Gold Summer Doldrums

2023.06.09 17:16

, , and their miners’ stocks suffer their weakest seasonals of the year in the early summers. With traders’ attention normally diverted to vacations and summer fun, interest in and demand for precious metals usually wane. Without outsized investment demand, gold tends to drift sideways to lower dragging silver and miners’ stocks with it. Long feared as the summer doldrums, they can offer good buying opportunities.

This doldrums term is very apt for gold’s traditional summer predicament. It describes a zone surrounding the equator in the world’s oceans. Their hot air is constantly rising, spawning long-lived low-pressure areas. They are often calm, with little prevailing winds. History is full of accounts of sailing ships getting trapped in this zone for days or weeks, unable to make headway. The doldrums were murder on ships’ morale.

Crews had no idea when the winds would pick up again, while they continued burning through their limited stores of food and drink. Without moving air, the stifling heat and humidity were suffocating on those ships long before air conditioning. Misery and boredom grew extreme, leading to fights breaking out and occasional mutinies. Being trapped in the doldrums was viewed with dread, it was a very trying experience.

Gold investors can somewhat relate. Like clockwork trudging through early summers, gold starts drifting listlessly sideways. It often can’t make significant headway no matter what trends looked like heading into June, July, and August. As the days and weeks grind on, sentiment deteriorates markedly. Patience is gradually exhausted, supplanted with deep frustration. So plenty of traders abandon ship, capitulating.

June and early July in particular have often proven desolate sentiment wastelands for precious metals, devoid of recurring seasonal demand surges. Unlike most of the rest of the year, the summer months simply lack any major income cycle or cultural drivers of outsized gold investment demand. Yet several recent summers have proven big exceptions to these decades-old seasonals, and 2023’s could still be another.

While gold has suffered a sizable pullback over this past month ramping bearish psychology, it is still having a good year. As of mid-week near selloff lows, the yellow metal was still up a solid 6.5% year-to-date. In early May, gold’s latest powerful upleg extended to big 26.3% gains over 7.2 months. The pullback since was largely fueled by massive gold futures selling as hawkish Fedspeak goosed the .

Rather than getting discouraged, traders should embrace gold’s summer doldrums. Healthy pullbacks are essential for maximizing uplegs’ longevity and ultimate gains, rebalancing sentiment before greed grows excessive enough to prematurely slay uplegs. These selloffs also offer the best mid-upleg buying opportunities. Instead of checking out in the early summer, traders should be researching great stocks to add.

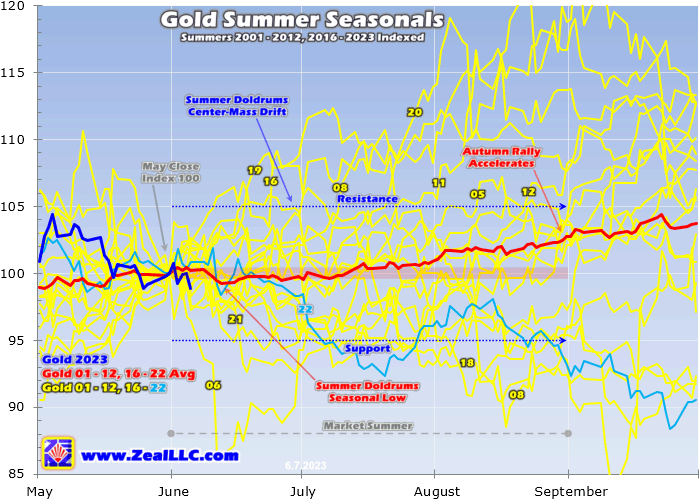

Quantifying gold’s summer seasonal tendencies during bull markets requires all relevant years’ price action to be recast in perfectly-comparable percentage terms. That is accomplished by individually indexing each summer’s gold prices to their last closes before, which are May’s final trading days. They are set to 100, then all summer gold-price action is recalculated off those common indexed baselines.

So gold trading at an indexed level of 110 simply means it has rallied 10% from May’s final close, while 95 shows it is down 5%. This methodology renders all bull-market-year gold summers in like terms. That’s necessary since gold’s price range has been so vast, from $257 in April 2001 to $2,062 in August 2020. That span encompassed two secular gold bulls, the first soaring 638.2% over 10.4 years into August 2011.

Following that mighty juggernaut, gold consolidated high then started correcting in 2012. But the yellow metal didn’t enter formal bear territory down 20%+ until April 2013. That beast mauled gold on and off over several years, so 2013 to 2015 are excluded from these seasonal averages. Gold finally regained bull status powering 20%+ higher in March 2016, then its modest gains grew to 96.2% by August 2020.

Another high consolidation emerged after that, where gold avoided relapsing into a new bear despite a serious correction. Later the yellow metal started powering higher again, coming within 0.5% of a new nominal record in early March 2022 after Russia invaded Ukraine. So 2016 to 2021 definitely proved bull years too, with 2022 really looking like one early on. Then Fed officials panicked, unleashing market chaos.

Inflation was raging out of control thanks to their extreme money printing. In just 25.5 months following the March 2020 pandemic-lockdown stock panic, the Fed ballooned its balance sheet an absurd 115.6%. That effectively more than doubled the US monetary base in just a couple of years, injecting $4,807b of new dollars to start chasing and bidding up the prices on goods and services. That fueled an inflation super-spike.

With big inflation running rampant, Fed officials frantically executed the most extreme tightening cycle in this central bank’s history. They hiked their federal funds rate an astounding 450 basis points in just 10.6 months, while also selling monetized bonds through quantitative tightening. That ignited a huge parabolic spike in the US dollar, unleashing massive gold futures selling slamming gold 20.9% lower into early September.

That was technically a new bear market, albeit barely and driven by an extraordinary anomaly that was unsustainable. Indeed gold soon rebounded sharply, exiting 2022 with a trivial 0.3% full-year loss. Gold kept on powering higher, reentering bull territory up 20.2% in early February 2023. So I’m also classifying 2022 as a bull year for seasonality research. Gold’s modern bull years include 2001 to 2012 and 2016 to 2022.

When all gold’s summer price action from these modern gold-bull years is individually indexed and thrown into a single chart, this spilt-spaghetti mess is the result. 2001 to 2012 and 2016 to 2021 are rendered in yellow. Last summer’s action is shown in light blue for easier comparison with this summer. Seeing all this perfectly-comparable indexed summer price action at once reveals gold’s centre-mass-drift tendency.

These summer seasonals are further refined by averaging together all 19 of these gold-bull years into the red line. Finally, gold’s summer-to-date action this year is superimposed over everything else in dark blue, showing how gold is performing compared to its seasonal mean. Just entering the summer doldrums, the yellow metal has meandered a little below trend as of mid-week. That’s perfectly normal doldrum behaviour.

Gold’s latest mid-upleg pullback is readily apparent here, dragging it a sharper 5.4% lower in several weeks into late May. Then gold challenged those pullback lows again this week. As of Thursday when I penned this essay, that looked like a successful technical retest and double-bottom. That morning some weak US economic data in surging weekly jobless claims slammed Fed-rate-hike odds, really boosting gold.

Across those two decades of modern gold-bull years, the yellow metal’s summer-doldrums seasonal low actually arrived quite early. On average from 2001 to 2012 and 2016 to 2022, gold bottomed on June’s 10th trading day just under 99.3 indexed. That was merely down 0.7% or so, highlighting the mostly-sideways-drifting nature of this seasonally-weak span. This year that seasonal low coincides with Wednesday, June 14th.

That happens to be a major news day for gold, which could drive big trading. The Fed’s Federal Open Market Committee is releasing its latest monetary-policy . After a blistering 500bp of hiking off zero in just 13.6 months, rate futures are largely next week. But that FOMC meeting is one of the every-other ones accompanied by top Fed officials’ latest federal-funds-rate forecasts in the dot plot.

If those dots come in significantly more hawkish or dovish than expected, that could really move both the US dollar and gold. The former would increase the odds of gold bottoms on its seasonal schedule in mid-June, but a surprise is unlikely. The FOMC’s FFR-target midrange is now at 5.13%, exactly where Fed officials had forecast it at year-end 2023 in their last dot plot in late March. They may add another hike or two.

But traders expect that, as federal-funds futures are now pricing in only about a 30% chance of a rate hike next week but nearly 90% for another 25bp one at the FOMC’s subsequent meeting in late July. So the new dots showing one or two more hikes shouldn’t shock traders. But even if gold carves a pullback low around there, that doesn’t mean the summer doldrums are over. They actually tend to grind on into early July.

After hitting that 99.3 indexed in mid-June, gold slumps back near 99.5 in both late June and early July. Then once again after the big US Independence Day holiday, gold retreats one more time to 99.6. So gold’s summer doldrums really stretch from roughly late May to early July. Traders shouldn’t expect too much upside from gold in this seasonally-weakest span, it is simply something that needs to be stoically endured.

But rather encouragingly, gold’s summer doldrums are mostly an early-summer phenomenon. In both July and August, the yellow metal increasingly picks up steam heading into its usual strong autumn rally. On average during these modern bull-market years, gold slumped 0.2% in June which isn’t much. And then in July and August, it averaged excellent 1.1% and 1.8% gains. So Gold’s June doldrums is more correct.

From a trading-strategy perspective, gold-stock trades are often stopped out or sold in May after their powerful seasonal spring rallies peak. If gold and gold stocks didn’t soar to extremely-overbought levels in May, any remaining trades can be held through June’s mostly sideways drift. The new trades can be added in late June and early July to fill up and top off trading books.

Gold’s summer doldrums aren’t a threat, but a good mid-upleg buying opportunity to enter gold stocks at relatively-low prices. While gold’s recent pullback again grew to 5.4% at worst in late May, that fueled a sizable parallel gold-stock selloff of 15.2% in that span per the leading gold-stock ETF. That made for normal 2.8x downside leverage in GDX’s usual 2x-to-3x range, leaving nice gold-stock bargains in its wake.

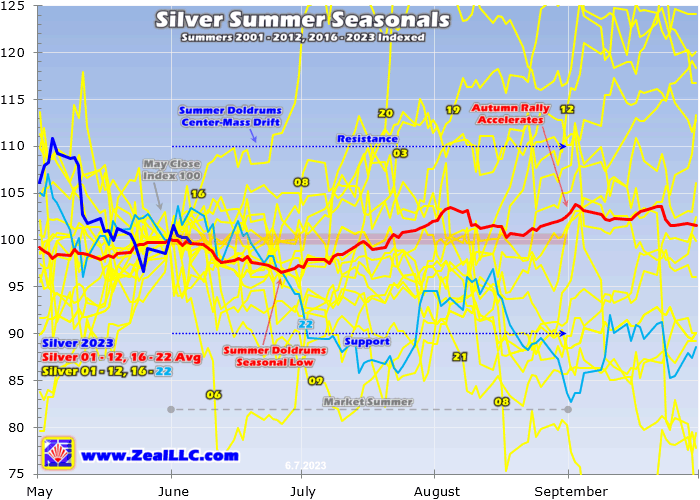

Gold’s price action overwhelmingly drives sentiment for the entire precious metals realm, so both gold stocks and silver are slaved to gold’s fortunes. They also tend to amplify the yellow metal’s price trends, so they suffer worse summer doldrums than gold. Starting with silver and then moving on to gold stocks, we’ll use this same summer-seasonal-indexing methodology. The white metal’s volatility well exceeds the yellow’s.

Silver’s summer-doldrums centre-mass drift has a much wider range, from 90 to 110 index compared to 95 to 105 for gold. Interestingly silver’s seasonal low comes a couple of weeks later than gold’s near the end of June, specifically on its 20th trading day. That averaged 96.5 during these same modern gold-bull years, for a 3.5% loss. That makes for much-worse Junes for silver, which averages bigger 2.8% losses.

Yet as gold’s autumn rally starts powering higher in July, silver bounces back strong enjoying a hefty average of 4.9% gains. All that surging apparently pulls forward some late-summer buying, so August slumps back to small 0.5% average rallies. Still silver’s overall summer trends mirror and amplify gold’s, starting with seasonal selloffs in June which reverse sharply into rallying on balance in July and August.

But through these entire 3-month market summers, silver’s average seasonal performance has proven disappointing. Gold averaged rather-impressive 2.7% full-summer gains in these modern bull years, but silver failed to leverage that only seeing lagging 2.5% gains. Silver acts like a gold sentiment gauge, and herd psychology usually festers on the bearish side throughout most of the market summers even as gold climbs.

Still when gold is enjoying outsized summer gains like several years ago, the resulting bullish sentiment catapults silver sharply higher. While gold blasted up 13.7% through June, July, and August 2020, silver skyrocketed up 58.1% in that summer-doldrums span. Once gold really gets moving generating real herd greed, silver explodes higher. This young summer of 2023 has better odds of seeing outsized gold gains again.

Major gold uplegs are fueled by three stages of buying, speculators’ gold-futures short covering, then their gold-futures long buying, and finally far-larger investment buying. While the stage-one short covering is exhausted, specs still have somewhere between half to four-fifths of their larger stage-two long buying left to do based on their current positioning. In our newsletters, I extensively analyze all the weekly data on that.

And investors have barely started their all-important stage-three buying in this gold upleg. The best high-resolution proxy for global gold investment demand hasn’t moved much yet. The combined holdings of the dominant American GLD (NYSE:) and iShares Gold Trust (NYSE:) ETFs are only up 4.3% at best within gold’s current upleg. They soared 30% to 35% higher during recent major gold uplegs. So gold still has huge potential buying ahead.

The catalyst to reignite specs’ stalled gold-futures long buying will likely be the Fed. Whether the FOMC hikes another time or two or not, this epic Fed rate hike cycle is effectively over. Soon top Fed officials who’ve been talking hawkish will have to admit that and shift more dovish. That should reignite US-dollar selling, driving gold higher. And speculators and investors alike love chasing upside momentum in gold.

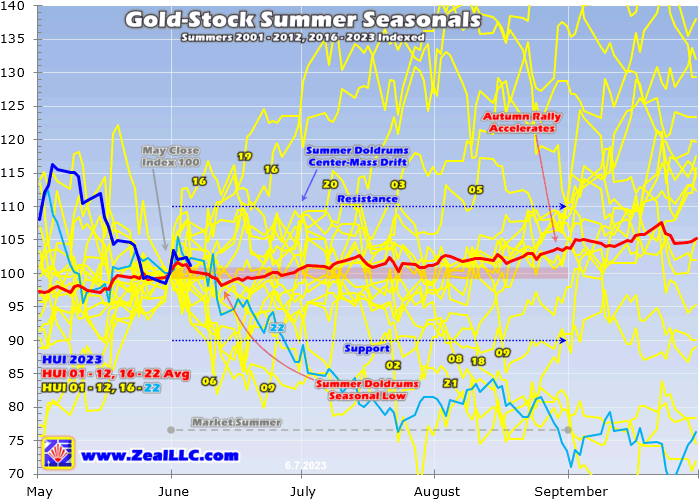

The gold miners’ stocks remain the biggest beneficiaries of gold strength, which their earnings and stock prices amplify to big gains. For gold-stock summer seasonals, I’m using the older gold-stock index which closely mirrors the GDX VanEck Gold Miners ETF more popular today. Unfortunately, GDX’s price history is insufficient to span these modern gold-bull years, as this leading sector ETF wasn’t born until May 2006.

The major gold stocks’ summer seasonals are more gold-like than silver-like, with their seasonal low also averaging June’s 10th trading day. On average from 2001 to 2012 and 2016 to 2022, the HUI bottomed at 98.2 indexed. That makes for a modest 1.8% summer-doldrums loss. The gold stocks start recovering from that right away, rallying on balance for the rest of the market summer with most of their gains later on.

In June, July, and August, the major gold stocks averaged 0.6%, 0.7%, and nice 2.7% gains during these modern gold-bull years. Gold-stock traders’ sentiment is heavily dependent on how gold is faring and often lags gold a bit. So most gold stocks’ summer gains are concentrated in August after gold’s young autumn-rally uptrends become clearer. This sector’s summer performances vary radically with gold.

During that summer of 2020 when gold surged 13.7%, GDX powered 23.2% higher for outsized gains. The summer before that in 2019, gold blasted up 16.7% on very-strong investment demand. That helped catapult GDX 38.2% higher in that June, July, and August stretch. When gold is thriving even during the summer doldrums, the gold stocks amplify its gains. But their leverage to gold is a double-edged sword.

When gold is weak during market summers, gold stocks get crushed. That last happened a year ago in the summer of 2022, as the Fed’s extreme monster rate hikes launched the US dollar parabolic. That unleashed heavy gold-futures selling slamming the yellow metal 6.8% lower during those three months. GDX cratered a brutal 25.0% on that, making for one miserable summer. Gold stocks totally depend on gold.

So if gold rallies later this summer as it ought to given today’s bullish setup, the major gold stocks of the HUI and GDX should amplify its gains by 2x to 3x like usual. Smaller fundamentally-superior mid-tier and junior gold miners should fare even better. We’ve specialized in that high-potential realm at Zeal for almost a quarter century, and are looking forward to topping off our newsletter trading books in the coming weeks.

The bottom line is traders shouldn’t fear gold’s summer doldrums. The yellow metal’s average seasonal slump in modern bull-market years is mild and mostly compressed into June. After tending to bottom in mid-June, gold generally recovers in July and August as its strong seasonal autumn rally gathers steam. Gold stocks largely mirror and amplify gold’s performances, enjoying big summer gains when gold rallies nicely.

This summer’s gold setup is more bullish than most, with the Fed nearing the end of this violent rate-hike cycle. Top Fed officials will have to start dialing back their hawkish rhetoric, fueling gold-futures buying. That will drive gold higher as speculators and investors alike chase its upside momentum. All that really ought to lead to a stronger summer for gold, silver, and their miners’ stocks with excellent upside potential.