Gold Lackluster After Fed Rate Cut

2024.09.20 16:41

reaction to the most-dovish Fed decision in years proved lackluster. Plenty of traders thought gold would surge after an outsized rate cut birthing a new cutting cycle. And with top Fed officials projecting many more cuts, it is going to be big. Gold did rally initially on that revelation, but quickly reversed into a larger intraday loss. Fed rate cuts are bullish for gold, but speculators’ gold-futures positioning is overextended.

On the eve of this latest Federal Open Market Committee , gold closed at $2,568 just off the prior day’s latest nominal record high of $2,582. Heading into Wednesday’s 2:00pm Fed decision, gold drifted along near those same $2,570 levels. When the FOMC statement announced a 50-basis-point rate cut, gold shot up to $2,600 for the first time ever. But over the next 90ish minutes, gold plunged back to $2,548.

That made for a serious 2.0% intraday drop post-Fed, leaving gold down 0.5% to $2,555 by the close. That reaction looked stunning and anomalous to many traders given the super-dovishness spewed by the FOMC. Its first rate cut in 4.5 years was a crisis-level 50bp instead of the usual 25bp. Just hours earlier, a Bloomberg survey of 113 Wall Street economists saw only 9 predict the Fed would actually go 50bp.

That wasn’t just unexpectedly-large, but unjustified given this backdrop. Stock markets, house prices, and costs of living are near record highs. Inflation certainly hasn’t been vanquished, with average annual CPI increases over the past year still hot at 3.2% compared to the FOMC’s +2.0% target. In the mid-1970s the Fed prematurely cut before fully beating inflation, unleashing resurgent even-larger inflation.

And that surprise emergency-grade 50bp cut wasn’t even the most-dovish thing the FOMC did this week. With every-other meeting, top Fed officials’ projections for the federal-funds-rate trajectory are published. The previous dot plot from mid-June had forecast one 25bp rate cut in 2024 followed by another four next year, 125bp total by year-end 2025. Not much has changed in the economy in the few months since then.

Top Fed officials’ real-GDP-growth projections this year merely slipped from +2.1% in June to +2.0% this week. Their core-PCE-inflation forecast for 2024 only moderated from +2.8% to +2.6% over this past quarter, still well above target. Yet these guys still dramatically slashed their collective federal-funds-rate projections in the dot plot. On top of this 50bp cut, they forecast 50bp of more cuts this year for 100bp total.

Then after those they expect another 100bp of cuts next year, or 200bp total by the end of 2025 including this week’s cutting-cycle opener. That would be super-dovish anytime, but is even more so considering the record general price levels permeating the US economy. Yet crazily heading into that FOMC meeting, traders were expecting 230bp of cuts by year-end 2025. I sure doubted the Fed could possibly live up to that.

With traders looking for nine-plus cuts, what if those top Fed officials had only forecast six or seven? Including this week’s, they actually predicted the equivalent of eight 25bp cuts. This latest dot plot coming in a bit-less-dovish than traders hoped contributed to gold’s selloff.

The Fed chair’s post-meeting press conference played a bigger role in reversing gold and the US dollar, which gold-futures speculators look to for their primary trading cues. Jerome Powell warned that “no one should look at the 50bp cut and say this is a new pace. … The committee is not in a rush, we will move as fast or as slow as we think is appropriate.” The surged sharply on that, pounding gold lower.

The day before the FOMC, I warned, “I don’t know what will happen tomorrow, but I’m much more nervous than usual for gold’s reaction. The combination of lofty rate-cut expectations, the battered US dollar, and very-overextended spec gold-futures positioning looks unusually-perilous.”

“Heck, even a single comment by the Fed chair in his post-meeting presser could be interpreted as too hawkish.” Thus gold’s “downside risks are outsized.” Given gold’s setup heading into the FOMC with impossibly-dovish rate-cutting expectations, its lackluster post-Fed reaction actually proved considerably better than I expected. Gold could’ve easily tumbled down 2%+ on close, kicking off a sharp 4%+ pullback.

Despite gold not blasting above $2,600 on this super-dovish Fed, this new rate-cutting cycle remains really bullish for the yellow metal. Some of gold’s most-powerful bull runs in recent decades were partially fueled by the FOMC slashing rates. Gold’s only problem this week was speculators’ excessively-bullish positioning in heading into the Fed. That short-term extreme will mean revert and normalize.

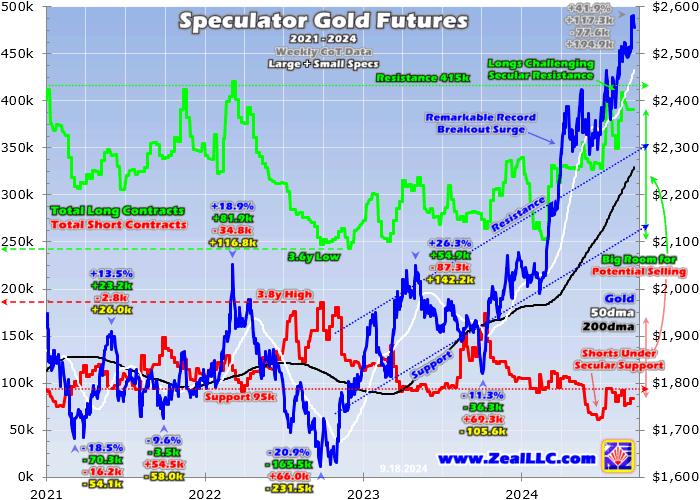

This chart superimposes gold over speculators’ total gold-futures long contracts in green and shorts in red. That data is only published weekly in the famous Commitments of Traders reports, which are current to Tuesday closes. But those CoTs aren’t released until late Friday afternoons, so the latest-available read when this essay was published was as of Tuesday September 10th, not this week’s FOMC eve.

This chart, which I also analyzed in more depth in last week’s essay well before the FOMC, fully explains gold’s lackluster post-Fed performance. In a nutshell, gold futures allow extreme leverage running up to 24.3x. Each contract controlling 100 ounces worth $255,000 at $2,550 gold only requires traders to keep $10,500 cash in their accounts. A mere 4.1% adverse gold move can wipe out 100% of traders’ capital risked.

Such exceedingly-unforgiving leverage greatly limits the numbers of traders willing to take such massive risks. So gold-futures specs’ collective capital is quite finite, small compared to broader markets. Yet 24x leverage still enables these guys to punch way above their weights in bullying around gold prices. Each dollar deployed in gold futures at 24x actually has 24x the price impact on gold as a dollar invested outright.

With limited capital in gold futures, over time total spec longs and shorts tend to form trading ranges. In recent years the secular resistance of longs ran near 415k contracts, and secular support of shorts near 95k. These levels being challenged warns that speculators’ likely capital firepower for buying has nearly been exhausted. They are effectively all-in, leaving them far more room to aggressively sell than keep buying.

Spec longs really outnumber shorts, averaging 3.4x higher over the past 52 CoT weeks. That makes longs proportionally more important than shorts for near-term gold-price direction. Those were way up at 390.9k in that latest-reported CoT eight days before the FOMC meeting. And odds are they surged much higher by FOMC eve, probably exceeding their 415k resistance when that 50bp cut and super-dovish dots hit.

Last Thursday the 12th gold blasted 1.9% higher despite mildly-hotter consumer and wholesale inflation reports. That momentum carried into the next day where gold surged another 0.9% to $2,580. Both of those bigger up days to new nominal records looked fueled by spec gold-futures buying. Those rallies tend to be faster due to specs’ huge leverage, so gold surging 2.7% in two days had to be gold-futures-driven.

Meanwhile total spec shorts a week ahead of the FOMC were down at 84.0k contracts, well under recent years’ 95k support. So no matter what top Fed officials decided, specs’ likely gold-futures buying firepower was pretty much tapped-out. There was little room for adding more longs or covering more shorts regardless of how the FOMC played out. But there was big room for selling if the Fed wasn’t dovish enough.

Excessively-bullish speculator gold-futures positioning which means very-high longs and very-low shorts is always short-term-bearish for gold, regardless of newsflow. Both sides of that trade need to mean revert and normalize after extremes, which means major selling in this scenario. While I was worried the FOMC would disappoint triggering that, it hasn’t happened yet despite gold’s lackluster reaction to the Fed.

While specs didn’t buy on that emergency-grade 50bp rate cut and super-dovish dots, they didn’t do much selling either. Although gold’s 2.0% intraday plunge in the wake of the Fed was big, its 0.5% closing loss on Fed Day certainly wasn’t. So the risks for gold suffering a gold-futures-mean-reversion-fueled pullback remain high, it could happen anytime. The most-likely catalysts are major economic data and Fedspeak.

Interestingly top Fed officials aren’t allowed to speak publicly or talk about monetary policy in blackout periods surrounding FOMC meetings. They run from the second Saturday before Wednesday decisions to the Thursday immediately after. This latest blackout was in effect from September 7th to the 19th. Now these guys are free to say whatever they want again until the next meeting’s blackout starts on October 26th.

Odds are some major US economic data will surprise sooner or later in directions arguing for slower or fewer Fed rate cuts. Monthly US jobs could beat big again as critical elections loom, or either CPI or PCE inflation could print hotter than expected again. Sufficient Fed-hawkish surprises could certainly lead some top Fed officials to warn that their rate-cut trajectories need to moderate. That would goose the USDX.

That leading US-dollar benchmark was pretty oversold heading into this week’s FOMC decision, trading just 0.1% over late August’s 13.3-month low this Monday. So there’s lots of room for a sizable-to-big bear rally on the right catalyst, which would probably shake loose major gold-futures selling. Normalizing spec positioning is ultimately bullish for gold, extending its upleg’s longevity. But it would force a short-term pullback.

As I warned last week, that could prove considerable given specs’ excessively-high longs and super-low shorts. Technically a pullback is a sub-10% selloff within an ongoing upleg. If gold suffers a larger 6%-to-9% one, that could slam gold back to roughly $2,350 to $2,425. While still very-high levels absolutely, that would feel quite bearish after $2,582. Traders need to be ready for a sizable gold-futures-driven pullback.

As the timing and speed of that inevitable normalizing selloff is unknown, traders need to put in stop-loss sell orders or tighten up existing stops. Gold’s lackluster post-Fed performance is a warning. Had spec gold-futures positioning been normal heading into this week’s FOMC, gold probably would’ve surged 2%+ on Fed Day and 5%+ during the subsequent week. Leveraged gold futures dominate short-term gold prices.

Mid-upleg pullbacks are very welcome, bleeding off excessive greed which extends uplegs’ longevity and ultimate size. They offer the best buying opportunities within ongoing uplegs, in both gold and its miners’ stocks. The latter are particularly exciting, as gold stocks still have a long way higher to run yet to reflect these awesome prevailing gold levels. Gold’s upleg has soared 41.9% higher at best since early October.

Typically the major gold stocks amplify material gold moves by 2x to 3x, while fundamentally-superior smaller mid-tiers and juniors fare even better. The leading GDX (NYSE:) gold-stock ETF surged to a 28.9-month high last week as gold hit $2,580. Yet gold stocks’ upleg had merely powered up 54.7% at best, only leveraging gold by 1.3x. This 40%+ monster gold upleg is the largest since a pair of 40%+ ones crested in 2020.

Gold averaged 41.4% gains in those, which catapulted GDX up 2.5x for big 105.4% average uplegs. Gold stocks are overdue to head way higher before this gold upleg gives up its ghost. Their upside potential is far bigger than normal since both majors and mid-tiers are earning their fattest profits ever achieved by far. So if you aren’t sufficiently deployed in great gold stocks, gold’s coming pullback is a big opportunity.

The bottom line is gold’s post-Fed performance has been lackluster. The FOMC’s decision was super-dovish, birthing a major new rate-cutting cycle with a crisis-level 50bp one while top Fed officials slashed their rate projections. Gold should’ve blasted higher on that, since Fed rate cuts have proven so bullish for it historically. Yet instead the yellow metal suffered a big-and-sharp intraday selloff after the FOMC.

The reason was simple, speculators’ gold-futures positioning ahead of the Fed was really overextended. Their total long contracts are very high challenging secular resistance, while total shorts are super-low under support. Their likely capital firepower for buying was largely expended before the FOMC, leaving way more room to sell. Specs’ positioning needs to normalize forcing a gold pullback before this upleg surges again.