Gold Loses Steam, Stocks Recover as Banking Storm Eases

2023.03.21 08:25

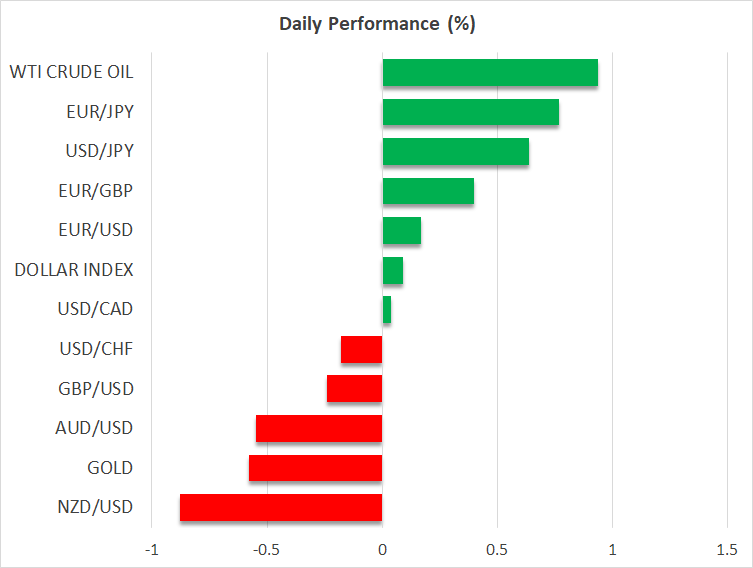

- Nerves around banking sector recede for now, as traders bet on Fed cuts

- Gold loses some of its safe-haven appeal, stock markets bounce back

- Dollar remains under pressure, unable to capitalize on market turbulence

Fed bets help calm nerves

It’s been a wild month for global markets, with regulators turning into firefighters to extinguish the stress in the banking system and prevent it from burning the real economy. The Fed rolled out an emergency lending program for troubled banks, the Treasury is considering unlimited federal guarantees for depositors, while Swiss authorities orchestrated the absorption of Credit Suisse by UBS.

These forceful policy responses helped restore order in financial markets, at least for now, alongside a resurgence of bets that the Fed will slash interest rates by the summer or fall. Investors are effectively betting that if there is a Fed rate increase this week, it will be the final one of this cycle, and rate cuts will begin soon thereafter.

The sharp repricing in interest rates reflects expectations that banks will curtail lending activities to protect their balance sheets, which is what the Fed wanted to achieve in the first place to cool inflation. The ‘problem’ is that the economic data pulse remains strong, putting the Fed in a dilemma on whether it should forge ahead with raising rates or hit pause.

Stock markets recover, gold retreats

Speculation for interest rate cuts has hammered US yields lower lately, and since yields are essentially the price of money, most risky assets from tech stocks to cryptocurrencies have enjoyed a sensational rally. The rate-sensitive Nasdaq has risen more than 6% from last week’s lows, with tech juggernauts such as Google (NASDAQ:) and Nvidia (NASDAQ:) spearheading the charge.

It sounds bizarre to say that stocks are partying because the banking sector has reached a breaking point, but such is the power of falling yields. Speculation for rate cuts is overriding everything for now, at least until investors realize that lower rates are a reflection of a troubled economy and what that implies for earnings.

The prospect of cheap money returning soon propelled gold prices higher too, briefly sending the precious metal above the $2000/ounce region yesterday. A softer US dollar and safe-haven demand played a role too. That said, the gains have started to evaporate on Tuesday with US yields staging a recovery. What the Fed does tomorrow will decide whether this rally has legs.

Dollar under pressure

Despite the banking turmoil, the world’s reserve currency has been under pressure lately, unable to attract the safe-haven flows it usually enjoys during every crisis of confidence. This sluggishness probably reflects speculation for rate cuts and the Fed extending swap lines to foreign central banks to prevent dollar shortages, and not any change in the currency’s safe-haven status.

Market pricing currently points towards a Fed rate increase tomorrow, but there are still doubts. The most prudent move would be for the Fed to mimic what the ECB did last week – raise rates to fight inflation and highlight that if there is more banking stress, the central bank has different tools to deal with that.

Beyond the rate increase itself, the new interest rate projections will be crucial as there is a massive gap between the last Fed projections that rates will end the year above 5%, and market pricing that now sees rates around 4% at year-end. If FOMC officials push back against rate-cut bets by keeping their projections for this year elevated near 5%, the dollar could come back to life.