Gold: Selling Spree Awaits Fed’s July Move

2023.07.11 10:41

Since the last hawkish move by the Federal Reserve on Jun 13-14, witnessed a sell-off after facing stiff resistance at $1,970 and continued to slide to hit a low at $1,900 on June 29, 2023.

Some odds and hopes for a reversal were in support of the bulls at this low, resulting in a pullback, but once again, futures are facing stiff resistance at $1,939.58.

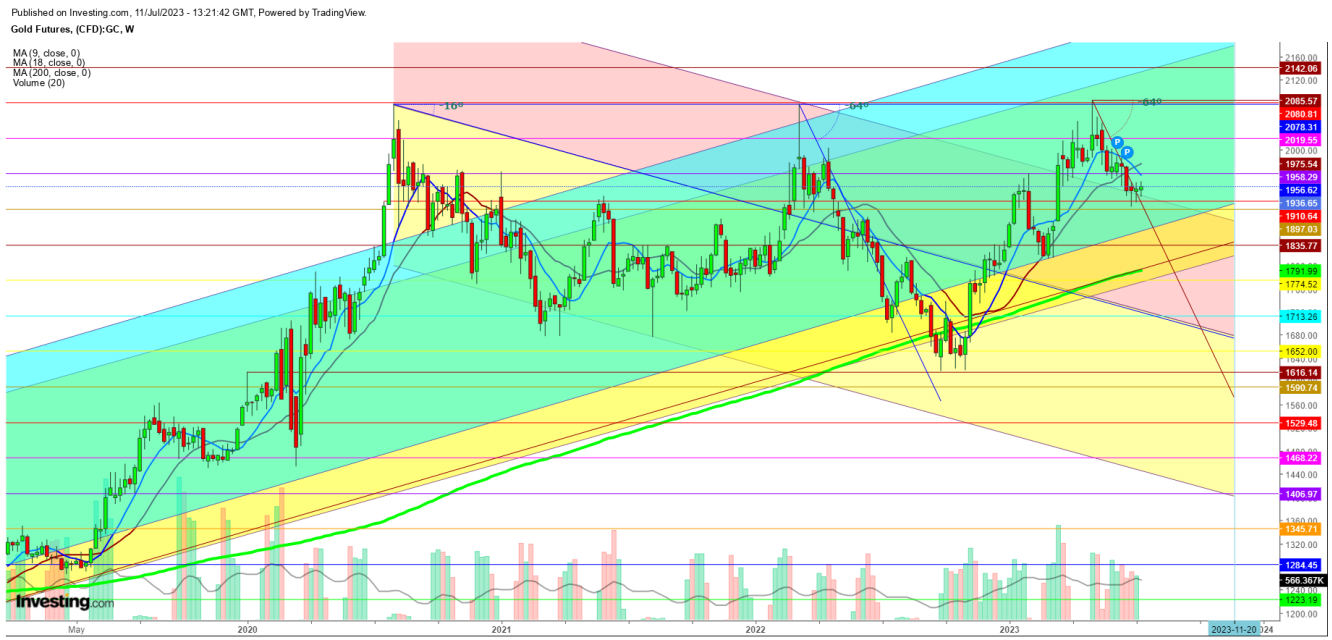

Gold Futures Weekly Chart

Gold Futures Weekly Chart

In the weekly chart, gold futures are trying to hold above the immediate support at $1,918 and the second support at $1,902, but constantly facing stiff resistance above $1,958 for the last two weeks – which suggests a selling spree is likely to start soon as the 9 DMA crosses 18 DMA with a down move, resulting in the formation of a bearish crossover.

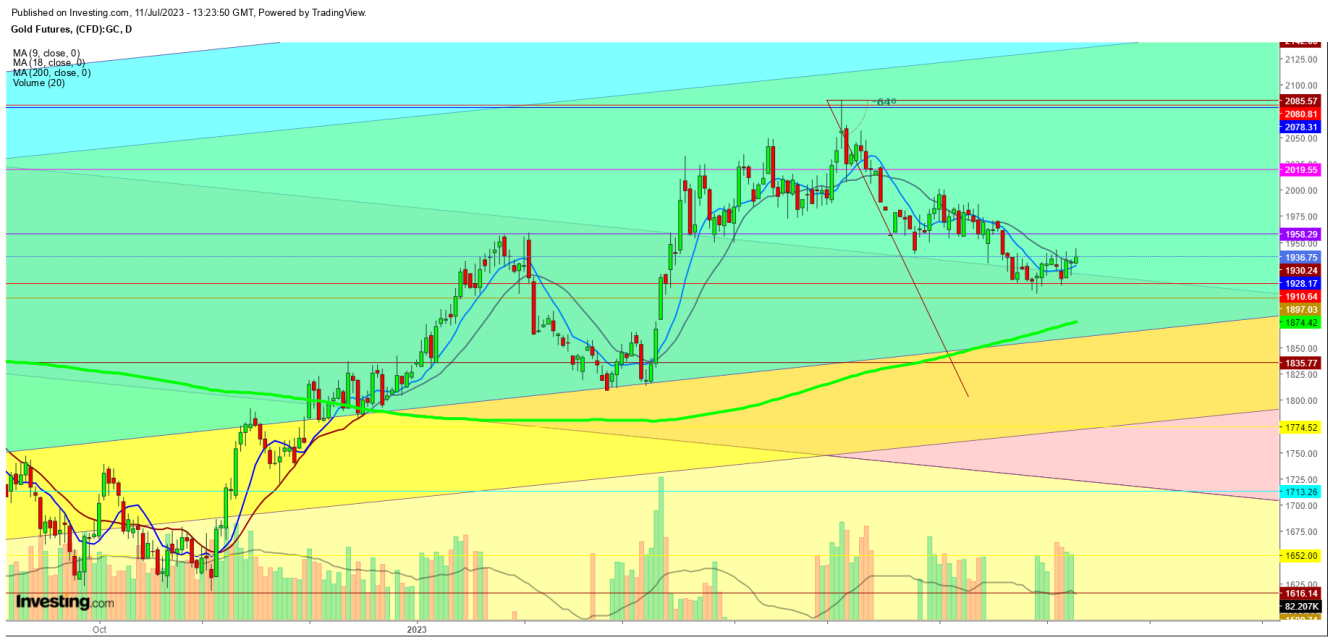

In the daily chart, futures are showing some strength in expectation of positive steps by the Federal Reserve in its upcoming meeting this month.

Futures could remain a little volatile for some more time before a breakdown starts below $1,939. On the other hand, a bullish crossover could complete its formation if futures sustain above $1,948 during this week, which could result in some bouncing moves.

Finally, I conclude if a sudden selling spree pushes the price up to the 200 DMA in the daily chart, which is at $1,874, it will provide an opportunity to go long. On the other hand, any upward swing above $1,962 will attract bears to come forward. Gold futures are likely to wobble in a narrow range up to the Federal Reserve meeting on July 25-26, 2023.

Disclaimer: The author of this analysis does not have any position in Gold futures. All the readers are advised to take any position at their own risk.