Gold’s Dramatic $100 Intraday Dive: What Sparked the Plunge?

2024.11.25 16:53

Have you previously seen slide $100 in several hours? Now you have.

It seems that my subscribers managed not only to take profits off the table from the long position just one day before the top (after entering the long position on the day of the bottom), but also enter the short positions right at it and just before the plunge. And since I wrote about the buy signal on the previous Friday, it seems that you might have profited as well.

It’s not important to go long exactly at the bottom and short exactly at the top – just to do it relatively near those moments. And that’s exactly what you managed to do. Congratulations once again!

moved somewhat higher right after the trading started for the week, but they collapsed shortly thereafter.

Yes, that’s an intraday $100 plunge in gold.

Let’s take a closer look.

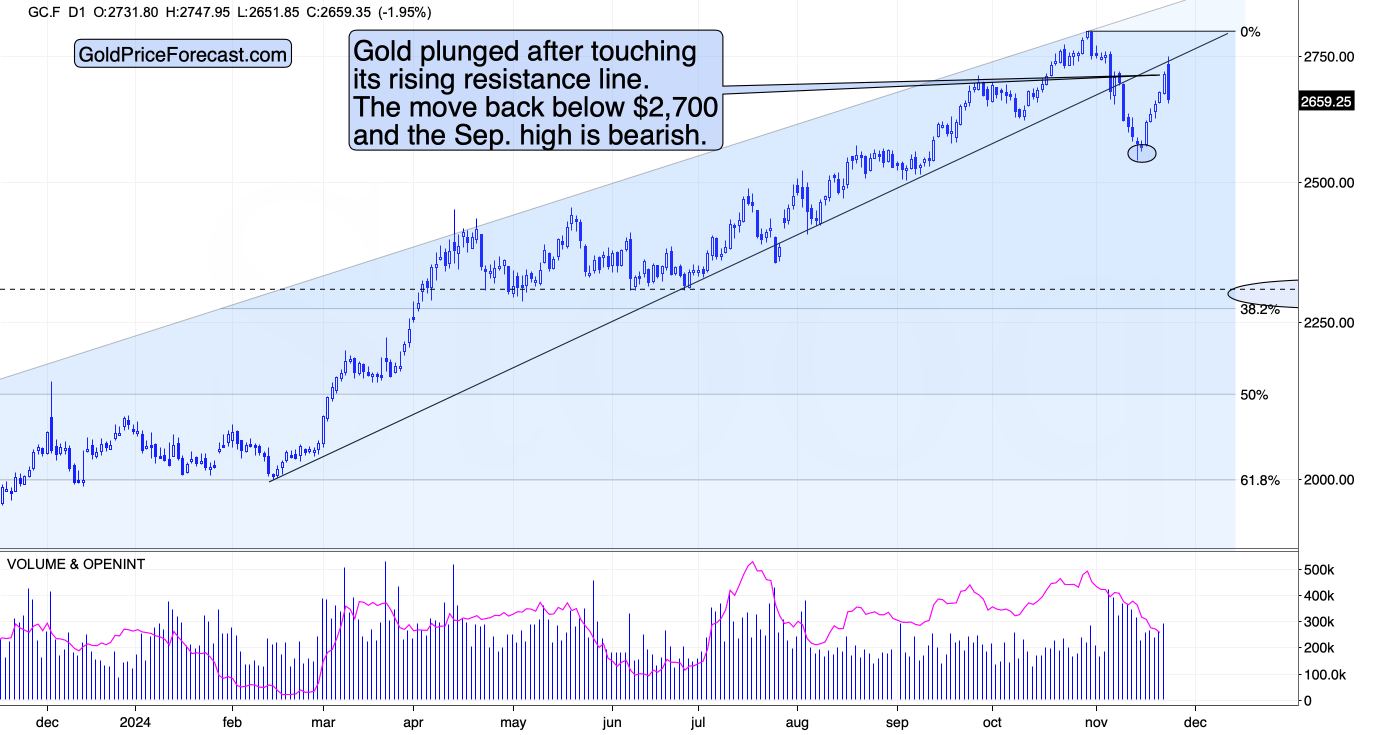

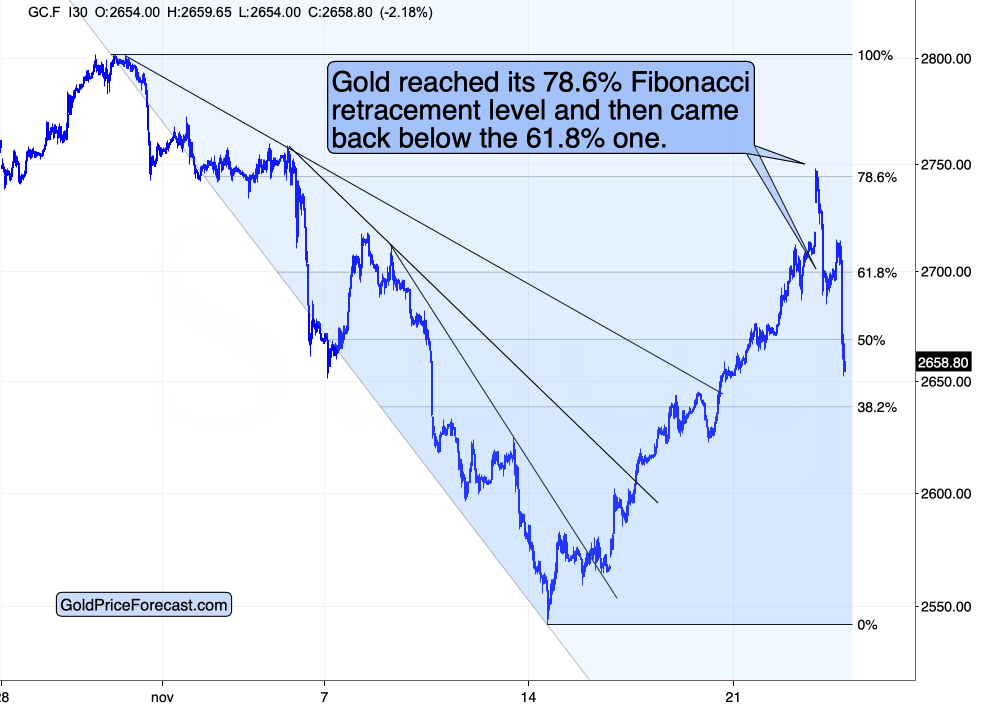

Gold reached its rising resistance line as well as the 78.6% Fibonacci retracement level and then turned south. The technical principles worked again – a combination of resistance levels triggered selling.

Now, the 78.6% retracement level is not as popular as the 38.2% or 61.8%, but it also works from time to time. This was the case earlier today. Anyway, as gold moved back below the 61.8% and 50% levels, the breakout above them was invalidated as well.

This means that the scenario that I had outlined on Friday – that the uptrend has most likely reversed – has just become more likely.

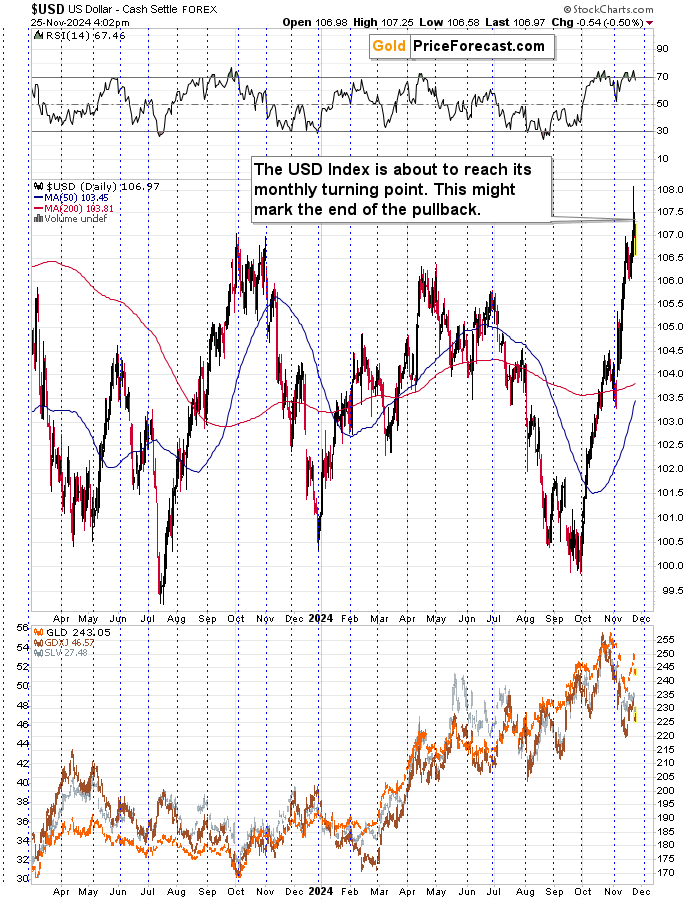

USD Index: Awaiting a Correction

The has been soaring for almost two months now and it might be time for a weekly correction.

Why weekly? Because of the USD Index’s tendency to reverse its course close to the turn of the month. I marked the previous such turnarounds with vertical, dashed lines. Sometimes the corrections are small and sometimes we see major short-term tops or bottoms.

Will we see a correction shortly? That’s quite possible. After all, no market moves up or down in a straight line without periodic corrections.

Will the correction in the USDX trigger a rally in gold and miners? I wouldn’t say that’s necessary. The most recent boost that both markets got was based on geopolitical turmoil (a new type of rocked used by Russia), and those tend to have only temporary impact on prices. Today’s move lower in gold and USDX confirms this. So, it is quite possible that we would see a decline in gold and the USD Index at the same time.

This would in turn make the price of gold in terms of the euro fall even more. And… This is very likely based on what we see on the chart featuring gold from this point of view.

Invalidations of breakouts are sell signals, and the invalidation of the move above the previous all-time high is a super-important sell signal. Especially that gold (priced in USD) topped in this way in 2011 forming THE top.

Today’s slide is crystal-clear to everyone. THE top is very likely in.

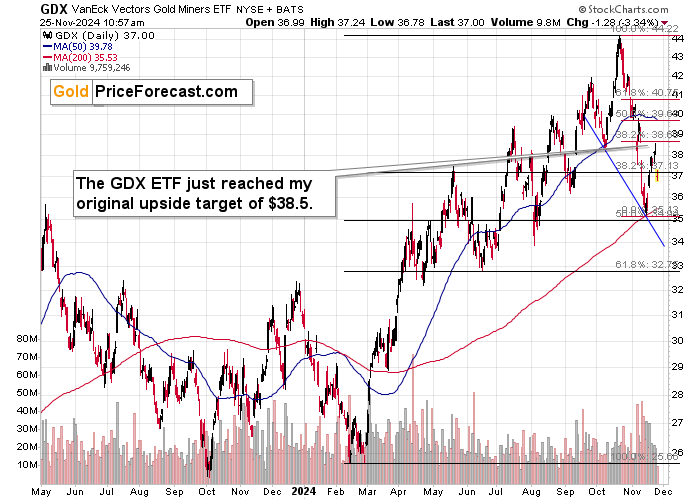

Meanwhile, the VanEck Gold Miners ETF (NYSE:) topped only $0.07 above my target for this corrective rally, and then it plunged.

Since gold and USD moved lower together, I see very little chance of gold and miners continuing the rally here. In other words, it does seem that the corrective rally is over, and the top is in.

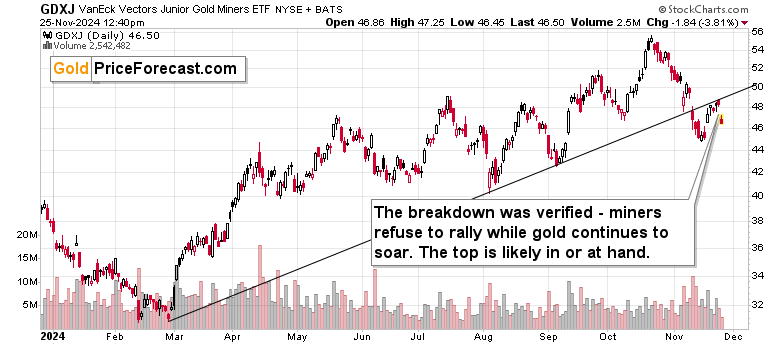

And while the GDX ETF declined significantly, the VanEck Junior Gold Miners ETF (NYSE:) declined even a bit more.

The GDXJ ETF verified the move below its rising resistance line, which means that the decline can now continue. It’s still early in it, and the vast majority of the already-profitable decline is still ahead of us. If you weren’t sure about the direction in which the mining stocks are heading, and you’ve been waiting for some kind of confirmation – this is it.

The potential for the medium-term decline is enormous, but even in case of the short-term move, it seems that the potential is either huge or big. It’s huge if the stock market declines, and it’s big, if it doesn’t. Either way, if you’ve been waiting on the sidelines, in my view this is still a great moment to join in. It’s likely that we’ll be taking profits from this short position close to the end of this year – or earlier.