Gold Near 1,900; Euro Hits 3-Month Low on ECB Signals

2023.09.15 08:23

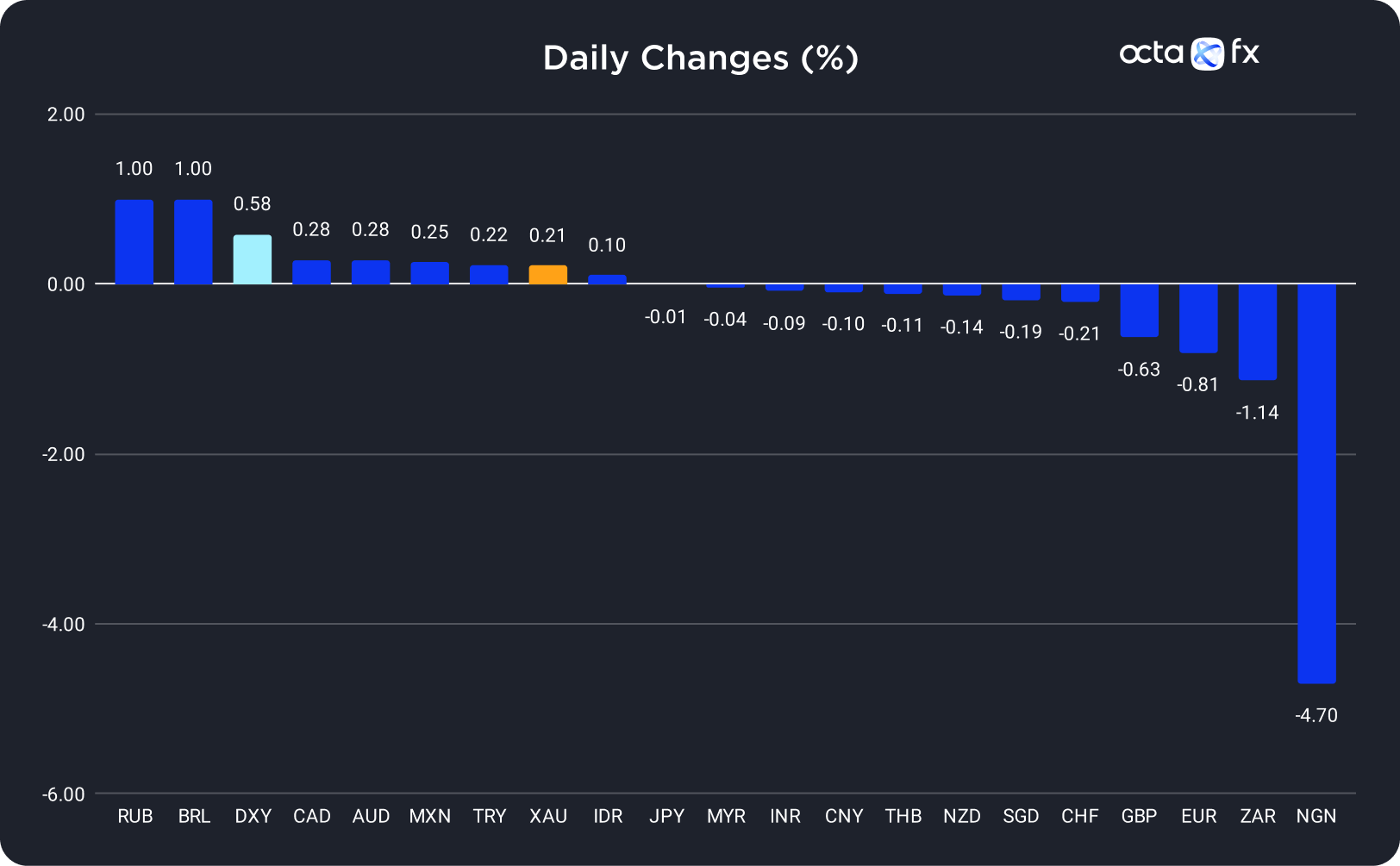

On Thursday, the Russian rouble (RUB) was the best-performing currency among the 20 global currencies we track, while the Nigerian naira (NGN) showed the weakest results. The was the leader among majors, while the underperformed.

Changes in Exchange Rates on 14 September

Changes in Exchange Rates on 14 September

Bargain Hunters Prevent XAU/USD From Falling Below 1,900

gained 0.21% on Thursday in a very volatile trading session despite a sharp rise in the US Dollar Index (DXY).

Initially, XAU/USD plunged to a three-week low as higher-than-expected U.S. Producer Price Index (PPI) and Retail Sales data increased the chances the Federal Reserve (Fed) may have to raise interest rates further. Thus, the US dollar and the Treasury yields rose. As the gold price neared the critical 1,900 level, many investors started to buy the bullion in what market participants described as a ‘bargain-hunting frenzy’. Although markets are pricing in a pause in the Fed rate-hiking cycle at next week’s meeting, there’s a 40% probability of another rate hike in November or December, according to the CME’s FedWatch Tool.

XAU/USD continued to rise during the Asian session as the US dollar weakened after higher-than-expected Chinese Industrial Production and Retail Sales data. The reports reduced investors’ worries over global recession and decreased safe-haven flows into the greenback. Today, the U.S. will publish two important reports—the New York State Manufacturing Index at 12:30 p.m. UTC and the Consumer Sentiment Index at 3:00 p.m. UTC. These releases may affect the market outlook on the U.S. rate-hike path. If the Consumer Sentiment Index is below market expectations, the US dollar will probably drop sharply, pushing XAU/USD higher.

The Euro Hits a Three-Month Low as the ECB Signals the End of the Rate-Hiking Cycle

The Euro fell by 0.81% on Thursday after the European Central Bank (ECB) indicated the end of the monetary tightening.

Yesterday, EUR/USD had one of its worst days as several negative news hit the market. First, the ECB’s decision to raise the benchmark interest rate by 25 basis points failed to envigorate the bulls as the regulator stated that the rate-hiking cycle is probably over. Analysts said yesterday’s ECB decision was a ‘dovish hike’, but the market still wonders whether it was a final hike. Moreover, bearish pressure on EUR/USD increased after U.S. macro statistics were much better than expected. All three reports—the Producer Price Index, the Retail Sales, and the Jobless Claims—showed a rather upbeat picture of the U.S. economy, raising the probability of another rate increase from the Federal Reserve and pushing the euro down.

EUR/USD rose during the Asian session, but the upward move looks like a technical correction rather than a bullish trend. Today, traders should focus on two U.S. reports— the New York State Manufacturing Index at 12:30 p.m. UTC and the Consumer Sentiment Index at 3:00 p.m. UTC. If the figures are lower than expected, EUR/USD may continue rising, possibly above 1.07000.