Gold Remains Strong Above $2400/oz as Fed Hints at Upcoming Rate Cuts

2024.08.09 10:02

- Despite a stronger US Dollar yesterday, gold’s upward trend continued, bolstered by the rate cut narrative.

- The technical outlook for gold indicates further upside potential, with prices possibly reaching between 2440 and 2450 during the US session.

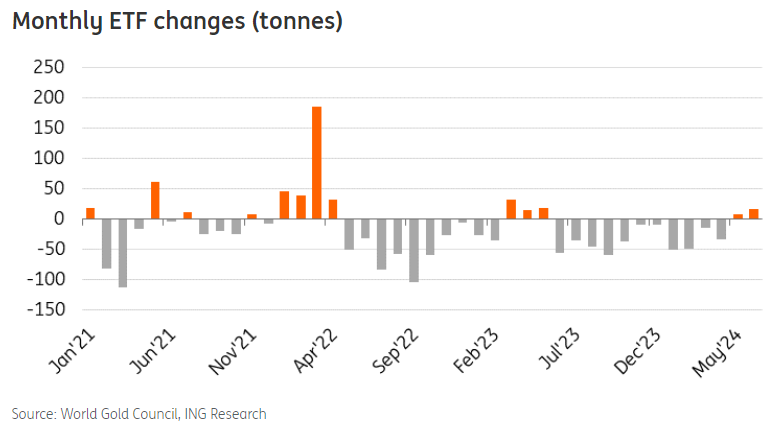

- The longer-term outlook is supportive of gold prices as geopolitics, ETF flows and Central Bank Buying remain in play.

Gold () prices surged yesterday, hitting a daily peak of $2424/oz, driven by comments from Fed policymakers and better-than-expected jobless claims data.

Improved sentiment from the jobless claims data gave a boost to the and saw US Treasury yields rise. However, gold continued its upward trend, defying the stronger .

Remarks from three Federal Reserve policymakers further bolstered the rate cut narrative, a key factor in gold’s rally this year.

Thomas Barkin from the Richmond Federal Reserve Bank was the least hawkish, highlighting a positive inflation print. Austin Goolsbee of Chicago met market expectations by stating that current high rates pose risks to the labor market. He also noted that the US elections and recent stock market rout would not influence Fed policy.

Overall, the outlook for gold remains positive. The rate cut narrative, geopolitical tensions, robust ETF flows, and central bank buying all support the precious metal.

ETF Flows Finally Turned Positive in May

Source: World Gold Council, ING Research

Given this context, any significant price drop is likely to be met with strong buying pressure, limiting the downside.

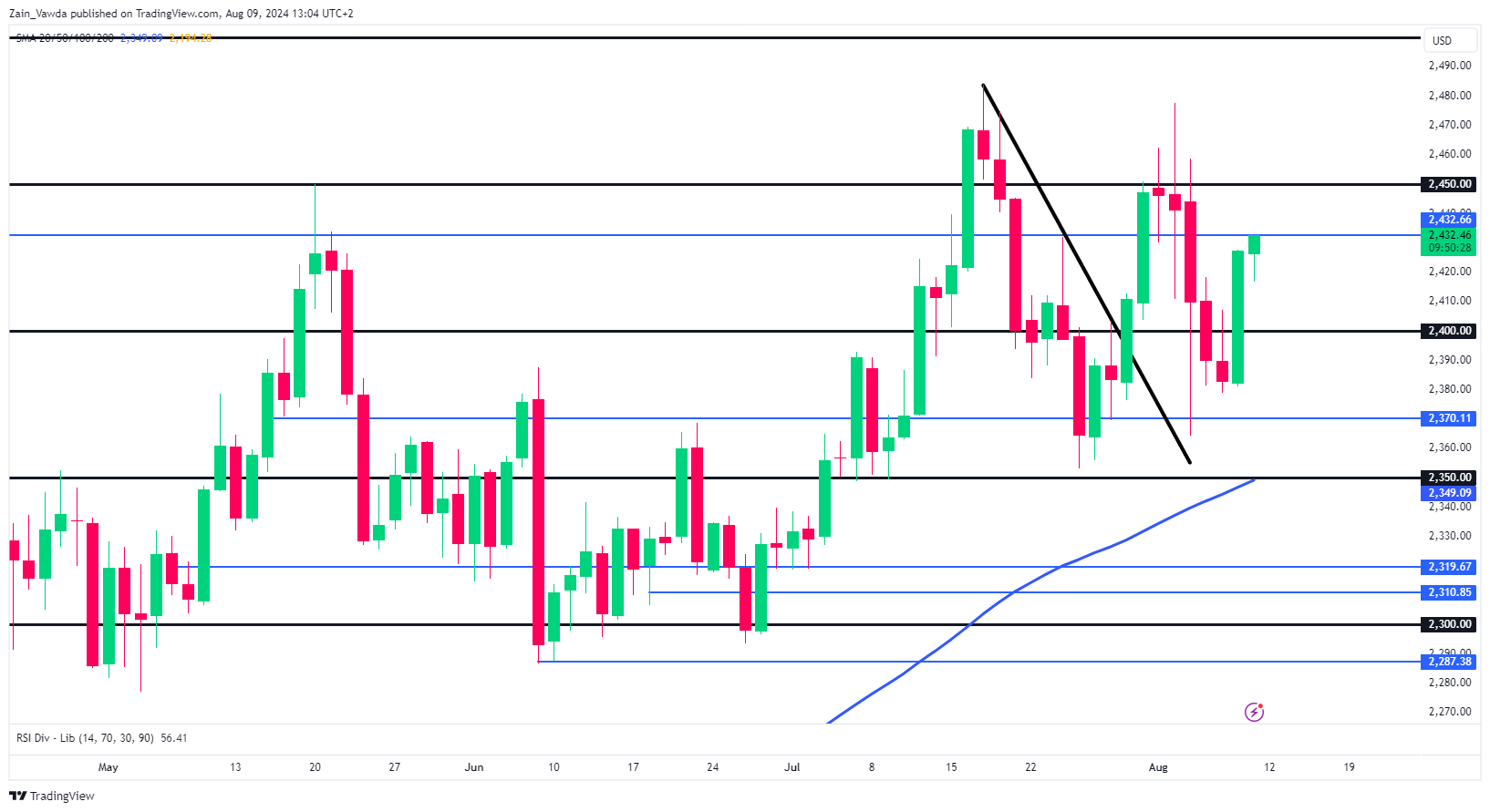

Technical Analysis Gold

From a technical perspective, gold posted a significant bullish engulfing candle yesterday, recovering losses from the previous two days. After a brief pullback during the Asian session, the upward momentum continued into the London session.

Currently, the price is challenging a key resistance level at 2432, with another resistance area at 2450. The technical outlook indicates further upside potential, and in the absence of economic data today, we could see prices reaching between 2440 and 2450 during the US session.

However, whether the bulls will push beyond this range ahead of the weekend remains uncertain.

Immediate support is located around the 2414 level, with the psychological 2400 mark also providing support. A retest of these levels could occur if buyers decide to take profits and unwind positions before the weekend.

GOLD (XAU/USD) Chart, August 9, 2024

Source: TradingView

Support

Resistance

Original Post