Gold Looks Overvalued Based on a ‘Fair Value’ Model

2023.05.10 08:44

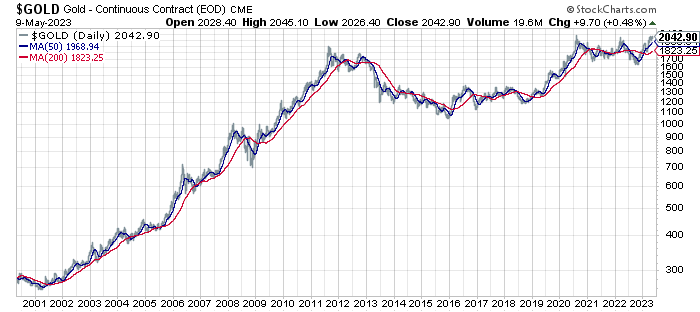

The world’s favorite precious metal is enjoying a moment in the sun lately. Trading at record highs recently, allure is back in vogue as various macro risk factors provide a tailwind.

But some things never change with gold, including the challenging task of putting a “fair value” on the metal. That’s always tough, as it is for all commodities, for a simple reason: there are no cash flows to value, no sales to assess, and no distributions to evaluate.

Even worse, gold’s economic value – in comparison to, say, oil or – is virtually nil. Real-world demand is linked with the appetite for gold jewelry and various industrial applications. But the lion’s share of gold’s demand is based on its perceived role as a store of value and as a form of money independent of governments.

The elephant in the room for the gold market: the ebb and flow of purchases and sales by central banks. Although gold’s official role as the foundation for money is long gone, central banks continue to hold large stocks of gold and periodically raise or lower their supplies. China’s central bank, for example, lifted its gold reserves for a fifth straight month in March to more than 2,000 tons.

The spot price of gold has recently been trading above $2000 an ounce, a record high. Deciding if that’s a reasonable price or not is tricky because it requires factoring in a number of variables that are slippery at best. But in a world crawling with risk factors, the appeal of gold is finding favor once more.

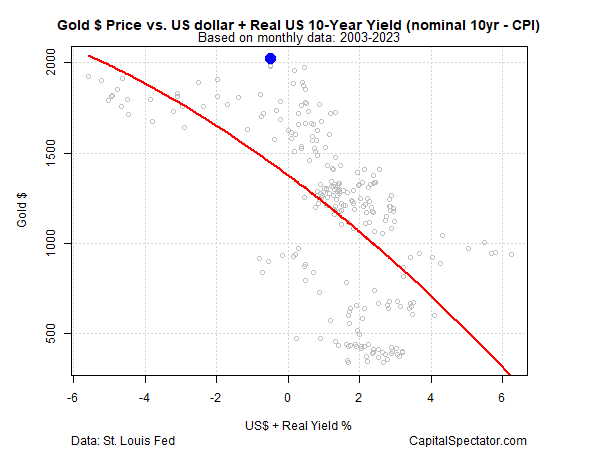

As an exercise in estimating a fair value for gold, a two-factor model comes to mind. It’s been well established that real (inflation-adjusted) interest rates and the US dollar are key factors driving gold’s price. The reasoning for real rates: when they’re low or negative, the relative appeal of gold, which is forever a 0% yielding asset, is stronger because the opportunity cost of holding it is lower.

Meanwhile, gold is considered an alternative to the , the world’s reserve currency. That’s wishful thinking in practical terms, of course, but there’s a history to the idea and so it’s factor for why gold’s ebb and flow tends to be negatively correlated with the greenback.

Let’s put these ideas into a model for a guesstimate of gold’s fair value. In the chart below, I regress gold’s price against the real US for the past 20 years. The real yield is calculated by taking the nominal 10-year rate and subtracting the year-over-year change in the Consumer Price Index (CPI). On that basis, the 10-year yield is negative: 3.5% 10-year yield less 5.0% inflation. To that estimate, I add the price of the US dollar. The main takeaway from this analysis: gold looks overvalued.

Gold Price vs US Dollar and Real US 10-Yr Yield

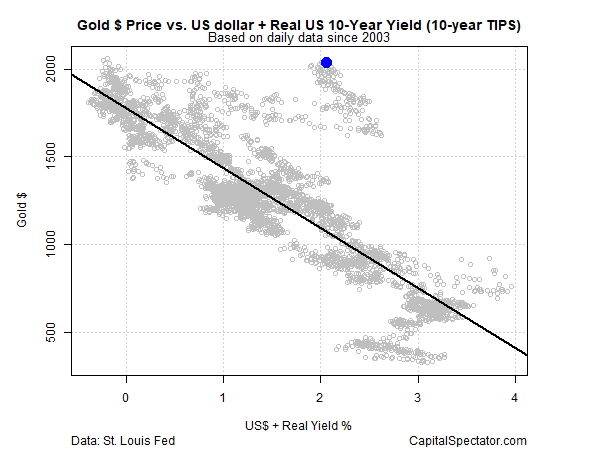

Similar results are generated if we use the 10-year inflation-indexed Treasury (TIPS) as a proxy for the real yield. Notably, a 10-year TIPS yield is currently positive at 1.30% (May 9). Nonetheless, the modeling still suggests gold is overvalued.

Gold Price vs US Dollar and Real US 10-Yr Yield

There are several caveats to the model, however. For starters, there are several ways to estimate “fair value” for gold, and minds will differ on whether this methodology is preferable. Another issue to consider: the gold market is highly speculative and is subject to major sources of supply and demand players with little if any rational economic incentives, i.e., central banks.

Fair value, in other words, may have little meaning, particularly in the short term for gold. Nonetheless, the charts above suggest that gold’s price appears lofty. Fear and other factors could drive it higher still, of course.

A useful question for gold investors at this juncture: What scenario would drive the price higher? By contrast, what factors could take a bite out of gold? One line of thinking is that after decades of low inflation and robust economic growth, the outlook has changed as governments have gorged on debt and globalization unwinds, to name two factors that some say will keep gold’s allure bubbling.

The momentum of late suggests that the metal looks set to run higher. The fair value estimate above suggests otherwise.

My takeaway: the low-hanging fruit of the gold rally is probably behind us. Bullish momentum seems set to push gold higher, but unless geo-economic and geopolitical threats worsen, gold’s rally faces stronger headwinds. In other words, quite a lot of risk is already factored into gold’s price. Pushing the metal higher may require negative surprises to keep the party going.