Gold Retreats Ahead of Fed; BoE Unlikely to Hike Rates

2023.09.20 07:31

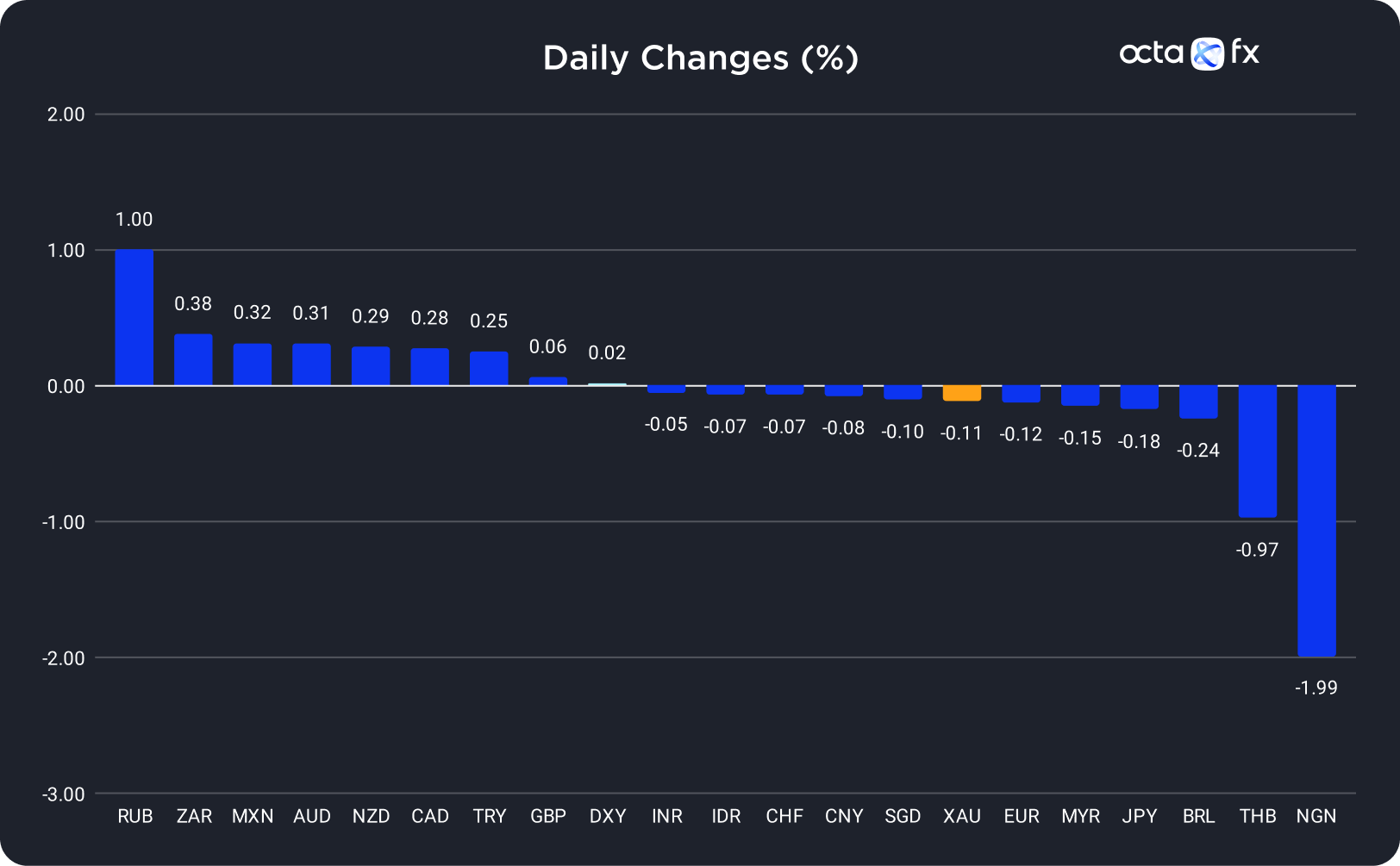

On Tuesday, the Russian rouble (RUB) was the best-performing currency among the 20 global currencies we track, while the Nigerian naira (NGN) showed the weakest results. The (AUD) was the leader among majors, while the (JPY) underperformed.

Changes in Exchange Rates on 19 September

Changes in Exchange Rates on 19 September

Gold Retreats From a Three-Week High as Traders Await the Fed Interest Rate Decision

On Tuesday, the declined by 0.11% as the rebounded from a one-week low in a technical correction.

XAU/USD has risen by 1.5% since last Thursday due to decreasing chances of a rate hike from the Federal Reserve (Fed). The market is pricing in only a 29% probability of a rate increase in November and a 40% chance in December. However, U.S. inflation remains above the Fed’s official 2% target, and it’s unclear how long the regulator will keep a high base rate. If macroeconomic data continue to be better than expected, the market may begin to expect additional rate hikes this year. Hawkish monetary policy should exert downward pressure on precious metals, but some safe-haven buying of XAU/USD continues as the U.S. government faces the possibility of a shutdown.

XAU/USD was falling during the Asian session. Today, traders will focus on the Fed’s interest rate decision at 6:00 p.m. UTC. The market expects the Central Bank to leave the base rate unchanged. However, market participants will examine the updated macroeconomic projections and listen carefully to Jerome Powell’s, the Fed’s Chair, statement at 6:30 p.m. UTC press conference. ‘The expectation is that the Fed is still going to lean hawkish on monetary policy because they want to get inflation closer to their 2% target, which would not be good for gold,’ said Jim Wyckoff, the senior market analyst at Kitco. The Fed may opt for a ‘hawkish pause’: leave the base rate unchanged but explicitly state that inflation is still high and more rate hikes are possible. If the Fed comments on the possibility of more rate hikes or plans to keep the monetary policy tight for longer, XAU/USD will face bearish pressure. Meanwhile, dovish-like statements and suggestions that inflation is tackled will have a bullish impact on gold. ‘Spot gold may retrace into a narrow range of 1,917 to 1,921 USD per ounce, as it failed to break a resistance zone of 1,933 to 1,935,’ said Reuters analyst Wang Tao.

U.K. Inflation Slowed, Decreasing the Chances of Another Rate Hike From the BOE

The rose slightly on Tuesday but fell sharply in the early European session on Wednesday after the U.K. Consumer Price Index (CPI) came out lower than expected.

Contrary to market expectations, U.K. inflation slowed unexpectedly in August, easing the pressure on the Bank of England (BOE) to keep raising rates. The headline CPI dropped to its lowest level since February 2022, lowering the probability of a rate hike from the BOE. Initially, investors expected the regulator to lift the base rate for the fifteenth consecutive time to 5.5%. Now, the market is pricing in a 45% chance of a pause in the rate-hiking cycle after the latest U.K. inflation figures.

GBP/USD might now consolidate in a tight range of 1.23300–1.23700 before the upcoming interest rate decision from the Federal Reserve (Fed) at 6.00 p.m. UTC may cause sharp currency movements. If the Fed sticks to a more balanced approach to the monetary policy instead of a hawkish one, GBP/USD may rise above 1.23700. Still, GBP traders also await the BOE interest rate decision on Thursday. If the U.K. Central Bank says inflation is easing and further rate hikes are unnecessary, GBP/USD may fall to 1.23000.