Gold Price Falls Ahead of Fed Rate Decision; Euro Drops on Weak GDP Figures

2023.11.01 07:16

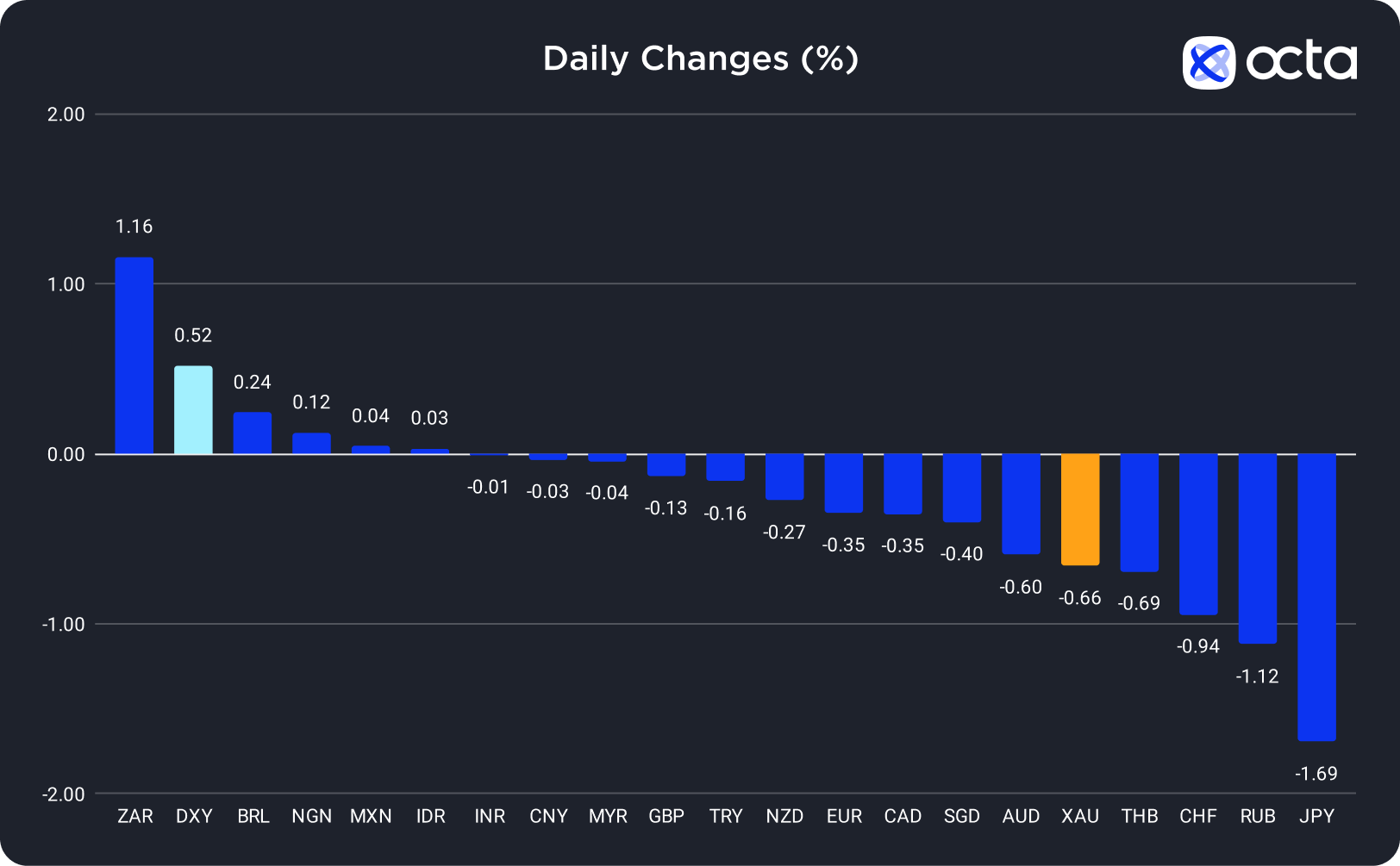

On Tuesday, the South African rand (ZAR) was the best-performing currency among the 20 global currencies we track, while the (JPY) showed the weakest results. The was the leader among the majors, while the Russian rouble (RUB) underperformed among emerging markets.

Changes in Exchange Rates on 31 October

Changes in Exchange Rates on 31 October

Gold Price Continues to Fall Ahead of Fed Rate Decision

(XAU) price dropped by 0.66% on Tuesday during an extremely volatile trading session. The price initially surged above the pivotal $2,000 level on renewed geopolitical tensions in the Middle East but later pulled back.

Gold’s inability to consolidate above the 2,000 mark suggests market fatigue and traders’ exhaustion in the face of strong resistance.

“Prices retreated on a combination of psychological resistance around $2,000 with some profit-taking ahead of key economic reports,” said David Meger, director of metals trading at High Ridge Futures.

Indeed, investors’ focus has now shifted from the Federal Reserve (Fed) to this week’s policy rate decision as well as the publication of a critical Nonfarm payrolls report.

XAU/USD was declining during the Asian and early European trading sessions. Today, all eyes will be on the Fed’s policy decision due at 6:00 p.m. UTC. Investors expect the Fed to leave the benchmark rate unchanged. However, they will be looking out for the updated macroeconomic projections and also carefully listen to what Jerome Powell, the Fed’s Chair, has to say at the press conference (6:30 p.m. UTC). Any indication that the Fed is prepared to hike more or plans to keep the monetary policy tight for an extended time period would have a bearish impact on gold. Alternatively, a more dovish statement or any suggestions that inflation no longer represents a major concern would have a bullish impact.

“Spot gold may fall into a range of 1,951–1,964 per ounce, following its repeated failures to break a resistance at 2,010,” said Reuters analyst Wang Tao.

The Euro Drops Below 1.06000 as Weak GDP Figures Poison Investors’ Sentiment

The (EUR) lost 0.35% on Tuesday as the (DXY) surged higher on better-than-expected macroeconomic reports.

Yesterday’s U.S. economic reports showed that labor costs increased noticeably in the third quarter, with wages rising by 1.2%. In addition, the U.S. Conference Board reported that in October, consumer confidence declined less than expected. All in all, these reports indicate the need for tighter monetary policy in the U.S. and show that interest rates might have to remain elevated for some time. Meanwhile, the Eurozone’s gross domestic product (GDP) contracted in the third quarter as growth in France, Spain, and Belgium failed to offset the slump in Germany. Unsurprisingly, EUR/USD fell on this news as there is a clear divergence between the U.S. economy, which remains relatively robust, and the Eurozone economy, which might enter a recession.

EUR/USD continued to fall during the Asian and early European sessions. The euro might now consolidate in a tight range of 1.05500–1.05700 before the upcoming interest rate decision from the Fed due at 6.00 p.m. UTC, which may provoke another sharp move one way or the other. In case Fed signals get to be more balanced and show a less hawkish approach to monetary policy going forward, EUR/USD may potentially recover above 1.06000. However, the hawkish stance on monetary policy would mark the continuation of the downtrend.