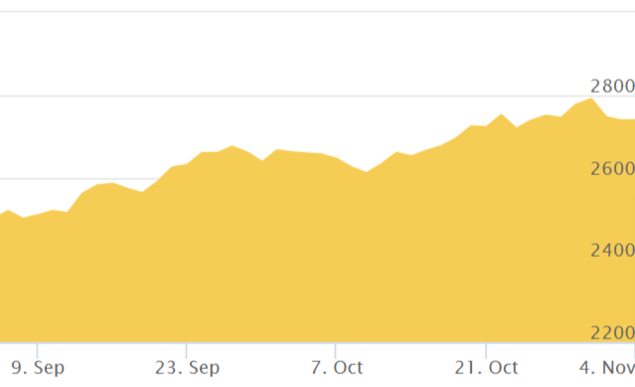

The two-month chart below places Thursday’s correction into perspective:

As you can see, Thursday’s big sell-off wasn’t anything out of the ordinary. We’ve had a number of such price smashes since this gold bull market began in mid-February. In fact, what’s really remarkable is how regularly they have come…and how the rebounds have been just as consistent.

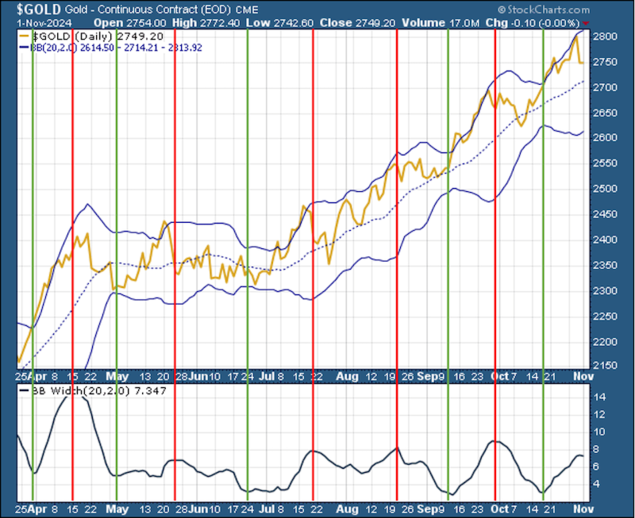

The key to understanding this is an important discovery I made in mid-summer: not only how remarkably consistent gold’s ebbs and flows have been but also how accurately the width of its Bollinger bands has indicated the next move upward.

Bollinger bands are a measure of volatility, and generally speaking, a narrowing of the bands often presages a price breakout, usually in the direction of the previous trend.

If you’ve been following my analyses since early July, you know how I’ve used the bottoms in gold’s Bollinger bands to predict the beginnings of each new price rally. You’ve also become familiar with my chart showing pinpointing each bottom in the bandwidth.

I’ve updated that chart below, marking not just the lows in the bandwidths but also the peaks.

In this chart, the green vertical lines mark the bandwidth lows, while the red lines mark the highs.

As you can see, while the high points faithfully show the price peaks and thereby predict the coming pause or correction, the relative height of those turning points varied in the early months of this bull market. They’ve been more consistent since mid-summer, however, and recently formed a peak that indicated an oncoming correction.

In other words, this indicator predicted an imminent pause in gold’s big rally, as I noted in the November issue of Gold Newsletter issued just last week. That pause began with the big price decline on Thursday, just as we were putting the final touches on that Gold Newsletter issue.

Look closely at the chart above, and you can see that the bandwidth in the bottom panel is just beginning to roll over.

The pattern will take a bit of time to complete and reach the bottom. Judging from how regular and frequent the peaks and valleys have become, with each move from one extreme to the other lasting only about three weeks, it seems like the next rally will begin.