Gold technical analysis for 16-11

2022.12.16 08:19

Gold technical analysis for 16-11

Budrigannews.com – Genuine Loan fees are the critical driver for valuable metals. In particular, declining genuine loan costs and negative genuine financing costs drive valuable metals higher.

In any case, there is a second driver that addresses the common pattern and throughout the long term I have realized this is essentially as significant as the pattern in genuine loan fees.

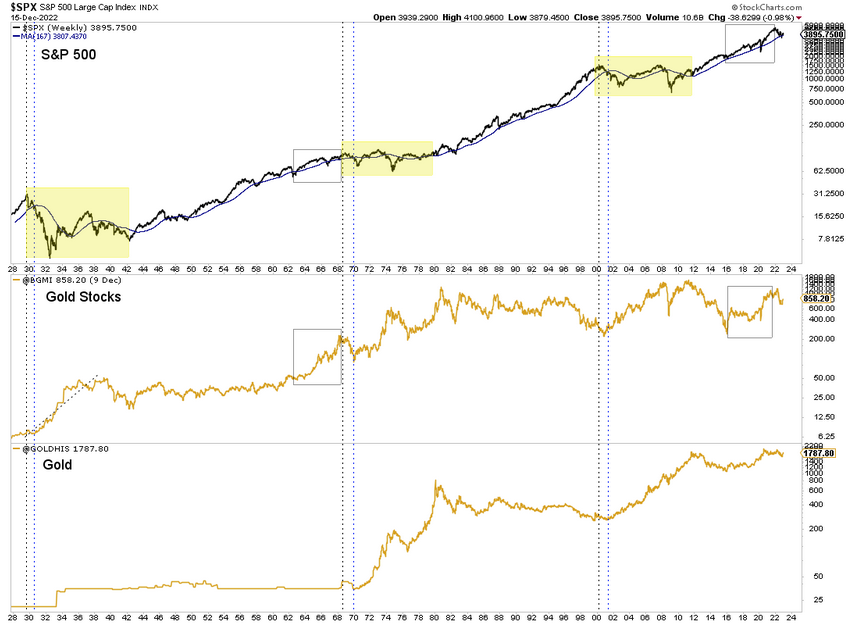

The best moves in valuable metals (barring the 1960s) all happened during common bear markets in US values. Those common bears happened from 1929 to 1942, 1968 to 1982, and 2000 to 2009/2011.

By the way, gold stocks performed very well during the 1960s yet at that point the US value buyer market had dialed back impressively.

The repetitive buyer market in from August 2018 to August 2020 didn’t develop into a common positively trending market on the grounds that the US securities exchange stayed in its mainstream buyer market.

The outline beneath gives a verifiable setting between the , gold diggers (Barron’s Gold Mining Record), and gold.

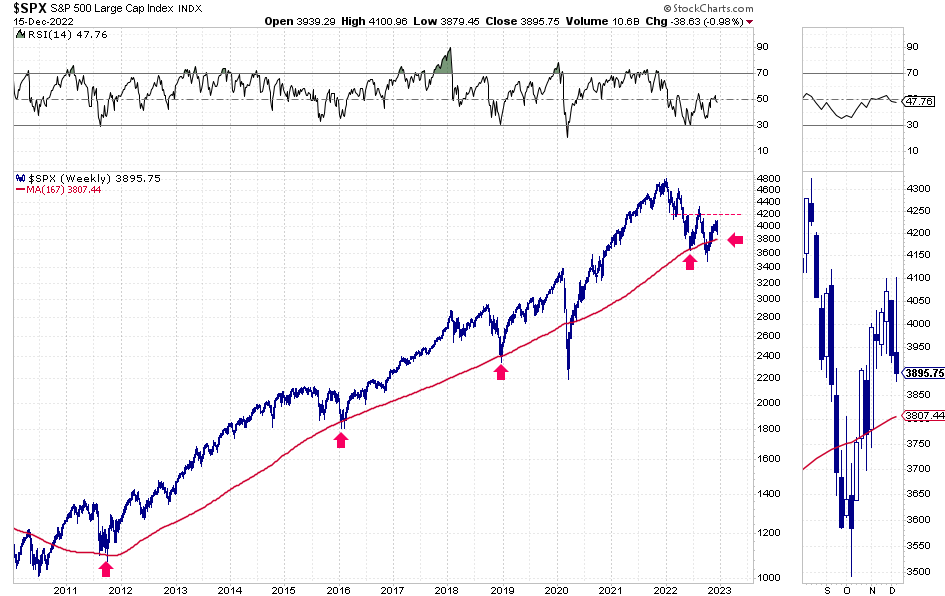

The upward lines show the beginning of the mainstream bear market and when the S&P 500 declined underneath its 40-month moving normal. The gold bottoms in 1970 and 2001 agreed with the S&P 500 losing its 40-month moving normal.

As I would see it, gold and gold stocks have proactively lined. Note that the gold stocks lined in late 2000, months before the S&P 500 lost its 40-month moving normal.

Regardless, on the off chance that the S&P 500 were to lose its 40-month moving normal (around 3,800) and lose the new low of 3,500, it would everything except affirm the securities exchange is in another mainstream bear market.

Naturally, that would be a very encouraging development for precious metals. Possibly the most encouraging development in the previous two decades. Only Gold would surpass $2,100/oz if it broke above a 12-year base.

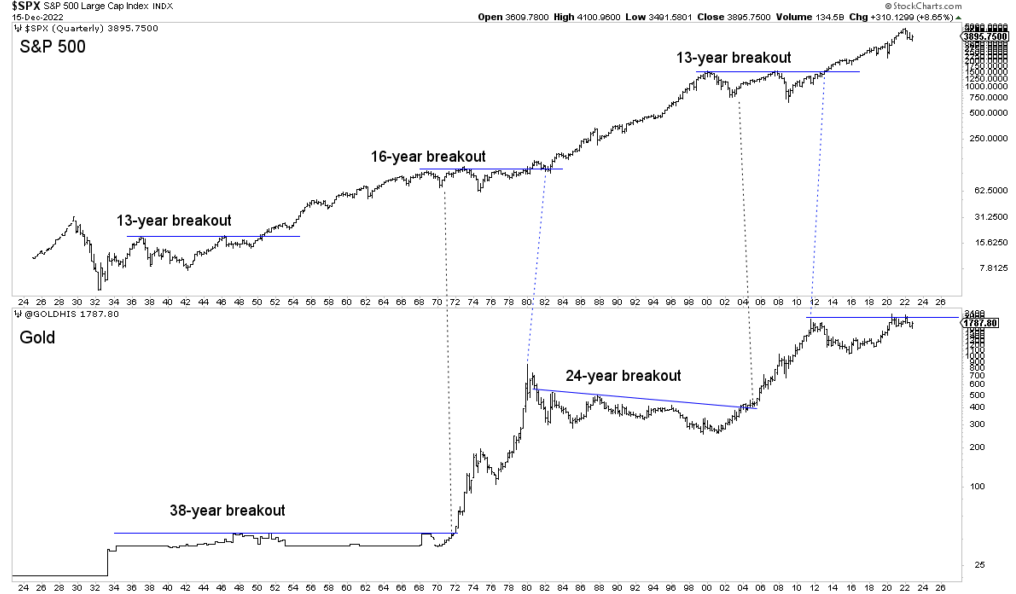

According to the graph that can be found below, major secular peaks in one counterpart typically precede multi-decade breakouts in gold and the S&P 500.

Major peaks in hard assets preceded the major breakouts that occurred in the S&P 500 in 2013, 1982, and 1951. After the secular peaks in stocks of 1968 and 2000, the major breakouts in gold (1971 and 2005) occurred.

In a nutshell, the possibility of the S&P 500 resuming its downward trend and making lower lows is a significant catalyst for precious metals.

As we mentioned in our previous communication, because the stock market has risen in tandem with precious metals, they will probably fall as the market moves closer to important support levels.

However, we want to be buyers precisely at that time.

Pay attention because in the coming weeks, some incredible values could emerge.