Gold Price Rebounds from Two-Month Low Amid U.S. Debt Limit Talks

2023.05.29 10:27

experienced a drop to its lowest level in two months last week. However, on Monday, the price per Troy ounce of gold is showing signs of recovery, reaching $1962.00 USD.

If an official announcement regarding an agreement to raise the US public debt limit is made soon, the value of gold may quickly rise due to the anticipated decline of the USD.

Despite the current market “stress” and “risk aversion” sentiment, gold has failed to act as a protective asset as the focus remains on the US, its budget, and its currency.

Physical demand for gold remains limited, providing minimal support to its price.

Technical analysis:

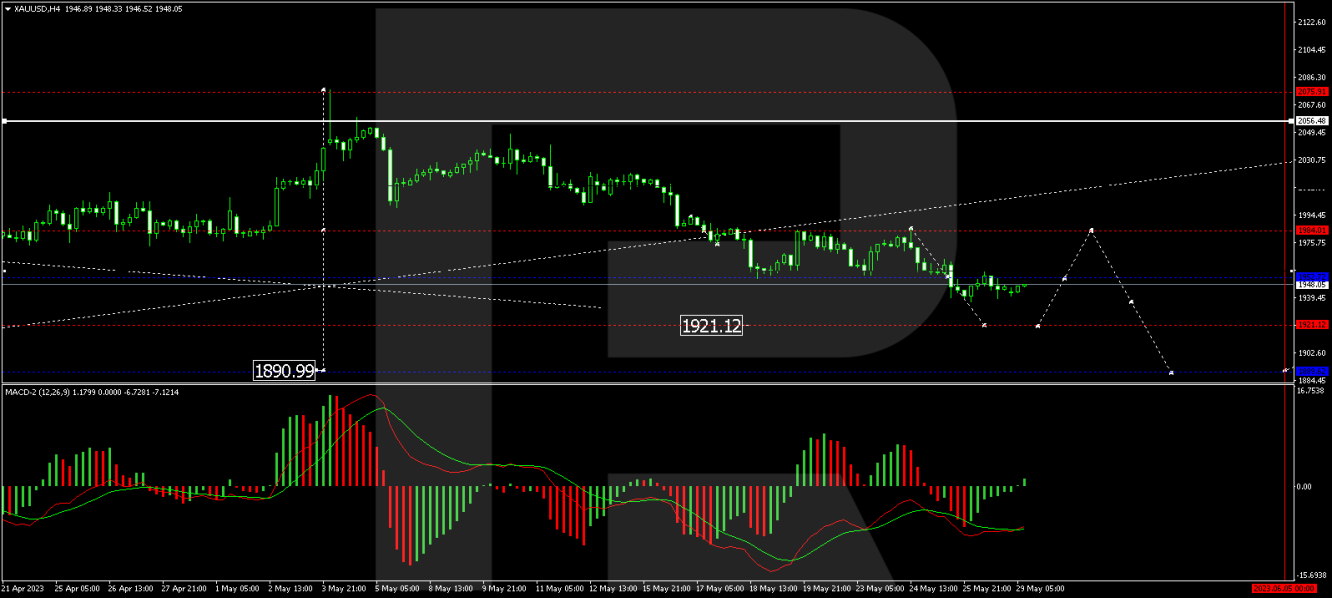

On the H4 timeframe, is forming a wide consolidation range around 1952.72. The anticipated wave of decline is expected to extend to 1921.10. Once this level is reached, a potential wave of growth towards 1984.00 might begin. This scenario is technically supported by the MACD, as its signal line is below zero, indicating further development of the declining wave on the price chart.

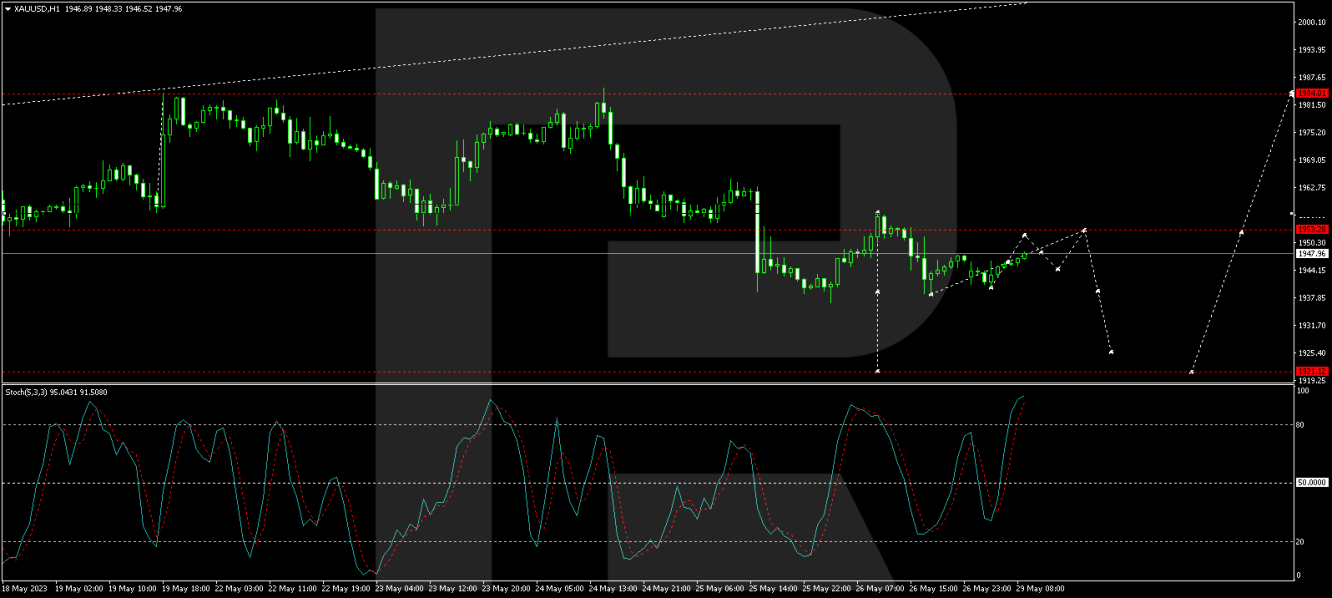

On the H1 timeframe, XAU/USD has completed a downward impulse, reaching 1938.75. Today, a correction may develop towards 1951.50. Subsequently, a decline to 1945.00 followed by a rise to 1953.30 could occur. At that point, the correction will likely conclude, and a wave of decline towards 1926.50 may start. This scenario is confirmed by the Stochastic oscillator, as its signal line is near 80, pointing downwards and potentially dropping to 20.

Disclaimer: Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.