Gold: Safe-Haven Demand Amid Global Uncertainties Makes $3K a Possibility in 2024

2024.10.24 05:14

Over the past 10 days, has surged nearly 4%, boosting its year-to-date gain to an impressive 32%.

This bullish momentum stands out, especially as it unfolds against a backdrop of a stronger and rising U.S. bond yields—factors typically unfavorable for gold buyers.

The recent upward trend reflects widespread uncertainty stemming from the situation in the Middle East and the upcoming U.S. presidential election.

However, yesterday’s session ended with a decline of over 1%, potentially signaling a correction due to profit-taking.

Given the dynamic increases, a deeper pullback wouldn’t be surprising, especially as sellers eye potential support around the $2,600 per ounce mark.

However, after the recent correction, it seems that dip-buyers have stepped in and sparked a strong recovery, with eyes on a $3,000 target by year-end.

How Will the U.S. Election Influence Fed Policy?

The U.S. presidential election on November 5 comes just before the ‘s next meeting.

While the election outcome is unlikely to sway the anticipated 25 basis point cut—currently more than 90% likely—the newly elected president could impact the Fed’s long-term strategies.

Candidates’ economic policies remain somewhat unclear ahead of the election, but indications suggest that Donald Trump might push for a more restrictive Fed stance.

His proposed tariff policy aims to raise rates, which would naturally increase pressure on imported goods. Conversely, if Kamala Harris wins, we might see a continuation of the current interest rate cut trajectory reflected in the Fed’s dot plot.

Recent polls show Trump gaining ground on his opponent, which has drawn the market’s attention and likely contributed to the U.S. dollar’s rise—news that may dampen the spirits of gold bulls.

Gold: $3K Likely in 2024?

Gold’s recent ascent reached new heights around $2,750, but the subsequent sharp pullback raises concerns about further declines.

A drop below the $2,700 threshold could confirm this downward trend, putting pressure on traders to reassess their positions in a shifting market landscape.

If this scenario unfolds, traders should consider the $2,620 to $2,600 per ounce range as a potential entry point to connect with the upward trend at a better price.

The key medium-term target for buyers remains the psychological $3,000 level. If the Fed signals more cuts later this year, reaching that target becomes increasingly plausible.

OceanaGold Corp: A Gold Mining Company With 35%+ Upside

Building on yesterday’s analysis of , let’s shift our focus to a gold mining company poised for upward momentum: OceanaGold Corporation (OTC:).

This company operates gold mining and exploration projects across multiple regions, including the U.S. and the Philippines.

Source: InvestingPro

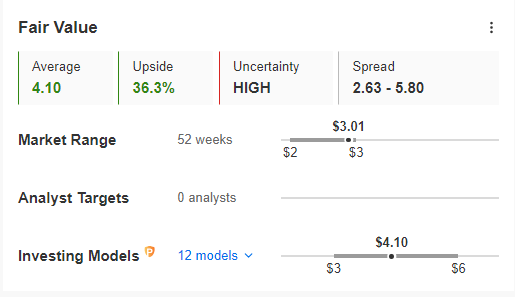

In the second quarter of this year, OceanaGold reported a profit for the first time since June 2023. If the upcoming Q3 2024 results, set to be published next month, reflect this positive trend, we could see a sustained bullish rally—one that has been evident throughout much of the year. According to the InvestingPro tool, OceanaGold boasts over 36% upside potential, further highlighting its investment appeal.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk rests with the investor. We also do not provide any investment advisory services.