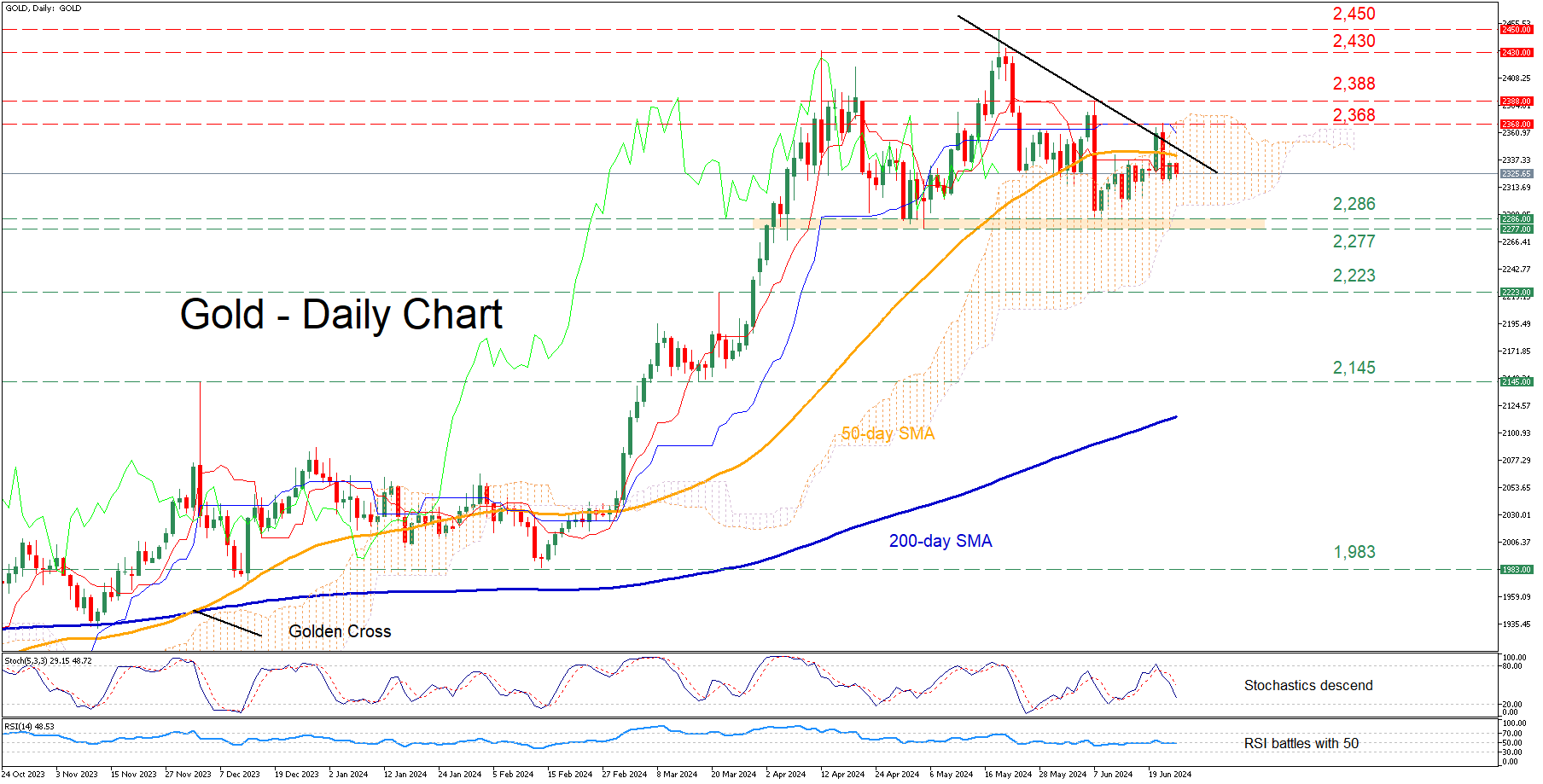

Gold Reverses Back Below 50-Day SMA

2024.06.26 03:44

-

Gold retreats after unsuccessful break above 50-day SMA

-

The price extends its structure of lower highs

-

Momentum indicators turn bearish

had been in a steady recovery from its recent one-month low, which led to the price closing above its 50-day simple moving average (SMA) last Thursday. Despite the violation of that crucial hurdle, bullion reversed back lower after failing to jump above the upper end of the Ichimoku cloud.

Should the latest weakness persist, initial support could be found at the 2,286-2,777 range, defined by the May and June lows. Sliding beneath that zone, the price could challenge the March resistance of 2,223, which could serve as support in the future. Further declines could then stall at 2,145, a region that has acted both as support and resistance in recent months.

On the flipside, if the price rotates back above the 50-day SMA, the latest rejection region of 2,368 could prove to be the first barricade for the bulls to overcome. Higher, the June peak of 2,388 may prevent further upside attempts ahead of the April high of 2,430. Failing to halt there, the price might revisit its record high of 2,450.

In brief, gold dipped below its 50-day SMA, extending its structure of lower highs. Therefore, a solid move above the restrictive trendline drawn by connecting these lower highs is needed for the price to escape its short-term bearish pattern.