Gold Subdued Amid Increasing Inflationary Pressure

2022.11.28 03:55

[ad_1]

upside was limited in the past two weeks, while the downside could be more than what the gold bugs expect in the coming days.

But positive cues from the of the Fed’s November meeting, released earlier this week, provided a tailwind for gold prices.

Most Fed policy-makers behind this month’s U.S. rate hike thought it was time to slow down the central bank’s aggressive pace of monetary tightening, minutes of that meeting released on Wednesday said.

The FOMC said,

“The minutes of the Nov. 1-2 Fed policy meeting show that a substantial majority of participants thought a slowing in the pace of interest rate hikes would be appropriate soon,”

The minutes were the clearest sign that the Fed was ready to take its foot off the rate hike pedal after carrying an intensive acceleration in rate hikes over the past seven months to cool .

Technical Outlook

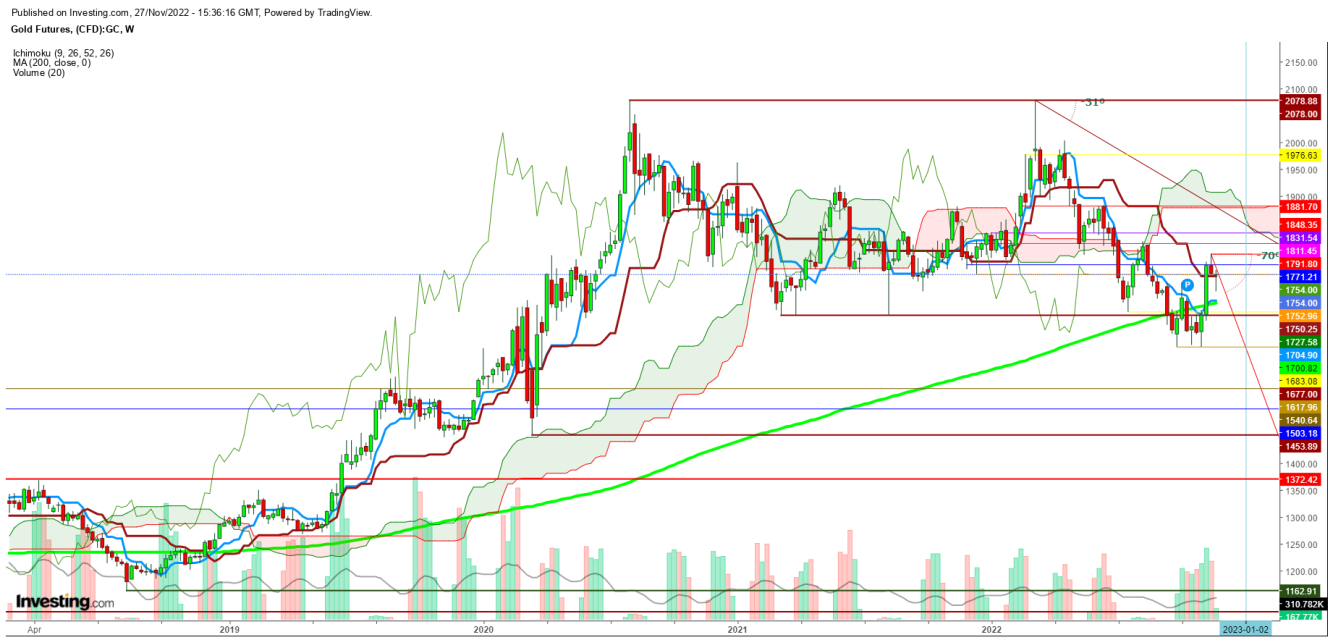

In the weekly chart, the prices are trying to defend the immediate support at 26 DMA which is currently at $1750.25 after testing a weekly high at $1761.20 and a low at $1720.80, closing the week at $1755.

This weekly move indicates exhaustion to continue next week if gold starts the week with a gap-down opening below the 26 DMA.

In case of a down move below $1746, the price could retest the next support at $1720 and the second support at 9 DMA, which is currently at $1704.

In case of a gap-up opening above the immediate resistance at $1662, it could move toward the second resistance at $1771.

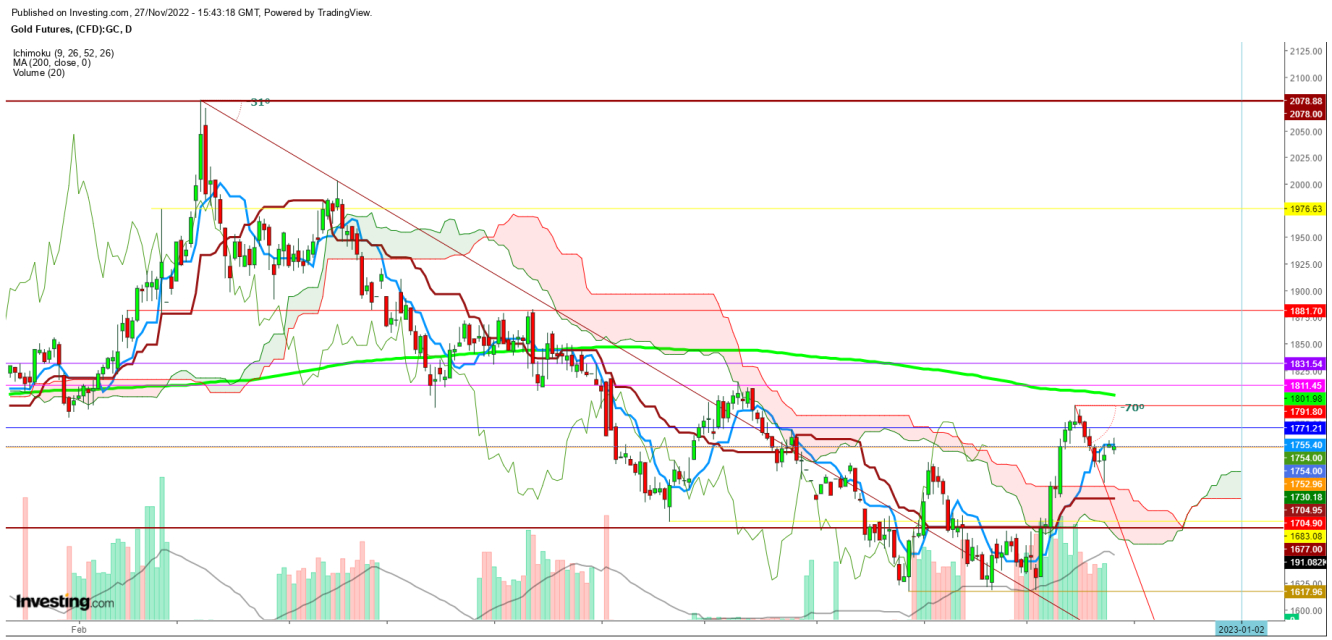

In the daily chart, the prices look ready for a breakout or a breakdown during the upcoming week after trading in a narrow range during the last week amid hopes and fear of interest hikes in the near future.

After finding a breakdown below the 200 DMA on Nov. 21, the prices continued to trade below 9 DMA during the last week looks evident enough for a breakdown soon.

A breakdown below the immediate support at $1738.71 will confirm the continuation of a downward trend during the upcoming week.

The second confirmation will be a sustainable move below $1720 that could push it below the $1704 level during the first half of December 2022.

Disclaimer: The author of this analysis may or may not have any position in gold. Readers can take any long or short trading position at their own risk.

[ad_2]

Source link