Gold Technical: A Less Dovish Fed May Reinforce a Medium-Term Corrective Decline

2024.12.16 08:13

- The proposed policies of Trumponomics 2.0 may ignite a further uptick in inflationary expectations in the US.

- Market-transacted inflationary expectations gauge, the 5-year and 10-year US breakeven inflation rates have been trending higher since September 2024.

- The Fed may switch its current dovish monetary policy to a “wait and see” pivot stance on 18 December FOMC.

This is a follow-up analysis of our prior report published “Medium-term uptrend damaged, spooked by rapid rise in 10-year US Treasury yield” on 14 November 2024. for a recap.

Since our last publication, the price actions of Gold () have staged a minor bounce of 7% to revisit the prior minor swing of US$2,710 printed on 8 November twice; on 22 November and 11 December but failed to make a significant breakout above US$2,710.

The yellow metal traded lower last Friday, 13 December, and reintegrated below its 50-day moving average which suggests that the bulls are being subdued as we head into a key event this week; the US monetary policy decision and the release of its latest economic projections (“dot plot”) this Wednesday, 18 December.

Market participants in the Fed funds futures market have already priced in with near certainty (97.1% chance based on the CME FedWatch tool as of 16 December) that the Fed will proceed to cut by 25 basis points (bps), its third cut to bring to Fed funds rate to 4.25-4.50%.

A Less Dovish Fed May Be on the Horizon Next (LON:)

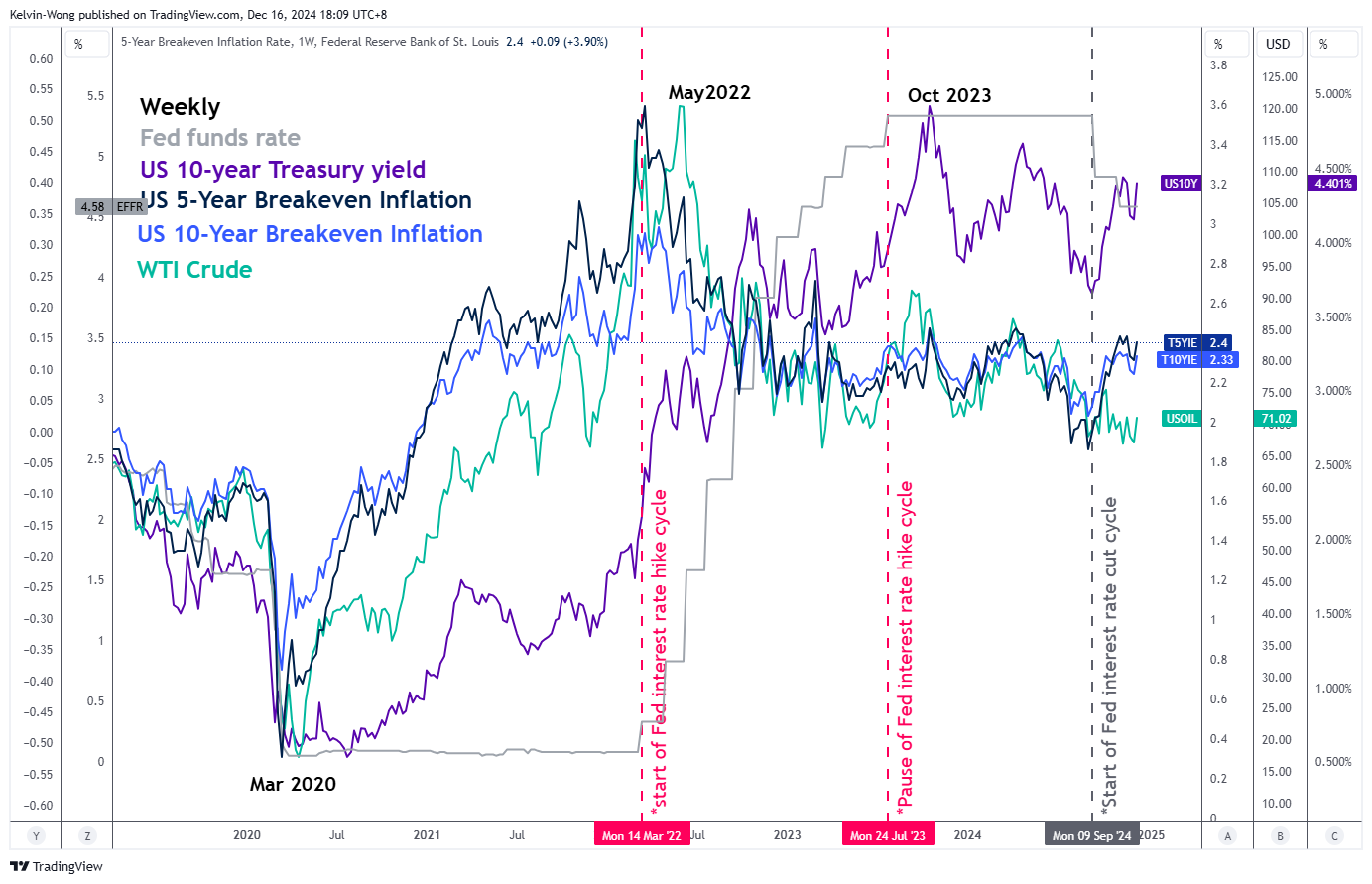

Fig 1: 5-year & 10-year US breakeven inflation rates major trends as of 13 Dec 2024 (Source: TradingView)

Market-transacted financial instruments have started to price in a further uptick in US inflationary expectations as derived from the movements of both the and US breakeven inflation rates that have been trending upwards since the start of the current Fed’s interest rate cut cycle on September 2024, to hover at 2.40% and 2.33% respectively as of 16 December 2024, above the Fed’s long-term inflation target of 2% (see Fig 1).

The primary catalyst for the current medium-term uptrend movements of the 5-year and 10-year US breakeven inflation rates have been triggered by the proposed policies of Trumponomics 2.0 that consist of deeper corporate tax cuts and higher trade tariffs imposed on US imports that will likely revive inflationary pressures in 2025, and beyond.

Based on the CME FedWatch tool as of 16 December 2024, market participants are expecting another two potential Fed funds rate cuts of 25 bps each in 2025 to bring the Fed funds rate to 3.75-4.00%, which is lesser than the last “dot plot” implied projection released on 18 September FOMC meeting that highlighted an approximate of four interest rate cuts of 25 bps each in 2025 (to bring the Fed funds rate to 3.4%) based on a median projection from Fed officials.

Bullish Reversal in 10-Year US Treasury Real Yield

Fig 2: 10-year US Treasury real yield medium-term & major trends as of 13 Dec 2024 (Source: TradingView)

Last week, the 10-year US Treasury real yield staged a significant V-shaped rebound of 16 bps after a retest on its key medium-term support at the 1.90% level on Monday, 9 December.

A potential further push up towards the 2.29% medium-term resistance will increase the opportunity cost of holding Gold (XAU/USD), and eventually cap its bullish strength at least in the short to medium-term horizon (see Fig 2).

An important point to note is that the major uptrend phase of Gold (XAU/USD) in place since October 2023 remains intact. Also, it is likely to be supported by the longer-term effects of higher trade tariffs component of Trumponomics 2.0 which may lead to a further escalation of deglobalization that can trigger headwinds to global economic growth where Gold (XAU/USD) may see higher demand due to its defensive hedging element.

Watch the US$2,716 Key Medium-Term Resistance on Gold (XAU/USD)

Fig 3: Gold (XAU/USD) medium-term & major trends as of 16 Dec 2024 (Source: TradingView)

Since its recent current all-time high of US$2,716 printed on 31 October, the price actions of Gold have started to oscillate in consolidation configuration with a lingering risk of facing a multi-week corrective decline to retest its key 200-day moving average within its major uptrend phase in place since 6 October 2023.

A break below the US$2,537 first medium-term support may reinforce the corrective decline sequence to expose the next medium-term support zone of US$2,484/415. It is also a potential inflection zone to kickstart another potential bullish impulsive sequence for Gold (XAU/USD) (see Fig 3).

On the other hand, a clearance above US$2,716 invalidates the corrective decline bearish scenario to revive the bulls towards the next medium-term resistance zone of US$2,850/886 in the first step.

Original Post