Gold jumps above crucial $2,000 mark

2023.03.20 06:42

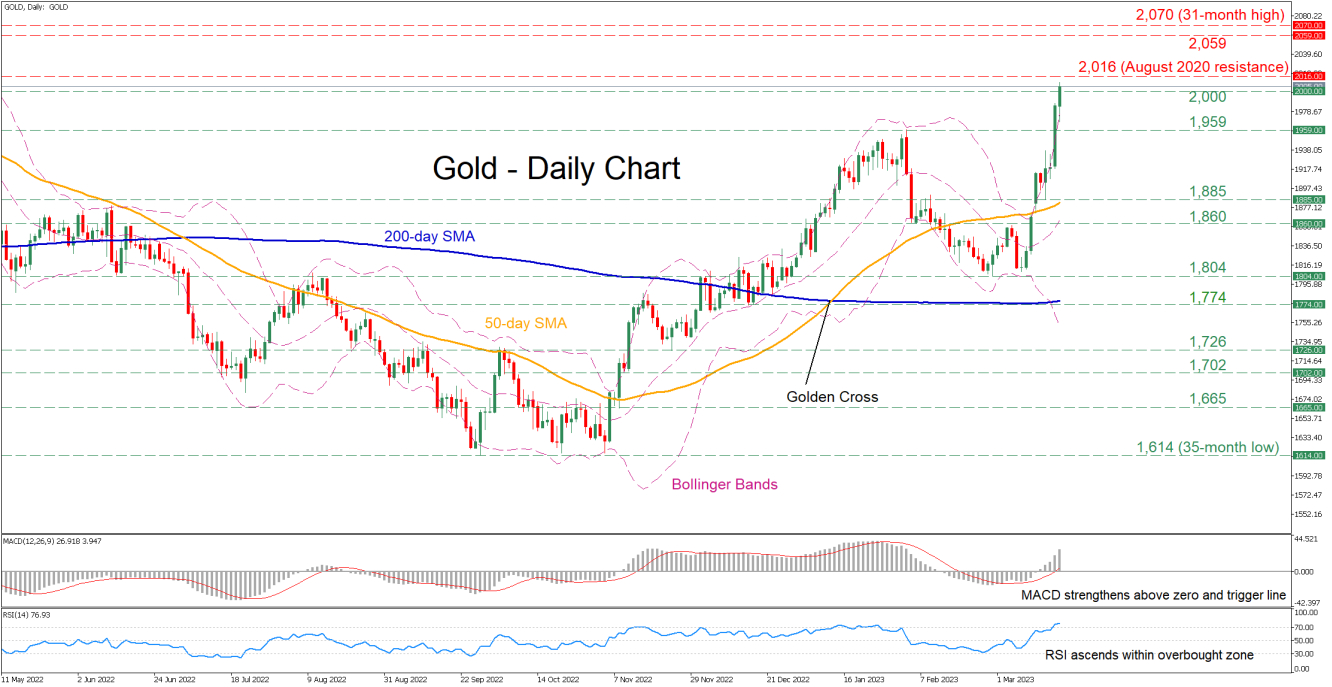

Gold has been in a steep uptrend since early March due to the ongoing turmoil in the global banking sector. In today’s session, bullion managed to rise above the 2,000 psychological mark for the first time in a year, eyeing the peaks observed after the Russian invasion of Ukraine.

The momentum indicators currently suggest that the recent rally could be overstretched as both the RSI and the MACD histogram are strengthening well within their overbought territories. Hence, a potential downside correction may be on the cards.

Should gold extend its advance above the 2,000 mark, the August 2020 resistance of 2,016 could initially cap its upside. Conquering this barricade, the price might ascend to challenge the 2,059 hurdle registered in March 2022. A break above that zone could set the stage for the 31-month high of 2,070.

On the flipside, if sellers re-emerge and push the price lower, the recent resistance region of 1,959 could act as support in the future. If that barrier fails, further declines could cease at 1,885, which overlaps with the 50-day simple moving average (SMA). Even lower, the February bottom of 1,804 could provide downside protection.

Overall, gold has staged a massive rally jumping above the 2,000 mark and is currently trading above its upper Bollinger band. Nevertheless, short-term oscillators are currently within overbought territories, so a move to the downside should not be ruled out.