Gold, Oil Drop: Is It Time to Bet on Rising Equities and Bitcoin?

2024.11.11 08:10

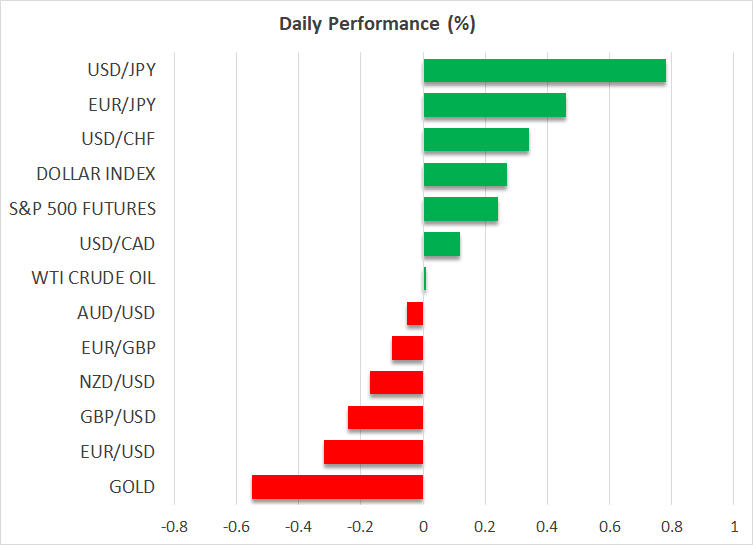

- Gold and oil suffer, while and equities rally

- Minority government in Japan, BoJ mini-minutes unsurprising

- Euro under pressure as Germany gets closer to snap election

Trump Prepares to Take Over

The markets continue to digest Trump’s victory and last Thursday’s dovish , with most market participants now speculating on the course of action of the new administration as the president-elect is assembling his cabinet. In this context, he has already taken the initiative to talk to Israel’s Netanyahu, Russia’s Putin and Ukraine’s Zelensky.

Gold and Oil Remain on the Back Foot

has been the main victim of the outcome of the US presidential election, losing around 3% from the early November highs. It is now trading above the $2,650 area, with the outlook remaining mostly bullish considering the two active conflicts and Trump’s unpredictable nature.

Similarly, prices remain on the back foot as concerns about China and global growth are elevated. Saturday’s Chinese inflation figures were again weak, with the market fearing deflation, particularly as the yearly change in the producer price index fell further into negative territory. Along with Friday’s announcements about local government debt, which were once again deemed as insufficient by the market, Chinese economic momentum remains negative. Meanwhile, China is preparing for a potential trade war with the US, a situation that could prove more challenging to tackle compared to Trump’s first term.

Equities and Cryptos Rally

On the flip side, equities and cryptocurrencies have benefited from Trump’s win. The closed 4.7% higher last week, recording its best weekly performance in a year, but lagged the . This small-caps stock index jumped by 8.6% on a weekly basis, the strongest weekly rally since April 2020.

Similarly, the crypto world is on fire with recording a new all-time high of around $81,800, and the market preparing for a continued rally towards the $90,000 level. The remaining major cryptocurrencies are also enjoying strong gains – for example ethereum is around 30% higher since election day – but most are still well below their all-time highs.

Partial Holiday in the US

A quieter session is in store today, as there is a partial bank holiday in the US. The rest of the week, though, is packed with key data releases, including Wednesday’s report and Friday’s US retail sales report. Also, a plethora of Fed speakers and more headlines about Trump’s new administration are expected to flood the airwaves.

Meanwhile, the is maintaining its post-US election gains with the euro being under pressure. has momentarily traded below 0.83000, the lowest level since April 2020, when the Covid pandemic was unfolding. The market is pessimistic about the area’s ability to navigate through four years of Trump’s administration, particularly as Germany remains the weakest link.

Chancellor Scholz’s plan for a March 2025 election has backfired with the opposition parties pushing for a confidence vote this week and snap elections to be held in mid-January. Amidst this environment, the market is pricing in a 15% probability for a 50bps ECB rate cut in December, with this likelihood most likely going up if next week’s preliminary PMI surveys disappoint.

Japan’s Ishiba Approved as PM, Outlook Remains Clouded

The summary of opinions – the first version of the October meeting’s minutes – did not produce any surprises as most members were on board with the continuation of the ongoing tightening process. Interestingly, BoJ members expressed concerns about the ’s depreciation. Meanwhile, LDP leader Ishiba has been approved as the prime minister of a minority government, since the smaller DPP party denied becoming the third coalition partner.