Gold Set to Face Intense Selling Pressure in the Coming Months

2023.09.15 07:50

While the crowd believed the Fed when it proclaimed inflation was contained, another mistake is unfolding as we speak.

Throughout 2021, investors were soothed by the Fed’s nonchalant inflation attitude and assumed the central bank had the situation under control. And while we warned that the pricing pressures would eventually rattle risk assets, 2022 brought harsh realities and killed the “transitory” narrative. Yet, with a similar misjudgment keeping optimism uplifted, Transitory 2.0 should rattle gold before this cycle ends.

To explain, while the crowd screamed recession throughout 2021 and 2022 and priced in a Fed pivot, we warned those bets would go bust. In a nutshell: long-term interest rates were too low, wages were too high, and consumers still had plenty of cash in their bank accounts. Add it all up, and they did not support a recession.

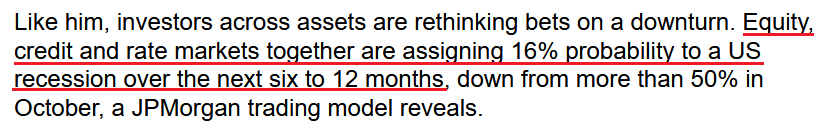

Although while many metrics have turned in a negative direction, JPMorgan revealed on Sep. 3 that the consensus has only priced in a 16% chance of a recession over the next six to 12 months.

Please see below:

Thus, with a recession poised to be Transitory 2.0 – meaning the overwhelming consensus is on the wrong side of reality – assets like and should confront severe selling pressure in the months ahead.

For context, this doesn’t mean a recession is imminent; it simply means the data has turned from green to yellow. And with red poised to follow, we’re much closer now than at any point over the last 24 months.

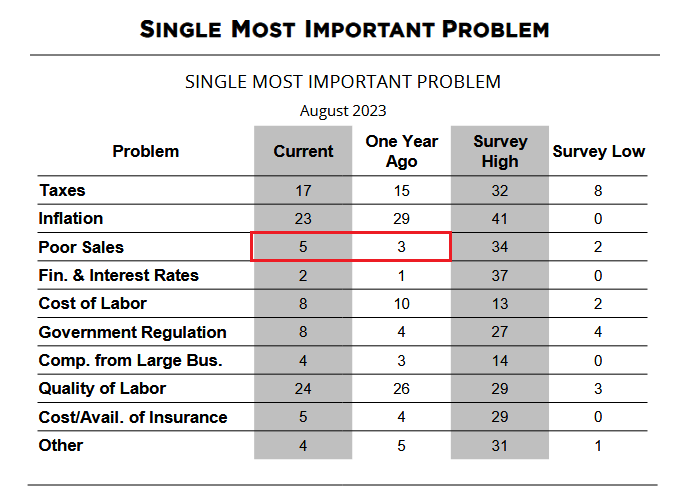

Please see below:

Single Most Important Problem

Single Most Important Problem

To explain, the NFIB released its Small Business Optimism Index on Sep. 12. Throughout 2021 and 2022, we highlighted how the percentage citing poor sales as their “Single Most Important Problem” was near an all-time low.

But, if you analyze the red rectangle, you can see that more small businesses are citing demand destruction as their top concern versus August 2022. Sure, the metric is still low relative to the survey high, but you don’t go from summer to winter overnight. In reality, the year-over-year (YoY) rise is an early warning sign of a deteriorating economic environment.

A Tough Job

The should soar if (when) the recession volatility erupts. And with the NFIB’s jobs report another early indicator, the road to recession is already underway.

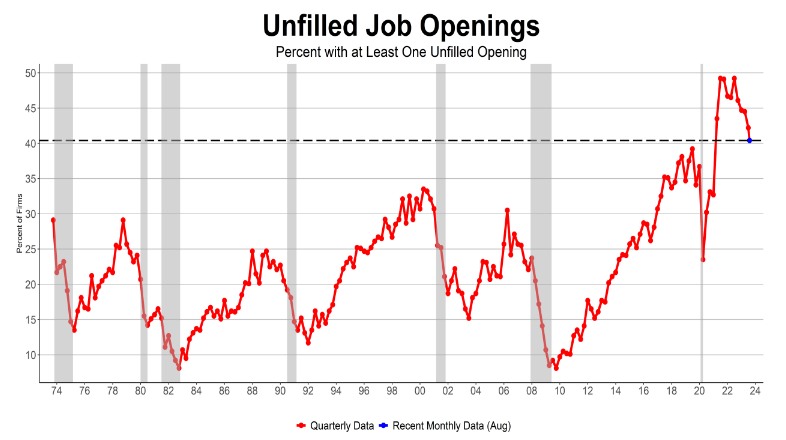

Please see below:

To explain, the red line above tracks the percentage of small businesses with at least one unfilled job opening. And with the metric hitting an all-time high in 2021/2022, it was another reason why we disregarded the recession talk and remained confident the Fed would stay hawkish for longer than expected.

However, those days are long gone. If you analyze the right side of the chart, you can see that the metric has declined materially. More importantly, please note how sharp declines in the red line have been precursors to recessions since the mid-1970s. Thus, the cycle continues to align with our expectations, and even the NFIB highlighted what the crowd fails to understand. The report stated:

“Since the Federal Reserve began tightening policy in March 2022, job openings have fallen 27 percent, according to the JOLTS data, while the unemployment rate has remained steadily low. Job openings will get cut significantly before actual layoffs rise.”

The last sentence is key. We warned that robust job openings were a leading indicator of realized employment, wage growth, and consumption. Now, it’s the opposite, and a continued decline in job openings should have drastic ramifications over the next three to nine months.

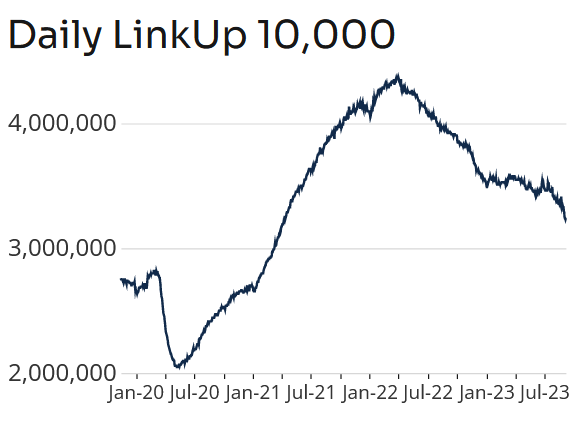

As further evidence, the LinkUp 10,000 tracks the total U.S. job openings from the top 10,000 global employers in the company’s system. And with the data also in a severe downtrend, it signals trouble for the U.S. unemployment rate and cyclical assets like over the medium term.

Please see below:

Daily Link-Up 10,000

To explain, the sharp descent on the right side of the chart shows how job openings remain destined for their pre-pandemic baseline. And when this occurs, the market sentiment may look much different.

Finally, while job postings on Indeed have remained relatively resilient, the company noted on Sep. 12:

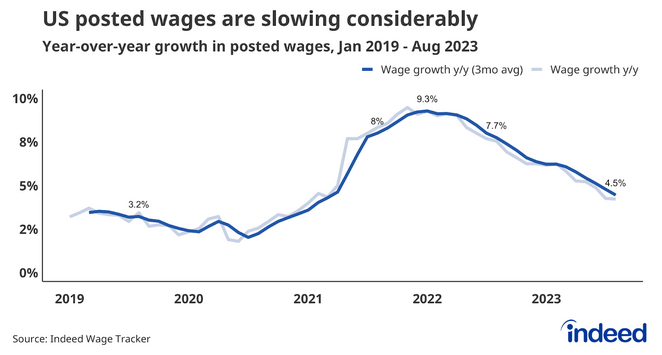

“Posted wages are slowing down in the vast majority of occupational sectors, reflecting a broad-based cooldown in the U.S. labor market. Only 22% of sectors had wage growth in August equal to or above their February 2023 level. The size of those declines varies by sector, but they have been considerable across wage tiers.”

Please see below:

To explain, the blue lines above track Indeed’s Wage Tracker. If you analyze the right side of the chart, you can see that the YoY metric has dipped to 4.5% and is also falling swiftly.

Thus, with job openings, wages, and “poor sales” responses heading in the opposite directions in 2021 and 2022, recession signs are plentiful you’re paying attention.

Overall, while the has benefited from bullish seasonality, it’s largely been range-bound over the last two months. And with the next major move likely to the downside, in our opinion, storm clouds have formed, and the PMs should suffer mightily when the weather turns.