Gold Stocks & a 100 Yard Dash

2023.08.22 16:42

The progressive movement (restoration of gold as the money of the world) has been hijacked, and pretenders to the money throne now claim that fiat credits, massive debt, rampant destruction of free speech, and vicious war mongering are “progressive”.

Fiat is a barbaric relic, and the world’s governments resemble cavemen with debt-funded clubs. The real progressive movement is about gold, a savings mentality, personal humility, general goodwill, and common sense. Perhaps a man named Simon said it best: Keep it simple.

Gold Miners Bullish Percent Index

Gold Miners Bullish Percent Index

The enticing BPGDM sentiment chart. It doesn’t get much simpler than buying low and selling high! Buy gold stocks when the BPGDM is low (sub 30 on the index) and sell them high (when it’s above 70).

The BPGDM reached the 21 area yesterday. Also, note the positive position of the Stochastics oscillator at the bottom of the chart. It’s massively oversold.

On another progressive and simple note: Today is what I’ve dubbed, “BRICS Expansion Day”. For the past few weeks or so, I’ve been suggesting gold and are highly likely to begin their next move higher from around this day.

It appears that silver may be leading the way. A fabulous inverse H&S breakout is in play.

What about gold? Well, there’s some very positive action taking place on the short-term chart. Yesterday, gold broke above the downtrend line that’s been in play from the $1980 area highs of July.

A complex inverse H&S pattern of size also appears to be in play, targeting the $2080 zone.

Could a stock market tumble derail the imminent metals market rally? Well, August 1 to October 31 is what I call “US stock market crash season”. I always urge stock market investors (and nervous gold bugs) to buy put options around Aug 1, which helps to mitigate their risk for minimal cost.

The chart. While a H&S top appears to be forming, there’s massive support just below the neckline of the pattern.

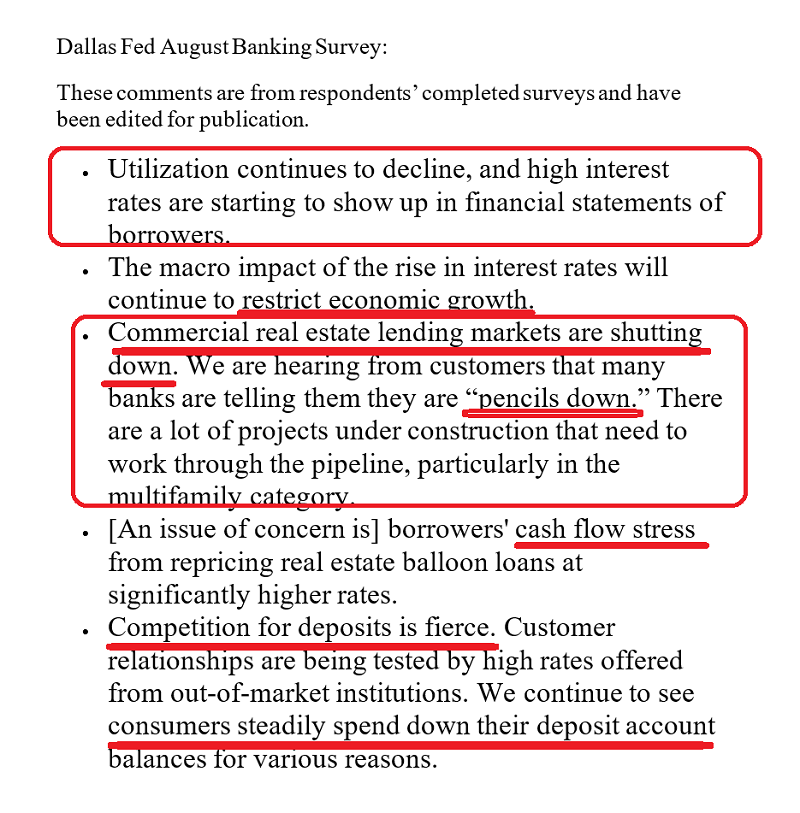

Dallas Fed August Banking Survey

Dallas Fed August Banking Survey

This doesn’t look good. Banks are projecting deteriorating business conditions over the next six months.

The Fed is already in de facto pause mode for rate hikes. The lull in inflation is likely temporary and could be followed by panic buying of gold when it spurts higher again.

But for right now, rates appear to be near a temporary peak as bank loans dry up and consumers exhaust their tiny savings. Savings that are mostly related to fiat handouts they got during the pandemic.

A look at the key ten-year rates chart. While rates could move a bit higher, they are in a big resistance zone. A significant reaction is likely to happen soon, and perhaps it starts right now.

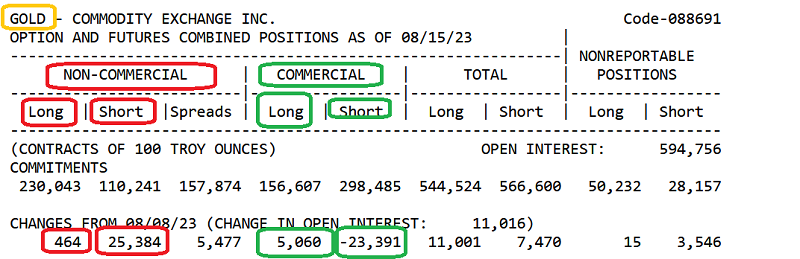

The glorious COT report chart.

The smart money commercial traders are gobbling up gold long positions and offloading a veritable truckload of profitable shorts!

The dumb money funds loaded up on shorts just in time for the price to start surging higher.

I was an eager gold stocks buyer yesterday, as an ode to my “big five” indicators that are all flashing key buy signals for gold, silver, and the miners.

The big five indicators are India buying (check!), COMEX commercials buying (check!), the BPGDM sub 30 (check!), rates at resistance (check!), and gold at big horizontal price support (check!).

Gold is at $1900 after a significant price sale, which gets the biggest checkmark of all.

Vaneck Vectors Gold Miners ETF

Vaneck Vectors Gold Miners ETF

What about gold stocks? A look at a fabulous daily chart for GDX (NYSE:). A key reversal is in play, with all of my “big five” indicators suggesting that now is the time to buy the miners.

Vaneck Vectors Gold Miners ETF-3Q

Vaneck Vectors Gold Miners ETF-3Q

A look at GDX from a candlestick perspective. There’s a hammer-style candlestick in play, and it could mark the low or the area of the low.

All in all, I think stock market bears need to look further ahead (to January 2024) for their “big crash”. A modest swoon that’s accompanied by bank loan tightening is likely to put a cap on rates, and make gold stocks the leaders of an imminent and enticing metals market dash!