Gold Stocks Catching Up | Investing.com

2024.05.31 16:28

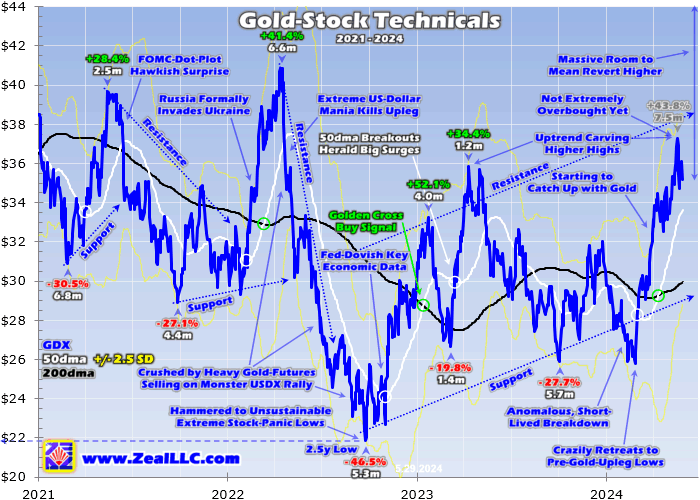

After getting off to a slow start in this upleg, miners’ stocks are beginning to catch up with their metal. Gold stocks lagged dreadfully early on, but are increasingly outperforming in gold’s remarkable breakout surge of recent months. These mounting gold-stock gains are boosting bullish sentiment, attracting in more traders accelerating the upside. This virtuous circle of capital inflows still has a long way to run.

If gold stocks can’t leverage gold’s gains, they aren’t worth owning. While miners have high potential to soar with their metal, they bear big additional risks. Those include all kinds of operational, geological, regulatory, and geopolitical challenges and problems. And they are all heaped on top of the biggest risk of all, gold price trends. Yet that’s the only risk in gold bullion, so miners’ stocks really need to outperform.

If they don’t, speculators and investors are much better off sticking to gold itself. Historically the leading GDX (NYSE:) gold-stock ETF has amplified material gold moves by 2x to 3x. This range’s lower end is probably the minimum acceptable to compensate traders for gold stocks’ big additional risks. And the upper end is where this high-flying sector can quickly multiply wealth. Unfortunately, much of gold’s latest upleg saw neither.

This mighty upleg was born in early October at a deep low near $1,820. Gold V-bounced sharply out of that anomalous nadir on heavy gold futures short-covering buying. By early December gold had already surged 13.8% to $2,071, its first record close in fully 3.3 years. Yet despite the growing excitement and bullishness that generated, GDX’s parallel early-upleg gains merely ran 22.8% making for weak 1.7x leverage.

After hitting a second marginally-higher record in late December, gold rolled over into a pullback. That really proved mild, with gold slumping just 4.2% at worst into mid-February. Yet confidence remained so darned low in gold stocks that GDX collapsed 19.1% on that, for horrendous 4.6x downside leverage. Then even though gold soon rebounded 2.1% by late February, GDX ground another 0.4% lower to $25.79.

Shockingly that was marginally under early October’s $25.91 when this upleg was born. Gold’s young upleg remained strong then, still up 11.7%. But the major gold stocks of GDX somehow still edged down 0.5% in that entire span. This sector was a total disaster, not only not leveraging gold but completely ignoring a strong upleg. That miserable anomaly was murder on sentiment, leaving bearishness running rampant.

I wrote an essay on gold stocks languishing that very week, concluding then:

“These seriously-oversold gold stocks riddled with capitulatory bearishness is an anomaly that will prove short-lived. They are due to soon mean revert sharply higher with gold. … gold’s bull advance will soon resume on big gold-futures long buying. Incredibly all that fueling gold’s young upleg has been reversed, fully reloading spec-long buying.”

I continued, “After similar past excessively-bearish longs, mean-reversion buying has catapulted gold about 12% higher in roughly six weeks. The battered gold stocks will fly as that drives gold deep into record territory.” I caught a lot of flak for that hardcore contrarian essay, which used this same chart. At that time, GDX was way down at its latest deep low labeled here “Crazily Retreats to Pre-Gold-Upleg Lows”.

With gold stocks at absurd lows relative to gold then, we were aggressively adding cheap trades to fill up our newsletter trading books. All that was a great call, as what happened since proved. We didn’t have to wait long either. As March dawned, a top Fed official gave a speech hinting at monetizing more US Treasuries. That indeed triggered epic gold futures long buying, and gold was quickly off to the races again.

Speculators’ gold-futures holdings are only published weekly in the famous Commitments of Traders reports. In the CoT week alone straddling that Fed surprise, gold rocketed a monster 4.9% higher. The specs bought an astounding 55.0k long contracts, the fourth highest on record out of all 1,314 CoT weeks since early 1999 then. GDX blasted up 10.2% during that CoT week, returning to normal 2.1x leverage.

Gold has powered higher on balance since, achieving 21 more nominal-record-high closes in recent months. Interestingly that colossal gold futures buying quickly petered out, yet gold continued rallying. That made its breakout surge remarkable, not fueled by its usual drivers of speculators’ gold-futures short-covering, their larger long buying, and American stock investors pouring capital into major gold ETF shares.

The gold-buying baton had been taken by Chinese investors and global central banks, as I’ve analyzed in depth in our newsletters. The former have been plagued by a long and deep bear market in stocks on top of a real-estate bust, leaving gold exceptionally attractive. The latter are prudently paring their excessive US-dollar reserve exposure, as the federal government’s extreme overspending is rapidly devaluing that currency.

While gold stocks stunk up the first half of this mighty upleg, they are increasingly outperforming in this recent second half. From mid-February to mid-May, gold blasted up 21.8% in that powerful breakout. Such consistent gains to so many new record highs started rebuilding traders’ confidence in battered gold stocks, ramping bullishness. So GDX powered 43.9% higher in that span, achieving 2.0x upside leverage.

Again that’s the minimum acceptable given gold stocks’ big additional risks, the bottom of that historical 2x-to-3x range. But it’s a heck of an improvement, and gold-stock outperformance tends to mount as gold uplegs mature. So 3x+ amplification is usually only seen late in major uplegs, when greed increasingly morphs into euphoria attracting in legions of new traders buying into toppings. Odds are that is still coming.

While gold stocks are finally catching up with gold, their overall leverage across this entire upleg remains quite poor. Between early October to mid-May, gold blasted 33.2% higher. That’s already a mighty upleg that is challenging monster status at 40%+ gains. But GDX’s parallel gains throughout gold’s entire upleg are only 43.8% at best. So the major gold stocks have only amplified gold’s upside by a pathetic 1.3x so far.

That’s no longer dreadful like the brutal mid-upleg lagging, but it’s still seriously bad. Several factors explain why gold stocks have dramatically underperformed. Leading the way is festering bearishness spawned by mid-2022’s extreme anomaly. GDX plummeted a brutal 46.5% then on gold plunging 20.9% in 6.6 months. That in turn was driven by huge gold futures selling as the rocketed parabolic.

The primary trading cue for gold-futures speculators, the USDX soared an epic 16.7% then to an extreme 20.4-year secular high. That was fueled by the Fed’s most extreme rate-hike cycle in its entire century-plus history, including 375 basis points in just 7.6 months. Neither that blistering hiking nor the resulting US-dollar moonshot were sustainable, which meant that exceedingly anomalous dollar-gold shock would reverse.

And it did, birthing the major gold-stock uptrend still persisting today. But gold and gold stocks’ mid-2022 plummeting as inflation raged out of control wreaked tremendous sentiment damage, countless traders lost faith in this sector. Restoring that is a slow process, requiring lots of time and rallying. The second factor has really drawn out that psychological normalization, general stock markets’ massive AI bubble.

From late October to late May, the flagship stock index has soared 29.2% achieving 24 new record closes of its own. That was led by AI market-darling NVIDIA’s stock skyrocketing 184.7% at best since. These red-hot stock markets have stolen all the market limelight, leaving gold and its miners’ stocks forgotten. Also super-anomalously, identifiable American-stock-investor gold demand has been zero.

That’s evident in the combined physical-gold-bullion holdings of the huge American GLD (NYSE:) and iShares Gold Trust (NYSE:), which dominate the world’s gold ETFs. Astoundingly during gold’s powerful 33.2% upleg, those still slumped 4.5% lower. In early March as gold blasted to seven new record closes in a row, GLD+IAU holdings fell to a shocking 4.5-year secular low. Midweek they are still limping along merely 0.8% above those levels.

It’s wildly unprecedented for American stock investors to totally ignore a mighty gold upleg. They have been distracted, enthralled by this AI stock bubble. But that is overdue to burst and deflate, as valuations are extreme. When that inevitably happens, investors will remember the wisdom of prudently diversifying their stock-heavy portfolios with gold and gold stocks. Investment demand surges when stock markets weaken.

Finally gold stocks themselves share some of the blame, particularly the super-major miners dominating GDX. Operating at vast scales, these giant gold stocks have been unable to overcome depletion for long years. Their mining costs are rising, impairing their earnings growth. I analyzed all this in depth in the last couple weeks’ essays digging into the GDX gold majors’ and GDXJ gold mid-tiers’ latest quarterly results.

As a professional gold-stock speculator and newsletter guy for a quarter-century now, I would never buy about a dozen top GDX stocks that command over half this ETF’s weighting. There are simply too many excellent fundamentally-superior smaller mid-tier and junior miners well worth owning. They’ve been able to consistently grow their production while mining at lower more profitable costs, unlike deadweight supermajors.

Again our newsletter trading books are full of great smaller gold stocks. In mid-April when GDX was up 43.8% at best during gold’s upleg, we had actual trades added since early October that already soared to big unrealized gains as high as +111.8%. Despite GDX being this sector’s leading benchmark, it really isn’t representative of gold stocks as a whole. Most of the majors dominating it are burdened with inferior fundamentals.

But most investors aren’t aware GDX is seriously hobbled, and most with gold-stock holdings have too much capital allocated to perpetually-poor-performing majors. Lately I’ve been doing plenty of portfolio consulting, evaluating investors’ gold-stock holdings. Researching and analyzing those and explaining the results and my recommendations in a telephone call usually costs under $1,000, really boosting future returns.

Yet despite GDX’s limitations, it still has lots of ground to regain to reflect these record prevailing gold prices. Today’s mighty gold upleg is the biggest by far since a pair of monsters crested in 2020, at huge 42.7% and 40.0% gains. Those were also gold’s last uplegs achieving new record highs, which creates a powerful record-momentum dynamic. That is well underway in today’s upleg, and continues to strengthen.

The more record closes gold hits, the more the mainstream financial media covers it and the more bullish that coverage grows. That builds awareness among speculators and investors who don’t usually follow gold. They get interested and start paying attention, then eventually deploy capital to chase those gains. The more buying they do, the faster and higher gold rallies to more record closes bolstering this virtuous circle.

This record-momentum dynamic catapulted GDX to 105.4% average gains during 2020’s last monster gold uplegs, amplifying their 41.4% average gains by 2.5x. Gold’s second upleg that year really fueled big greed and euphoria, catapulting GDX 134.1% higher for fantastic 3.4x upside leverage to gold. With gold breaking out to so many dazzling records in today’s upleg, we should see 3x+ before it gives up its ghost.

At 40% gold monster-upleg gains, 3x translates into 120% GDX gains. Getting there today would require GDX to blast way up near $57, another 62% higher from mid-week levels. And that’s just for the majors, with fundamentally-superior mid-tiers and juniors well outperforming. Plenty of those great gold stocks could still double, triple, or more from current levels. So gold stocks lagging their metal is a buying opportunity.

The recent best times to go heavily long gold stocks were back in October and February when they were universally forgotten or loathed, deeply out of favor. That’s indeed when we added most of our trades for our newsletter subscribers, buying in really low. But necessary mid-upleg selloffs to rebalance sentiment offer additional buying opportunities for traders late to the upleg party. Another one could be coming soon.

Gold has been trading at extremely overbought levels, which is why it has been mostly consolidating high since mid-April. But gold is heading into the summer doldrums, its weakest time of the year seasonally mostly in June. That natural demand lull this time of year may force a bigger pullback, which gold stocks will amplify. So if you want to get deployed in gold stocks, do your homework and get prepared for that.

This timing is even better ahead of gold miners’ coming Q2 earnings season, which will almost certainly prove their best ever by far. Q2s usually see global gold production surge from Q1s, driving down mining costs proportionally. And this quarter-to-date’s stunning $2,342 average gold prices way surpassed the highest on record. So from mid-July to mid-August, smaller gold miners should be reporting blowout earnings.

The bottom line is gold stocks are starting to catch up with gold. Although their upleg leverage remains weak, their gains are accelerating as traders grow more bullish. That essential sentiment normalization is mounting as gold remains near nominal record highs. The more normal gold-stock outperformance relative to gold resumes, the more speculators and investors will deploy more capital to chase those gains.

This mighty gold upleg is gradually reversing festering psychological damage from mid-2022’s extreme Fed rate hikes. And while the AI stock bubble has stolen limelight from gold, that is increasingly likely to burst soon. So still-lagging gold stocks have great potential to power much higher in coming months, perhaps after a typical summer-doldrums pullback. That might prove the next solid mid-upleg buying opportunity.