Gold Price Steady on Inauguration Day: Is It the Calm Before the Storm?

2025.01.20 08:32

- Gold prices found stability above $2700/oz after an initial drop.

- Historically, gold prices saw an initial two-day rally followed by a decline after Trump’s 2017 inauguration, driven by safe-haven demand and uncertainty.

- Technically, gold appears to be in a “wait and see” mode, with a bounce off the 2700 handle suggesting potential upside.

- Markets will be keeping an eye on the proposed tariffs and policy changes under the new.

prices dropped following the market open yesterday but has since found some stability above the $2700/oz handle. Markets had expected a bout of volatility which I still believe will begin tomorrow and potentially later in the day.

The US holiday however, does mean that low levels of liquidity will be present during the US session and could mean any significant moves may materialize from tomorrow onward.

Golds Reaction to Trump 2.0

Historic data is always worth paying attention to even though at times they do not always pan out. Based on Trump’s first term, how did the price of gold fare after the inauguration?

Well, in 2017, January 20 when Trump was inaugurated Gold prices rose for an initial two-day rally before falling over 2.75% over the next three-days. At the time a lot of the rise in Gold was possibly down to safe-haven demand as uncertainties about a Trump Presidency were rife.

This time around, however, Trump does enjoy the support of the majority of Republicans which should allay fears within the US. However, Global Markets will be on edge in the coming days as they wait to see what plans Trump looks to implement when it comes to tariffs, border control and cryptocurrency.

This could lead to some wild price swings in the day ahead and thus warrants keeping a close eye on.

The return of Trump and proposed tariff hikes has lent strength to the US Dollar over the past 2 months. However, this is a double-edged sword as high tariffs is likely to lead to a drop in gold prices at least temporarily while the uncertainty could keep haven demand active.

Is Gold about to enter a new phase of ‘consolidation’? We will soon find out.

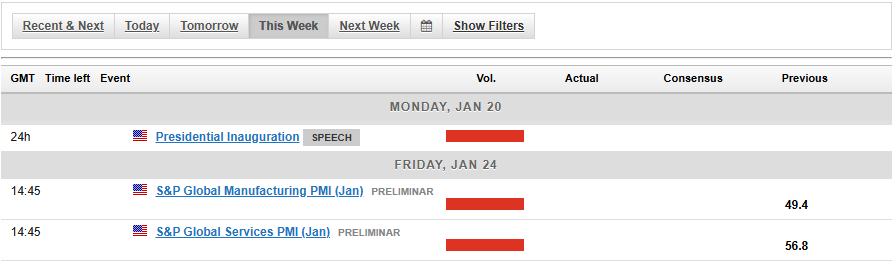

The Week Ahead

The inauguration and first few days in office for President Trump do promise a lot and thus could overshadow data releases this week. The US does not have a lot of data scheduled for the week ahead with the and data due out on Friday.

In the interim, i would suggest paying close attention to tariff chatter and the like as this could have material implications across a variety of markets and instruments.

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, this analysis is a follow-up from the technicals last week. Read:

Gold appears to be in a wait-and-see mode at present.

Looking at the daily timeframe below and a bounce off the 2700 handle does bode well for bullish continuation.

That coupled with the overall trend leaves me to believe that we could be in for more upside in the days ahead.

Gold (XAU/USD) Daily Chart, January 29, 2025

Source: TradingView

Dropping down to a H1 chart and as you can see below, price is currently in no man’s land.

The H1 however, does appear to have changed structure and now also hints at further potential upside.

However a H1 candle close above the 2716 handle could help facilitate further upside and maybe even retest of the 2024 highs.

Gold (XAU/USD) One-Hour H1 Chart, January 20, 2025

Source: TradingView

Support

Resistance

Most Read:

Original Post