Gold Stocks to Overshoot | Investing.com

2024.07.19 16:26

The miners’ stocks have blasted higher to a powerful upside breakout this month. Amplifying gold’s underlying surge, they’ve achieved major new bull-market highs. Yet despite that big rallying, gold stocks remain undervalued relative to the metal they mine that drives their earnings. They still need to mean revert much higher to reflect prevailing gold prices, with momentum buying fueling a proportional overshoot.

Markets are forever cyclical, flowing and ebbing in endless marches of uplegs and corrections within bulls and bears. Price action is pendulum-like, oscillating between opposing extremes. Those include high and low technicals, overvalued and undervalued fundamentals, and greedy and fearful sentiment. Long-term averages reflect the bottom midpoints of pendulum arcs, mean-reversion targets for stretched prices.

But pendulums pulled way to either side don’t stop in the middle once they start swinging back. Their kinetic momentum carries them well through their midpoints in proportional overshoots to the other side. Markets dragged to either extreme function similarly, not just normalizing to averages but swinging right through to opposing extremes. Gold-stock cycles are no exception, and they recently saw an extreme anomaly.

Gold-mining profits are overwhelmingly driven by prevailing gold prices, as mining costs only change gradually. This is readily evident in the major gold miners included in the benchmark GDX (NYSE:) gold-stock ETF. Their last-reported quarterly results were Q1’24’s, where the top 25 GDX gold miners averaged $1,277 all-in sustaining costs. Subtracting those from gold’s average price yields a great sector earnings proxy.

In Q1 gold averaged $2,072, so GDX-top-25 profits ran $795 per ounce. A year earlier in the comparable Q1’23, gold was $1,892 while it cost these elite majors $1,302 to produce. That made for unit earnings of $589 per ounce. So during a year where average gold prices rallied a nice 9.5%, the GDX-top-25 majors’ profits surged 34.9%. This latest real-world example clocked in at excellent 3.7x upside leverage to gold.

Stock prices ultimately reflect some reasonable multiple of underlying earnings, and gold price trends fuel the great majority of gold miners’ profits. Thus gold stocks have always acted like leveraged plays on the metal they mine. After painstakingly analyzing the GDX top 25’s latest results for 32 consecutive quarters now, I can sure tell you that takes a ton of work. But an easy proxy decently reflects this key fundamental link.

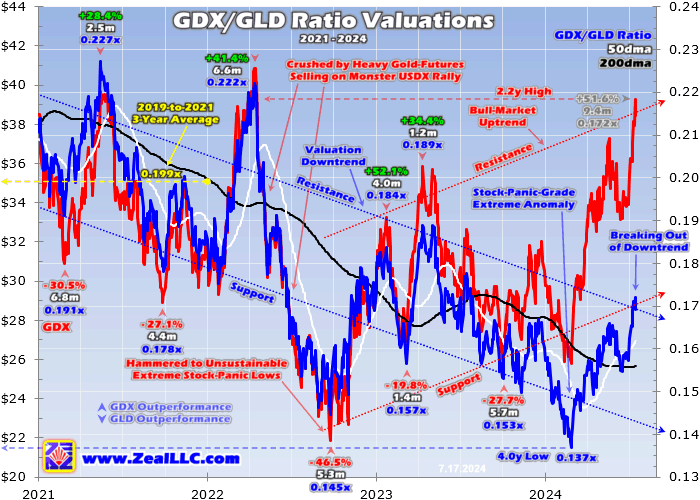

It’s simply the ratio between gold-stock and gold price levels. Charted over time, this shows whether gold stocks are overvalued or undervalued relative to the metal driving their earnings. For many years I’ve been using the GDX/GLD ratio or GGR variant of this metric. It divides that leading gold-stock ETF’s daily closes by those of the mighty American GLD (NYSE:) gold ETF, the largest physical-bullion-backed one in the world.

The GGR’s positioning relative to recent-year averages is analogous to gold stocks’ valuation pendulum. That was recently pulled to an exceedingly-anomalous extreme, with the mean reversion now well underway. Odds highly favor that momentum buying fueling a proportional overshoot, arguing much more gold-stock gains are coming. In this chart the GDX/GLD ratio in blue is superimposed over the raw GDX in red.

Flagging market extremes is important for trading since they mark major cyclical reversals, the tops of pendulums’ arcs. The more-extreme any extreme, the greater the likelihood it will spawn a proportional mean reversion and overshoot. An astounding one happened in late February, when GDX plunged to just $25.79. That was actually marginally under early October’s $25.91 when gold’s latest upleg was born.

Over a 4.8-month span where gold had powered 11.7% higher in a strong upleg, the leading gold-stock ETF somehow slipped 0.5% lower. That was insane, as I pointed out to our newsletter subscribers at the time. Normally major gold stocks amplify material gold moves by 2x to 3x, thus GDX should’ve been up 23% to 35%. So our newsletters added a bunch of cheap gold-stock trades in February as this anomaly worsened.

On February 28th at that inexplicable GDX nadir, the GDX/GLD ratio collapsed to just 0.137x. Though an extreme 4.0-year secular low, that understates how anomalous this was. The GGR had only been slightly lower at 0.133x on one single day in the dark heart of March 2020’s pandemic-lockdown stock panic. The market fear then was off the charts, as the flagship plummeted 33.9% in just over one month.

Everything including gold stocks was sucked into that brutal maelstrom of panic selling, as GDX suffered a miserable 38.8% freefall over several weeks. But that was understandable with stock markets’ fear gauge soaring to challenge 83. Gold stocks’ mean-reversion overshoot out of that wild extreme was huge, with GDX skyrocketing 134.1% over the next 4.8 months. Super-low GGRs are phenomenal buying ops.

But there was zero market fear in late February 2024 as the GGR revisited those stock-panic-grade lows, with the VIX under 14. And if it hadn’t been for that single stock-panic day, this recent GGR low would’ve proven gold stocks’ worst levels relative to gold in fully 8.1 years. The sheer extremity of this latest gold-stock-valuation anomaly can’t be overstated. This sector’s cyclical pendulum was stretched to a breaking point.

Indeed the mean reversion since then is gathering steam, with GDX powering 52.3% higher at best as of mid-week. Our newsletter trades added in February while that extraordinary GGR anomaly festered already have unrealized gains as high as +97%. But this gold-stock pendulum is only beginning to swing the other way after stretching to 4-to-8-year extremes. This Tuesday the GGR had merely recovered to 0.172x.

While quite an improvement from late February’s absurd 0.137x, that hasn’t even regained averages let alone swung through to the other side. The last quasi-normal years for gold stocks were 2019 to 2021. In 2022 gold and thus gold stocks were crushed by heavy gold-futures selling driven by a monster rally on the most-extreme Fed rate hikes ever witnessed. GDX collapsed 46.5% during that.

That horrible carnage left gold stocks deeply out of favor, and more-normal sentiment is only starting to return. In 2019 to 2021 before all that unprecedented 2022 craziness, the GDX/GLD ratio averaged 0.199x which is a reasonable mean baseline. GDX would have to rally another 18% from here at mid-week gold prices to mean revert, near $45.25. But pendulums stretched to secular extremes demand overshoots.

Late February’s epic anomaly was 0.062x under that 2019-to-2021 average, revealing extraordinary gold-stock undervaluation relative to gold. A proportional overshoot as the pendulum swings back driven by momentum buying portends a topping GGR of 0.261x. Plug that into mid-week GLD levels, and that yields a GDX upside target above $59.25. That’s another 54% higher from here, a big rally well worth riding.

Interestingly that would leave GDX’s entire upleg with massive 130.0% gains. That’s right in line with that last GGR mean-reversion overshoot out of that pandemic-lockdown stock panic when GDX soared 134.1%. The symmetry of similar GGR extremes yielding similar rebound uplegs is certainly agreeable. But it wouldn’t surprise me at all if gold stocks do even better, as their setup this time around is uniquely-bullish.

The major gold miners’ latest quarterly results for Q2 are imminent, being reported from late July to mid-August. As I analyzed in a late-June essay, the gold miners likely achieved record quarterly earnings. That’s mostly due to dazzling record quarterly-average gold prices, which clocked in at $2,337. That surged 18.2% YoY, the most since Q4’20. As I explained then, GDX-top-25 AISCs should come in near $1,325.

That would make for implied Q2 unit profits of $1,012 per ounce. That’s not only the best ever by far, but would soar 69% YoY. With the great majority of traders apathetic on gold stocks in recent years and not paying attention, gold miners’ epic earnings should really surprise in coming weeks. Exceedingly-strong fundamentals ought to start attracting fund investors, resulting in big capital inflows accelerating this upleg.

Also buying begets buying, as speculators and investors alike love chasing upside momentum. The longer and higher gold stocks rally, the more traders will want to deploy more capital to ride those gains. That will also generate more-frequent and more-bullish financial media coverage, further expanding awareness of this sector. This virtuous-circle dynamic is largely responsible for gold stocks’ upside breakout in July.

The resulting buying could persist on balance for a long time. This chart shows gold-stock valuations have languished in a downtrend for several years now. Not only was a major reversal all but certain after late February’s extreme lows, the GGR has already surged back up through that entire downtrend channel. It looks to be breaking out now, laying the groundwork for a new secular uptrend getting underway.

And gold stocks’ upside potential is proportionally boosted by gold’s underlying upleg and bull market still looking like they have a long way to run yet. After consolidating high mostly between $2,300 to $2,400 in recent months, gold just surged over mid-May’s last record close of $2,424 this week. Near $2,465 on Tuesday, gold’s total upleg since early October has grown to a mighty 35.5%. This run has proven remarkable.

Normally powerful gold uplegs are fueled by sequential buying largely from gold-futures speculators and American stock investors. The latter is evident in the combined physical-gold-bullion holdings of the GLD and iShares Gold Trust (NYSE:) gold ETFs, the world’s largest. Yet during gold’s upleg so far, these holdings have actually fallen 4.5% or 57.2 metric tons. American stock investors haven’t even yet started chasing today’s gold upleg.

They are entranced by this AI stock bubble, ignoring everything else. But as that inevitably decisively bursts, the scales will fall from their eyes. They will marvel at these record gold prices and remember the wisdom of diversifying their tech-stock-heavy portfolios with gold. Today’s gold upleg is the biggest by far and first to achieve new-record-high streaks since a pair both cresting in 2020, begging to be noticed by all.

Gold uplegs grow to monster size on gold-record momentum. Increasing buying drives gold higher on balance hitting more traders’ radars. Record streaks also generate increasing financial-media coverage which grows more bullish. The faster gold rallies, the more traders want to buy. The more they buy, the faster gold rallies. The resulting surging prices attract in the financial media, spreading awareness among traders.

Again today’s mighty 35.5% gold upleg happened despite 57.2t GLD+IAU draws. Yet that 2020 pair of uplegs soared 42.7% and 40.0%, directly fueled by huge GLD+IAU-holdings builds of 30.4% or 314.2t and 35.3% or 460.5t. Today’s upleg has mostly been driven by Chinese-investor and central-bank buying, who have done most of the heavy lifting. That leaves American stock investors big room to flood back in.

It doesn’t matter how big gold’s upleg has already grown, it’ll get a lot bigger on normal differential GLD-and-IAU-share buying. American stock investors could easily swing their gold investments from about -50t in GLD+IAU-holdings terms to +400t or more. That portends much more gold upside ahead. And the higher gold powers, the bigger the ultimate gold-stock gains since gold prices directly fuel their earnings.

While the GDX majors will do great, smaller fundamentally-superior mid-tiers and juniors will fare much better. They are better able to consistently grow their production from smaller bases. Their littler stables of mines tend to have lower costs too, boosting their profitability. Their smaller market capitalizations also make their stocks much easier to bid higher. Our newsletter trading books are full of great smaller miners.

The bottom line is gold stocks are mean reverting relative to gold and due to proportionally overshoot. Gold-stock prices were recently pounded to exceedingly-anomalous levels not witnessed since the very bottom of the last stock panic. Gold stocks have enjoyed a strong mean-reversion rebound since. But they remain well under recent years’ average levels compared to gold, let alone overshooting to high ones.

Gold stocks have an exceptionally-bullish setup supporting much-bigger gains. Gold miners are about to report their best quarterly results and fattest profits ever, fueling institutional buying. Meanwhile American stock investors haven’t even yet started chasing gold’s underlying upleg. Their inevitable return once this AI stock bubble rolls over should drive gold much higher. The undervalued gold stocks will amplify those gains.