Gold & Silver: Correlations That Matter

2023.07.18 17:29

Are fiat and debt planet Earth’s two main pillars of evil?

While billions of citizens grovel for food, medicine, and education, their greedy governments inject themselves, and the citizens, with fiat heroin and debt cocaine.

The wages of fiat and debt are the impoverishment, sickness, and ultimately the death of citizens, in an array of nations around the world.

American citizens are told by their government that this horror can’t happen to them. They are promised that they are, “The Greatest!” and “Number Fiat One!” They are told to shout these ego-infested slogans at the rest of the world, and a few of them are silly enough to do it.

If the stock market goes up and the carnage from their government’s wars stays out of the homeland… gullible citizens of the late-stage American empire believe the “Everything is awesome, and anything bad that happens is not our fault!” gibberish that they are spoon fed by their government.

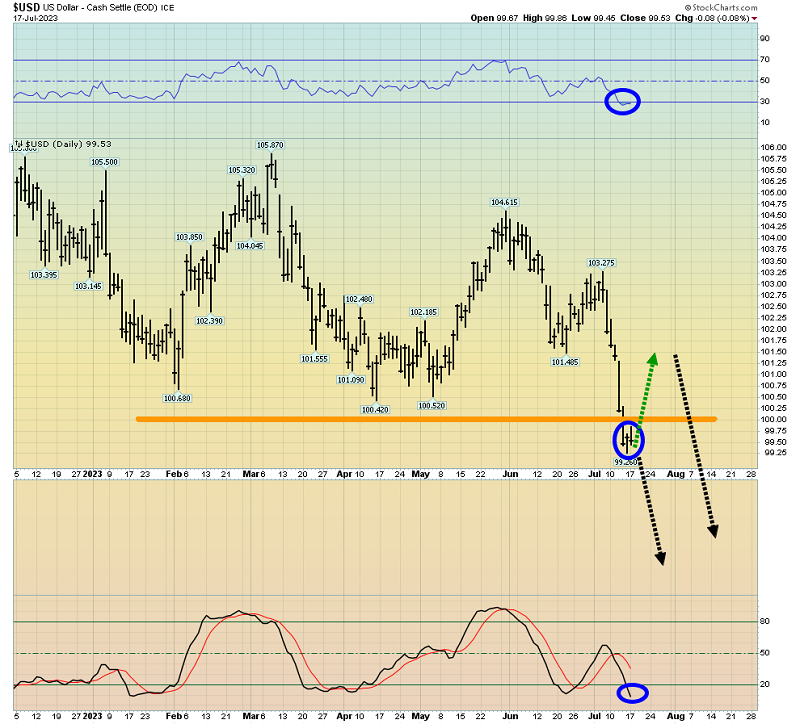

In the global gold community, these silly logans don’t mean much. It’s versus fiat trench warfare, the US fiat chart. While many analysts are excited about the “break” of the key 100 support zone, basis Edward/Magee, minor trend rallies often begin right after a new low is made.

And that could be the case with the right now.

In the weekly chart, note that the dollar went to a new low, but gold didn’t go to a new high.

The is mainly about the dollar and the . Sometimes it correlates perfectly with the gold price…and sometimes not.

CBOE 10 Yr Treasury Yields

CBOE 10 Yr Treasury Yields

Gold and US interest rates are much more correlated than gold and the dollar.

Another look at gold and rates. It appears that Fed boss Jay wants to do one hike next Wednesday (July 26), and then a couple more later in the year. If Jay holds to that path, gold likely continues its current rally against fiat until around September or October.

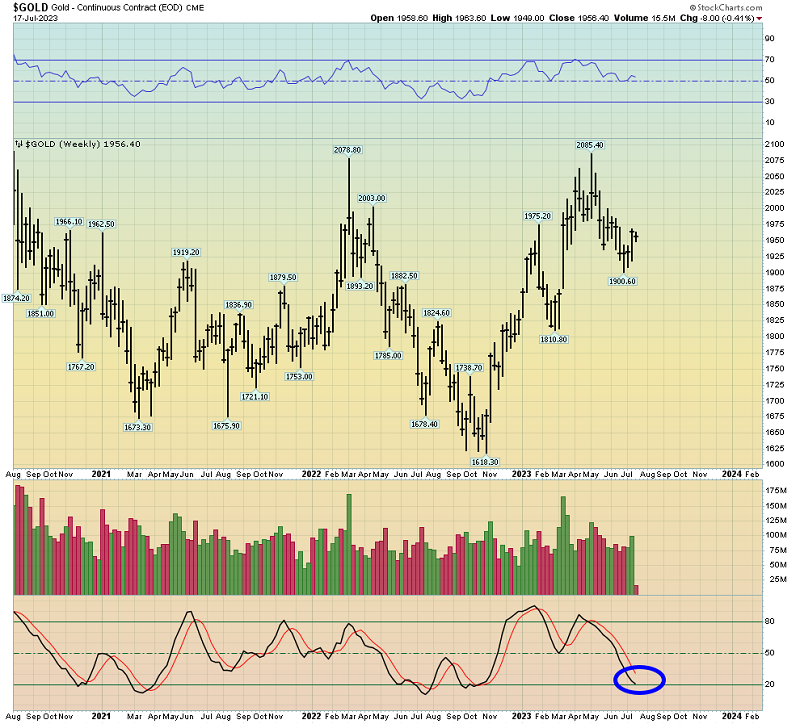

The important weekly gold chart. I would urge all gold bugs to focus on my 14,5,5 Stochastics oscillator at the bottom of the chart and on next week’s announcement from Jay.

Gold is vulnerable in the short-term, but if Jay announces a significant pause in his hikes (as this chart suggests he will), a Stochastics crossover buy signal and a barnburner of a rally for gold is highly likely.

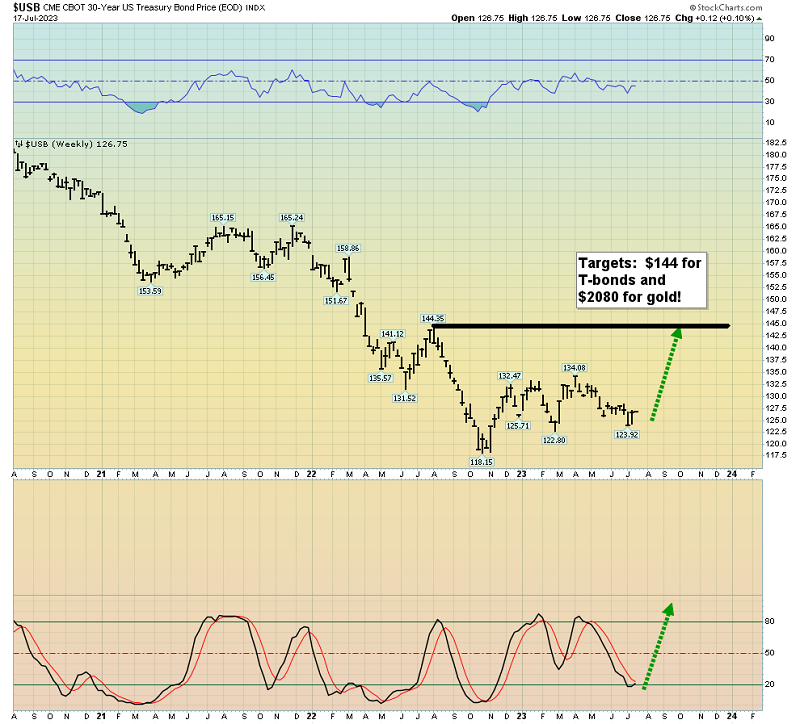

In the weekly T-bond chart, note the fabulous position of the Stochastics oscillator. It’s in perfect sync with the gold chart and my suggested path for Jay.

A daily focus on the big picture is critical for investors as inflation, recession, the 2021-2025 war cycle, a wildly overvalued stock market, debt ceiling horror, and empire transition dominate the investing landscape.

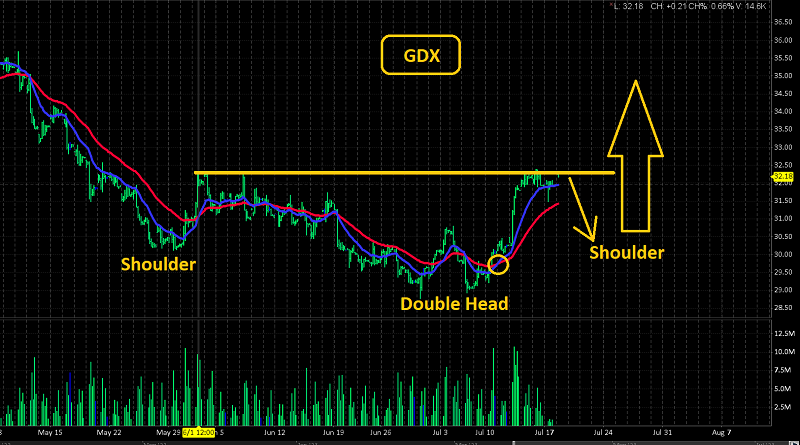

What about the miners? The magnificent short-term GDX (NYSE:) chart. The miners could keep rallying from here, but a pullback is likely either before or as Jay makes his announcement.

The good news is that the pullback would create a right shoulder of a very nice inverse H&S bottom pattern. Also, note the solid position of the 10,25 Wilder moving averages. The current buy signal would likely hold as a right shoulder forms.

GDX VanEck Vectors Gold Miners

GDX VanEck Vectors Gold Miners

The weekly GDX shows the Stochastics oscillator in the same fabulous position as for gold, and arguably a bit better.

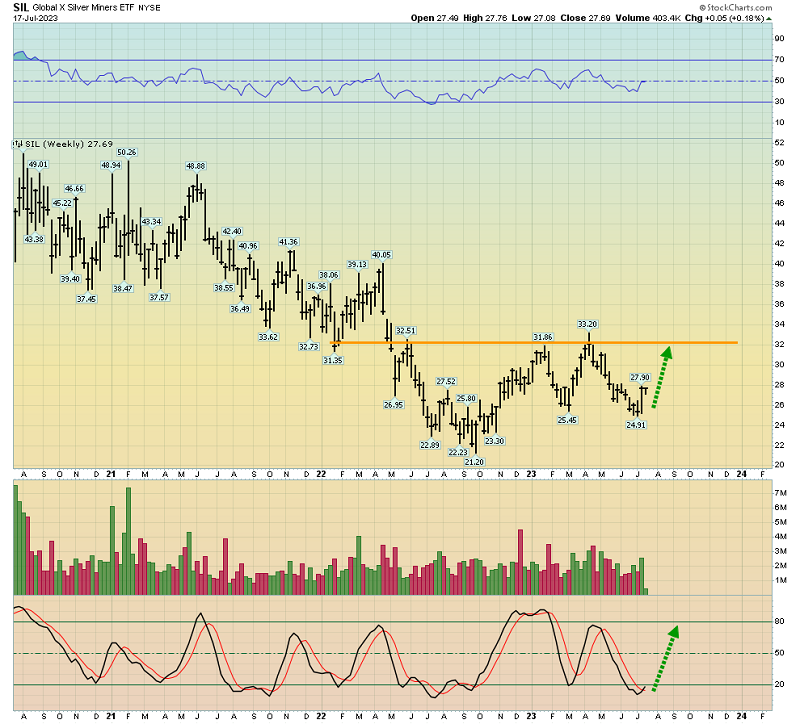

What about the miners? The weekly SIL chart is the best of the bunch. A Stochastics oscillator cross is already in play, and it makes sense as silver bullion has recently been even stronger than gold!