Gold: Multiple Confirmations Corrective Upswing Is Nearing Its End

2024.12.06 15:42

In my yesterday’s Trading Alert, I wrote that we had some clues regarding the end of the corrective upswing.

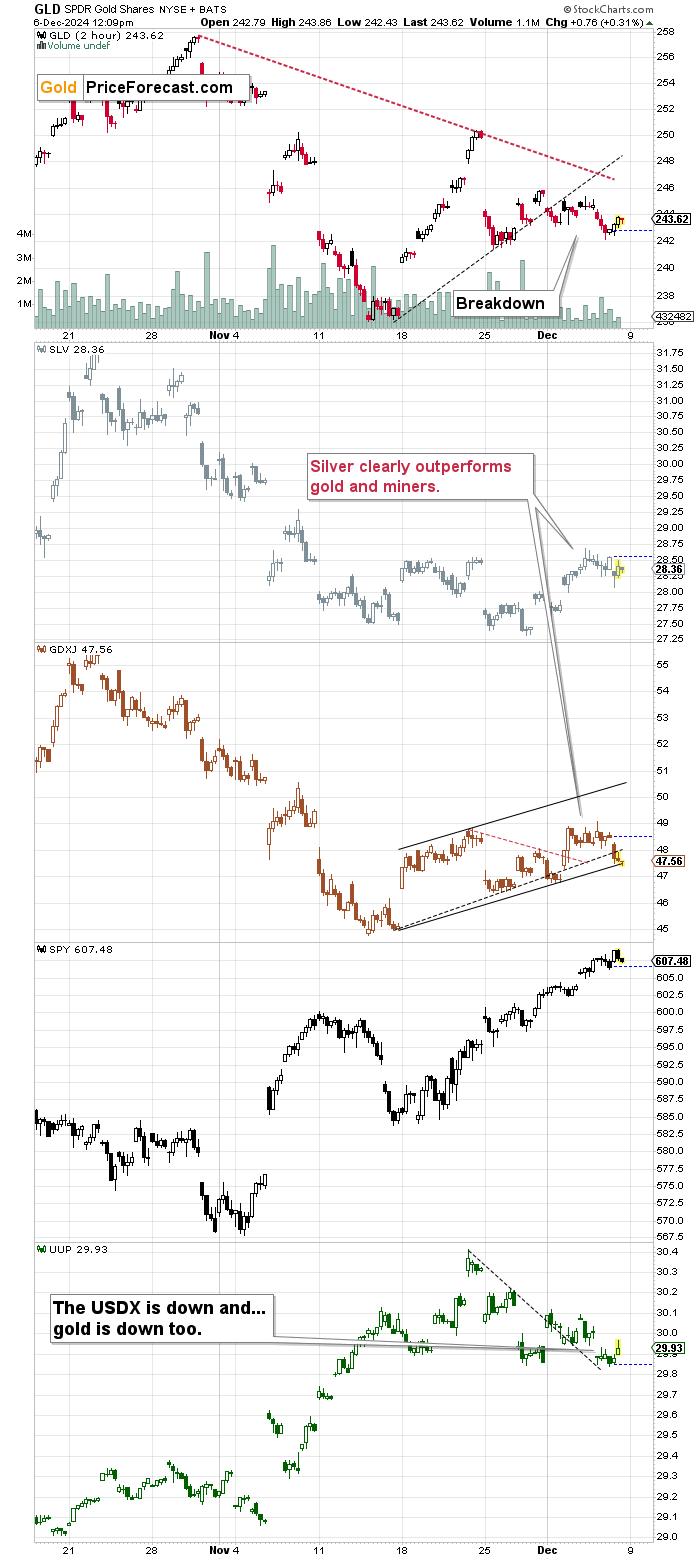

We saw an invalidation in the VanEck Junior Gold Miners ETF (NYSE:) (of the tiny move to new short-term highs), and before that outperformed on a short-term basis, which was also a bearish indication. Today, we got some more.

Today, miners are back in their underperformance mode. While gold (btw, did you know that you can earn interest in gold – paid in gold?) is pretty much doing nothing, the GDXJ is down. Stocks are not down, so it’s not that weak stock market performance would explain this weakness in the GDXJ.

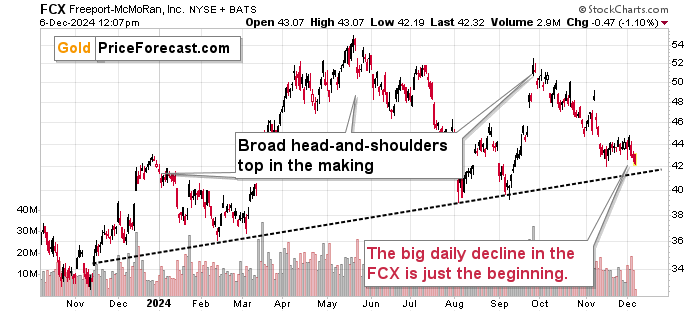

That’s one confirmation. Another one comes from the market, and more precisely from the way Freeport-McMoran Copper & Gold Inc (NYSE:) (copper and gold producer) is behaving given copper’s short-term (small, but still) upswing.

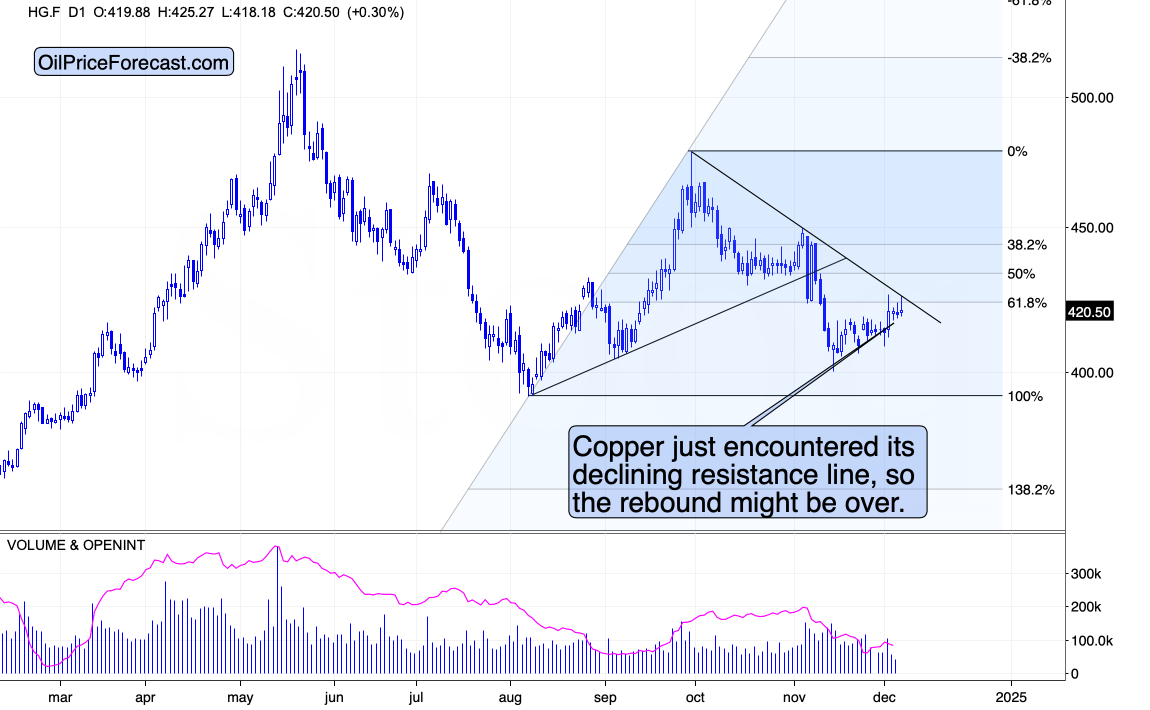

Copper moved higher in the last few weeks. Not significantly so – it simply launched a nice correction after a sharp decline. That’s normal.

Now, one thing suggesting that the corrective rally might be over is that copper’s price reached its declining resistance line. The other – that I mentioned earlier – is that despite the recent run-up, FCX, being primarily a copper stock has been performing poorly – also today.

FCX looks like it just can’t wait to break below the neck level of the head-and-shoulders top formation. It’s already trading at its November low, even though copper is relatively far from it.

Gold stocks underperforming gold price indicate lower prices for both.

Copper stocks underperforming copper indicate lower prices for both.

And since precious metals and commodities tend to move together during big moves (not in each and every case, but quite often so), the above points also serve as a bearish confirmation for the precious metals market.

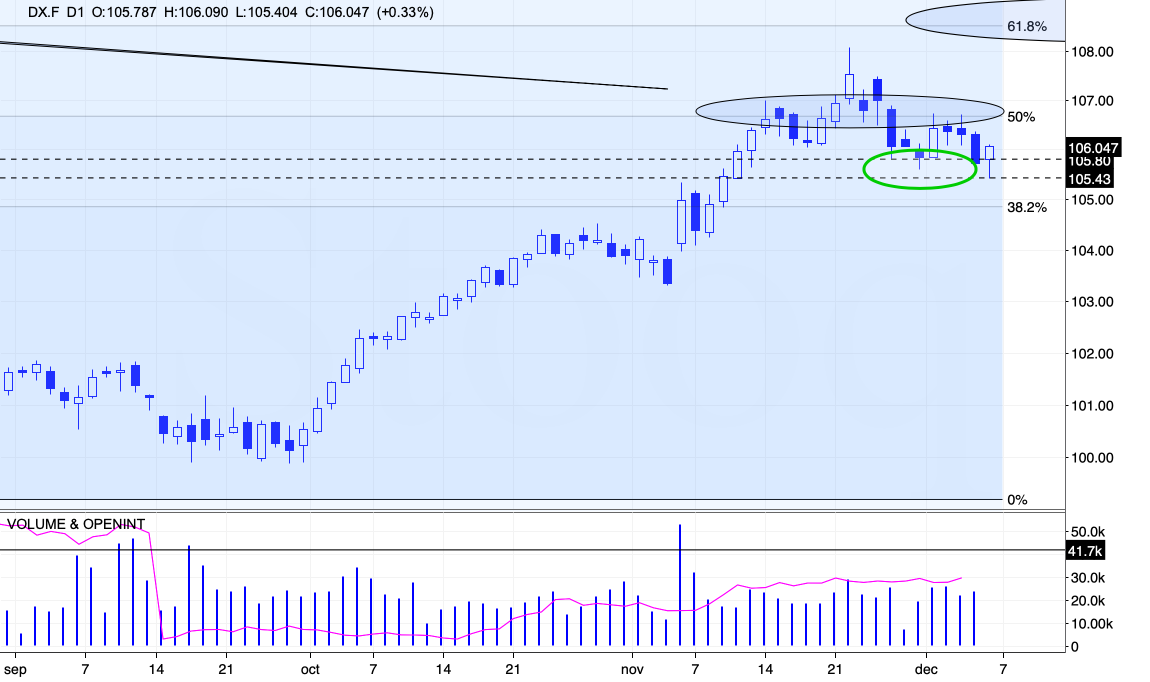

Bullish Hammer in the USDX

Finally, something interesting happened in the . Right after almost completing it (supposedly) bearish head and shoulders top pattern… It rose back up like phoenix from the ashes.

Maybe the analogy seems too big for just a daily comeback, but given how sharply USD Index was rallying previously, this daily revival could easily turn into another big move up.

Please note how perfectly the USD Index moved back up after reaching the lower of the dashed lines (support based on the previous highs). At the same time, it invalidated the move below the late-November low.

Also, the session is not yet over, but if the USDX closes more or less where it’s trading at the moment of writing these words (or higher), we’ll have a daily reversal (bullish “hammer” candlestick), which would be bullish on its own, but also given the analogies to what happened when we previously saw this candlestick.

We saw it in late September and in the early November. In both cases, sizable rallies followed. And since the precious metals market is once again reacting to USDX’s rallies (by declining), the above is bearish for the former.

So, yes, we have quite a few additional reasons to expect the precious metals sector to move lower in the following weeks, and – quite possibly – days.

Is it better to profit from declining prices of precious metals (junior miners are likely to decline the most in my view), or from the decline in copper stocks?… Actually, why not both?