Gold Moves Lower

2023.02.07 07:46

By the beginning of the week, a Troy ounce of has dropped to 1889 USD. The precious metal used to look fantastically confident while the USD was falling. But as soon as the latter gained back control, the situation became as before.

Gold does not generate its own income, so it looks weaker compared to the return on treasury bonds or the USD. It turns out that gold does not have any strategically trigger as yet, and all the pathways up are bound to currencies.

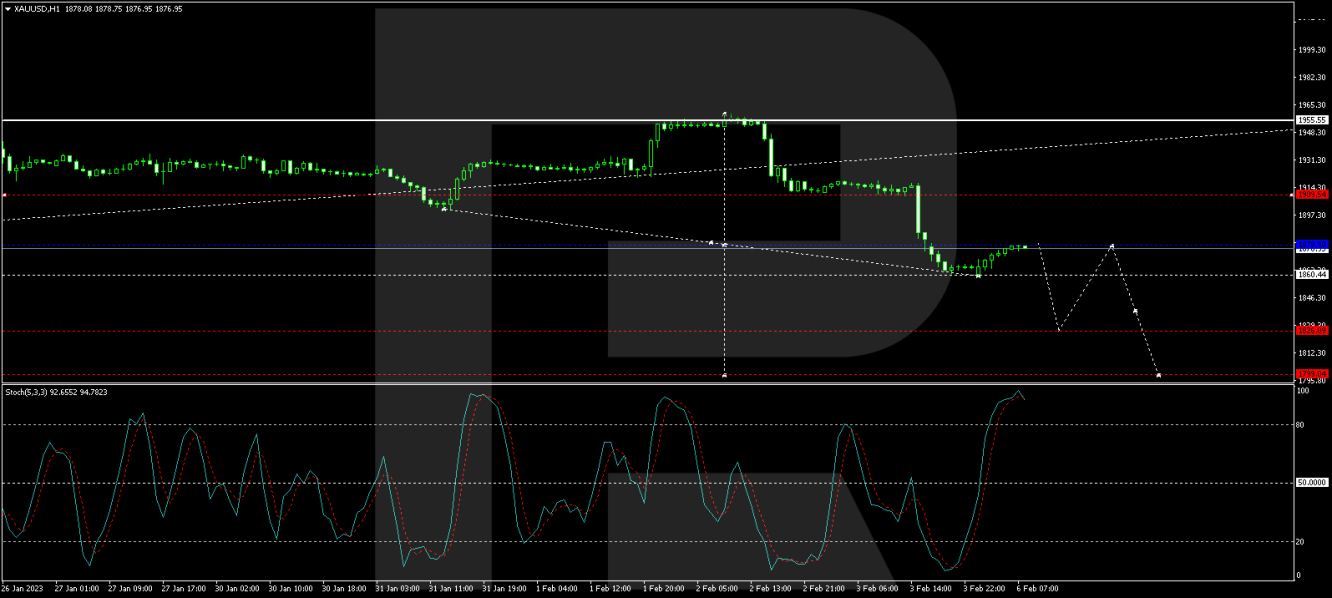

On H4, has formed an impulse of decline to 1860.50. Today the market is forming a consolidation range above it. With an escape upwards, a correction to 1910.00 might follow.

With an escape downwards, a pathway down to 1850.00 should open, from where the wave might extend to 1800.00. Technically this scenario is confirmed by the MACD. Its signal line is under zero and is going to renew the lows.

On H1, a consolidation range is forming above 1860.50. With an escape upwards, a correctional structure to 1910.00 might form. With an escape downwards, the trend might continue to 1826.00, from where the structure might extend to 1800.00.

Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is above 80. A decline to 50 is expected. With a breakaway downwards, the line might fall to 20.

Disclaimer: Any forecasts contained herein are based on the author’s opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

Source link