Gold Steadies After Volatile Monday; US Dollar Bounces Back

2024.08.06 10:37

- Gold prices rebounded above $2,400/oz after a dip to $2,364/oz, showing resilience despite a strengthening US Dollar.

- Gold benefits from expectations of more aggressive rate cuts and its safe-haven status.

- Geopolitical and economic risks in the second half of 2024, along with anticipated rate cuts, should theoretically support the gold rally, but a Middle East peace agreement could complicate the outlook.

prices bounced back robustly yesterday following a selloff that saw the precious metal dip to around $2,364/oz. Since then, gold has rallied back above the $2,400/oz mark and continues to consolidate above this level.

The resilience of gold and sustained buying interest are evident, even with the US Dollar strengthening significantly in European trade this morning. Despite the rise in the (DXY), gold prices have remained largely unaffected.

The notion of the Dollar’s demise as a safe-haven asset might be premature, given the increasing geopolitical risks.

Today’s bounce in the Dollar comes amid heightened tensions in the Middle East, suggesting that the US Dollar may still retain some of its haven appeal despite ongoing recessionary concerns.

On the chart, the DXY found support around the key 102.00 level yesterday.

A rally has since followed, but the DXY is now encountering its first resistance at approximately 103.200, with further resistance ahead at 103.60.

Conversely, a push to the downside from this point could lead Gold to revisit recent lows, but this would require a daily candle close below 102.60 for it to materialize.

US Dollar Index Daily Chat, July 25, 2024

Source:TradingView.com

Support

Resistance

Gold is benefitting from expectations of more aggressive rate cuts, along with its safe-haven appeal. Moving forward, gold could return to the rangebound behavior observed frequently in 2024.

The second half of the year presents numerous risks, both geopolitical and economic. These, coupled with anticipated interest rate cuts, should theoretically sustain the gold rally.

However, a peace agreement in the Middle East could complicate the outlook, necessitating a reassessment of gold’s medium-term direction at the very least.

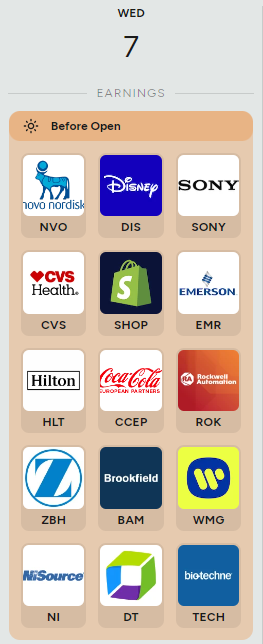

Economic Data, US Earnings and Geopolitics to Drive Sentiment

Data is sparse for the US this week and thus the geopolitics and US earnings may be the driving force of sentiment as well.

Among the big names on the earnings front this week, we have Occidental Petroleum (NYSE:) and Disney (NYSE:) reporting tomorrow among a host of other names.

Source: Earnings Hub

Technical Analysis Gold (XAU/USD)

From a technical standpoint, gold made an impressive recovery during the US session yesterday, leaving markets puzzled by its earlier selloff.

This rebound positions the precious metal for potential further gains. Immediate support at $2,400 is crucial; a daily candle close below this level could signal sustained downside pressure.

The key question remains whether this will be counterbalanced by gold’s safe-haven appeal.

GOLD (XAU/USD) Chart, August 6, 2024

Source: TradingView

Support

Resistance

Original Post