Gold: Key Trading Levels as Geopolitics, Fed Keep Pushing Metal Toward New ATH

2024.08.19 11:35

The price of continues its impressive ascent, balancing around $2,500 per troy ounce early this week, hovering near record peaks. The primary catalyst driving this rally is the intensified demand for safe-haven assets amid ongoing geopolitical tensions.

The spotlight remains on the Middle East conflict, with U.S. Secretary of State Antony Blinken slated to participate in ceasefire talks between Israel and Gaza. However, the fluctuating news from the region casts doubt on the success of these negotiations, thereby boosting gold’s appeal as a secure investment.

Further supporting gold’s rally are the market expectations surrounding the U.S. Federal Reserve’s upcoming actions. Despite robust economic indicators, inflation is inching closer to the Fed’s target, prompting speculation of forthcoming interest rate reductions.

Investors are currently anticipating a 25 basis point cut in September, with the potential for additional cuts at the year’s remaining meetings, summing up to 75–100 basis points.

This week is pivotal for gold investors, with the Federal Reserve set to release the minutes from its latest meeting and a scheduled speech by Fed Chairman Jerome Powell. These events are expected to clarify the Fed’s stance on monetary policy, influencing XAU/USD’s price forecast trajectory.

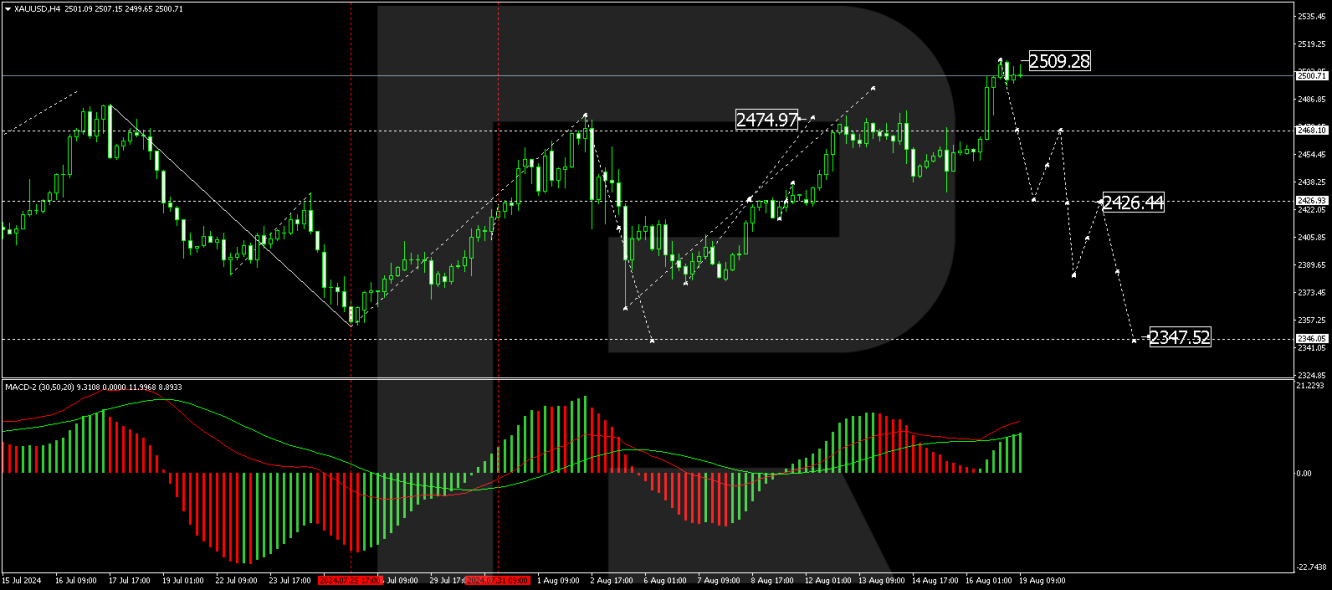

Technical Analysis of XAU/USD

Gold has completed a growth structure, reaching $2509.00 on the H4 chart. Currently, a consolidation pattern is forming below this peak, with expectations leaning towards a downward breakout initiating a decline towards $2426.44, potentially extending down to $2347.55.

This bearish outlook is technically supported by the MACD indicator, where the signal line is set for a downward trajectory from above the zero level.

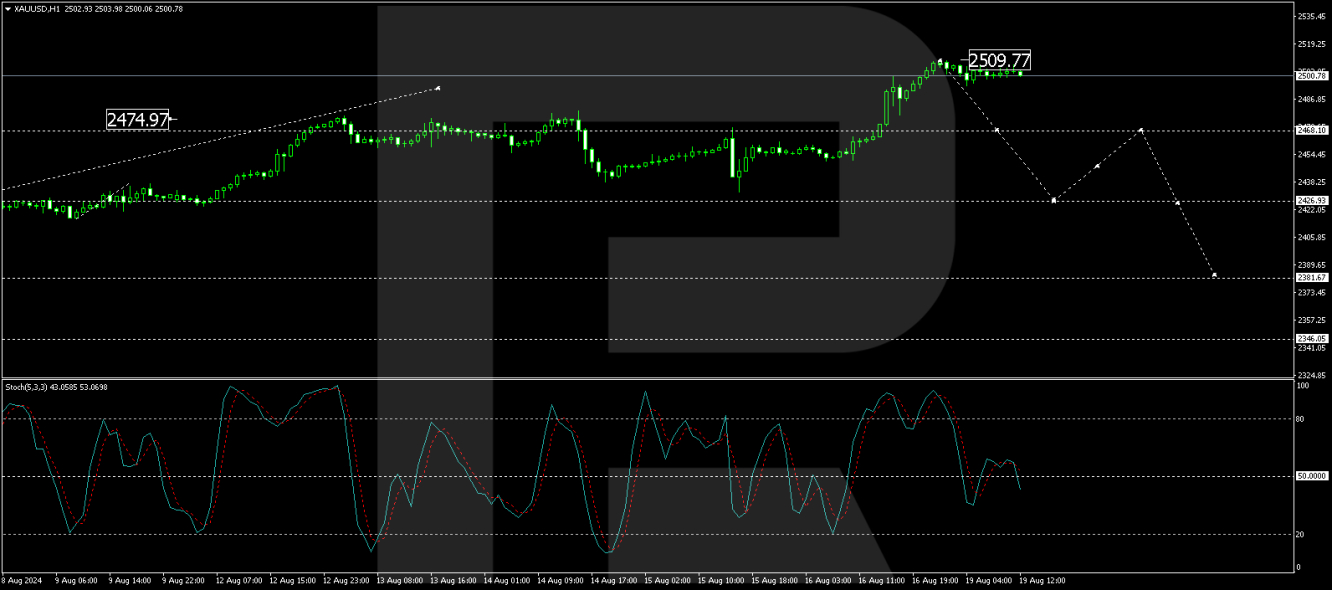

On the H1 chart, gold has achieved the upper boundary of its latest growth wave at $2509.77, followed by a formation of a tight consolidation range. Anticipations are set for a downward movement, targeting a decline to $2468.00 with a further potential to reach $2426.90.

This bearish perspective aligns with the Stochastic oscillator’s signal line, which is poised to drop from below 80 to 20, suggesting a potential selloff in the near term.

As geopolitical events unfold and the Federal Reserve’s monetary policy becomes clearer, gold’s price dynamics are expected to remain a focal point for investors seeking stability in uncertain times.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.