Gold: US CPI Data a Possible Catalyst for Breakout Toward New All-Time High

2024.09.11 08:22

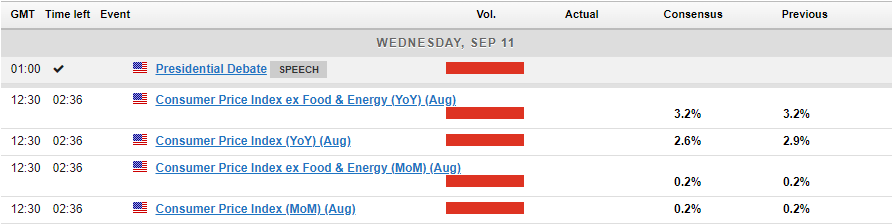

- Gold prices are inching higher as the market awaits the US CPI release.

- Market reaction to the CPI data will depend on whether rate cut expectations are already priced in.

- From a technical analysis perspective, the gold chart may be forming a double-top pattern ahead of the CPI release.

Gold () prices inched higher in Asian trade as market participants brace for the release. The precious metal continues to flirt with the all-time highs (ATH) around 2531/oz.

Market participants may be eyeing US CPI as a catalyst that could inspire a breakout and push gold prices to fresh highs. I am a bit more skeptical, however, and there are two reasons for that. The first being that US inflation data does not hold the same sway as it did a few weeks back. The second is the reaction following last week’s labor data suggests that a lot of the rate cut expectations may be priced in.

If that is the case, we could see an initial spike to print a fresh high before a significant pullback. However, as the trading adage goes, ‘trade what you see, not what you think’. We need to keep this in mind and keep an eye on the data release as well as the market’s reaction to it.

The US Dollar has struggled to maintain Monday’s momentum with the (DXY) failing to advance. This in part could explain gold’s rise overnight.

This could be caution ahead of the CPI release with market participants mindful of the US Dollar price action we saw after the jobs data on Friday.

Geopolitics remain in play and continue to underpin gold prices. A visit by US Secretary Blinken and UK’s David Lammy to Ukraine has increased concerns that the US and UK may grant Ukrainians the ability to use weapons from Western Nations to strike at the heart of Russia.

Market participants may view this as an unnecessary risk which may keep gold prices supported. Such an attack would surely prompt a Russian response and the fear is that this could trigger attacks by Russia on European nations or potentially NATO members.

Technical Analysis

From a technical analysis standpoint, the four-hour gold chart could be forming a potential double-top pattern heading into the US CPI release.

The last time, we had a double bottom pattern, gold prices rallied from 2471 on September 4 to a high of around 2529 on September 6. Will a double bottom lead to a similar move but to the downside?

It is a tough one to call, as we saw following the US jobs data release. Markets may have already priced in a substantial amount of rate cuts and thus only a significant miss from the CPI may warrant a significant reaction. Even then I remain skeptical that such a move would prove sustainable.

A move lower from current price, may find some support at a key confluence area around 2507 which houses the 100-day MA.

Conversely, a move higher from here needs to navigate its way past the ATH print of 2531 before the 2550 handle comes into play.

GOLD (XAU/USD) Four-Hour (H4) Chart, August 23, 2024

Source: TradingView

Support

Resistance

Original Post